Looking to minimize fees in mutual funds? You’ve come to the right place! In this article, we’ll explore practical strategies to help you save money and optimize your investments. Whether you’re an experienced investor or just starting out, cutting down on fees is key to maximizing your returns. By the end of this article, you’ll have a clear understanding of how to make smarter choices when it comes to minimizing fees in mutual funds. So, let’s dive right in!

How to Minimize Fees in Mutual Funds

Investing in mutual funds can be a great way to grow your wealth over time. However, it’s important to understand that these investment vehicles come with various fees and expenses that can eat into your returns. Managing and minimizing these fees is crucial to maximizing your investment gains. In this article, we’ll delve into strategies and tips to help you minimize fees in mutual funds and keep more of your hard-earned money.

1. Understand the Different Types of Mutual Fund Fees

Before diving into the strategies for minimizing fees, let’s first familiarize ourselves with the different types of fees you may encounter when investing in mutual funds:

1.1 Expense Ratio

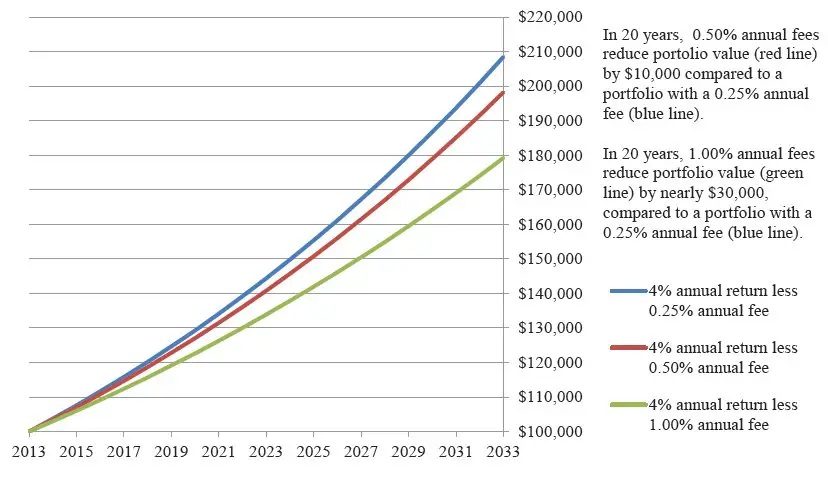

The expense ratio represents the annual fees charged by the mutual fund company to manage the fund. It includes administrative costs, operating expenses, and advisory fees. This fee is expressed as a percentage of your invested assets. The lower the expense ratio, the better it is for your returns.

1.2 Sales Loads

Sales loads are fees charged when buying or selling mutual fund shares. There are two types of sales loads: front-end loads and back-end loads. Front-end loads are charged when you buy shares, while back-end loads are charged when you sell them. These loads are expressed as a percentage of your investment amount and can vary between funds.

1.3 Transaction Fees

Transaction fees, often known as trading fees, are charged for buying or selling mutual fund shares. These fees cover the costs associated with executing the trades. They are typically charged by brokerage firms or platforms and can vary depending on the provider.

1.4 Redemption Fees

Redemption fees are imposed by some mutual funds when you sell your shares within a certain period. The purpose of redemption fees is to discourage short-term trading and promote long-term investing. These fees are expressed as a percentage of the amount redeemed and are paid directly to the fund.

2. Choose Low-Cost Mutual Funds

One of the most effective ways to minimize fees in mutual funds is to choose low-cost funds. Here are some factors to consider when evaluating the cost-effectiveness of a fund:

2.1 Look for Low Expense Ratio Funds

Compare the expense ratios of different funds within the same category. Look for funds with expense ratios that are below the average for their respective category. This will help you identify funds that are relatively cost-effective.

2.2 Consider Index Funds or ETFs

Index funds and exchange-traded funds (ETFs) are known for their low expense ratios. These funds aim to replicate the performance of a specific market index rather than attempt to beat the market. Since they require less active management, their expense ratios tend to be significantly lower than those of actively managed funds.

2.3 Evaluate the Impact of Sales Loads

If you decide to invest in funds with sales loads, be sure to assess whether the potential benefits outweigh the costs. In some cases, paying a sales load might be justifiable if the fund has a strong track record or offers other advantages.

3. Consider No-Load Funds and Fee Waivers

No-load funds are mutual funds that do not charge sales loads. Investing in these funds can be an effective way to avoid paying unnecessary fees. Additionally, some fund companies offer fee waivers or discounts on sales loads and other fees for certain investors. This can be beneficial if you meet the eligibility criteria for such waivers or discounts.

4. Utilize Fee-Free Investment Platforms

Consider using fee-free investment platforms that offer a wide range of mutual funds without charging transaction fees. These platforms often operate on a no-commission model and can significantly reduce your overall investment costs.

5. Take Advantage of Employer-Sponsored Retirement Plans

If you have access to an employer-sponsored retirement plan, such as a 401(k), take full advantage of it. These plans often provide a selection of mutual funds with institutional share classes, which typically have lower expense ratios compared to retail share classes. Additionally, some employers may cover certain administrative costs associated with these plans, further reducing your fees.

6. Monitor and Adjust Your Portfolio

Regularly review your mutual fund portfolio and assess the performance and fees associated with each fund. Consider consolidating your investments to reduce duplication and streamline your portfolio. By keeping a close eye on your investments, you can identify opportunities to minimize fees and make informed decisions regarding your holdings.

7. Consult with a Fee-Only Financial Advisor

Working with a fee-only financial advisor can help you navigate the complex world of mutual fund fees. These advisors are compensated solely based on the fees they charge for their services, rather than earning commissions or other incentives from recommending specific funds. They can provide objective guidance and help you construct a cost-effective mutual fund portfolio tailored to your financial goals.

In conclusion, minimizing fees in mutual funds is crucial for investors looking to maximize their returns. By understanding the different types of fees, choosing low-cost funds, considering fee-free investment platforms, and leveraging employer-sponsored retirement plans, you can significantly reduce your investment costs. Regularly monitor and adjust your portfolio, and consider seeking guidance from a fee-only financial advisor to ensure you’re on the right track. By implementing these strategies, you can keep more of your hard-earned money working for you in the long run.

How to Reduce Mutual Funds in Your Portfolio?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I minimize fees in mutual funds?

1. Can I invest directly in mutual funds to avoid fees?

2. Are there any low-cost mutual fund options available?

3. What is the impact of expense ratios on mutual fund fees?

4. How can I compare expense ratios between different mutual funds?

5. Do index funds generally have lower fees compared to actively managed funds?

6. What are the advantages of investing in passively managed funds to reduce fees?

7. Can I negotiate lower fees with my financial advisor or broker?

8. Are there any tax-efficient strategies to minimize fees in mutual funds?

Final Thoughts

To minimize fees in mutual funds, there are a few strategies you can employ. Firstly, opt for low-cost index funds or ETFs instead of actively managed funds. These passive funds tend to have lower expense ratios. Secondly, keep an eye on transaction fees and choose funds with no or minimal trading costs. Additionally, consider investing directly with the fund company to avoid any intermediary fees. Lastly, regularly review your investment portfolio to ensure you’re not overpaying for duplicate or unnecessary funds. By following these simple steps and being mindful of expenses, you can effectively minimize fees in mutual funds.