Planning to take a sabbatical? Wondering how to manage finances during a sabbatical without stress? Look no further! We’ve got you covered. In this blog article, we will discuss effective strategies and practical tips to help you navigate your finances while enjoying your well-deserved time off. Whether you’re embarking on a career break, traveling the world, or pursuing personal interests, managing your finances wisely is essential. So, let’s delve into the art of balancing your budget, maximizing savings, and ensuring financial stability during this exciting chapter of your life.

How to Manage Finances During a Sabbatical

From time to time, everyone needs a break from the daily grind. Whether it’s taking a year off to travel, pursuing further education, or simply taking a break to recharge and pursue personal goals, a sabbatical can be a valuable and fulfilling experience. However, managing your finances during this time can be a significant concern. In this article, we will explore various strategies and tips to help you effectively manage your finances during a sabbatical, allowing you to make the most of your time away without unnecessary financial stress.

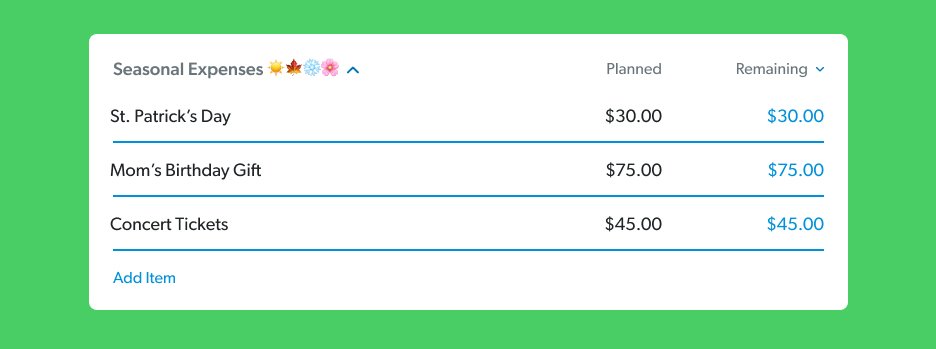

Create a Detailed Budget

The first step in managing your finances during a sabbatical is to create a detailed budget. Start by assessing your current financial situation and establishing your financial goals for the duration of your time off. Consider all your expenses, such as housing, transportation, food, healthcare, and any outstanding debts. Then, determine how much money you have available and allocate it accordingly.

- Identify essential and non-essential expenses: Differentiate between necessary expenses, such as rent or mortgage payments, utilities, and insurance, and discretionary expenses like entertainment, dining out, and travel.

- Estimate income sources: Consider any sources of income you may have during your sabbatical, such as savings, investments, rental income, or freelance work.

- Set realistic spending limits: Determine how much you can comfortably spend each month while still meeting your financial obligations. This will help you avoid overspending and dipping into your savings excessively.

- Emergency fund: It’s crucial to set aside an emergency fund to cover unexpected expenses or emergencies that may arise during your sabbatical.

Creating a detailed budget will provide a clear roadmap for managing your finances and help you stay on track throughout your sabbatical.

Minimize Expenses

During your sabbatical, it’s essential to find ways to reduce your expenses and stretch your budget further. Here are some strategies to help you minimize expenses:

- Downsize housing: Consider downsizing your living arrangements, whether by moving to a smaller apartment, renting out your home, or opting for house sitting opportunities. This can significantly reduce your housing expenses and free up additional funds.

- Transportation: Explore cost-effective transportation options such as public transportation, walking, or cycling, which can help you save on gas, parking, and maintenance costs.

- Save on groceries: Plan your meals in advance, look for sales and discounts, and consider buying in bulk to save on grocery expenses. Additionally, explore local farmers’ markets for fresh and affordable produce.

- Entertainment and leisure: Look for free or low-cost activities, such as exploring local parks, attending community events, or taking advantage of free museum days. Opt for affordable leisure activities that align with your budget.

- Utilities and subscriptions: Evaluate your utility bills and consider ways to reduce energy consumption, such as adjusting thermostat settings or installing energy-efficient appliances. Also, review your subscription services and consider canceling or pausing non-essential ones for the duration of your sabbatical.

By consciously minimizing your expenses, you can maximize your financial resources and make your sabbatical more financially sustainable.

Generate Additional Income

If you find that your savings alone may not be sufficient to cover your expenses during your sabbatical, exploring additional income opportunities can help bridge the gap. Consider the following options:

- Freelancing or consulting: Leverage your skills and expertise to provide freelance services or consulting work in your field during your sabbatical. This can provide a steady source of income while allowing you to work on your own terms.

- Part-time or remote work: Look for part-time or remote work opportunities that align with your interests and skills. This can provide both income and an opportunity to stay engaged professionally.

- Rent out assets: If you have any assets, such as a spare room, property, or a car, consider renting them out to generate additional income.

- Passive income streams: Explore passive income options like investing in dividend stocks, peer-to-peer lending, or creating and selling digital products online. These can provide ongoing income with minimal effort.

By combining these income-generating strategies with your existing savings, you can ensure a more stable financial footing during your sabbatical.

Insurance and Healthcare

When taking a sabbatical, it’s important to review your insurance coverage and healthcare needs to avoid any unexpected financial burdens. Consider the following:

- Health insurance: Ensure you have adequate health insurance coverage during your sabbatical. If you’re leaving your job, explore options such as COBRA or individual health insurance plans to maintain coverage.

- Travel insurance: If you’re planning to travel extensively during your sabbatical, consider purchasing travel insurance to protect yourself against any unexpected medical expenses or trip cancellations.

- Home and property insurance: Review your home and property insurance policies to ensure coverage during your absence. If you’re renting out your home or property, consider landlord insurance.

- Liability insurance: Depending on your activities during your sabbatical, such as volunteering or starting a small business, check if you need any additional liability insurance to protect yourself financially.

Taking the time to assess and update your insurance coverage will provide peace of mind and protect you from potential financial setbacks.

Investment and Retirement Accounts

While on a sabbatical, it’s important to keep your long-term financial goals in mind, including investments and retirement planning. Consider the following:

- Review investment portfolio: Evaluate your investment portfolio and make necessary adjustments based on your sabbatical goals and risk tolerance. Consult with a financial advisor if needed.

- Retirement contributions: If possible, continue making contributions to your retirement accounts, such as a 401(k) or IRA, even during your sabbatical. This will help ensure you stay on track for long-term financial security.

- Investment income: If you have investments that generate income, such as dividends or interest, consider reinvesting those earnings or using them to cover your expenses during your sabbatical.

By actively managing your investments and retirement accounts, you can maintain progress toward your long-term financial goals while enjoying your sabbatical.

Monitor Your Finances Regularly

Throughout your sabbatical, it’s essential to regularly monitor your finances to ensure you stay on track and make any necessary adjustments. Consider the following:

- Track your expenses: Keep a record of all your expenses and regularly review them to identify any areas where you may need to cut back or reallocate funds.

- Check your progress: Assess your financial goals periodically to see how you’re progressing. If necessary, make adjustments to your budget or income strategies to stay on course.

- Automate bill payments: Set up automatic bill payments to avoid late fees or missed payments. This will ensure your financial obligations are met on time, even if you’re busy enjoying your sabbatical.

- Stay organized: Keep all your financial documents organized and easily accessible. This will help streamline the process of managing your finances and ensure you don’t miss any important deadlines or opportunities.

Regularly monitoring your finances will give you peace of mind and allow you to proactively address any financial challenges that may arise during your sabbatical.

In conclusion, managing your finances during a sabbatical requires careful planning and consideration. By creating a detailed budget, minimizing expenses, generating additional income, reviewing insurance and healthcare needs, managing investment and retirement accounts, and monitoring your finances regularly, you can ensure a financially stable and fulfilling sabbatical experience. Remember, the goal is to enjoy your time off while maintaining financial security, so you can fully embrace the opportunities and growth that a sabbatical can offer.

But Do You Have Sabbatical Money? ????

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I effectively manage my finances during a sabbatical?

During a sabbatical, it’s crucial to develop a financial plan to ensure your expenses are covered. Start by creating a budget that includes all your essential expenses like housing, food, and utilities. Consider cutting back on discretionary spending and finding ways to save money. Additionally, explore alternative sources of income or part-time work opportunities to supplement your savings.

2. Should I save money before going on a sabbatical?

Yes, it’s advisable to save money before embarking on a sabbatical. Building a financial cushion will provide you with a sense of security and allow you to cover your expenses during the period without relying solely on your regular income. Aim to save enough to cover your financial obligations and any unforeseen expenses that may arise.

3. How do I plan for unexpected expenses during a sabbatical?

It’s essential to have an emergency fund in place to handle unexpected expenses during your sabbatical. Set aside a portion of your savings specifically for unexpected costs such as medical emergencies or car repairs. By having this safety net, you can comfortably address any unforeseen financial challenges that come your way.

4. What steps can I take to reduce my expenses during a sabbatical?

To minimize expenses during a sabbatical, start by reviewing your monthly budget and identifying areas where you can cut back. Consider downsizing your living arrangements, cooking at home instead of eating out, and reducing non-essential expenses such as subscriptions or entertainment. Additionally, explore cost-saving measures like public transportation or sharing resources with others.

5. How can I generate income while on a sabbatical?

While on a sabbatical, you can explore various avenues to generate income. Look for part-time job opportunities or freelance work in your field of expertise. Consider leveraging your skills to offer consulting services or taking on short-term projects. You can also explore alternative sources of income such as renting out a room or starting a small side business.

6. Is it advisable to use credit cards during a sabbatical?

Using credit cards during a sabbatical can be convenient, but it’s important to exercise caution. Make sure you have a clear plan to pay off your credit card balances promptly to avoid accumulating high-interest debt. Consider using credit cards with rewards programs that align with your spending patterns, which can provide additional benefits or discounts.

7. How can I make the most of my savings during a sabbatical?

To optimize your savings during a sabbatical, consider exploring ways to reduce costs without sacrificing your quality of life. Look for discounts and deals on essential expenses, explore free or low-cost entertainment options, and prioritize experiences that align with your interests and budget. Additionally, track your expenses diligently and make adjustments as necessary to stay within your financial means.

8. Is it wise to invest money during a sabbatical?

Investing money during a sabbatical can be a strategy to grow your wealth in the long run. However, it’s essential to assess your risk tolerance and consult with a financial advisor before making any investment decisions. Investing in low-risk options such as diversified portfolios or index funds can offer potential returns while minimizing the risk of significant losses.

Final Thoughts

To effectively manage finances during a sabbatical, it is crucial to plan ahead and prioritize. Start by creating a budget that outlines necessary expenses and allows for savings. Consider cutting back on non-essential costs and finding creative ways to save money. Additionally, explore opportunities for part-time work or remote freelancing to supplement your income. Research affordable housing options and take advantage of travel discounts to make the most of your sabbatical experience. By proactively managing your finances and staying mindful of your spending, you can ensure that your sabbatical is financially sustainable and fulfilling.