Are you looking for practical ways to rebuild your credit after going through a bankruptcy? Don’t worry, we’ve got you covered! In this article, we’ll provide you with valuable tips for improving credit after a bankruptcy. It’s natural to feel overwhelmed and uncertain about the future, but rest assured, there are steps you can take to regain control and start your journey towards financial recovery. Let’s dive in and explore some effective strategies that can help you rebuild your credit score and gain a fresh start.

Tips for Improving Credit After a Bankruptcy

Introduction

Going through a bankruptcy can be a challenging and overwhelming experience. However, it does not have to define your financial future. One aspect that may be impacted by bankruptcy is your credit score, making it harder to access loans, credit cards, and favorable interest rates. The good news is that there are steps you can take to improve your credit after a bankruptcy. In this article, we will provide you with a comprehensive guide on how to rebuild your credit and regain financial stability.

1. Understand the Impact of Bankruptcy

Before diving into the strategies for improving your credit, it’s essential to understand how bankruptcy affects your credit score. Bankruptcy is a significant negative event that can stay on your credit report for up to ten years. During this period, your credit score may be significantly lower, making it harder to qualify for loans or credit cards.

1.1 Types of Bankruptcy

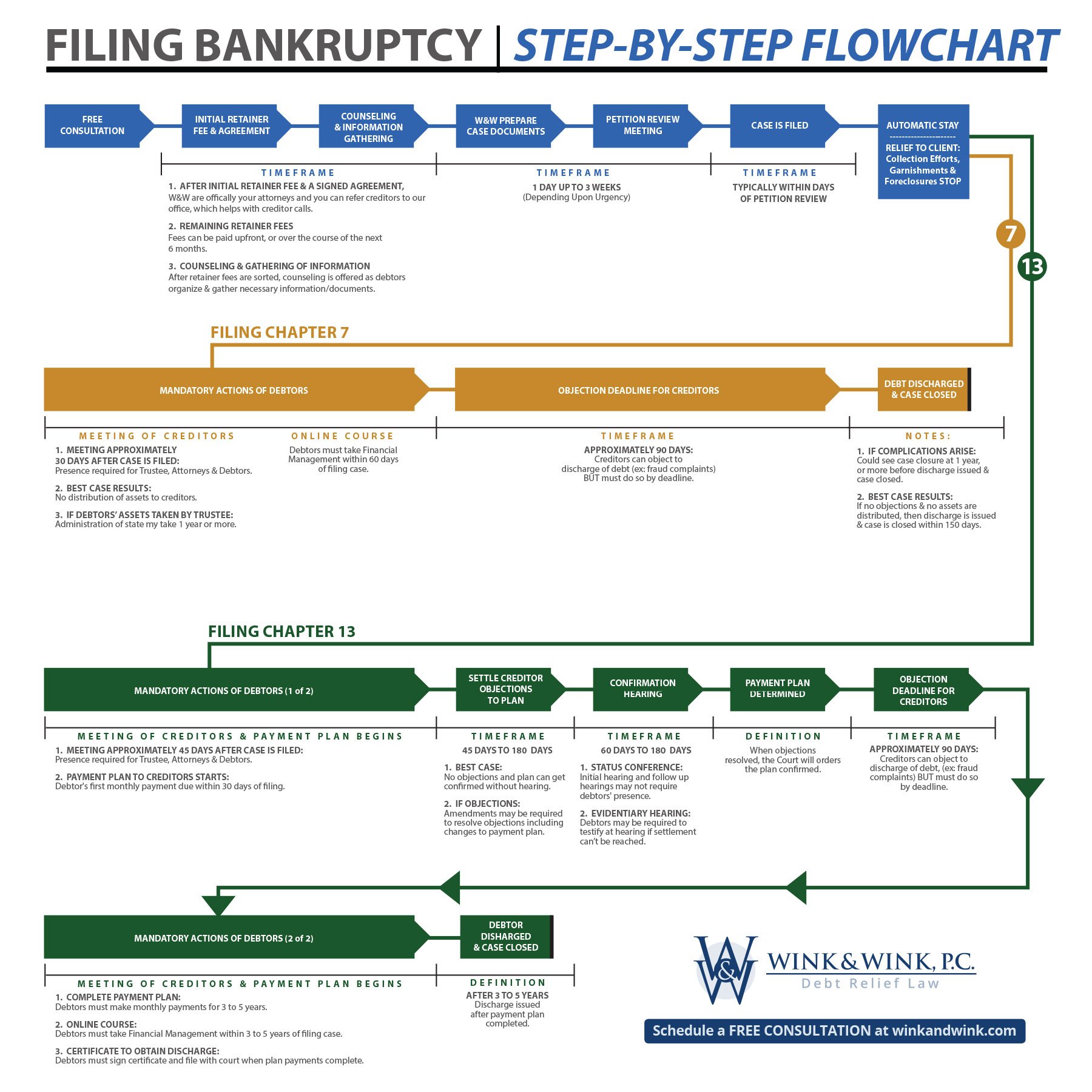

There are two common types of bankruptcy for individuals: Chapter 7 and Chapter 13. Understanding the specifics of each can help you navigate the credit rebuilding process effectively.

– Chapter 7 Bankruptcy: Also known as “liquidation bankruptcy,” Chapter 7 involves the discharge of most of your debts. It typically stays on your credit report for ten years.

– Chapter 13 Bankruptcy: Referred to as “reorganization bankruptcy,” Chapter 13 involves creating a repayment plan to settle your debts over a specific period, usually three to five years. It stays on your credit report for seven years.

1.2 Impact on Credit Score

Bankruptcy has a severe impact on your credit score, causing it to drop significantly. The exact impact may vary depending on your initial credit score, but it can reduce it by 100 points or more. Rebuilding your credit score after bankruptcy will be a gradual process, but by following the right steps, you can improve your creditworthiness over time.

2. Review Your Credit Report

After bankruptcy, it’s crucial to obtain a copy of your credit report and review it thoroughly. This step will help you identify any errors, inaccuracies, or inconsistencies that may be negatively impacting your creditworthiness. You can request a free copy of your credit report from each of the major credit bureaus once a year.

2.1 Correcting Errors

When reviewing your credit report, keep an eye out for the following:

– Inaccurate account information: Check if the accounts listed in your report accurately reflect your bankruptcy status or any debts that have been discharged.

– Duplicate accounts: Look out for duplicate entries for the same account, as this can artificially inflate your debt and negatively impact your credit score.

– Outdated information: Ensure that any accounts included in your bankruptcy are updated to reflect their discharged status.

If you spot any errors, you have the right to dispute them with the credit bureau. Provide supporting documentation and follow up until the inaccuracies are corrected.

3. Establish a Budget and Emergency Fund

Rebuilding credit after bankruptcy requires a solid financial foundation. Start by creating a budget that accounts for your income, expenses, and debt repayment. This budget will help you manage your finances effectively and avoid falling into further debt.

Additionally, strive to build an emergency fund. Having savings set aside for unexpected expenses can prevent you from relying solely on credit in times of financial strain. Start by setting aside a small amount each month and gradually increase your savings over time.

4. Secured Credit Cards

Secured credit cards are an excellent tool for rebuilding credit after bankruptcy. Unlike traditional credit cards, secured cards require a cash deposit as collateral. This deposit acts as a security measure for the lender, reducing their risk. By using a secured credit card responsibly, you can demonstrate your ability to manage credit and rebuild your credit score.

4.1 Choosing a Secured Credit Card

When selecting a secured credit card, consider the following factors:

– Annual fees: Look for cards with minimal fees to keep costs low.

– Reporting to credit bureaus: Ensure that the card issuer reports to all three major credit bureaus, as this will help rebuild your credit history.

– Graduation options: Some secured cards offer the opportunity to transition to an unsecured card after a certain period of responsible card usage. This can further boost your credit rebuilding efforts.

4.2 Responsible Credit Card Usage

To maximize the benefits of a secured credit card, follow these best practices:

– Pay your bill on time: Consistently making on-time payments is crucial for credit rebuilding and score improvement.

– Keep your credit utilization low: Aim to utilize only a small portion of your available credit, ideally below 30%.

– Avoid excessive credit applications: Applying for multiple credit cards or loans in a short period can negatively impact your credit score.

5. Become an Authorized User

If you have family members or close friends with good credit, you may consider becoming an authorized user on their credit card. By being added as an authorized user, the positive payment history and credit utilization of the primary cardholder can benefit your credit score.

However, it’s vital to choose a responsible cardholder who consistently makes on-time payments and maintains low credit utilization. Additionally, ensure that the credit card issuer reports authorized user activity to the credit bureaus.

6. Explore Credit Builder Loans

A credit builder loan is an option specifically designed to help individuals rebuild their credit. With a credit builder loan, the loan amount is deposited into a secured account, and you make monthly payments towards the loan. The payments are reported to the credit bureaus, demonstrating your ability to manage credit responsibly.

Once you have repaid the loan in full, you gain access to the funds plus any interest earned. This type of loan allows you to build credit while simultaneously saving money.

7. Watch for Predatory Lenders

As you work towards improving your credit, be cautious of predatory lenders who may take advantage of your financial situation. Some lenders may offer loans or credit cards with exorbitant interest rates, hidden fees, or unfavorable terms. Before committing to any financial product, carefully review the terms and conditions, compare options, and ensure you understand the full cost of borrowing.

8. Patience and Persistence

Rebuilding credit after bankruptcy takes time, patience, and persistence. Consistently practicing responsible financial habits, such as making on-time payments, keeping credit utilization low, and avoiding excessive debt, is key. Over time, these positive habits will contribute to an improved credit score and better financial opportunities.

While bankruptcy can have a significant impact on your credit, it doesn’t mean your financial future is ruined. By following the tips outlined in this article, you can take proactive steps to rebuild your credit after a bankruptcy. Remember, it may require time and effort, but with dedication and responsible financial habits, you can bounce back and regain your financial stability.

How to increase your credit score OVER 700s after Bankruptcy | Rickita

Frequently Asked Questions

Tips for Improving Credit after a Bankruptcy

How long does bankruptcy stay on my credit report?

After filing for bankruptcy, it can stay on your credit report for up to 10 years, depending on the type of bankruptcy you filed.

Can I improve my credit score after bankruptcy?

Yes, it is possible to improve your credit score after bankruptcy. By following responsible financial habits and demonstrating good credit behavior, you can gradually rebuild your creditworthiness over time.

What steps can I take to rebuild my credit after bankruptcy?

To rebuild your credit after bankruptcy, you can take the following steps:

1. Pay your bills on time: Consistently paying your bills on time will help rebuild your credit history.

2. Monitor your credit report: Regularly check your credit report for errors and discrepancies. Dispute any inaccuracies you find.

3. Establish new credit: Open a secured credit card or apply for a small loan to start building a positive credit history.

4. Keep credit utilization low: Aim to keep your credit utilization ratio below 30% by paying down debts and not maxing out credit cards.

5. Diversify your credit mix: Have a healthy mix of credit accounts such as a mortgage, car loan, or credit cards.

6. Use credit responsibly: Avoid excessive borrowing and only use credit for necessary expenses.

Will my credit score immediately improve after bankruptcy is discharged?

While your credit score may not immediately improve after bankruptcy is discharged, it provides a fresh start for rebuilding your credit. With time and responsible credit behavior, your score can gradually improve.

How long does it take to rebuild credit after bankruptcy?

The time it takes to rebuild credit after bankruptcy can vary for each individual. It may take several years of consistent, responsible credit behavior to see significant improvements in your credit score.

Can I get a credit card after bankruptcy?

Yes, it is possible to get a credit card after bankruptcy. However, you may initially qualify for secured credit cards or those with higher interest rates. As you demonstrate responsible credit behavior, you can gradually access more favorable credit card options.

Should I apply for new credit immediately after bankruptcy?

It is generally advisable to wait some time before applying for new credit after bankruptcy. Take time to focus on rebuilding your financial health and improving your credit before seeking new credit opportunities.

Can I remove bankruptcy from my credit report?

Removing bankruptcy from your credit report can be challenging. Generally, bankruptcy information stays on your report for the specified period. However, you can dispute any errors or inaccuracies related to your bankruptcy with the credit bureaus.

Final Thoughts

In conclusion, there are several strategies that can help you improve your credit after a bankruptcy. First, focus on paying your bills on time and in full to establish a positive payment history. Second, consider getting a secured credit card to rebuild your credit. Third, monitor your credit report regularly to identify and dispute any errors. Fourth, avoid taking on new debt and focus on reducing existing debt. Finally, be patient and consistent in following these tips for improving credit after a bankruptcy.