Curious about the capital gains tax rate? Look no further! Understanding how this tax works is crucial for anyone navigating the financial world. So, what is the capital gains tax rate exactly? Let’s break it down in a conversational and easy-to-understand manner. Whether you are a seasoned investor or just starting to dip your toes into the world of finance, this article will help you grasp the ins and outs of capital gains taxation. Get ready to demystify this topic as we delve into the details in the following paragraphs.

What is the Capital Gains Tax Rate?

The capital gains tax rate refers to the tax imposed on the profit made from the sale of a capital asset. When an individual or entity sells an investment or property at a higher price than its original purchase price, they realize a capital gain. This gain is subject to taxation, and the rate at which it is taxed varies depending on several factors.

Understanding the capital gains tax rate is crucial for investors and individuals looking to sell their assets. In this comprehensive guide, we will delve into the details of the capital gains tax rate, its implications, and how it affects different types of assets.

How does the Capital Gains Tax Rate Work?

The capital gains tax is calculated based on the profit gained from the sale of a capital asset. Generally, the tax is only applicable when the asset is sold, not when it is held or owned. The amount subject to taxation is known as a capital gain.

Let’s consider an example to understand how the capital gains tax rate works:

1. Mr. Smith purchased stocks for $10,000.

2. After a few years, the value of the stocks increased to $15,000.

3. Mr. Smith decides to sell the stocks at $15,000, realizing a capital gain of $5,000.

The capital gains tax rate will be applied to this $5,000 gain, and the resulting amount will be the tax owed.

Types of Capital Gains Tax Rates

The capital gains tax rate can vary depending on the holding period of the asset and the individual’s income level. Here are the different types of capital gains tax rates:

1. Short-term Capital Gains Tax Rate

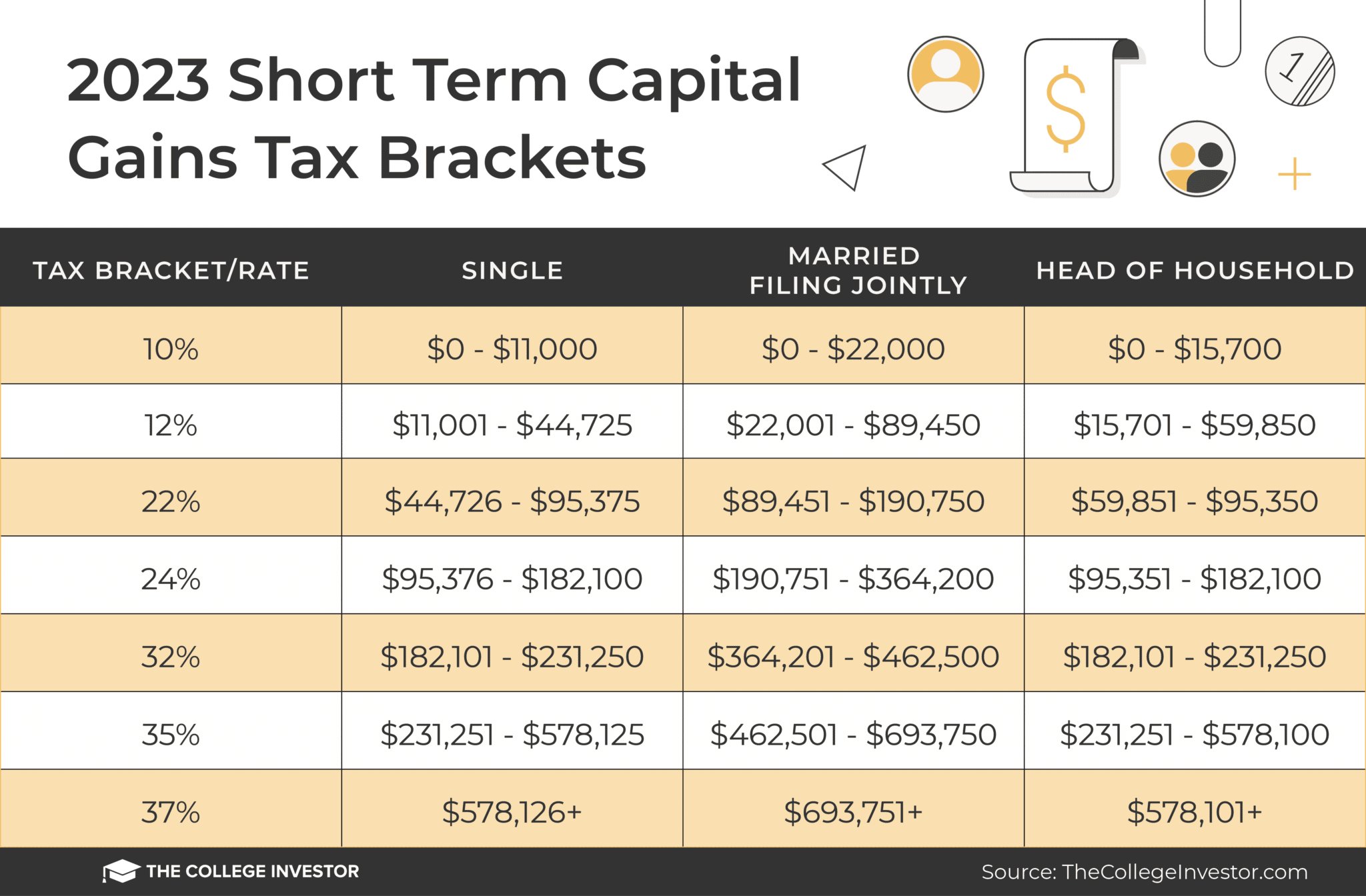

Short-term capital gains occur when an asset is held for one year or less before being sold. The short-term capital gains tax rate is generally higher compared to the long-term rate.

The short-term capital gains tax rate is the same as the ordinary income tax rate. It means that the gain will be taxed at the individual’s applicable tax bracket, which can range from 10% to 37%.

2. Long-term Capital Gains Tax Rate

Long-term capital gains apply when an asset is held for more than one year before being sold. The long-term capital gains tax rate is often more favorable than the short-term rate.

The long-term capital gains tax rate depends on the individual’s income level and can be categorized into different tax brackets. As of 2021, the long-term capital gains tax rates for most individuals are as follows:

– 0% for taxpayers in the 10% and 12% income tax brackets.

– 15% for taxpayers in the 22%, 24%, 32%, and 35% income tax brackets.

– 20% for taxpayers in the 37% income tax bracket.

It’s important to note that these rates may change based on tax reforms implemented by the government.

3. Net Investment Income Tax (NIIT)

In addition to the regular capital gains tax rate, high-income individuals may be subject to the Net Investment Income Tax (NIIT). The NIIT is an additional 3.8% tax on net investment income.

The NIIT applies to individuals with modified adjusted gross income (MAGI) exceeding certain thresholds:

– $200,000 for single filers

– $250,000 for married couples filing jointly

– $125,000 for married couples filing separately

It’s important to consider the NIIT when calculating the overall tax liability on capital gains.

Capital Gains Tax Rates for Different Assets

The capital gains tax rate can vary depending on the type of asset being sold. Here are some common types of assets and their associated capital gains tax rates:

1. Stocks and Bonds

Stocks and bonds are considered capital assets for tax purposes. The capital gains tax rate for stocks and bonds depends on various factors, including the holding period and the individual’s income level.

– Short-term capital gains from stocks and bonds are taxed at the individual’s ordinary income tax rate.

– Long-term capital gains from stocks and bonds are taxed based on the long-term capital gains tax rates mentioned earlier.

It’s important to review the specific tax regulations in your country to determine the applicable rates.

2. Real Estate

Real estate is another common asset subject to capital gains tax. The tax treatment of real estate capital gains can vary based on factors such as the type of property and the holding period.

In the United States, real estate held for more than one year is subject to the long-term capital gains tax rates. However, if the property was utilized as a primary residence for at least two out of the past five years, individuals may qualify for certain exemptions or exclusions from capital gains tax. The specific rules and rates may differ in other countries.

3. Collectibles and Artwork

Capital gains from the sale of collectibles and artwork are generally subject to a higher tax rate compared to other assets. In the United States, the maximum capital gains tax rate for collectibles and artwork is 28%.

It’s important to note that determining the fair market value of collectibles and artwork can be subjective, and professional appraisals may be required to ensure accurate reporting.

4. Cryptocurrencies

Cryptocurrencies have gained significant popularity in recent years. When it comes to capital gains tax on cryptocurrencies, the tax treatment varies by country.

In the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as property, which means they are subject to capital gains tax rules. The tax rate will depend on the holding period and the individual’s income level at the time of sale.

It’s crucial to consult with a tax professional or refer to the tax regulations in your country to understand how cryptocurrencies are taxed.

Strategies to Optimize Capital Gains Tax

While capital gains tax is an inevitable part of selling assets, there are strategies that can help optimize the tax impact. Here are a few strategies to consider:

1. Holding Period

Holding assets for more than one year can qualify them for the more favorable long-term capital gains tax rates. Consider your investment goals and evaluate opportunities to hold assets for the long term to potentially reduce your tax liability.

2. Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have experienced a loss to offset capital gains from other investments. By strategically realizing losses, individuals can reduce their overall taxable income. It’s important to familiarize oneself with the specific regulations and limitations related to tax-loss harvesting in your country.

3. Tax-Advantaged Accounts

Utilizing tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s in the United States, can offer potential tax benefits. Contributions to these accounts are often tax-deductible, and growth within the accounts is tax-deferred or tax-free, depending on the account type.

By utilizing tax-advantaged accounts, individuals can potentially defer capital gains tax until they withdraw funds in retirement, allowing for tax-efficient growth.

4. Charitable Donations

Donating appreciated assets to qualified charities can be a tax-efficient strategy. When donating appreciated assets, individuals may be eligible for a tax deduction based on the fair market value of the asset, while also avoiding capital gains tax on the appreciation.

It’s important to consult with a tax advisor or financial planner to evaluate the specific tax implications and requirements when donating assets.

Understanding the capital gains tax rate is crucial for investors, property owners, and individuals looking to sell their assets. By comprehending the different types of capital gains tax rates, tax considerations for various assets, and strategies to optimize tax impact, individuals can make informed decisions when managing their investments and tax obligations.

Remember to consult with a qualified tax professional or financial advisor to ensure compliance with applicable tax laws and to fully understand the specific rules and regulations related to capital gains tax in your country.

Capital Gains Tax Explained 2021 (In Under 3 Minutes)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the capital gains tax rate?

The capital gains tax rate refers to the percentage of tax imposed on the profits made from the sale of assets such as stocks, bonds, real estate, or other investments. The tax rate can vary depending on the type and duration of the investment.

How is the capital gains tax rate determined?

The capital gains tax rate is typically determined by the individual’s income level and how long they held the asset before selling it. In general, short-term capital gains (assets held for less than a year) are taxed at a higher rate compared to long-term capital gains (assets held for more than a year).

What is the current capital gains tax rate in the United States?

As of 2021, the capital gains tax rates in the United States range from 0% to 20%. The actual tax rate applied depends on the individual’s income level, filing status, and whether the gains are considered short-term or long-term.

Are there different capital gains tax rates for different income levels?

Yes, the capital gains tax rates in the United States can vary based on an individual’s income level. Generally, individuals in lower income tax brackets may qualify for a lower capital gains tax rate or even be exempt from paying capital gains tax altogether.

Do capital gains tax rates differ for married couples filing jointly?

Married couples filing jointly may have different capital gains tax rates compared to individuals. The specific tax rate will depend on the couple’s combined income and whether the gains are short-term or long-term.

How do I calculate my capital gains tax?

To calculate your capital gains tax, you need to determine the taxable gain by subtracting the purchase price or “cost basis” of the asset from the selling price. Then, apply the appropriate capital gains tax rate based on your income level and the duration the asset was held.

Do capital gains tax rates differ for different types of assets?

Yes, different types of assets can have different capital gains tax rates. For example, the tax rate on long-term capital gains from the sale of stocks and bonds might be different from the tax rate on real estate or collectibles. It is important to consult tax regulations or a tax professional for specific rates applicable to different asset types.

What about capital gains tax rates in other countries?

Capital gains tax rates can vary significantly across countries. Each country has its own set of tax laws and regulations that determine how capital gains are taxed. If you have investments or assets in another country, it is advisable to seek guidance from a tax professional familiar with that specific jurisdiction.

Final Thoughts

The capital gains tax rate is the percentage of tax imposed on the profits made from selling certain assets. In the United States, the capital gains tax rate varies depending on the type of asset and how long it was held. For short-term capital gains (assets held for less than a year), the tax rate is based on the individual’s income tax bracket. Long-term capital gains (assets held for more than a year) have their own tax rates, which are generally lower than the income tax rates. It is crucial to understand the capital gains tax rate as it can significantly impact your investment decisions and overall financial planning.