Securities lending in investment is a concept that may seem complex at first, but fear not, I’m here to break it down for you. Essentially, securities lending refers to the temporary transfer of financial instruments, such as stocks or bonds, from one party to another. This process allows the borrower to use these securities for various purposes, like facilitating short selling or hedging strategies, while the lender earns a fee for lending out their assets. So, if you’ve ever wondered what is securities lending in investment, today we’re going to dive into the details and explore this fascinating aspect of the financial world. Let’s get started!

What is Securities Lending in Investment

Securities lending is a practice in the investment world that involves the temporary transfer of securities from one party, known as the lender, to another party, known as the borrower. The lender essentially lends their securities to the borrower for a specified period, usually in exchange for collateral and a fee. This process allows financial institutions, such as banks, hedge funds, and asset managers, to obtain the securities they need for various purposes, such as short-selling, market-making, or settling trades.

In this article, we will delve deeper into the concept of securities lending, its mechanics, benefits, risks, and the role it plays in investment strategies. So, let’s explore this fascinating aspect of the financial world.

The Mechanics of Securities Lending

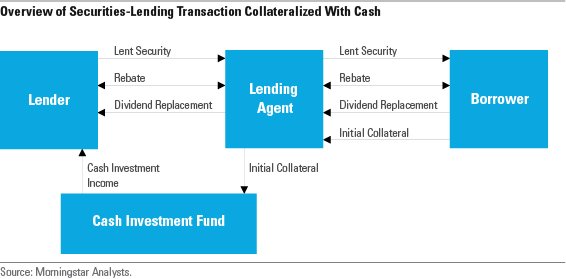

Securities lending involves several key players and steps. Let’s understand the mechanics of this process:

1. Lender: The lender is the institutional investor or individual who owns the securities and agrees to lend them temporarily. The lender can be pension funds, mutual funds, insurance companies, or even individual investors.

2. Borrower: The borrower is typically a financial institution, such as a hedge fund, investment bank, or broker-dealer, seeking to borrow securities to fulfill their specific objectives, such as short-selling or hedging.

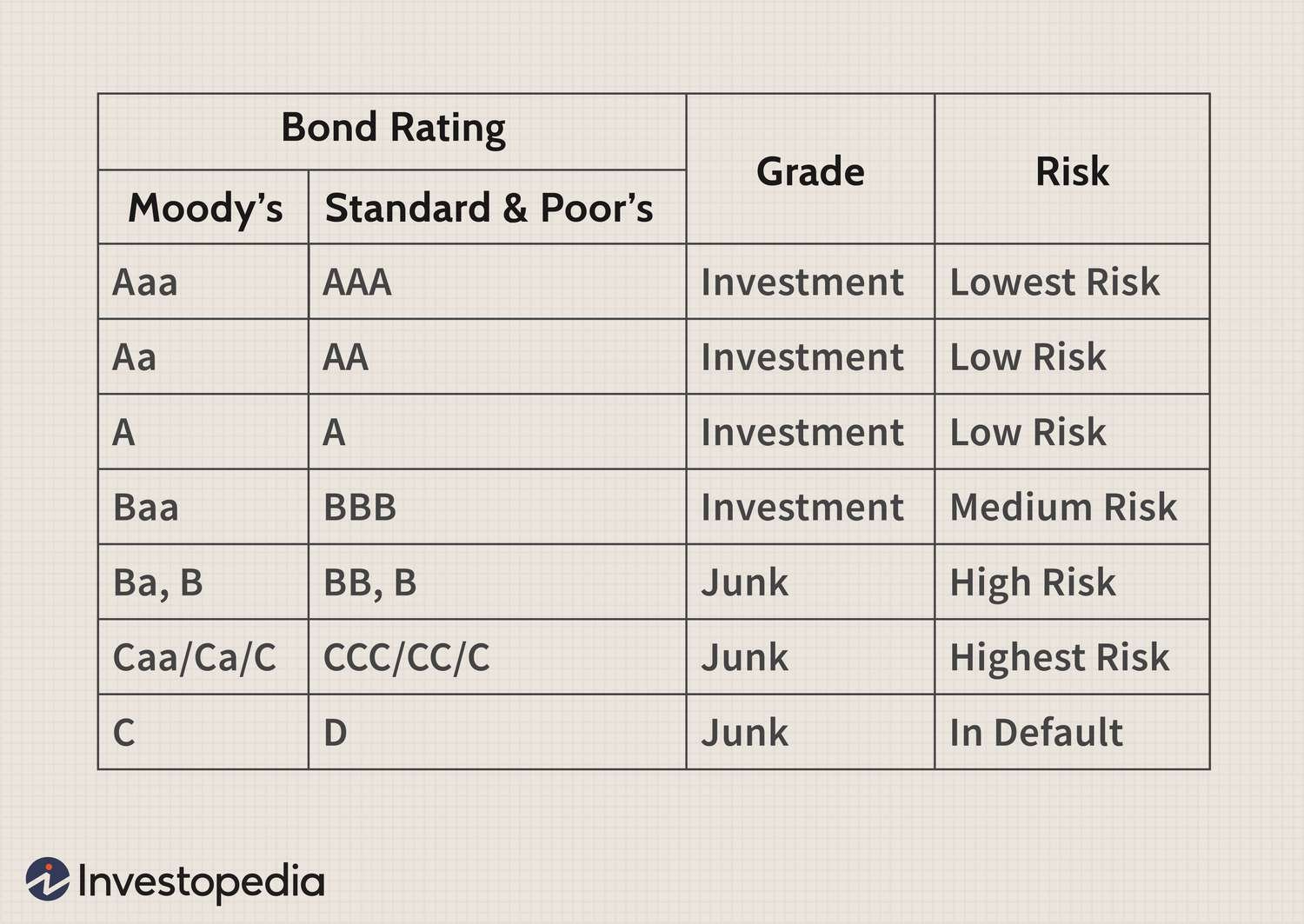

3. Collateral: To mitigate the risks associated with securities lending, borrowers are required to provide collateral to the lender. Collateral can be in the form of cash, other securities, or letters of credit. The collateral value is often higher than the market value of the borrowed securities to provide a cushion in case of any market fluctuations.

4. Loan Agreement: The lender and borrower enter into a loan agreement that outlines the terms and conditions of the securities lending transaction. This agreement includes details such as the duration of the loan, the fee charged by the lender, and the agreed-upon collateral value.

5. Transfer of Securities: Once the loan agreement is in place, the lender transfers the securities to the borrower. This transfer is usually facilitated by a custodian or a securities lending agent acting on behalf of the lender.

6. Fee Structure: In securities lending, the lender earns a fee for lending their securities to the borrower. This fee is typically calculated based on factors such as the market demand for the securities, their liquidity, and the duration of the loan.

7. Duration of the Loan: Securities lending transactions can range from overnight loans to long-term loans lasting several months or even years. The duration depends on the requirements of the borrower and the flexibility of the lender.

8. Return of Securities: At the end of the loan period, the borrower returns the borrowed securities to the lender. Upon the return of the securities, the lender returns the collateral to the borrower, and any outstanding fees are settled.

Benefits of Securities Lending

Securities lending offers several benefits to both lenders and borrowers. Let’s explore the advantages of engaging in securities lending transactions:

1. Generate Additional Income: For lenders, securities lending provides an opportunity to generate additional income on their investment portfolios. By lending out idle securities, lenders can earn fees that enhance their overall investment returns.

2. Diversification of Investment Strategy: Lenders can use securities lending to diversify their investment strategy by lending securities that they may not currently need in their portfolio. This strategy allows them to maximize the potential returns from their assets.

3. Cost Reduction for Borrowers: Borrowers can utilize securities lending to reduce the costs associated with short-selling. By borrowing securities instead of purchasing them outright, borrowers can avoid transaction costs and potentially benefit from favorable market movements.

4. Facilitates Market Liquidity: Securities lending plays a crucial role in facilitating market liquidity. By allowing borrowers to access securities they require for various purposes, such as settlement or market-making, securities lending contributes to overall market efficiency.

5. Improved Portfolio Performance: Borrowers, especially hedge funds and proprietary trading firms, can utilize securities lending to enhance their portfolio performance. Short-selling, for example, allows them to profit from falling stock prices and potentially hedge against overall market downturns.

Risks Associated with Securities Lending

While securities lending offers benefits, it also carries certain risks that participants should be aware of. Let’s explore some of the risks associated with securities lending:

1. Counterparty Risk: The risk of default by the borrower is known as counterparty risk. If the borrower fails to return the borrowed securities or provide the agreed-upon collateral, the lender may face losses or difficulties in recovering their assets.

2. Collateral Risk: The value of the collateral provided by the borrower may fluctuate during the loan period. If the value of the collateral falls below the agreed-upon level, the lender may face challenges in recovering the full value of their lent securities.

3. Market Risk: Market movements can impact the value of lent securities. If the value of the lent securities decreases during the loan period, the lender may face the risk of not fully recovering the value of their lent securities.

4. Operational Risk: Securities lending involves various operational processes, such as collateral management, trade settlement, and reconciliation. Operational risks arise from errors or inefficiencies in these processes, potentially leading to financial losses or delays.

5. Regulatory and Legal Risks: Securities lending is subject to regulatory frameworks that vary across jurisdictions. Changes in regulations or legal disputes can expose participants to compliance and legal risks.

Securities Lending in Investment Strategies

Securities lending plays a significant role in various investment strategies. Let’s explore how securities lending is utilized in different investment approaches:

1. Short-Selling: Short-selling involves borrowing securities and selling them with the expectation of buying them back at a lower price in the future. Securities lending fulfills the need for borrowed securities in short-selling strategies, enabling investors to profit from falling prices.

2. Arbitrage: Arbitrage strategies aim to profit from price discrepancies between related securities. Securities lending allows investors to access the securities required for such strategies, contributing to the efficiency of the arbitrage trade.

3. Liquidity Provision: Market makers and liquidity providers often engage in securities lending to ensure they have the necessary securities to facilitate smooth trading and market liquidity. By lending securities, these participants ensure a continuous supply of stocks and other instruments for market participants.

4. Hedging: Investors, especially institutional investors, employ securities lending as part of their hedging strategies. By borrowing securities and using them to hedge their existing positions, investors can mitigate risks associated with adverse market movements.

5. Enhanced Yield: Some investment funds and fixed-income strategies utilize securities lending to enhance portfolio yield. By lending securities, these funds can generate additional income, contributing to overall returns.

In conclusion, securities lending is a vital practice in the investment world, allowing lenders to earn extra income and borrowers to access securities for various purposes. While securities lending offers benefits, it is essential for participants to understand the associated risks and carefully consider their investment objectives. By harnessing the potential of securities lending, investors can enhance their portfolio performance and contribute to market liquidity.

Securities Lending Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is securities lending in investment?

Securities lending in investment is a practice where investors lend their securities, such as stocks or bonds, to other investors or financial institutions in return for a fee. This allows the borrowers to use the securities for various purposes, such as short selling or hedging, while the lenders continue to earn income from the lending arrangement.

How does securities lending work?

In securities lending, the lender transfers the ownership of the securities to the borrower for a specified period. The borrower provides collateral, typically in the form of cash or other securities, to the lender as a security against the loan. The borrower pays a fee or interest to the lender, and at the end of the agreed period, the borrowed securities are returned to the lender.

Who participates in securities lending?

Securities lending involves various participants, including institutional investors, such as pension funds and mutual funds, as well as financial intermediaries like banks and broker-dealers. Hedge funds and other investment firms also engage in securities lending to enhance their investment strategies and generate additional returns.

What are the benefits of securities lending for investors?

Securities lending offers several benefits to investors. Firstly, it provides an additional source of income through the lending fees or interest earned. Additionally, it can increase overall portfolio returns. It also helps to enhance market liquidity by facilitating short selling and other trading activities.

What are the risks associated with securities lending?

While securities lending can be profitable, it also involves certain risks. One primary risk is counterparty risk, where the borrower fails to return the securities or fulfill their obligations. Market risks, such as fluctuations in stock prices or interest rates, can also impact the profitability of the lending arrangement. However, strict collateral requirements and risk management practices help mitigate these risks.

Can individual investors participate in securities lending?

Yes, individual investors can participate in securities lending through certain financial institutions or brokerage firms. However, it is more commonly practiced by institutional investors due to the scale and complexity involved in the lending process.

How is the lending fee determined in securities lending?

The lending fee in securities lending is determined by market forces and can vary depending on factors such as demand for specific securities, availability, and market conditions. The fee is typically a percentage of the value of the borrowed securities and is agreed upon between the lender and borrower.

Are securities lending transactions regulated?

Yes, securities lending transactions are subject to regulatory oversight to ensure fair and transparent practices. Regulatory bodies, such as securities commissions or financial authorities, may impose rules and guidelines to protect the interests of investors and maintain market integrity. Participants in securities lending also need to adhere to various legal and regulatory requirements.

Final Thoughts

Securities lending in investment is a practice where investors lend their securities, such as stocks or bonds, to other parties for a specified period. It is primarily done to generate additional income for the lender through the lending fees received. By participating in securities lending, investors can potentially increase their investment returns while maintaining ownership of the securities. This process involves various participants, including borrowers, lenders, and intermediaries called agents or custodians. Securities lending plays a crucial role in facilitating market liquidity and supporting short-selling activities. It also enables institutional investors to enhance their investment strategies by generating additional revenue streams. Overall, securities lending in investment offers opportunities for investors to optimize their returns while mitigating risks.