Are you worried about the increasing threat of identity theft? Well, you’re in luck! In this blog article, we’ll discuss effective ways to protect yourself from identity theft. From simple steps you can take today to more advanced security measures, we’ve got you covered. By implementing these strategies, you can safeguard your personal information and prevent unauthorized access to your sensitive data. So, let’s dive right in and discover how to protect yourself from identity theft!

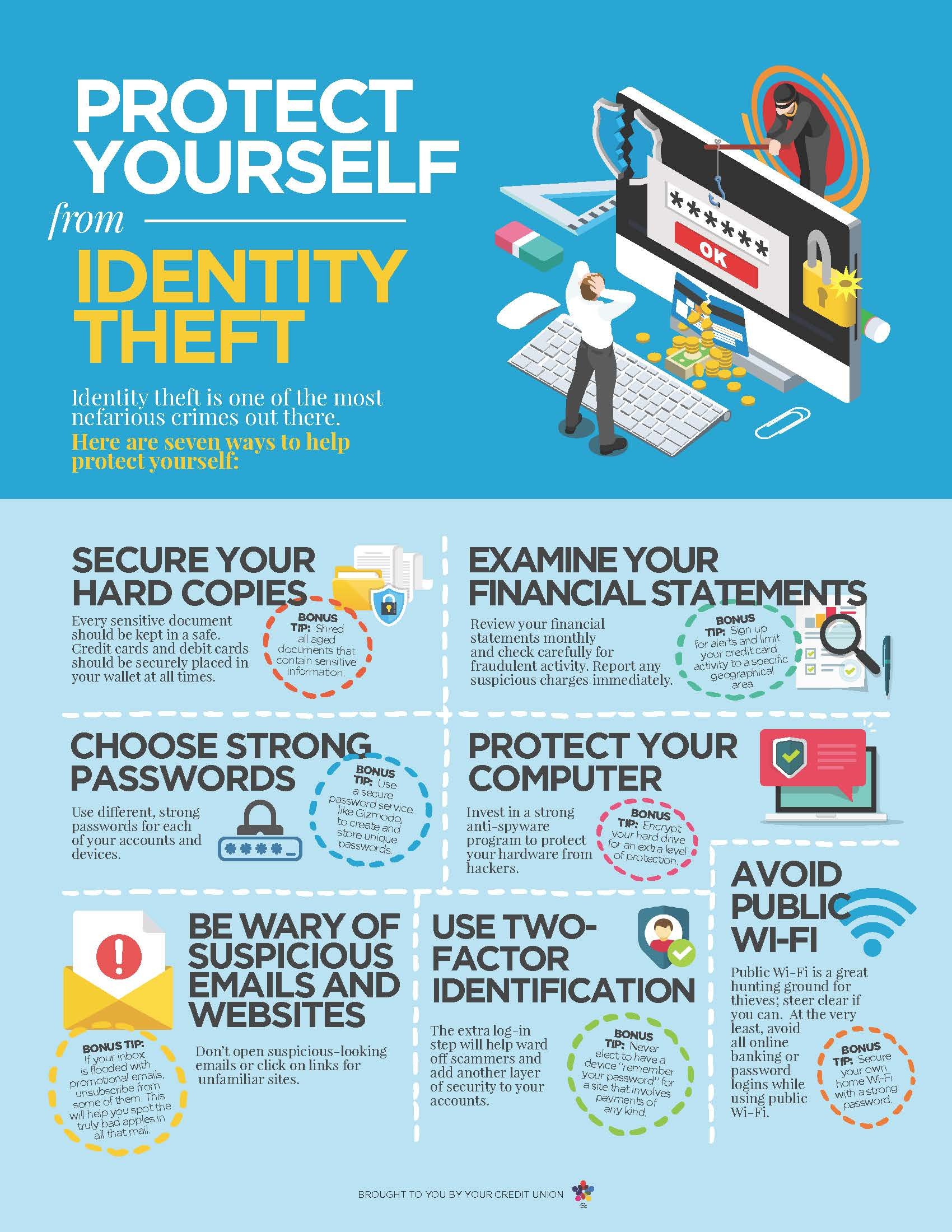

How to Protect Yourself from Identity Theft

Identity theft is a serious concern in today’s digital age. With advancements in technology, criminals have found new and sophisticated ways to steal personal information and use it for their gain. It is crucial to take proactive measures to safeguard yourself against identity theft. In this article, we will discuss various strategies and best practices that can help protect you from falling victim to this crime.

Educate Yourself About Identity Theft

Understanding the different types of identity theft and the methods used by criminals can empower you to take necessary precautions. Here are some key points to be aware of:

- Phishing: Criminals often use deceptive emails and websites to trick individuals into revealing sensitive information like passwords, social security numbers, or credit card details.

- Skimming: Devices called skimmers can be attached to ATMs or payment terminals to capture credit card information without your knowledge.

- Pretexting: Scammers may pose as legitimate organizations or individuals to trick you into sharing personal information.

- Malware and hacking: Malicious software and hacking techniques can grant criminals unauthorized access to your devices or online accounts.

- Shoulder surfing: Thieves may physically observe or record your personal information, such as PIN numbers or passwords, in public places.

By familiarizing yourself with these common methods, you can recognize potential threats and take appropriate action to protect your identity.

Create Strong and Unique Passwords

Using weak passwords or reusing the same password across multiple accounts puts you at a higher risk of identity theft. Here are some guidelines for creating strong passwords:

- Use a combination of upper and lowercase letters, numbers, and symbols.

- Avoid using personal information such as your name, birthdate, or address in passwords.

- Ensure your passwords are at least 12 characters long.

- Consider using a password manager to generate and store unique passwords for each of your accounts.

Remember, having a unique password for each online account is crucial. If one account is compromised, using the same password across multiple accounts would enable the criminal to gain access to all of them.

Secure Your Online Accounts

Securing your online accounts is vital in preventing identity theft. Here are some measures you can take to enhance the security of your accounts:

- Enable multi-factor authentication (MFA) whenever possible. MFA adds an extra layer of security by requiring additional verification, such as a fingerprint scan or a unique code sent to your mobile device, in addition to your password.

- Regularly update your account passwords to ensure optimal security.

- Monitor your accounts for any suspicious activity and report it immediately to the respective account providers.

- Be cautious while accessing your accounts on public Wi-Fi networks as they can be vulnerable to hackers. Whenever possible, use a secure and private network or a virtual private network (VPN) for added protection.

Taking these steps will significantly reduce the risk of unauthorized access to your online accounts.

Be Wary of Phishing Attempts

Phishing attempts are one of the most common methods employed by identity thieves. They often create fake emails or websites that mimic legitimate organizations to trick individuals into revealing sensitive information. To avoid falling victim to phishing attempts, follow these guidelines:

- Be cautious when clicking on links or downloading attachments from unfamiliar or suspicious emails.

- Verify the legitimacy of websites before entering any personal information. Check for secure connections (HTTPS) and look for clear signs of trust, such as official logos and contact information.

- Never provide sensitive information through email or over the phone unless you have initiated the contact and are sure of the recipient’s identity.

- If you receive an email requesting sensitive information, contact the organization directly using their official website or phone number to confirm the request.

By staying vigilant and adopting a skeptical approach towards unsolicited requests for personal information, you can avoid falling for phishing scams.

Protect Your Physical Documents

While much focus is placed on digital security, it is important not to overlook the security of physical documents. Here are some steps to safeguard your important paperwork:

- Keep sensitive documents such as your social security card, passport, and financial statements in a secure, locked place at home.

- Consider investing in a fireproof and waterproof safe to protect your valuable documents from potential disasters.

- Shred any documents containing personal information before disposing of them.

- Avoid carrying unnecessary identification documents or cards when out in public.

Protecting your physical documents is an essential aspect of identity theft prevention.

Monitor Your Financial Accounts Regularly

Regularly monitoring your financial accounts is crucial in detecting and preventing identity theft. Here are some recommended practices:

- Review your bank and credit card statements frequently for any unauthorized transactions.

- Set up account alerts to receive notifications for any suspicious activity on your accounts.

- Check your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion) at least once a year. Look for any discrepancies that could indicate identity theft.

- Consider utilizing reputable credit monitoring services that provide ongoing monitoring and alerts for changes in your credit profile.

By promptly detecting any unauthorized activity, you can take immediate action to mitigate the potential damage caused by identity theft.

Protect Your Social Security Number

Your social security number (SSN) is a valuable piece of information that identity thieves seek. Safeguarding your SSN can significantly reduce the risk of identity theft. Here’s what you can do:

- Avoid carrying your social security card in your wallet or purse unless absolutely necessary.

- Be cautious about sharing your SSN, and only provide it when required for legitimate purposes.

- Don’t include your SSN on resumes, online profiles, or other public platforms.

- Regularly check your social security earnings statement to ensure there are no discrepancies.

Protecting your social security number is an integral part of preventing identity theft.

Stay Informed About Data Breaches

Data breaches have become increasingly common, with organizations experiencing security breaches that expose sensitive customer information. Stay informed about data breaches, as they can significantly increase the risk of identity theft. Here’s what you can do:

- Monitor news and media outlets for information about recent data breaches.

- If you discover that a company you have an account with has experienced a data breach, take immediate action by changing your password and monitoring your accounts for any unusual activity.

- Consider utilizing identity theft protection services that offer monitoring and alerts for potential data breaches.

By staying informed and taking necessary precautions, you can minimize the impact of data breaches on your personal information.

Protecting yourself from identity theft is paramount in today’s interconnected world. By educating yourself about the different methods used by criminals, creating strong passwords, securing your online accounts, and staying vigilant against phishing attempts, you can significantly reduce the risk of identity theft. Additionally, safeguarding your physical documents, monitoring your financial accounts regularly, and protecting your social security number will further enhance your overall security. Stay informed about data breaches and take appropriate action when necessary. Remember, prevention is key when it comes to identity theft – taking proactive measures is the best way to safeguard your personal information and financial well-being.

How to PREVENT IDENTITY THEFT (for free, in less than 10 min)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I protect myself from identity theft?

Protecting yourself from identity theft involves taking various measures. Here are some steps you can take:

2. What should I do if my personal information is stolen?

If your personal information is stolen, take the following actions immediately:

3. Are there any ways to detect if my identity has been stolen?

Yes, there are signs that could indicate your identity has been stolen. Look out for the following:

4. Should I use strong passwords to protect my online accounts?

Using strong passwords for your online accounts is crucial. Here are some guidelines:

5. Can using antivirus software help protect against identity theft?

While antivirus software may not directly prevent identity theft, it can still be beneficial. Consider the following:

6. Is it safe to provide personal information over the phone or email?

It is generally not safe to provide personal information over the phone or email. Take note of the following:

7. What should I do if I suspect someone has stolen my identity?

If you suspect that someone has stolen your identity, take the following steps:

8. Is it advisable to monitor my credit reports regularly?

Monitoring your credit reports regularly is highly recommended. Here’s why it’s important:

Final Thoughts

Protecting yourself from identity theft is crucial in today’s digital age. The first step is to safeguard your personal information by using strong, unique passwords and regularly updating them. Secondly, be cautious of phishing emails or suspicious links, as they often trick individuals into disclosing their sensitive data. Another effective measure is to monitor your bank statements and credit reports regularly for any unauthorized activity. Additionally, consider freezing your credit to prevent unauthorized access. By implementing these measures, you can significantly reduce the risk of becoming a victim of identity theft. Stay vigilant and protect yourself from this growing threat.