Are you a diligent intern looking to navigate the realm of finances with finesse? Look no further! Managing your finances during an internship can be a daunting challenge, but fret not, for we have curated a set of valuable tips to help you navigate this financial maze. From budgeting like a pro to eschewing unnecessary expenses, we’ve got you covered. So, let’s dive right in and explore these practical strategies for managing finances during an internship. Ready? Let’s get started!

Tips for Managing Finances During an Internship

Create a Budget

One of the first steps in managing your finances during an internship is to create a budget. A budget helps you track your income and expenses, enabling you to make informed decisions about your spending. To create a budget:

- List all your sources of income. This could include your internship stipend, part-time job, or any other sources.

- Make a list of your monthly expenses, including rent, utilities, groceries, transportation, and entertainment.

- Allocate a certain amount to each expense category based on their priority.

- Track your expenses regularly and adjust your budget as needed.

Having a well-planned budget will help you stay in control of your finances and avoid unnecessary debt.

Minimize Living Expenses

During your internship, it’s important to minimize your living expenses to make the most of your income. Here are some tips to help you reduce your living expenses:

- Consider sharing accommodation with roommates or finding a sublet to split rent and utilities.

- Opt for cost-effective transportation options like public transit or carpooling.

- Cook meals at home instead of eating out regularly.

- Look for student discounts and deals to save money on entertainment and leisure activities.

- Reduce unnecessary subscriptions and memberships that you don’t use frequently.

By being mindful of your living expenses, you can free up more of your income for other financial goals.

Save for the Future

Even during an internship, it’s important to start saving for the future. Here are some strategies to help you save money:

- Automate your savings by setting up a direct deposit into a savings account.

- Consider opening a high-yield savings account to maximize your interest earnings.

- Set specific savings goals, such as building an emergency fund or saving for post-internship expenses.

- Track your progress regularly and adjust your savings goals if needed.

- Avoid unnecessary impulse purchases and focus on long-term financial stability.

By saving a portion of your income, you’ll be better prepared for future expenses and financial goals.

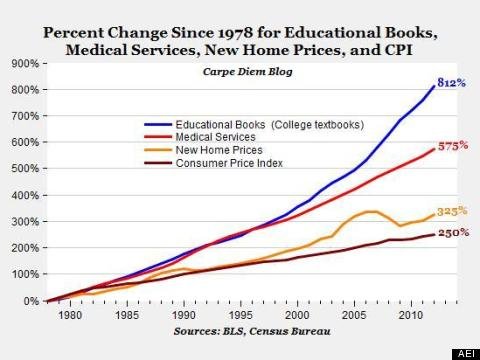

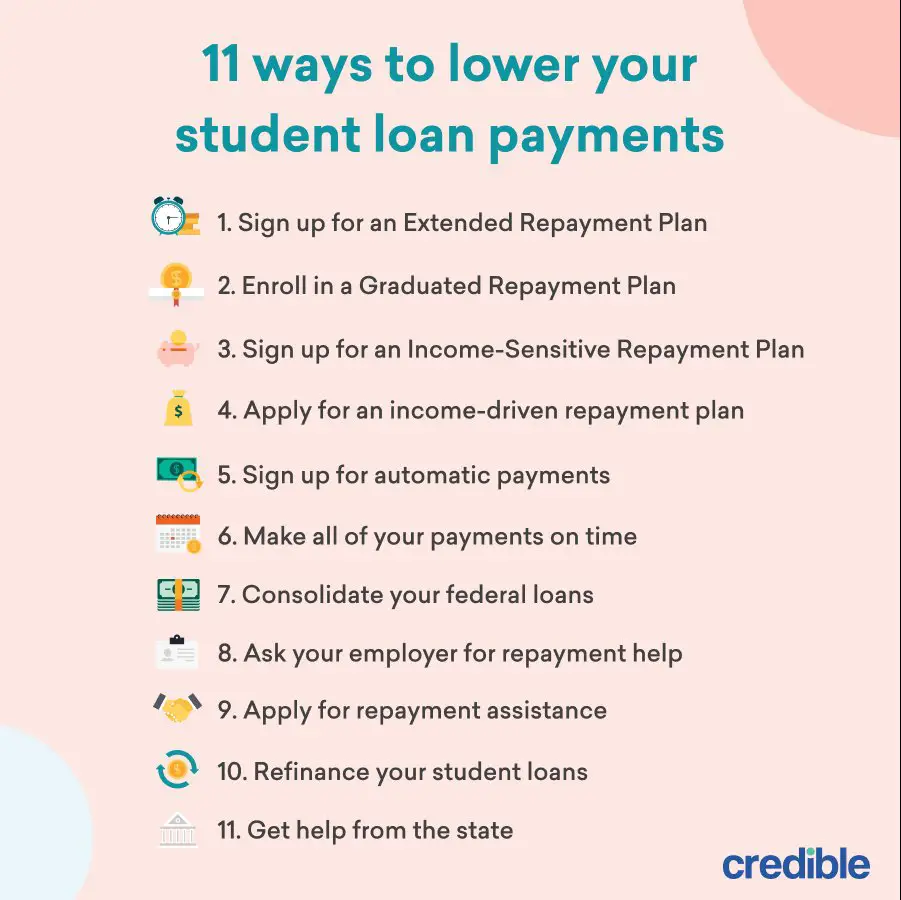

Manage Student Loans

If you have student loans, managing them during an internship is crucial. Here’s what you can do:

- Understand your loan terms, including the interest rates and repayment plans.

- Consider making interest-only payments during your internship to prevent interest from accruing.

- Explore options for deferment or income-driven repayment plans if you’re facing financial hardship.

- Stay organized by keeping track of all loan-related documents and deadlines.

- Make extra payments whenever possible to reduce the overall interest paid.

Effectively managing your student loans during your internship will help you stay on top of your financial obligations and avoid unnecessary stress.

Take Advantage of Internship Benefits

Some internships offer additional benefits beyond the stipend. These benefits can help you save money and manage your finances more efficiently. Here are some benefits to look out for:

- Health insurance: If your internship provides health insurance coverage, make sure to understand the terms and utilize it when needed.

- Retirement plans: Consider participating in any retirement plans offered by your internship to start building your future savings.

- Professional development: Take advantage of any professional development opportunities provided by your internship, as they can enhance your skills and increase your long-term earning potential.

- Tuition reimbursement: If your internship offers tuition reimbursement or educational assistance, take advantage of it to reduce the financial burden of future education.

By leveraging these benefits, you can make your internship experience more financially rewarding.

Track and Monitor Your Expenses

To ensure you are staying within budget and effectively managing your finances, it’s crucial to track and monitor your expenses carefully. Here are some strategies to help you:

- Maintain a detailed record of all your expenses, either using a spreadsheet or a budgeting app.

- Categorize your expenses to identify areas where you may be overspending.

- Regularly review and analyze your spending patterns to make necessary adjustments.

- Set spending limits for different categories and strive to stick to them.

- Consider using expense tracking tools or budgeting apps that can automate the process and provide you with insights into your spending habits.

By actively tracking and monitoring your expenses, you’ll have a better understanding of where your money is going and can make informed financial decisions.

Build a Credit History

During your internship, building a positive credit history is important for your future financial well-being. Here are some steps to take:

- Open a credit card account, if you don’t have one already, and use it responsibly.

- Make regular payments on time and in full to avoid late fees and interest charges.

- Keep your credit utilization ratio low by not maxing out your credit limit.

- Avoid unnecessary debt and only borrow what you can afford to repay.

- Regularly check your credit report to ensure there are no errors or fraudulent activities.

By building a positive credit history, you’ll have better access to loans, lower interest rates, and greater financial flexibility in the future.

Seek Financial Advice

If you’re unsure about how to manage your finances during your internship, don’t hesitate to seek professional financial advice. A financial advisor can provide personalized guidance based on your specific situation and help you make sound financial decisions. They can assist you with:

- Creating a comprehensive financial plan.

- Managing investments and retirement planning.

- Debt management and repayment strategies.

- Providing insights on tax planning and maximizing deductions.

Consulting a financial advisor can give you peace of mind and set you on the right track towards financial success.

In conclusion, managing your finances during an internship is essential for a successful and stress-free experience. By creating a budget, minimizing living expenses, saving for the future, managing student loans, taking advantage of internship benefits, tracking and monitoring expenses, building a credit history, and seeking financial advice when needed, you can ensure that your financial well-being remains intact. Remember, the habits and skills you develop during your internship can have a lasting impact on your financial future, so it’s important to start practicing good financial management from the very beginning.

Listen Up Interns

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are some key tips for managing finances during an internship?

During an internship, managing finances effectively is crucial to maintain financial stability. Here are some key tips to consider:

How can I create a budget to manage my internship finances?

Creating a budget is essential in managing your finances during an internship. Start by determining your income sources, such as internship stipends or part-time jobs. Then, list your expenses, including rent, transportation, food, and other necessary items. Allocate a specific amount for each category and track your spending accordingly.

Can you suggest ways to save money while interning?

Absolutely! Here are some effective ways to save money during your internship:

– Cook meals at home instead of eating out.

– Use public transportation or carpool to save on commuting costs.

– Shop smart by using student discounts or buying second-hand items.

– Take advantage of free or low-cost entertainment options in your area.

Should I consider opening a separate bank account for my internship income?

Opening a separate bank account for your internship income can provide better financial control and organization. It allows you to separate your personal and internship funds, making it easier to track your spending and savings.

What should I do if I encounter unexpected expenses during my internship?

Unexpected expenses can arise during an internship, and it’s essential to be prepared. Consider building an emergency fund to cover unforeseen costs. If you encounter an unexpected expense, evaluate its urgency and impact on your overall budget. Adjust your spending in other areas if necessary or explore alternative funding sources.

Is it advisable to use credit cards during an internship?

While credit cards offer convenience, it’s crucial to use them responsibly. If you decide to use a credit card, make sure to pay the balance in full each month to avoid accumulating interest charges. Be cautious not to rely on credit cards for essential expenses and always stick to your budget.

What tools or apps can help me track my internship expenses?

Several free money management apps are available to help track and manage your internship expenses. Some popular options include Mint, PocketGuard, and Wally. These tools can assist you in setting budgets, tracking spending, and even sending reminders for bill payments.

How can I make the most of my internship experience without overspending?

To make the most of your internship experience without overspending, consider the following:

– Prioritize experiences and networking opportunities that align with your career goals.

– Seek out affordable or free professional development resources.

– Take advantage of any benefits or perks offered by your internship program, such as mentorship or training opportunities.

Final Thoughts

In conclusion, managing finances during an internship can be challenging but with these tips, you can stay on track and make the most of your experience. Firstly, create a budget to track your expenses and prioritize your spending. Secondly, take advantage of student discounts and free resources available to you. Thirdly, save money by preparing meals at home and limiting unnecessary expenses. Finally, consider finding part-time work or freelance opportunities to supplement your income. By applying these tips for managing finances during an internship, you can develop good financial habits and ensure a successful financial journey throughout this phase of your professional development.