Income volatility can be a perplexing concept to grasp, but fear not, this article is here to help you demystify it. So, what exactly is income volatility? It refers to the fluctuation or instability in a person’s income over a given period of time. Understanding this concept is crucial, as it can have a significant impact on your financial well-being and planning. From unexpected expenses to irregular paychecks, income volatility can present challenges that require proactive measures to navigate successfully. Join us as we delve into the intricacies of income volatility and explore practical strategies to mitigate its effects.

Understanding the Concept of Income Volatility

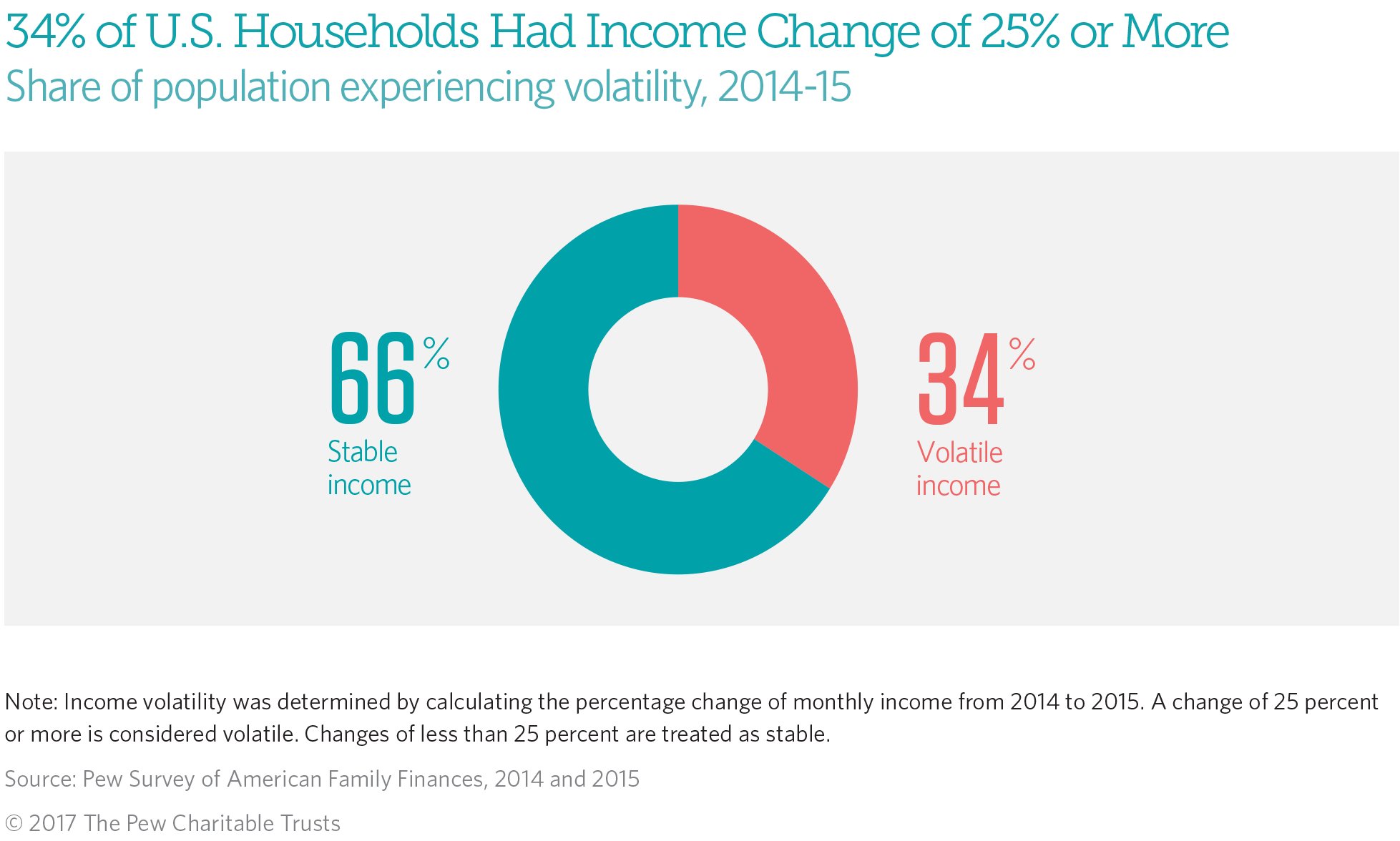

Income volatility refers to the fluctuation in an individual’s or household’s income over a given period of time. It is the variation in income levels experienced by individuals or households from year to year, month to month, or even day to day. Income volatility can have significant implications for financial stability, budgeting, and overall well-being.

Causes of Income Volatility

Income volatility can be caused by various factors, including:

1. Employment Instability:

– Job loss or layoffs

– Fluctuations in working hours or shifts

– Unpredictable income from freelance work or self-employment

2. Seasonal or Cyclical Nature of Work:

– Certain industries or occupations are inherently vulnerable to seasonal fluctuations in demand.

– For example, tourism-related jobs may experience higher income during peak seasons and lower income during off-peak seasons.

3. Economic Factors:

– Economic recessions or downturns can impact income stability across various sectors.

– Economic policies and market conditions can influence job creation, wages, and overall income levels.

4. Personal and Life Events:

– Life events such as marriage, divorce, having children, or changing careers can impact income stability.

– Education and training opportunities may lead to temporary income reductions but potentially higher long-term income.

Effects of Income Volatility

Income volatility can have significant consequences for individuals, families, and communities. Some of the key effects include:

1. Financial Insecurity:

– Fluctuating income can make it challenging to meet regular expenses, save for emergencies, or plan for the future.

– Individuals may resort to debt or financial assistance to bridge income gaps, leading to a cycle of financial instability.

2. Limited Access to Credit:

– Income volatility can make it difficult for individuals to qualify for loans or credit cards, as lenders often prefer stable income sources.

– Limited access to credit can further hinder financial stability and limit opportunities for investments or major purchases.

3. Psychological Stress:

– The uncertainty and unpredictability of income can lead to increased stress, anxiety, and mental health issues.

– Constantly worrying about meeting financial obligations can affect overall well-being and quality of life.

4. Reduced Long-Term Financial Planning:

– Income volatility can hinder long-term financial planning, such as saving for retirement or higher education.

– It becomes challenging to set and achieve financial goals when income fluctuates significantly.

Strategies to Manage Income Volatility

While income volatility can be challenging to overcome completely, there are strategies individuals and households can employ to manage its effects:

1. Build an Emergency Fund:

– Establish a savings account specifically dedicated to covering unexpected expenses or income gaps.

– Aim to save at least three to six months’ worth of living expenses to provide a financial buffer during volatile periods.

2. Diversify Income Sources:

– Explore opportunities to diversify income by taking on part-time work, freelance gigs, or side businesses.

– Having multiple sources of income can help mitigate the impact of income fluctuations from a single source.

3. Budgeting and Expense Tracking:

– Create a comprehensive budget to track income and expenses, allowing for better financial planning and identifying areas for savings.

– Use budgeting tools, apps, or spreadsheets to monitor cash flow and analyze spending habits.

4. Develop Marketable Skills:

– Enhancing professional skills and pursuing additional education or certifications can increase job prospects and income stability.

– Investing in oneself can lead to better job opportunities and potentially higher income levels.

5. Seek Financial Counseling or Education:

– Consult with financial advisors or seek financial education resources to gain knowledge and skills in managing income volatility.

– Professional guidance can assist in developing effective strategies and financial plans tailored to individual situations.

Policy Implications and Support

Income volatility is a multifaceted issue that requires attention from policymakers, employers, and social support systems. Some potential policy actions and support mechanisms include:

1. Labor Market Policies:

– Implementing policies that promote job stability, such as worker protections, fair employment practices, and income security programs.

– Providing training and job placement assistance to help individuals transition into stable and higher-paying jobs.

2. Safety Nets and Social Support Systems:

– Strengthening social safety net programs to provide temporary income support during periods of volatility.

– Expanding access to affordable healthcare, housing assistance, and other essential services to alleviate financial burdens.

3. Employer Practices:

– Encouraging employers to prioritize stable work schedules, fair wages, and benefits to reduce income volatility among employees.

– Promoting flexible work arrangements that allow individuals to balance multiple income sources.

4. Financial Education and Counseling:

– Integrating financial education programs into school curricula and workplace training to equip individuals with essential money management skills.

– Expanding access to financial counseling services to help individuals navigate income volatility and make informed financial decisions.

Income volatility is a complex issue that affects individuals and communities worldwide. Understanding and addressing the causes and effects of income volatility is crucial for creating a more financially stable and inclusive society. By implementing strategies at both the individual and policy level, we can help mitigate the negative impacts of income volatility and build a more secure future.

An Introduction to Income Volatility

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is income volatility?

Income volatility refers to the fluctuation or variation in an individual or household’s income over a certain period of time. It typically happens when there are significant changes in earnings, such as irregular paychecks, variable commission-based jobs, or changing economic conditions.

How does income volatility affect individuals and households?

Income volatility can have both short-term and long-term effects on individuals and households. In the short term, it can make it difficult to budget and plan for expenses, leading to financial stress. In the long term, it may affect savings, retirement planning, and overall financial security.

What are the causes of income volatility?

There are several factors that can contribute to income volatility, including fluctuations in employment, changes in business conditions, seasonal work, freelance or gig economy jobs, and economic recessions. Additionally, factors such as unexpected expenses or emergencies can further exacerbate income volatility.

How can one manage income volatility effectively?

Managing income volatility requires a combination of financial planning and strategies. It is important to create a budget, save for emergencies, diversify income sources, and seek stable employment whenever possible. Developing skills and knowledge in personal finance can also help individuals better navigate income volatility.

Are there any risks associated with income volatility?

Yes, income volatility poses certain risks. It can lead to financial instability, making it harder to meet basic needs, pay bills, or save for the future. It can also make it challenging to access credit or loans, as inconsistent income may be perceived as a higher risk by lenders.

Can income volatility be reduced?

While income volatility cannot be completely eliminated, there are steps one can take to reduce its impact. Building an emergency fund, creating multiple income streams, diversifying skills and qualifications, and seeking financial advice can all help mitigate the effects of income volatility.

How does income volatility affect financial planning?

Income volatility can significantly impact financial planning. It requires individuals and households to adapt their budgeting strategies, savings plans, and investment decisions to accommodate irregular income patterns. Long-term financial goals may need to be adjusted, and contingency plans should be put in place to handle unexpected income fluctuations.

What resources are available to help understand and manage income volatility?

There are various resources available to gain a better understanding of income volatility and learn effective management strategies. These include financial literacy programs, online courses, books, and workshops focused on personal finance, budgeting, and income stability. Additionally, consulting with financial advisors or experts can provide personalized guidance.

Final Thoughts

Income volatility is a significant aspect of personal finance that affects individuals’ financial stability and planning. By understanding the concept of income volatility, individuals can gain valuable insights into fluctuations in their income streams over time. This understanding allows them to make informed decisions regarding budgeting, saving, and investing. Being aware of income volatility helps individuals adapt to potential changes in their financial situation and build resilience. Overall, understanding the concept of income volatility is crucial in managing personal finances and achieving long-term financial well-being.