Are you looking for tips to successfully plan your finances for the long term? Well, look no further! In this article, we will explore practical strategies and insightful advice that will help you navigate the path to financial security. Effective long-term financial planning is key to achieving your goals and ensuring a stable future. Whether you’re saving for retirement, building wealth, or preparing for unexpected expenses, these tips for successful long-term financial planning will provide you with the guidance you need. So let’s dive in and discover how you can take control of your financial future!

Tips for Successful Long-Term Financial Planning

Introduction

Planning for the future is an essential part of ensuring financial stability and security. Long-term financial planning allows individuals to set goals, establish a roadmap, and make informed decisions to achieve their desired outcomes. Whether you are saving for retirement, buying a house, or starting a business, having a well-thought-out financial plan is crucial. In this article, we will explore some valuable tips and strategies for successful long-term financial planning that can help you build a solid foundation for your financial future.

1. Set Clear and Realistic Financial Goals

The first step in creating an effective long-term financial plan is to define your goals. Setting clear and realistic objectives will provide you with a target to aim for and will help you stay motivated throughout the process. Consider both short-term and long-term goals, such as buying a car, paying off debts, saving for education, or building an emergency fund. Write them down and prioritize based on importance and achievable timelines.

Tips for Setting Financial Goals:

- Be specific: Clearly define what you want to achieve.

- Make them measurable: Set quantifiable targets, such as saving a specific amount of money.

- Set a timeframe: Determine when you want to accomplish each goal.

- Ensure they are realistic: Consider your income, expenses, and other obligations when setting goals.

- Revisit and adjust: As your circumstances change, review and modify your goals accordingly.

2. Create a Budget and Stick to It

Budgeting is a crucial aspect of long-term financial planning. It helps you monitor your income, expenses, and savings, enabling you to make necessary adjustments to achieve your goals. By creating a realistic budget and sticking to it, you can gain control over your finances and avoid unnecessary debt.

Steps to Create an Effective Budget:

- Analyze your income: Calculate your total income from all sources.

- Track your expenses: Keep a record of all your expenses, including fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Categorize your expenses: Divide your expenses into categories, such as housing, transportation, food, and entertainment.

- Identify areas for adjustment: Review your expenses and identify areas where you can cut back or reduce spending.

- Allocate savings: Set aside a portion of your income for savings and investments.

- Monitor and adjust: Regularly review your budget, track your spending, and make necessary adjustments to stay on track.

3. Build an Emergency Fund

Unexpected events and emergencies can disrupt even the most well-planned financial strategies. Building an emergency fund is crucial to protect yourself from unforeseen expenses and financial setbacks. This fund acts as a safety net, providing you with peace of mind and preventing you from relying on credit cards or taking out loans when unexpected costs arise.

Tips for Building an Emergency Fund:

- Set a target amount: Aim to have three to six months’ worth of living expenses saved.

- Start small: Begin by setting aside a small percentage of your income each month and gradually increase it over time.

- Automate savings: Set up automatic transfers from your checking account to a separate savings account dedicated to your emergency fund.

- Make it a priority: Treat your emergency fund savings as a fixed expense and prioritize it over discretionary spending.

- Avoid temptation: Keep your emergency fund separate from your regular spending accounts to prevent impulsive withdrawals.

4. Manage and Reduce Debt

Debt can be a significant obstacle to long-term financial success. Managing and reducing your debt is an essential part of any financial plan. By minimizing your debt burden, you can free up funds that can be directed towards savings and investments.

Strategies for Managing and Reducing Debt:

- Create a debt repayment plan: List all your debts, including balances and interest rates. Prioritize paying off high-interest debts first.

- Consider debt consolidation: Explore options to consolidate multiple debts into a single loan with a lower interest rate.

- Avoid incurring new debt: Pause unnecessary spending and focus on paying off existing debts before taking on new ones.

- Make regular payments: Pay at least the minimum amount due on all debts to avoid late fees and penalties.

- Seek professional advice: If your debt situation feels overwhelming, consider consulting a financial advisor or credit counseling agency for guidance.

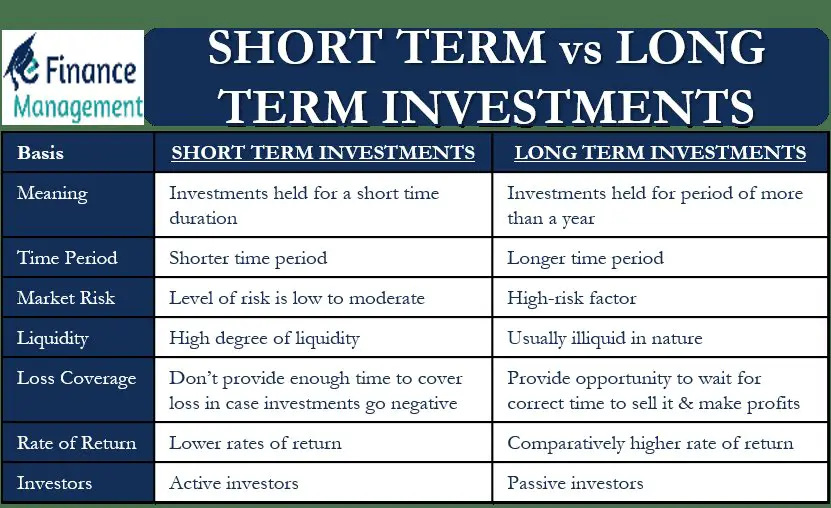

5. Diversify Your Investments

Investing is a critical component of long-term financial planning. Diversifying your investments helps spread risk and maximize potential returns. By allocating your funds across various asset classes, such as stocks, bonds, real estate, and mutual funds, you can mitigate the impact of market fluctuations and optimize your portfolio’s performance.

Key Principles for Investment Diversification:

- Asset allocation: Allocate your investments across different asset classes based on your risk tolerance and investment goals.

- Consider time horizon: Adjust your investment mix based on your time horizon, with longer-term investments potentially taking on more risk.

- Regularly rebalance: Periodically review and rebalance your investment portfolio to maintain the desired asset allocation.

- Consider professional advice: If you are unsure about investment strategies, consider consulting with a financial advisor to determine the best approach for your circumstances.

6. Educate Yourself and Stay Informed

Financial knowledge is empowering. Take the time to educate yourself about various financial concepts, investment strategies, and personal finance best practices. Stay informed about market trends, tax regulations, and changes that may impact your long-term financial plan.

Useful Resources for Financial Education:

- Books and publications: Read books, articles, and reputable publications on personal finance and investment topics.

- Online courses and webinars: Participate in online courses or webinars that cover financial planning, budgeting, and investment strategies.

- Financial websites and blogs: Follow credible financial websites and blogs that provide valuable insights and tips for successful financial planning.

- Financial advisors: Consider working with a qualified financial advisor who can provide personalized guidance based on your specific goals and circumstances.

Successful long-term financial planning requires discipline, dedication, and a proactive approach. By setting clear goals, creating a realistic budget, building an emergency fund, managing debt, diversifying investments, and continuously educating yourself, you can take control of your financial future. Remember that financial planning is not a one-time event but an ongoing process that requires regular review and adjustments. With careful planning and informed decision-making, you can build a bright and secure financial future for yourself and your loved ones.

Creating and Sticking to a Long-Term Financial Plan: 6 Tips for Success

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start planning for long-term financial success?

To start planning for long-term financial success, you should first assess your current financial situation, set specific financial goals, create a budget, establish an emergency fund, and develop a savings plan. It is also crucial to regularly review and adjust your financial plan as needed.

2. What are some key factors to consider when planning for the long term?

When planning for the long term, it is important to consider factors such as your income, expenses, debt, investments, inflation, and risk tolerance. You should also take into account any specific milestones or events you anticipate in the future, such as buying a home, starting a family, or retiring.

3. How can I stay motivated to stick to my long-term financial plan?

To stay motivated, it is helpful to periodically revisit your goals and remind yourself of the reasons why achieving financial success is important to you. Celebrate milestones along the way and track your progress. Surround yourself with positive influences and seek support from family, friends, or even a financial advisor.

4. What are some strategies for saving money in the long run?

Some strategies for saving money in the long run include automating your savings, cutting unnecessary expenses, negotiating bills and contracts, comparing prices before making major purchases, and avoiding impulse buying. It is also beneficial to prioritize saving and make it a regular habit.

5. How can I effectively manage and reduce my debt over time?

To manage and reduce your debt over time, start by creating a realistic debt repayment plan. Prioritize your debts based on interest rates and tackle high-interest debt first. Consider consolidating debts or negotiating with creditors for better terms. Additionally, minimizing new debt and practicing responsible borrowing habits will help you in the long run.

6. Is investing necessary for long-term financial planning?

While investing is not a requirement for long-term financial planning, it can significantly enhance your financial success. Investing allows your money to grow over time, potentially outpacing inflation and providing you with a source of income in the future. It is important to understand your risk tolerance and research different investment options before making any decisions.

7. How often should I review and update my long-term financial plan?

It is recommended to review and update your long-term financial plan at least once a year, or whenever there are significant changes in your life such as getting married, having children, changing careers, or reaching major financial milestones. Regularly monitoring your plan ensures that it remains aligned with your goals and circumstances.

8. What are some common pitfalls to avoid in long-term financial planning?

Some common pitfalls to avoid in long-term financial planning include failing to have an emergency fund, not diversifying investments, neglecting to regularly review and adjust your plan, and succumbing to impulsive or emotional financial decisions. It is also important to avoid relying solely on short-term market trends and to instead focus on long-term goals.

Final Thoughts

In conclusion, successful long-term financial planning requires careful consideration and strategic decision-making. Firstly, it is crucial to set clear financial goals and regularly review them to ensure they align with your changing needs. Secondly, creating a realistic budget and sticking to it can help you maintain control over your finances. Additionally, diversifying investments and regularly monitoring their performance can help mitigate risk. Furthermore, it is important to build an emergency fund to handle unexpected expenses. Finally, staying informed about financial trends and seeking professional advice when needed can provide valuable insights. By following these tips for successful long-term financial planning, individuals can secure their financial future and achieve their goals.