Looking to make a positive impact with your investments? Understanding the benefits of impact investing is crucial. This approach goes beyond financial returns, aiming to generate positive social and environmental outcomes. By aligning your investments with causes you care about, you have the opportunity to support initiatives that drive change and create a better future. Whether it’s addressing climate change, promoting social equality, or driving innovation in health care, impact investing allows you to make a difference while still achieving your financial goals. So, let’s delve into the world of impact investing and explore how it can reshape the way we invest, one impactful decision at a time.

**Understanding the Benefits of Impact Investing**

Introduction

Impact investing is a powerful and innovative approach to finance that seeks to generate positive social and environmental outcomes alongside financial returns. As individuals and institutions increasingly recognize the need to address pressing global challenges, impact investing has gained traction as a means to create meaningful change while still achieving financial goals. In this article, we delve into the various benefits of impact investing and explore how it can make a difference in the world.

1. Creating Positive Social and Environmental Impact

Impact investing goes beyond conventional investing by intentionally directing capital towards solutions that address social and environmental issues. By investing in enterprises and projects that prioritize social and environmental outcomes, investors can directly contribute to positive change in areas such as:

- Poverty alleviation

- Access to education and healthcare

- Sustainable agriculture and food security

- Clean energy and climate change mitigation

- Gender equality and empowerment

- Conservation of natural resources and biodiversity

This approach allows investors to align their financial resources with their values and actively participate in creating a more just and sustainable world.

2. Financial Returns

Contrary to a common misconception, impact investing does not necessarily mean sacrificing financial returns. In fact, it can potentially offer attractive financial benefits. Several studies have shown that impact investments can perform as well as, or even outperform, conventional investments. For example:

- A study by the Global Impact Investing Network (GIIN) found that the majority of impact investing funds targeting market-rate returns met or exceeded their expectations.

- Research conducted by Cambridge Associates revealed that impact investing in private equity and venture capital generated median net returns that were comparable to traditional funds.

- Investments in renewable energy have shown strong growth potential, with solar and wind projects delivering competitive returns in many markets.

By carefully selecting impact investments, investors can obtain financial returns while simultaneously contributing to positive change.

3. Risk Management and Diversification

Impact investing provides opportunities for risk management and diversification. Including impact investments in a portfolio can help mitigate risks associated with traditional investments and create a more balanced investment strategy. Here’s how impact investing can contribute to risk management:

- Resilience to External Shocks: Impact investments that focus on sectors resilient to economic or environmental shocks, such as healthcare or renewable energy, can help cushion the overall portfolio against adverse events.

- Market Opportunities: Investing in sectors addressing critical social and environmental challenges can unlock new market opportunities. These sectors, often driven by long-term trends and demographic shifts, can offer potential growth even during periods of economic volatility.

- Diversification: Including impact investments across different asset classes, such as private equity, debt, and real estate, can diversify risk and potentially enhance overall portfolio performance.

Adding impact investments to a portfolio can provide risk-adjusted returns and help investors navigate an increasingly complex and interconnected global economy.

4. Enhanced Reputation and Stakeholder Engagement

In today’s socially conscious world, businesses and institutions are under increasing scrutiny to demonstrate their commitment to sustainable practices and societal well-being. Engaging in impact investing allows companies and organizations to align their financial activities with their core values and positively impact their reputation. Here’s how impact investing can enhance reputation and stakeholder engagement:

- Attracting Stakeholders: Impact investments can help attract socially and environmentally conscious investors, customers, and employees who are more likely to support organizations that prioritize sustainability.

- Building Trust: Demonstrating a commitment to impact investing builds trust and strengthens relationships with stakeholders, including regulators, communities, and nonprofit organizations.

- Meeting ESG Standards: Impact investing aligns with Environmental, Social, and Governance (ESG) standards, which are increasingly important for investors and stakeholders concerned about the long-term sustainability of organizations.

By integrating impact investing into their strategies, companies and institutions can bolster their reputation and actively engage with stakeholders who share their values.

5. Catalyzing Innovation and Scalable Solutions

Impact investing plays a crucial role in unlocking capital for innovative and scalable solutions to societal and environmental challenges. By providing funding and support to mission-driven entrepreneurs and enterprises, impact investors can accelerate the development and deployment of cutting-edge technologies, business models, and initiatives. Here’s how impact investing catalyzes innovation:

- Early-Stage Financing: Impact investors often provide early-stage financing that traditional investors may deem too risky. This patient capital allows entrepreneurs to test bold ideas and develop impactful solutions that can eventually attract mainstream investors.

- Proof of Concept: By supporting innovative ventures, impact investors can help demonstrate the viability and effectiveness of new models and technologies. These successful proof-of-concept projects can then inspire further investments and replication globally.

- Scaling Solutions: Impact investors play a critical role in scaling up impactful ventures. Their financial support, expertise, and networks can help enterprises expand operations, reach new markets, and achieve greater social and environmental impact.

Through impact investing, investors actively contribute to the creation and dissemination of innovative solutions that have the potential to address some of the world’s most pressing challenges.

Impact investing offers a unique and compelling approach to finance that allows individuals and institutions to create positive social and environmental impact while generating financial returns. By directing capital towards meaningful solutions, impact investors contribute to poverty alleviation, environmental conservation, and social progress. Moreover, impact investing can provide attractive financial returns, mitigate risks, enhance reputation, catalyze innovation, and scale scalable solutions. As more stakeholders embrace impact investing, the ripple effect of positive change will continue to shape the future of finance and contribute to a more sustainable and equitable world.

Webinar: Impact Investing: The Next Trillion

Frequently Asked Questions

Frequently Asked Questions (FAQs)

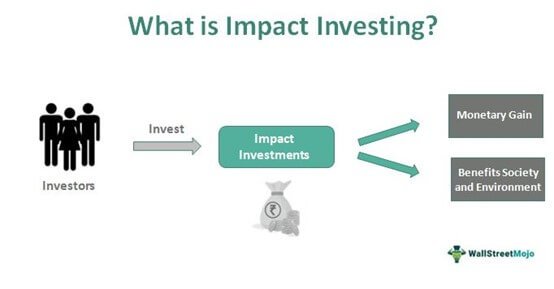

What is impact investing?

Impact investing refers to the practice of making investments with the intention of generating positive social and environmental impact, alongside financial returns. It involves deploying capital to address pressing challenges and drive positive change in society.

How does impact investing differ from traditional investing?

Unlike traditional investing, impact investing focuses on generating measurable social and environmental benefits in addition to financial returns. The primary goal is to contribute to societal progress and address important global issues such as poverty alleviation, climate change, and sustainable development.

What are the advantages of impact investing?

Impact investing offers several benefits. Firstly, it allows investors to align their financial goals with their values by directing capital towards causes they believe in. Secondly, it has the potential to generate financial returns while simultaneously creating positive social and environmental change. Lastly, impact investing can contribute to the long-term sustainability and well-being of communities and the planet.

Who can engage in impact investing?

Anyone can engage in impact investing, including individuals, institutions, corporations, and foundations. Impact investing is not limited to a specific group or sector; it is a flexible approach that can be tailored to different investment strategies and asset classes.

How can impact investments create positive social change?

Impact investments can create positive social change by supporting businesses and organizations that are dedicated to solving social or environmental issues. By providing funding and resources, impact investors enable these entities to scale their impact and drive meaningful change in areas such as education, healthcare, clean energy, and more.

Is impact investing profitable?

Yes, impact investing can be profitable. While financial returns may vary depending on the specific investment and its impact objectives, impact investors aim to achieve both financial and social/environmental returns. The financial performance of impact investments can be influenced by various factors, including market conditions, risk management, and the effectiveness of the impact strategy.

How can one measure the impact of an investment?

Measuring the impact of an investment involves evaluating the social, environmental, and financial outcomes it has generated. Impact investors employ various metrics and frameworks, such as the Impact Reporting and Investment Standards (IRIS) or the United Nations Sustainable Development Goals (SDGs), to assess the extent of the positive change achieved through their investments.

What are some examples of impact investments?

There are numerous examples of impact investments across different sectors. These can include investing in renewable energy projects, microfinance institutions, affordable housing initiatives, sustainable agriculture ventures, and social enterprises focused on education or healthcare. The possibilities for impact investing are vast and encompass a wide range of industries and causes.

Final Thoughts

Understanding the benefits of impact investing is crucial for individuals and organizations looking to make a positive difference in society. Impact investing allows investors to align their financial goals with social and environmental objectives, creating a win-win situation. By actively supporting businesses that have a positive impact, investors can address pressing issues like climate change, poverty, and inequality. Impact investing not only generates financial returns but also contributes to the sustainable development of communities and the protection of the planet. It empowers investors to be part of the solution, driving positive change and leaving a lasting impact for future generations.