Business credit score – we’ve all heard about it, but do we really understand what it means? Simply put, a business credit score is a numerical representation of a company’s creditworthiness. It’s a tool that lenders, suppliers, and potential business partners use to assess the financial health of a business. Wondering how this score is calculated and why it matters? In this article, we’ll delve into the world of business credit scores, uncovering their significance and how they can impact your business’s financial future. So, let’s get started and demystify what is a business credit score.

What is a Business Credit Score?

A business credit score is a numerical representation of a company’s creditworthiness. Similar to a personal credit score, a business credit score evaluates the financial health and creditworthiness of a business entity. It provides lenders, suppliers, and other stakeholders with an insight into the likelihood of a business repaying its debts and fulfilling its financial commitments.

Having a good business credit score is essential for establishing and maintaining a strong financial reputation. It not only impacts a company’s ability to secure loans and credit but can also influence the interest rates, terms, and credit limits offered by lenders and suppliers. A positive credit score can open doors to better financing options and business opportunities, while a low score can limit access to necessary resources.

Understanding the factors that contribute to a business credit score is crucial for business owners seeking to establish and improve their creditworthiness. Let’s explore the key elements that determine a business credit score and the importance of each factor.

Factors Affecting Business Credit Scores

Several factors influence a business credit score. These factors may vary depending on the credit reporting agency and the scoring model used. However, some common elements are universally considered when calculating a business credit score. Here are the key factors that affect business credit scores:

1. Payment History

Payment history is a critical factor that significantly impacts a business credit score. It evaluates how consistently a business makes payments on its financial obligations, such as loans, credit cards, and trade credit. Late payments, defaults, and delinquencies can have a detrimental effect on a company’s creditworthiness. On the other hand, consistently making timely payments boosts a business’s credit score and builds trust with lenders and suppliers.

2. Credit Utilization

Credit utilization refers to the percentage of available credit a business is using at any given time. It compares the amount of credit used to the total credit available. A high credit utilization ratio can indicate that a business is heavily reliant on credit and may be at risk of overextending its financial resources. Maintaining a low credit utilization ratio demonstrates responsible credit management and can positively impact a business credit score.

3. Credit History

The length of a business’s credit history is another crucial factor in determining its credit score. It assesses the age of the oldest credit account and the average age of all credit accounts associated with the business. A longer credit history provides a more substantial basis for evaluating creditworthiness. Generally, a business with a longer credit history is perceived as less risky compared to a newer business with limited credit data.

4. Public Records and Collections

Public records, such as bankruptcies, tax liens, and judgments, can significantly impact a business credit score. Negative public records suggest financial instability and an inability to meet financial obligations. Similarly, collections and outstanding debts can lower a business’s creditworthiness. Maintaining a clean record without any public records or collections is crucial for a healthy credit score.

5. Company Size and Industry Risk

The size of a business and its industry risk also play a role in calculating a business credit score. Companies operating in industries with higher risk factors, such as construction or retail, may face higher scrutiny and potentially have lower credit scores compared to businesses in less volatile sectors. Additionally, larger companies may have more extensive credit profiles, which can provide a more accurate assessment of creditworthiness.

Importance of a Good Business Credit Score

A good business credit score offers numerous benefits and can significantly impact a company’s financial success. Here are some reasons why a strong credit score is vital:

1. Easier Access to Financing

A high business credit score increases the likelihood of securing loans and other forms of financing. Lenders view businesses with good credit scores as less risky, making it easier for them to qualify for loans with more favorable terms, lower interest rates, and higher credit limits. This access to financing enables businesses to invest in growth opportunities, expand operations, and navigate through challenging economic times.

2. Better Supplier Terms

Suppliers often check a company’s credit score before extending trade credit or offering favorable payment terms. A good credit score demonstrates a company’s ability to honor its financial commitments, which can lead to better supplier relationships. With a strong credit score, businesses can negotiate longer payment terms, access discounts, and build trust with suppliers, ultimately improving cash flow and reducing costs.

3. Enhanced Business Reputation

A solid credit score enhances a business’s reputation and credibility in the marketplace. Customers, partners, and investors are more likely to trust and engage with companies that demonstrate financial stability. A good credit score can attract new customers, foster partnerships, and attract investment opportunities.

4. Lower Insurance Premiums

Some insurance companies take a business’s credit score into account when determining the premiums for general liability and property insurance. A higher credit score may result in lower premiums, potentially saving businesses money in insurance costs.

5. Increased Business Opportunities

A strong credit score can open doors to new business opportunities. Whether it’s bidding for lucrative contracts, securing favorable leasing agreements, or partnering with high-profile organizations, a good credit score demonstrates the financial strength and reliability necessary to capitalize on these opportunities.

In conclusion, a business credit score is a critical measure of a company’s creditworthiness and financial health. Maintaining a positive credit score is essential for accessing financing, securing favorable terms with suppliers, and establishing a reputable business presence. By understanding the factors that influence a business credit score and actively managing credit obligations, businesses can improve their creditworthiness and unlock a world of opportunities.

How Does Business Credit Score Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a business credit score?

A business credit score is a numerical representation of a company’s creditworthiness. It helps lenders determine the risk associated with extending credit to a business. Similar to personal credit scores, business credit scores are calculated based on various factors such as payment history, credit utilization, length of credit history, and public records.

How is a business credit score different from a personal credit score?

While personal credit scores reflect an individual’s creditworthiness, business credit scores evaluate the creditworthiness of a company. Personal credit scores are based on an individual’s financial behavior, whereas business credit scores consider factors like company size, industry, and financial data specific to the business.

Why is a business credit score important?

A business credit score is important because it helps lenders, suppliers, and other businesses assess the financial stability and creditworthiness of a company. It can impact a business’s ability to secure loans, obtain favorable terms on credit, win contracts, and establish relationships with suppliers.

How is a business credit score calculated?

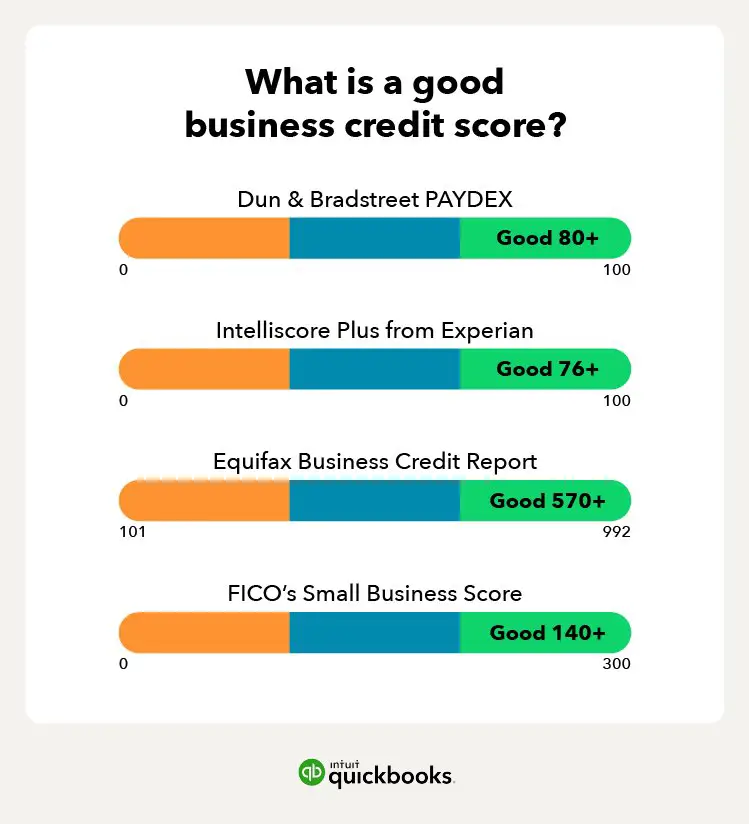

Business credit scores are calculated by credit bureaus such as Dun & Bradstreet, Experian, and Equifax. Each bureau has its own methodology, but common factors considered include payment history, credit utilization, public records, industry risk, company size, and length of credit history. The exact weightage assigned to each factor may vary.

What is considered a good business credit score?

Business credit scores usually range from 0 to 100, with higher scores indicating lower credit risk. While score ranges may vary between credit bureaus, generally a score above 75 is considered good. However, lenders and suppliers may have their own criteria for evaluating creditworthiness, so it’s important to understand their specific requirements.

How long does it take to establish a business credit score?

Building a business credit score takes time and consistent credit behavior. It typically takes at least six months of actively using credit and making timely payments to establish a credit history. However, the length of time required to achieve a good credit score may vary depending on the credit bureau and the specific credit activities of the business.

Can a business credit score be improved?

Yes, a business credit score can be improved over time. Businesses can take steps to improve their creditworthiness by making timely payments, minimizing credit utilization, maintaining a positive payment history, and regularly monitoring and disputing any errors on their credit reports. Building strong relationships with suppliers who report to credit bureaus can also help improve credit scores.

Do all businesses have a business credit score?

No, not all businesses have a business credit score. Business credit scores are typically associated with established businesses that have credit accounts and payment history. New businesses or those that haven’t yet established credit may not have a business credit score. However, it’s important for all businesses to start building credit as soon as possible to establish financial credibility.

Final Thoughts

A business credit score is a crucial factor in determining the creditworthiness of a company. It provides valuable insights into a business’s financial health, allowing lenders to assess the risk involved in extending credit. By analyzing factors such as payment history, credit utilization, and length of credit history, a business credit score helps lenders make informed decisions. It also plays a crucial role in establishing a company’s reputation and credibility in the eyes of potential partners, suppliers, and investors. Therefore, understanding and actively managing a business credit score is essential for long-term success and financial stability.