Have you ever wondered how to manage your 401(k) effectively? This vital retirement account can be a powerful tool for building wealth and securing a comfortable future. In this article, we will explore some practical strategies to make the most of your 401(k) investment. Whether you’re just starting out or looking to maximize your returns, we’ve got you covered. So, let’s dive in and discover how to effectively manage your 401(k) to achieve your financial goals.

How to Manage Your 401(k) Effectively

Understanding the Importance of Managing Your 401(k)

Managing your 401(k) effectively is crucial for securing your financial future. A 401(k) is a retirement savings plan offered by many employers, allowing employees to contribute a portion of their salary to a tax-advantaged investment account. By actively managing your 401(k), you can maximize your investment returns, reduce taxes, and ensure that you are on track to meet your retirement goals.

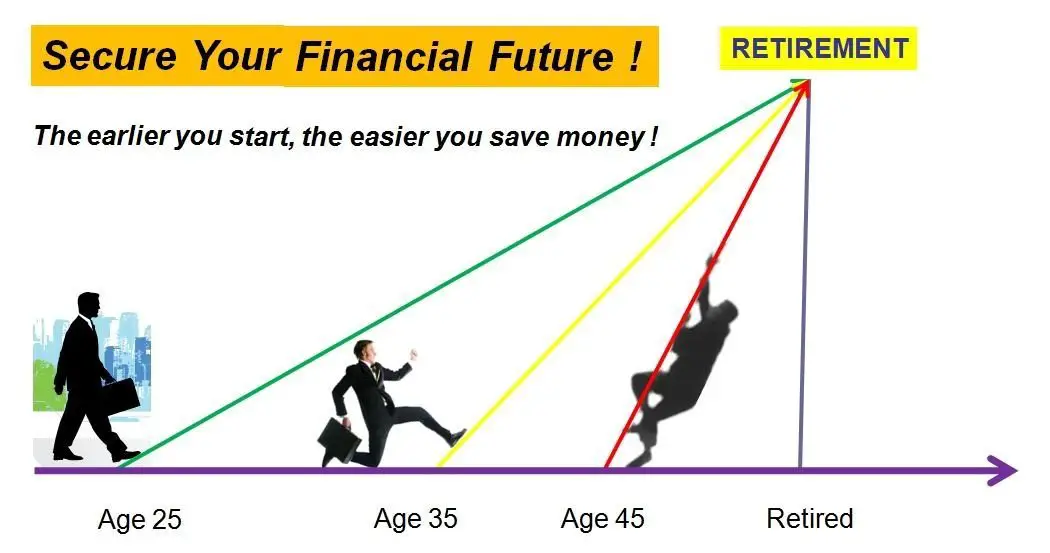

1. Start by Setting Clear Goals

Before you begin managing your 401(k), it’s important to have clear goals in mind. Ask yourself questions such as:

- At what age do I plan to retire?

- How much money will I need to maintain my desired lifestyle during retirement?

- What other sources of income do I expect to have during retirement?

Setting specific goals will provide you with a roadmap for managing your 401(k) effectively.

2. Review and Optimize Your Asset Allocation

Asset allocation is one of the most critical factors in determining the performance of your 401(k) portfolio. It refers to the distribution of your investments across different asset classes, such as stocks, bonds, and cash. By diversifying your investments, you can potentially reduce risk while maximizing returns.

Consider the following factors when reviewing and optimizing your asset allocation:

- Your risk tolerance: Assess how much risk you are willing to take on. Younger investors with a longer time horizon may be more comfortable with a higher allocation to stocks, while older investors nearing retirement may prefer a more conservative approach.

- Your investment goals: Align your asset allocation with your long-term investment goals. If you have a higher risk tolerance and aim for higher growth, you may choose a higher allocation to stocks.

- Market conditions: Regularly review and rebalance your portfolio to maintain your desired asset allocation, taking into account market conditions and any changes to your risk tolerance or investment goals.

3. Take Advantage of Employer Matching Contributions

Many employers offer matching contributions to employees’ 401(k) accounts. This means that for every dollar you contribute, your employer will also contribute a certain percentage, typically up to a certain limit.

To maximize the benefits of employer matching contributions, make sure you:

- Contribute enough to receive the full employer match: Review your employer’s matching policy and contribute at least the minimum amount required to receive the maximum match. Otherwise, you’re essentially leaving free money on the table.

- Understand vesting schedules: Some employers have vesting schedules that determine when you become fully entitled to the employer’s contributions. Familiarize yourself with these schedules to ensure you meet the required criteria.

4. Regularly Monitor and Rebalance Your Portfolio

Managing your 401(k) effectively involves regularly monitoring and rebalancing your portfolio. This ensures that your investment mix remains aligned with your goals and risk tolerance.

Consider the following steps when monitoring and rebalancing your portfolio:

- Review your investments: Regularly assess the performance of your investments and make informed decisions based on their ongoing suitability.

- Adjust asset allocation: If your target asset allocation has deviated significantly from your desired mix, rebalance your portfolio by buying or selling assets to bring it back in line.

- Stay informed about market trends: Keep yourself updated on market trends and economic conditions that may impact your investment choices.

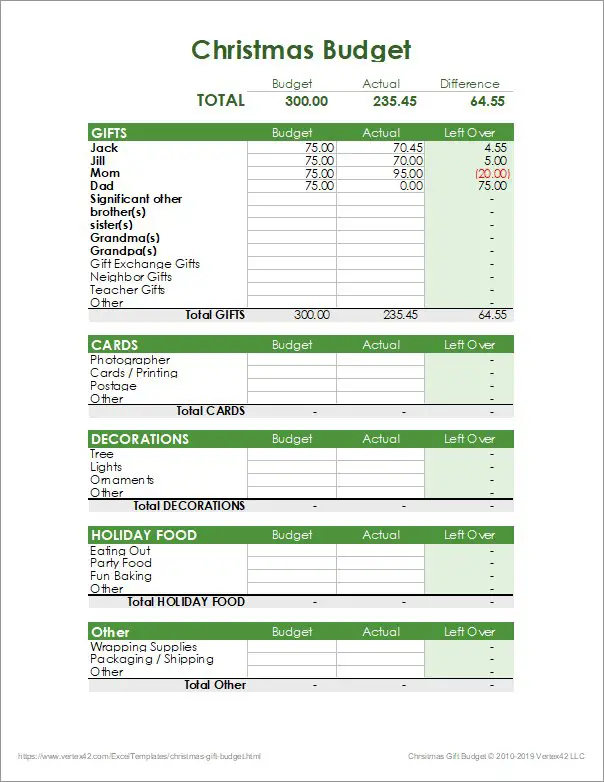

5. Minimize Fees and Expenses

Fees and expenses can eat into the growth of your 401(k) savings over time. To manage your 401(k) effectively, consider the following tips to minimize fees:

- Compare expense ratios: Expense ratios represent the percentage of assets deducted annually to cover administrative and management expenses. Compare the expense ratios of different investment options within your 401(k) plan and choose lower-cost funds.

- Avoid unnecessary transactions: Frequent buying and selling of investments can lead to additional transaction costs. Stick to a long-term investment strategy and avoid unnecessary trading.

- Consolidate accounts: If you’ve changed jobs and have multiple 401(k) accounts, consider consolidating them into a single account to reduce administrative fees.

6. Stay Informed and Seek Professional Advice

Managing your 401(k) effectively requires staying informed about retirement planning strategies, investment options, and tax laws. Consider the following sources of information and advice:

- Financial websites: Stay up-to-date with reputable financial websites that provide insights into retirement planning and investment strategies.

- Retirement calculators: Use retirement calculators to assess your progress toward your retirement goals and make adjustments accordingly.

- Financial advisors: Consult with a qualified financial advisor who can provide personalized guidance based on your unique financial situation and goals.

Effectively managing your 401(k) is crucial for a successful retirement. By setting clear goals, optimizing your asset allocation, taking advantage of employer matching contributions, regularly monitoring your portfolio, minimizing fees, and staying informed, you can maximize the potential of your 401(k) investments. Remember, managing your 401(k) is an ongoing process, so regularly review and adjust your strategy as needed to ensure a secure and comfortable retirement.

Essential Tips to Maximize Your 401k (Don't Leave Money on the Table)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

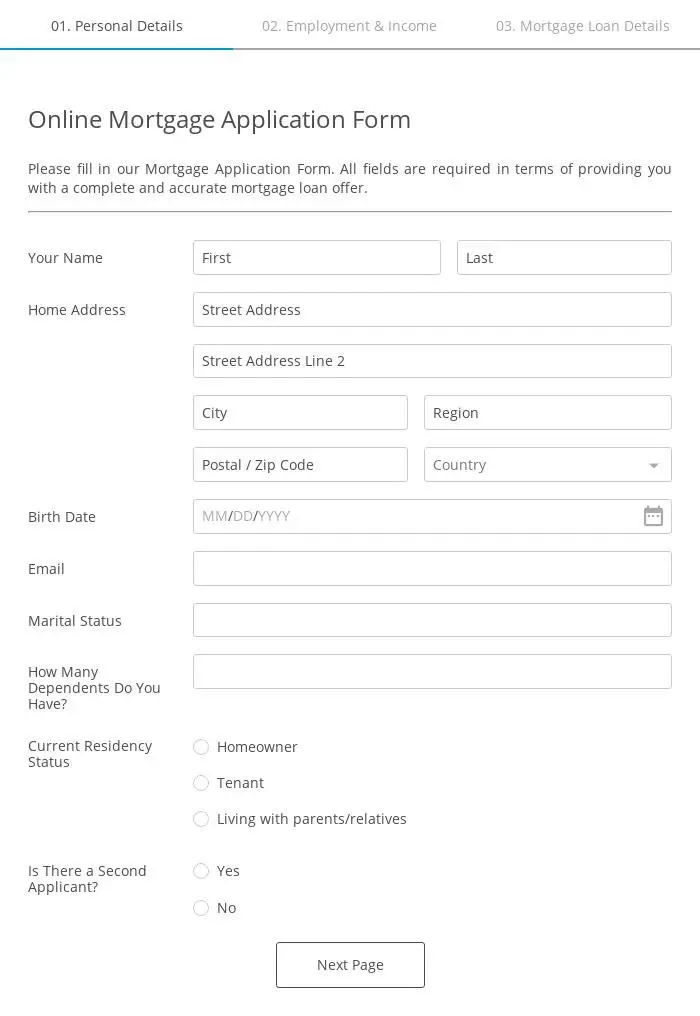

1. How can I effectively manage my 401(k) retirement account?

By following these steps, you can manage your 401(k) account effectively:

- Regularly review your investment options and make adjustments if necessary.

- Contribute the maximum amount allowable to take full advantage of employer matches.

- Diversify your investments to spread risk and maximize potential returns.

- Monitor your account performance and make necessary changes based on your goals and risk tolerance.

- Stay informed about changes to retirement regulations and adjust your strategy accordingly.

2. How often should I review my 401(k) investments?

It is recommended to review your 401(k) investments at least once a year or whenever there are significant changes in your financial situation, such as a new job or a change in your risk tolerance.

3. Should I seek professional advice to manage my 401(k) account?

While it’s not mandatory, seeking professional advice can be beneficial, especially if you are unsure about investment options or need guidance in creating a suitable retirement plan. A professional financial advisor can help you make informed decisions based on your specific situation.

4. Are there any penalties for withdrawing from my 401(k) before retirement age?

Yes, there are typically penalties for early withdrawals from a 401(k) account before reaching the age of 59 ½. These penalties include income tax on the withdrawal amount and an additional 10% early withdrawal penalty. However, some exceptions apply, such as financial hardship or certain medical expenses.

5. Can I contribute to my 401(k) if I change jobs?

Yes, you have the option to roll over your 401(k) from a previous employer into your new employer’s 401(k) plan or an individual retirement account (IRA). You can also choose to leave the money in your old 401(k) plan, but it may be subject to certain limitations.

6. What is the difference between a traditional and a Roth 401(k)?

A traditional 401(k) allows you to contribute pre-tax income, reducing your taxable income for the year. Withdrawals from a traditional 401(k) are taxed as ordinary income during retirement. On the other hand, a Roth 401(k) is funded with after-tax income, meaning withdrawals during retirement are tax-free, as long as certain conditions are met.

7. Can I borrow money from my 401(k) account?

Most 401(k) plans offer the option to take out a loan from your account balance. However, there are limitations and potential drawbacks to consider. It’s essential to review the terms and consequences of borrowing from your 401(k) before making a decision.

8. What happens to my 401(k) if I leave my job?

When you leave your job, you typically have several options for your 401(k) account. You can choose to leave it with your previous employer, roll it over into your new employer’s plan or an IRA, or withdraw the funds. Each option has different implications, so it’s advisable to carefully consider your choices based on your specific circumstances.

Final Thoughts

In order to manage your 401(k) effectively, it is crucial to understand your financial goals and create a well-diversified investment portfolio. Regularly review and adjust your contributions to ensure you’re maximizing your employer’s matching contributions and taking advantage of any available tax benefits. Stay informed about the performance of your investments and consider consulting with a financial advisor for expert guidance. Keep track of any changes in your employment or financial situation that may require adjustments to your retirement savings strategy. By actively managing your 401(k) with a focus on long-term growth, you can secure a financially stable future.