Are you in your 50s and wondering how to plan for retirement? You’ve come to the right place! Planning for retirement can seem like a daunting task, but with the right mindset and approach, it can be a smooth and fulfilling process. In this article, we will guide you through the steps to create a solid retirement plan that ensures financial security and a comfortable lifestyle in your golden years. So, if you’re ready to take charge of your future and make the most out of your retirement, let’s dive in and explore how to plan for retirement in your 50s.

How to Plan for Retirement in Your 50s

Retirement is an important milestone in life, and planning for it in your 50s can ensure a comfortable and fulfilling future. As you approach this stage of life, it’s essential to consider various aspects, such as financial readiness, healthcare, lifestyle adjustments, and personal goals. By taking proactive steps and making informed decisions, you can pave the way for a secure and enjoyable retirement.

Assess Your Financial Situation

One of the first steps in planning for retirement in your 50s is to assess your financial situation. Consider the following factors:

- Current Savings: Take stock of your existing retirement savings, including any pensions, IRAs, or 401(k) accounts. Determine if your current savings are on track to meet your retirement goals.

- Debt Evaluation: Evaluate your outstanding debts, such as mortgages, loans, or credit card balances. It’s crucial to create a plan to pay off high-interest debts before retiring.

- Projected Expenses: Estimate your future expenses in retirement. Account for essential costs such as housing, healthcare, food, transportation, and other lifestyle choices. Creating a budget can help you understand the financial resources you’ll need.

- Expected Income: Assess your expected income sources during retirement, such as Social Security benefits, pensions, or rental income. Determine how these income streams will contribute to your retirement funds.

- Investment Strategy: Review your investment portfolio to ensure it aligns with your retirement goals. Consider diversifying your investments and consulting with a financial advisor to optimize your returns.

Maximize Retirement Savings Contributions

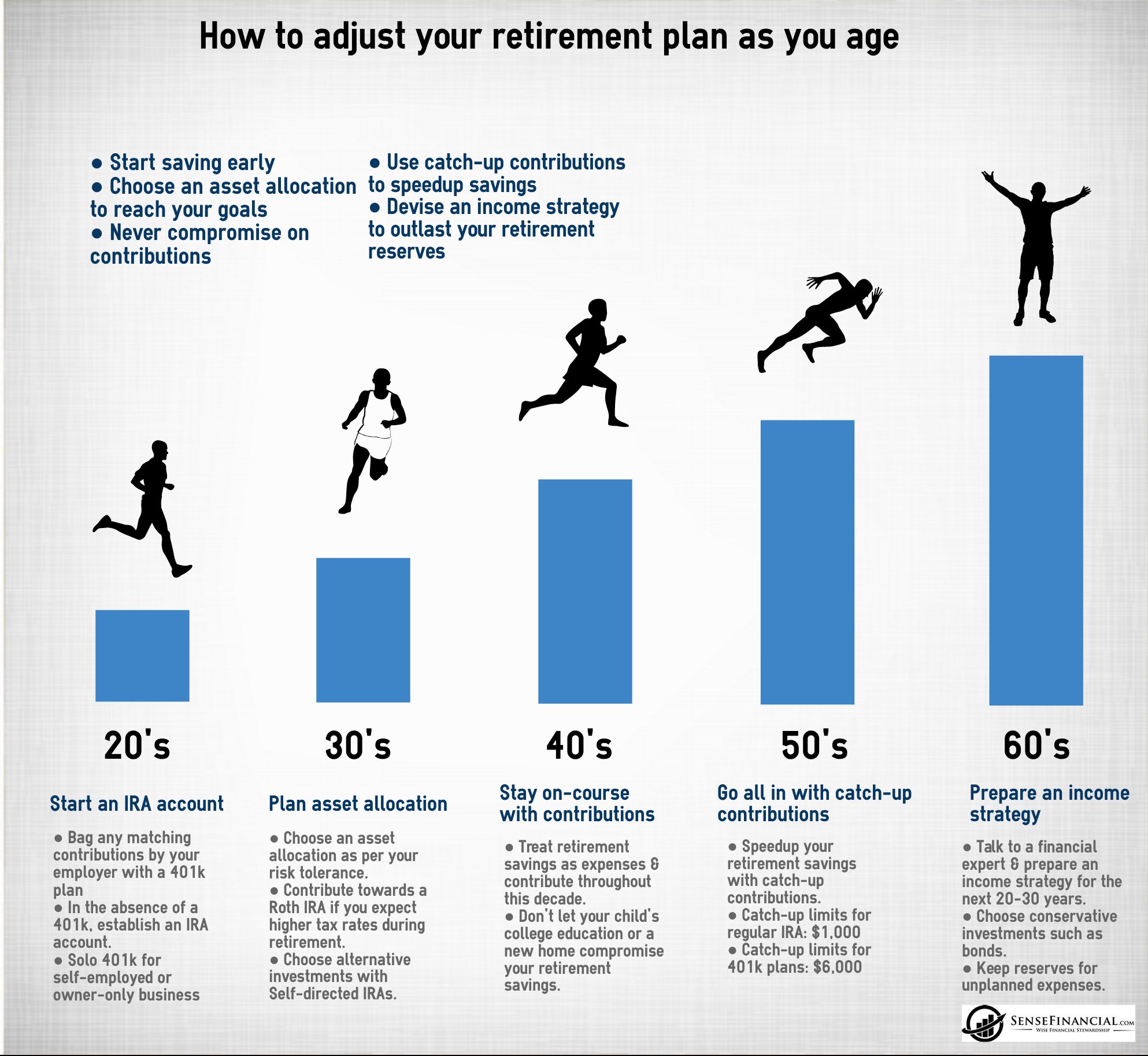

Once you have assessed your financial situation, it’s essential to maximize your retirement savings contributions in your 50s. Here are some strategies to consider:

- Take Advantage of Catch-Up Contributions: If you’re 50 or older, you’re eligible for catch-up contributions to retirement accounts. For example, in 2021, you can contribute an extra $6,500 to your 401(k) and an additional $1,000 to your IRA. Maximize these contributions to boost your retirement savings.

- Explore Roth IRAs: Consider contributing to a Roth IRA in addition to your traditional retirement accounts. Roth IRAs provide tax-free withdrawals in retirement, which can be advantageous for certain individuals.

- Utilize Employer Matches: If your employer offers a matching contribution to your retirement account, make sure you contribute enough to receive the full match. Employer matches are essentially free money that can significantly enhance your retirement savings.

Consider Healthcare Needs

Medical expenses are a significant concern during retirement. Planning for healthcare needs in your 50s can help you avoid financial stress down the road. Here are some steps to consider:

- Evaluate Health Insurance Options: Explore your health insurance options once you retire. If you retire before the age of 65, when Medicare eligibility begins, you’ll need to find alternative coverage. Research options such as COBRA, private insurance, or coverage under a spouse’s plan.

- Understand Medicare: Familiarize yourself with the various parts of Medicare, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage). Consider enrolling in Medicare promptly to avoid penalties.

- Long-Term Care: Investigate long-term care insurance options to protect yourself from potentially high costs associated with nursing homes or in-home care. Long-term care insurance can provide peace of mind and financial security as you age.

Adjust Lifestyle and Expenses

Retirement often comes with changes in lifestyle and expenses. By adjusting your lifestyle and managing your expenses in your 50s, you can better prepare for retirement. Consider the following:

- Downsize Your Home: If you have a large home, downsizing can reduce housing expenses and provide extra funds for retirement. Evaluate your housing needs and consider moving to a smaller, more affordable residence.

- Eliminate Non-Essential Debt: Prioritize paying off non-essential debt to reduce financial burdens in retirement. Eliminate high-interest credit card debt, car loans, or other loans with substantial interest payments.

- Practice Frugality: Embrace a frugal lifestyle by cutting unnecessary expenses. Review your budget and find areas where you can reduce spending. Small changes, such as cooking at home more often or cancelling unused subscriptions, can make a significant impact over time.

- Consider Part-Time Work: If you enjoy working or need additional income, consider exploring part-time job opportunities or turning your hobbies into a source of income during retirement.

Create a Retirement Income Plan

Developing a retirement income plan is crucial to ensure a steady cash flow during your post-working years. Here’s how to create an effective retirement income plan:

- Estimate Retirement Expenses: Calculate your estimated retirement expenses based on your projected budget. Consider factors such as housing, healthcare, transportation, food, and leisure activities.

- Plan Social Security Strategy: Understand the implications of claiming Social Security benefits early versus waiting until full retirement age or even later. Research the best strategy for maximizing your benefits based on your individual circumstances.

- Explore Withdrawal Strategies: Determine a sustainable withdrawal strategy for your retirement savings. The 4% rule, which suggests withdrawing 4% of your savings in the first year and adjusting for inflation in subsequent years, is a commonly used guideline.

- Consider Annuities: Investigate the possibility of purchasing an annuity to provide guaranteed income during retirement. Annuities can offer a steady stream of payments, providing stability and peace of mind.

- Review Tax Implications: Understand the tax implications of your retirement income sources. Consult a tax professional to explore strategies that can minimize tax obligations and maximize your income.

Planning for retirement in your 50s requires careful consideration of various factors, ranging from financial readiness to healthcare needs and lifestyle adjustments. By taking a proactive approach, maximizing your savings, and making informed decisions, you can set the stage for a fulfilling and secure retirement. Start planning today and enjoy the peace of mind that comes with knowing you’re on the right track.

Sample retirement plan for 50 year old getting late start.

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start planning for retirement in my 50s?

Starting retirement planning in your 50s may require a more focused approach. Begin by assessing your financial situation, including your savings, investments, and debts. Set realistic retirement goals, create a budget, and explore investment options that align with your risk tolerance and time horizon. Seek guidance from a financial advisor to develop a comprehensive retirement plan.

2. Is it too late to save for retirement if I’m in my 50s?

No, it’s never too late to start saving for retirement. While you may have less time to accumulate wealth compared to someone in their 20s or 30s, there are still various strategies you can employ. Maximize your contributions to retirement accounts, such as 401(k)s or IRAs, and consider diversifying your investments. Reduce unnecessary expenses and consider working with a financial advisor to develop an effective savings plan.

3. How much money should I save for retirement in my 50s?

The amount of money you should save for retirement in your 50s varies depending on your lifestyle and retirement goals. A general rule of thumb is to aim for a retirement savings goal equal to 10 to 12 times your annual income. Consider factors such as anticipated expenses, healthcare costs, and desired lifestyle to estimate a realistic retirement savings target.

4. Should I consider downsizing my home as part of my retirement plan?

Downsizing your home can potentially free up funds that can be redirected towards retirement savings or used to cover living expenses during retirement. Consider your housing needs, financial situation, and personal preferences when deciding whether to downsize. Consult with a real estate professional to assess the market and evaluate the potential benefits and drawbacks of downsizing.

5. What role does healthcare play in retirement planning at age 50?

Healthcare costs can significantly impact your retirement finances, especially as you age. It’s crucial to evaluate and plan for these expenses in your retirement strategy. Research health insurance options available to you, such as Medicare, and consider long-term care insurance to protect against potential high medical costs. Include healthcare expenses in your retirement budget to ensure your financial preparedness.

6. Can I still contribute to retirement accounts if I’m in my 50s?

Absolutely! In fact, individuals in their 50s may have additional catch-up contribution options. For certain retirement accounts like 401(k)s and IRAs, there are catch-up provisions that allow individuals aged 50 and above to contribute extra funds beyond the standard limits. Take advantage of these catch-up contributions to help boost your retirement savings.

7. Should I consider working longer to increase my retirement savings?

Working longer can have a positive impact on your retirement savings. By extending your career, you can continue contributing to retirement accounts, delay accessing Social Security benefits, and potentially rely less on your savings during retirement. However, it’s important to assess your overall health, personal circumstances, and desire to continue working before making this decision.

8. Do I need a financial advisor to help me plan for retirement in my 50s?

While not necessary, working with a financial advisor can provide valuable expertise and guidance when planning for retirement in your 50s. A knowledgeable advisor can assess your financial situation, help you set realistic goals, create a customized retirement plan, and provide insights on investment options. A financial advisor can also help you stay on track and adjust your strategy as needed over time.

Final Thoughts

Planning for retirement in your 50s is essential for a secure future. Start by assessing your current financial situation and setting clear retirement goals. Contribute regularly to retirement accounts, taking advantage of any employer matching programs. Diversify your investments to minimize risk and maximize returns. Consider downsizing or adjusting your lifestyle to save more. Create a budget and stick to it, avoiding unnecessary expenses. Continually review and adjust your retirement plan to ensure you stay on track. By following these steps and taking proactive measures, you can effectively plan for retirement in your 50s.