Payday loans: the solution to quick cash or a financial trap? Understanding the pros and cons of payday loans is crucial before considering this option. If you’re in a pinch and need money urgently, payday loans may seem like a viable solution. However, it’s essential to delve deeper and evaluate the potential pitfalls of these short-term loans. In this article, we’ll explore the benefits and drawbacks of payday loans, providing you with the knowledge needed to make an informed decision. Let’s dive in.

Understanding the Pros and Cons of Payday Loans

Introduction

Welcome to our comprehensive guide on understanding the pros and cons of payday loans. In this article, we will delve into the details of payday loans, exploring their benefits and drawbacks. Before you consider taking out a payday loan, it’s crucial to have a clear understanding of how these short-term loans work and the potential implications they may have on your financial situation.

What are Payday Loans?

Payday loans, also known as cash advances or paycheck advances, are short-term loans that provide borrowers with quick access to cash. These loans are typically small amounts, ranging from $100 to $1,000, and are usually repaid within a few weeks or on the borrower’s next payday. Payday loans are designed to be a temporary solution for individuals facing unexpected expenses or cash shortages between paychecks.

- Fast and convenient: One of the main advantages of payday loans is their quick turnaround time. Borrowers can often receive the funds within a few hours of applying, making it a convenient option for those in urgent need of cash.

- No credit check required: Unlike traditional loans, which often involve a thorough credit check, payday lenders typically do not require a credit check. This makes payday loans accessible to individuals with poor credit or no credit history.

- Minimal documentation: Payday lenders usually require minimal documentation, such as proof of income and a valid identification. This streamlined process makes it easier for borrowers to apply for a loan.

The Pros of Payday Loans

While payday loans offer some benefits, it’s important to carefully consider the potential drawbacks and evaluate whether they outweigh the advantages. Let’s take a closer look at the pros of payday loans:

1. Accessibility for Borrowers with Poor Credit

One of the primary advantages of payday loans is that they provide access to funds for individuals with poor credit or no credit history. Traditional lenders typically rely heavily on credit scores when assessing loan applications. However, payday lenders focus more on the borrower’s steady income source than their credit history, making it easier for those with less-than-perfect credit to qualify for a loan.

2. Fast Approval and Disbursement

When faced with unexpected expenses, such as a medical emergency or car repair, having access to quick funds can be crucial. Payday loans offer a speedy approval process, often providing funds within hours of applying. This makes them an attractive option for individuals who need immediate financial assistance.

3. Flexible Borrowing Limits

Payday loans usually have lower borrowing limits compared to traditional loans. While this may seem like a disadvantage, it can actually be beneficial for borrowers who only need a small amount of money to cover a short-term expense. The lower borrowing limits help prevent individuals from taking on more debt than necessary and can be a responsible way to manage financial emergencies.

4. Simplified Application Process

Applying for a payday loan is typically straightforward and hassle-free. The application process involves minimal paperwork, and borrowers can often complete it online or in person at a payday loan store. This simplicity and convenience make payday loans an appealing option for those seeking immediate financial relief.

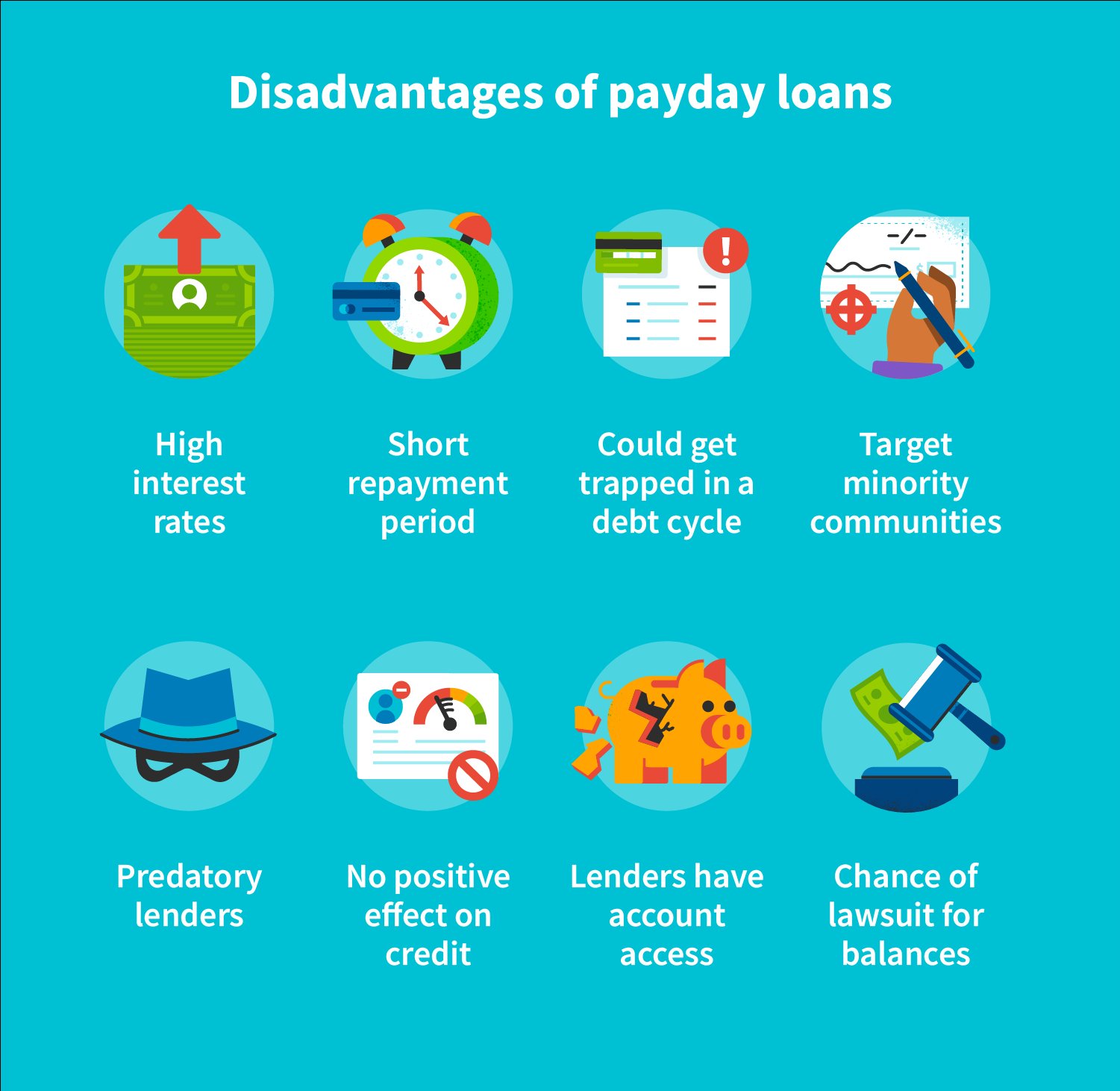

The Cons of Payday Loans

While payday loans may seem like a viable solution in certain situations, it’s crucial to consider the potential disadvantages before making a decision. Here are some of the cons of payday loans that you should be aware of:

1. High Interest Rates and Fees

One of the most significant drawbacks of payday loans is their high interest rates and fees. Payday lenders often charge exorbitant interest rates, resulting in a much higher cost of borrowing compared to traditional loans. These high rates can quickly accumulate, making it challenging for borrowers to repay the loan on time and potentially leading to a cycle of debt.

2. Short Repayment Period

Payday loans typically have short repayment periods, ranging from a few weeks to a month. While this may be manageable for some borrowers, for others, it can be difficult to repay the loan in such a short timeframe. Failing to repay the loan on time can result in additional fees and penalties, further exacerbating the financial burden.

3. Potential for Debt Cycle

Due to the high interest rates and short repayment periods, some borrowers may find themselves trapped in a cycle of debt. When unable to repay the loan on time, they may be forced to take out another loan to cover the previous one, leading to a cycle of borrowing and escalating debt. This can have severe long-term financial implications and make it challenging to break free from the cycle.

4. Predatory Lending Practices

While there are reputable payday lenders, the industry has also faced criticism for predatory lending practices. Some lenders may take advantage of vulnerable borrowers by charging excessive fees, using aggressive collection tactics, or offering loans to individuals who cannot afford to repay them. It’s essential to carefully research and choose a reputable lender if considering a payday loan.

In conclusion, payday loans can offer quick access to funds for individuals facing financial emergencies. They provide accessibility to borrowers with poor credit and have a simplified application process. However, it’s crucial to be aware of the potential drawbacks, including high interest rates, short repayment periods, and the potential for falling into a debt cycle. Borrowers should carefully evaluate their financial circumstances and consider alternatives before deciding to take on a payday loan.

Remember, payday loans should be used as a last resort and only for genuine emergencies. If you find yourself in need of financial assistance, it’s important to explore other options such as personal loans, credit unions, or reaching out to reputable nonprofit organizations that provide financial counseling and assistance.

FAQ

– Q: Are payday loans available to everyone?

– A: Payday loans are accessible to individuals with a steady income, but eligibility requirements may vary depending on the lender. They often do not require a credit check, making them an option for individuals with poor credit or no credit history.

– Q: How much can I borrow with a payday loan?

– A: Payday loans typically range from $100 to $1,000, but the specific borrowing limits depend on the lender and your income level.

– Q: Can payday loans help improve my credit score?

– A: Payday loans are generally not reported to credit bureaus, so repaying them on time may not directly improve your credit score. However, failing to repay the loan can negatively impact your creditworthiness.

– Q: Are there alternatives to payday loans?

– A: Yes, there are alternative options to payday loans, such as personal loans from banks or credit unions, credit card cash advances, borrowing from friends or family, or seeking financial assistance from nonprofit organizations.

– Q: How can I avoid falling into a debt cycle with payday loans?

– A: To avoid falling into a debt cycle, it’s crucial to borrow responsibly and only take out a payday loan if absolutely necessary. Create a budget, evaluate your repayment capabilities, and explore alternatives before considering a payday loan. If you do take out a payday loan, make every effort to repay it on time to minimize additional fees and penalties.

Should You Get a Payday Loan? (Pros and Cons)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the advantages of payday loans?

Payday loans offer several advantages, including quick access to funds, no credit check requirements, easy application process, and flexibility in loan usage.

Are there any disadvantages to payday loans?

While payday loans can be helpful in certain situations, they also come with some disadvantages such as high interest rates, potential for debt cycle, and limited loan amounts.

How do payday loans work?

Payday loans are short-term loans that are typically due on your next payday. You borrow a small amount of money and repay it, along with any applicable fees, when you receive your next paycheck.

What are the eligibility requirements for payday loans?

To qualify for a payday loan, you usually need to be at least 18 years old, have a steady source of income, and provide proof of identification and a valid bank account.

Can I get a payday loan if I have bad credit?

Yes, payday loans are often available to individuals with bad credit as they usually don’t require a credit check. However, it’s important to note that payday loan interest rates are generally higher for borrowers with poor credit.

How much can I borrow with a payday loan?

The loan amount you can borrow with a payday loan varies depending on various factors such as your income, state regulations, and the lender’s policies. Generally, payday loans range from $100 to $1,000.

What fees are associated with payday loans?

Payday loans typically have fees that are calculated based on the loan amount. These fees can vary depending on the lender and state regulations, so it’s important to review the terms and conditions before applying.

Can I extend the repayment period for my payday loan?

Some payday lenders offer loan extensions or rollovers, but they usually come with additional fees. It’s important to carefully consider whether extending the repayment period is the best option for your financial situation.

Final Thoughts

Understanding the pros and cons of payday loans is essential before making a decision. On the positive side, payday loans offer quick access to cash, making them convenient for emergencies. Additionally, the application process is often straightforward and does not require a credit check. However, it’s important to consider the drawbacks. Payday loans come with high interest rates and fees, leading to potential debt traps. Furthermore, the short repayment period can put borrowers under financial stress. Therefore, it is crucial to evaluate individual circumstances and consider alternatives before opting for a payday loan.