Are you looking to invest in mutual funds, but unsure about how to choose the right one for you? Well, look no further! In this blog article, we will walk you through the process of selecting the perfect mutual fund that aligns with your financial goals and risk appetite. Whether you’re a beginner or a seasoned investor, understanding the key factors to consider will ensure you make informed decisions. So, let’s dive right in and demystify the process of choosing the right mutual fund for you.

How to Choose the Right Mutual Fund for You

Investing in mutual funds can be an effective way to grow your wealth and achieve your financial goals. With so many options available, choosing the right mutual fund can feel overwhelming. In this comprehensive guide, we will walk you through the process of selecting the perfect mutual fund for your needs. From understanding your investment objectives to evaluating fund performance, we’ve got you covered. Let’s dive in!

Evaluating Your Investment Objectives

Before you begin your search for the ideal mutual fund, it’s important to evaluate your investment objectives. This step will help you narrow down your options and find a fund that aligns with your goals. Consider the following points:

1. Determine Your Time Horizon

Your time horizon refers to the length of time you intend to keep your money invested. Are you investing for the short term, like a down payment on a house in a few years? Or are you looking to build a retirement nest egg over several decades? Identifying your time horizon will help you decide on the appropriate mutual fund category.

– Short-term goals (1-3 years): Consider money market funds or short-term bond funds for capital preservation and liquidity.

– Medium-term goals (3-5 years): Balanced funds or bond funds may be suitable for moderate growth and income.

– Long-term goals (5 years or more): Equity funds, such as index funds or actively managed funds, offer potential for long-term growth.

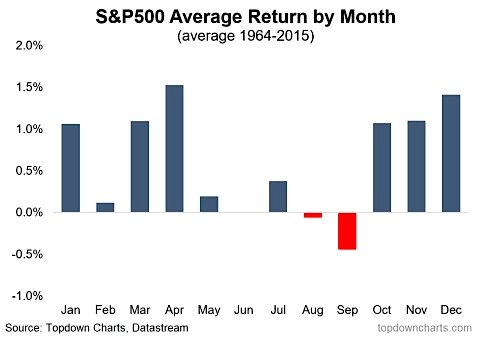

2. Assess Your Risk Tolerance

Understanding your risk tolerance is crucial when choosing a mutual fund. Risk tolerance refers to your comfort level with the ups and downs of the stock market. Generally, higher-risk investments have the potential for greater returns, but also come with increased volatility. Consider the following risk categories:

– Conservative: Preferring stable returns with minimal risk, you may opt for bond funds or money market funds.

– Moderate: Willing to accept some fluctuations, you may consider balanced funds or a mix of stocks and bonds.

– Aggressive: Comfortable with market volatility, you may lean towards equity funds or sector-specific funds.

3. Define Your Financial Goals

Clearly defining your financial goals will help you choose a mutual fund that aligns with your aspirations. Consider the following questions:

– What are you investing for? (e.g., retirement, education, home purchase, wealth accumulation)

– How much return do you expect to achieve your goals?

– What are your income needs and timeline for achieving these goals?

Understanding Fund Categories

Mutual funds come in various categories, each with its own investment strategies and objectives. Understanding these categories will enable you to make informed decisions when selecting a fund. Here are some common mutual fund categories:

1. Equity Funds

Equity funds primarily invest in stocks and target long-term growth. They come in different subcategories, such as:

– Large-cap funds: Focus on established companies with stable earnings.

– Mid-cap funds: Invest in medium-sized companies with growth potential.

– Small-cap funds: Target small, emerging companies with high growth potential.

– Sector-specific funds: Concentrate on specific industries, such as technology, healthcare, or energy.

2. Bond Funds

Bond funds invest in fixed-income securities like government bonds, corporate bonds, or municipal bonds. They aim to generate income through regular interest payments. Bond funds can be categorized as:

– Government bond funds: Invest in Treasury bonds and are considered low-risk.

– Corporate bond funds: Purchase bonds issued by corporations with varying risk levels.

– High-yield bond funds: Seek higher yields by investing in lower-rated or riskier bonds.

3. Balanced Funds

Balanced funds, also known as hybrid funds, provide investors with a mix of stocks and bonds. These funds aim for both capital appreciation and income. They can be further classified based on asset allocation, such as:

– Conservative balanced funds: Prioritize income generation with a higher bond allocation.

– Growth-oriented balanced funds: Emphasize long-term growth with a higher equity allocation.

4. Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. These funds offer broad market exposure at a lower cost compared to actively managed funds. They are passively managed and follow a “buy and hold” approach.

Evaluating Fund Performance

After identifying the mutual fund categories that align with your investment objectives, it’s essential to evaluate their performance. Here are some key factors to consider:

1. Historical Performance

Assessing a fund’s historical performance can provide insights into its track record. Look for consistent returns over multiple time periods and compare them to relevant benchmarks. Keep in mind that past performance is not a guarantee of future results.

2. Expense Ratio

The expense ratio represents the annual operating costs of a mutual fund as a percentage of its assets. Lower expense ratios can significantly impact your overall returns. Consider funds with expense ratios that align with your investment strategy.

3. Fund Manager Expertise

The expertise and track record of the fund manager can play a crucial role in a fund’s performance. Research the fund manager’s experience, investment philosophy, and tenure with the fund. A seasoned and skilled manager can add value to your investment.

4. Portfolio Holdings

Reviewing a fund’s portfolio holdings will give you insights into its underlying investments. Ensure that the fund’s holdings align with your investment objectives, risk tolerance, and diversification preferences. Look for a well-diversified portfolio across different sectors and asset classes.

Considering Costs and Minimum Investments

When choosing a mutual fund, it is important to consider the costs involved and the minimum investment required. Here are some cost factors to evaluate:

1. Loads

Some mutual funds charge sales loads, which are fees paid when buying or selling shares. There are two types of loads:

– Front-end loads: Charged upfront when purchasing shares.

– Back-end loads: Charged when selling shares (typically decreases over time).

Consider no-load funds or funds with low loads to minimize expenses.

2. Redemption Fees

Redemption fees are charged when you sell your mutual fund shares within a specified holding period, typically a year. Be aware of any redemption fees and their impact on your investment strategy.

3. Minimum Investments

Each mutual fund may have a minimum investment requirement. Ensure that the minimum investment fits your budget and investment goals.

Seeking Professional Advice

If you find the process of selecting a mutual fund overwhelming or lack the time and expertise to thoroughly evaluate funds, seeking professional advice is a wise option. Financial advisors can guide you through the selection process, considering your unique circumstances and goals. They can provide personalized recommendations based on their expertise and access to comprehensive data.

Choosing the right mutual fund requires careful consideration of your investment objectives, risk tolerance, and financial goals. By evaluating fund categories, assessing performance metrics, and considering costs and minimum investments, you can make an informed decision. Remember that investing involves risks, and diversification is key to managing those risks effectively. Ensure you stay updated on the performance of your chosen mutual fund and make adjustments when necessary. Start your investment journey today and work towards achieving your financial aspirations.

How Do I Pick the Right Mutual Funds?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I choose the right mutual fund for me?

Choosing the right mutual fund requires careful consideration of several factors such as your financial goals, risk tolerance, investment time frame, and investment knowledge. Here are some steps to help you:

What should I consider when assessing my financial goals?

When assessing your financial goals, you should consider your short-term and long-term objectives, whether you are saving for retirement, education, or a specific purchase. It is important to align your investment strategy with your financial goals.

How can I determine my risk tolerance?

To determine your risk tolerance, you need to evaluate how comfortable you are with the possibility of losing money in your investments. Factors such as age, investment experience, and financial obligations can influence your risk tolerance.

What is the difference between active and passive mutual funds?

Active mutual funds are managed by fund managers who aim to outperform the market by actively selecting and managing investments. In contrast, passive mutual funds, also known as index funds, aim to replicate the performance of a specific market index.

Should I invest in equity, debt, or balanced mutual funds?

The choice between equity, debt, or balanced mutual funds depends on your risk tolerance and investment goals. Equity funds are suitable for investors with a higher risk appetite, while debt funds are more conservative. Balanced funds offer a mix of both equity and debt investments.

What fees should I consider when choosing a mutual fund?

When choosing a mutual fund, you should consider the expense ratio, which includes management fees and operating expenses. Additionally, some funds may charge front-end or back-end loads, which are sales commissions.

How can I research and compare different mutual funds?

You can research and compare different mutual funds by reviewing their historical performance, expense ratios, investment objectives, and portfolio holdings. Online platforms and financial advisors can provide valuable resources for conducting this research.

Should I consult a financial advisor before investing in mutual funds?

Consulting a financial advisor can provide valuable insights and guidance tailored to your specific financial situation. They can help you assess your risk tolerance, determine your investment goals, and recommend suitable mutual funds.

Final Thoughts

Choosing the right mutual fund for you requires careful consideration and research. Start by determining your financial goals and risk tolerance. Evaluate the fund’s performance, expense ratio, and management team. Consider the fund’s investment strategy and holdings, ensuring they align with your investment objectives. Additionally, review the fund’s track record and historical returns. Lastly, compare multiple funds and seek professional advice if needed. By following these steps and conducting thorough due diligence, you can select a mutual fund that suits your needs and helps you achieve your financial goals.