Are you curious about what an equity line of credit is and how it can benefit you? Look no further! An equity line of credit is a flexible financing option that allows homeowners to borrow against the value of their home. It provides access to funds that can be used for a variety of purposes, such as home renovations, debt consolidation, or unexpected expenses. With an equity line of credit, you have the freedom to use the funds as needed, making it a versatile solution for managing your finances. Let’s dive deeper into this topic and explore the advantages and considerations of an equity line of credit.

What is an Equity Line of Credit?

An equity line of credit, also known as a home equity line of credit (HELOC), is a type of loan that allows homeowners to borrow money against the equity they have built up in their property. This financial tool can provide individuals with a flexible and accessible source of funds, often at lower interest rates compared to other types of loans. In this section, we will delve deeper into the concept of an equity line of credit, exploring how it works, its benefits, and considerations before applying for one.

How does an Equity Line of Credit work?

When you have equity in your home, which is the difference between the current market value of your property and the outstanding balance of your mortgage, you may be eligible to apply for an equity line of credit. With a HELOC, you can borrow against this equity, similar to a credit card, but with your home serving as collateral.

The borrowing limit for an equity line of credit is typically determined by a percentage of the appraised value of your home, minus the outstanding mortgage amount. The specific percentage can vary depending on factors such as the lender’s policies and your creditworthiness. For example, if the lender offers a maximum borrowing limit of 80% and your home is appraised at $300,000 with a mortgage balance of $200,000, you may be eligible for a HELOC of up to $40,000 ($300,000 * 0.8 – $200,000).

Once approved for a HELOC, you can access the funds as needed, up to the approved limit, during the draw period. This draw period, typically lasting around ten years, allows you to withdraw funds and use them for various purposes, such as home improvements, debt consolidation, education expenses, or unexpected financial needs.

The Benefits of an Equity Line of Credit

Obtaining an equity line of credit can offer numerous advantages for homeowners, providing them with financial flexibility and potential cost savings. Here are some key benefits to consider:

- Lower interest rates: HELOCs often come with lower interest rates compared to credit cards or personal loans, making them a cost-effective borrowing option.

- Tax deductibility: In many cases, the interest paid on a HELOC may be tax-deductible. However, it is important to consult with a tax advisor to understand the specific rules and eligibility criteria.

- Flexibility: With a HELOC, you have the freedom to use the funds for various purposes, providing financial flexibility and allowing you to address different needs as they arise.

- Revolving credit: Similar to a credit card, a HELOC provides a revolving credit line. This means that as you make payments towards the principal balance, those funds become available for you to borrow again.

- Accessibility: Having a HELOC in place ensures that you have access to a source of funds, providing peace of mind in case of emergencies or unexpected expenses.

Considerations before Applying for an Equity Line of Credit

While an equity line of credit offers numerous benefits, it is essential to carefully consider certain aspects before deciding to apply for one. Understanding these considerations will help you make an informed decision and ensure that a HELOC aligns with your financial goals. Here are some key factors to keep in mind:

1. Interest Rates and Repayment

- At the outset, it’s crucial to understand the interest rate structure of the HELOC. Typically, the interest rates for a HELOC can be variable, meaning they can fluctuate over the life of the loan. Ensure that you understand how often the rates can change and any potential caps or limits on these adjustments.

- During the draw period, you may only be required to make minimum monthly payments, typically based on the interest accrued. However, once the draw period ends, you will enter the repayment period, during which you will need to repay both the principal and interest.

- Consider your financial ability to make payments during both the draw and repayment periods, and evaluate the impact of potential interest rate increases on your budget.

2. Fees and Closing Costs

- Before finalizing an equity line of credit, it’s crucial to understand all associated fees and closing costs. These may include application fees, appraisal fees, closing fees, annual fees, or any other charges specific to the lender.

- Take the time to compare offers from different lenders and carefully review the terms and conditions, ensuring that the costs align with the benefits you expect to receive from the HELOC.

3. Potential Risks

- As with any financial decision, there are inherent risks to consider. One primary risk associated with a HELOC is the use of your home as collateral. Failure to make payments can lead to foreclosure, potentially resulting in the loss of your property.

- Evaluate your financial stability and ability to repay the loan before committing to an equity line of credit. Consider factors such as your income, employment stability, and overall financial health.

- Furthermore, be cautious about using the funds for discretionary expenses that may not offer long-term value, as this can lead to unnecessary debt and financial strain.

4. Your Future Plans

- Before applying for a HELOC, consider your future plans and how they may impact your financial situation.

- If you anticipate a change in income, such as transitioning to retirement or starting a family, carefully evaluate whether you will still be able to afford the payments during the repayment period.

- Additionally, if you plan to sell your home in the near future, it may not be the ideal time to take out an equity line of credit.

By thoroughly considering these factors, you can make an informed decision and determine if a HELOC is the right financial tool for you. Remember to approach the application process with caution, carefully review the terms and conditions, and seek guidance from financial professionals if needed. An equity line of credit can provide significant benefits, but it’s essential to ensure that it aligns with your long-term financial goals and overall financial well-being.

How a Home Equity Line of Credit Works! (HELOC EXPLAINED & How To Get a HELOC)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an equity line of credit?

An equity line of credit, also known as a home equity line of credit (HELOC), is a type of loan that uses the equity in a property as collateral. It allows homeowners to borrow money based on the difference between the market value of their property and the amount they owe on their mortgage.

How does an equity line of credit work?

With an equity line of credit, borrowers are given a credit limit based on the amount of equity in their property. They can borrow money up to this limit, similar to a credit card, and only pay interest on the amount they borrow. As they repay the borrowed amount, the credit becomes available again for future use.

What can an equity line of credit be used for?

An equity line of credit can be used for various purposes such as home renovations, debt consolidation, college tuition, or any other expenses. However, it is important to use the funds responsibly and within your means.

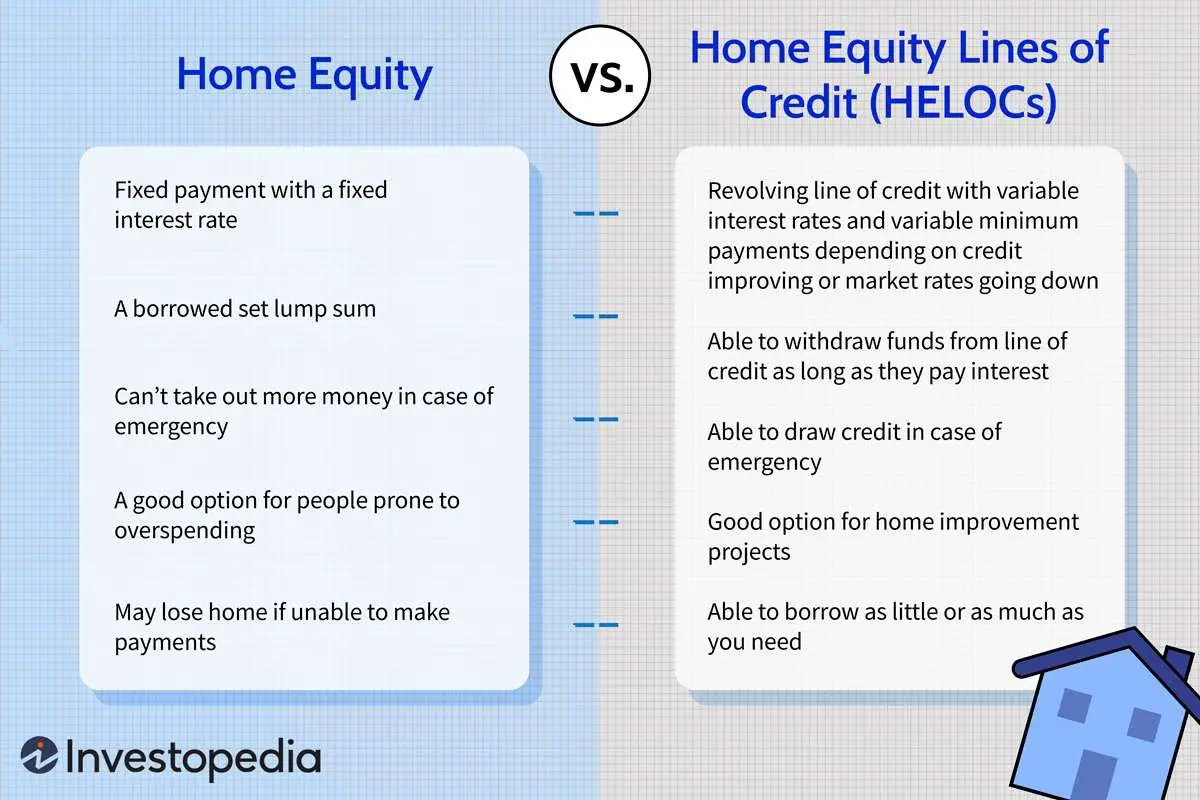

How is an equity line of credit different from a home equity loan?

While both options use the equity in a property as collateral, a home equity loan provides a lump sum upfront, which is repaid over time with fixed monthly payments and a fixed interest rate. In contrast, an equity line of credit offers a flexible credit line that can be used as needed, with variable interest rates.

What are the advantages of an equity line of credit?

One advantage of an equity line of credit is the flexibility it offers. Borrowers have the freedom to use the funds as needed, and they only pay interest on the amount borrowed. Additionally, the interest paid on the loan may be tax-deductible, but it’s recommended to consult a tax advisor for specific information.

What are the potential risks of an equity line of credit?

While an equity line of credit can be a valuable financial tool, it also carries certain risks. If property values decrease or if borrowers are unable to make payments, they could face foreclosure. It’s important to carefully consider the terms and conditions, interest rates, and repayment options before opting for an equity line of credit.

How is the interest calculated on an equity line of credit?

The interest on an equity line of credit is usually variable, meaning it can fluctuate over time based on market conditions. The interest rate is typically based on a benchmark, such as the prime rate, plus a margin determined by the lender. It’s important to understand how the interest rate is calculated and how it may impact your payments.

How can I qualify for an equity line of credit?

To qualify for an equity line of credit, lenders typically consider factors such as the amount of equity in your property, your credit score, income, and debt-to-income ratio. Each lender may have specific eligibility requirements, so it’s advisable to reach out to them directly to understand their criteria and the application process.

Final Thoughts

An equity line of credit is a flexible financing option that allows homeowners to tap into the equity they have built in their property. With an equity line of credit, individuals can borrow money as needed, up to a predetermined limit, using their home as collateral. This type of credit offers convenience and control, as borrowers can access funds whenever they need them and only pay interest on the amount borrowed. It can be used for a variety of purposes, such as home improvements, debt consolidation, or unexpected expenses. Understanding what an equity line of credit is can empower homeowners to make informed financial decisions.