Financial underwriting in insurance is a crucial process that determines the risk associated with insuring an individual or entity. It involves evaluating the financial stability, creditworthiness, and ability to pay premiums of the policyholder. Essentially, it helps insurance companies assess the likelihood of a claim being made and the potential financial impact. By delving into the financial details, underwriters can make informed decisions about coverage and pricing. So, what is financial underwriting in insurance, and why is it so important? Let’s explore further.

What is Financial Underwriting in Insurance?

Financial underwriting is a crucial process in the insurance industry that plays a significant role in determining the risk profile and premium rates for insurance policies. It involves the assessment of an individual or entity’s financial status, income, assets, and liabilities to determine their insurability and the appropriate coverage options. Specifically, financial underwriters analyze financial information provided by applicants and make informed decisions about their eligibility for insurance coverage.

Why Financial Underwriting is Important

Financial underwriting is essential for insurance companies in effectively managing risk and ensuring the financial stability of their operations. By carefully evaluating an applicant’s financial standing, underwriters can determine the likelihood of claims and losses, as well as the potential impact on the insurer’s financial health. This evaluation helps insurance providers set appropriate premium rates, coverage limits, and terms to align with the risk profile of applicants.

The Role of Financial Underwriters

Financial underwriters are highly skilled professionals responsible for assessing the financial information provided by insurance applicants. They play a critical role in the underwriting process, which involves gathering and analyzing data to evaluate the potential risks associated with a policy.

Here are some key tasks performed by financial underwriters:

- Evaluating Financial Statements: Underwriters review financial statements such as income statements, balance sheets, and cash flow statements to assess an applicant’s financial stability. This helps determine their ability to meet financial obligations and the overall risk they represent.

- Assessing Creditworthiness: Underwriters analyze credit reports and credit scores to assess an applicant’s reliability in meeting financial obligations. A good credit history often indicates responsible financial behavior, which may result in more favorable insurance terms.

- Analyzing Debt-to-Income Ratio: Underwriters examine an applicant’s debt-to-income ratio to gauge their financial capacity to handle insurance premiums and potential claims. This ratio compares an individual’s debt obligations against their income and helps underwriters determine their financial strain.

- Reviewing Assets and Liabilities: Underwriters closely examine an applicant’s assets and liabilities, including investments, properties, and outstanding debts. This information provides insight into an individual’s financial net worth and overall financial health.

- Considering Industry-specific Factors: In some cases, underwriters evaluate industry-specific factors that may impact an applicant’s financial stability. For example, for businesses, underwriters may consider factors such as industry trends, market conditions, and business risk profiles.

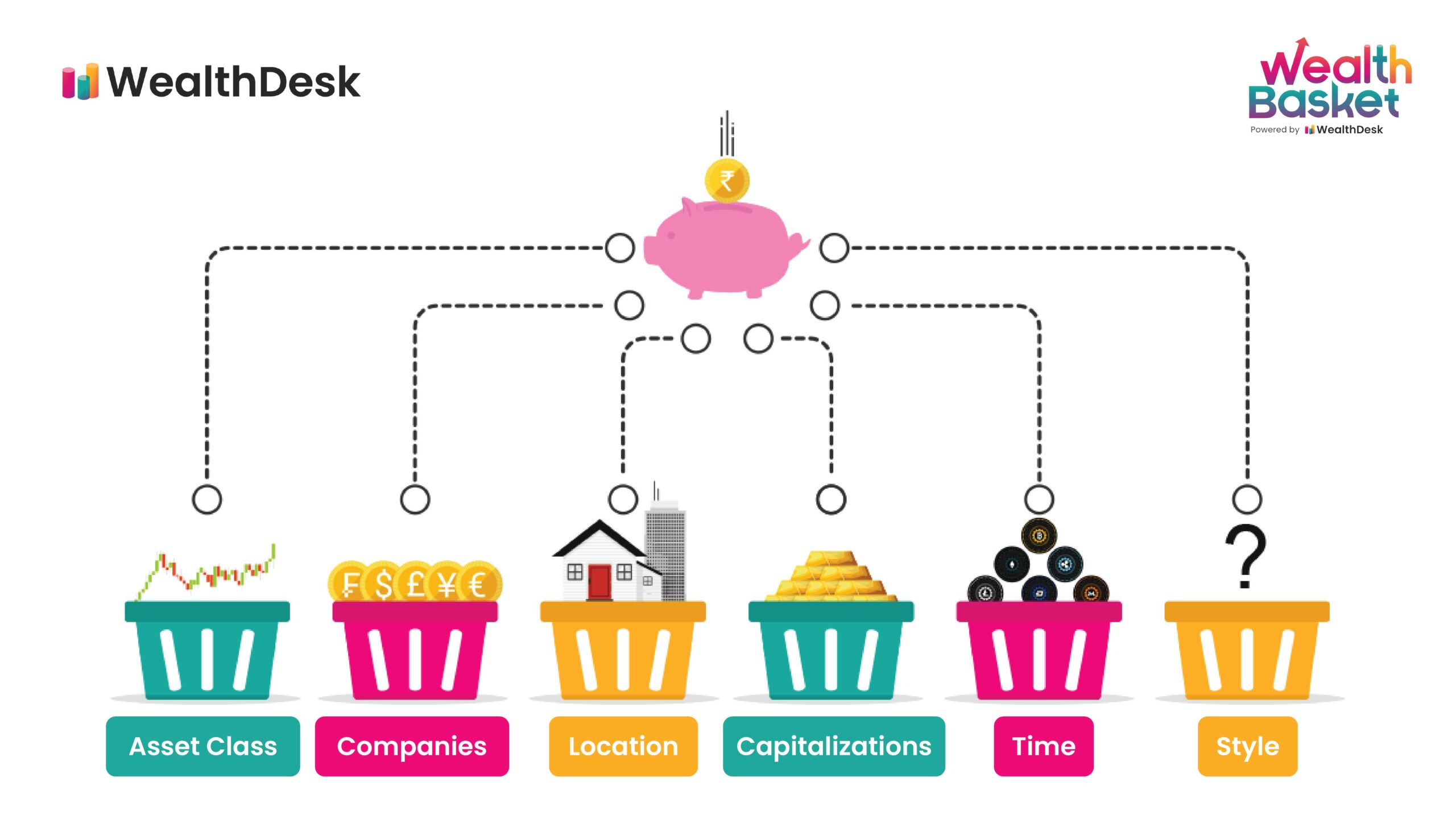

Factors Considered in Financial Underwriting

Financial underwriters assess a range of factors to evaluate the financial standing and risk profile of insurance applicants. These factors may include:

- Income and Employment Stability: Underwriters consider an applicant’s income stability by examining employment history, salary, and job security. Stable income indicates a higher ability to afford premiums and meet financial obligations.

- Debt Obligations: Underwriters examine an applicant’s existing debts, such as mortgages, loans, and credit card balances. The level of debt plays a role in determining disposable income and ability to repay debts.

- Financial History: Underwriters assess an applicant’s financial history, including bankruptcies, foreclosures, or previous insurance claims. Past financial difficulties may impact the underwriting decision.

- Industry and Occupation: For business insurance applicants, the underwriter may consider the industry and occupation to evaluate the potential risks associated with the business.

- Investments and Assets: Underwriters assess an applicant’s investment portfolio, real estate holdings, and other assets to determine their overall financial stability and ability to handle potential financial setbacks.

The Underwriting Process

Financial underwriting typically follows a structured process that involves several steps. While the exact process may vary among insurance companies, it generally includes the following:

1. Application and Documentation

The first step is for the applicant to complete an insurance application and submit the necessary documentation. This includes providing financial statements, tax returns, credit reports, and other relevant information as required by the underwriter.

2. Review and Analysis

The underwriter carefully reviews and analyzes the submitted documentation. They assess the financial information provided, verify its accuracy, and evaluate its impact on the applicant’s insurability and risk profile. This analysis helps determine the appropriate coverage and terms for the insurance policy.

3. Risk Assessment

Based on the information gathered, the underwriter assesses the level of risk associated with insuring the applicant. They consider various factors, such as the applicant’s financial stability, creditworthiness, and potential liabilities. This assessment helps determine the risk tolerance of the insurance company and the appropriate premium rates.

4. Decision-Making

After completing the analysis and risk assessment, the underwriter makes a decision regarding the applicant’s insurability and the terms of their policy. This decision may result in offering coverage with specific conditions, adjusting premium rates, or denying coverage altogether.

5. Policy Issuance

If the underwriter approves the application, they proceed with issuing the insurance policy. The policy outlines the coverage, premium rates, deductibles, and any additional terms and conditions.

The Benefits of Financial Underwriting

Financial underwriting offers various benefits for both insurance companies and policyholders. Let’s explore some of these advantages:

- Risk Mitigation: Through financial underwriting, insurance companies can evaluate the risks associated with potential policyholders. This helps them set appropriate premium rates, implement risk management strategies, and maintain their financial stability.

- Fair and Customized Pricing: Financial underwriting allows insurers to set premium rates based on an individual’s risk profile. This ensures that policyholders pay a fair price that reflects their unique circumstances and risk exposure.

- Accurate Coverage: By assessing an individual’s financial status, underwriters can determine suitable coverage limits and terms. This ensures that the policyholder is adequately protected without being over or underinsured.

- Financial Stability: For insurance companies, financial underwriting plays a crucial role in maintaining their financial stability. By effectively managing risk and setting appropriate premiums, insurers can ensure their ability to pay out claims and sustain their operations.

- Reduced Fraud: Thorough financial underwriting helps identify potential cases of insurance fraud. By scrutinizing an applicant’s financial information, underwriters can detect inconsistencies or misrepresentations, thereby reducing fraudulent claims.

In conclusion, financial underwriting in insurance is an integral part of the underwriting process. It involves assessing an applicant’s financial status, income, assets, and liabilities to evaluate their insurability and determine appropriate coverage and premium rates. By conducting thorough financial analysis, underwriters help insurance companies manage risk and maintain their financial stability. This process benefits both insurers and policyholders by ensuring fair pricing, accurate coverage, and overall risk mitigation.

What Is FINANCIAL Underwriting? | Financial Fridays #8

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is financial underwriting in insurance?

Financial underwriting in insurance refers to the process of evaluating an individual or organization’s financial situation to determine their insurability and appropriate coverage. It involves assessing factors such as income, assets, debts, credit history, and financial stability to calculate the risk involved in providing insurance coverage.

How does financial underwriting work?

During financial underwriting, insurance companies review the applicant’s financial records and relevant documents to assess their financial health. This includes examining income statements, tax returns, credit reports, bank statements, and other financial documentation. By analyzing this information, insurers can determine the applicant’s ability to pay premiums and whether they have any outstanding debts that may impact their ability to fulfill financial obligations.

What factors are considered during financial underwriting?

Several factors are taken into account during financial underwriting. These typically include the applicant’s income level, stability of income, existing debts, credit history, savings, investments, and overall financial responsibilities. These factors help insurers assess the applicant’s financial capacity to pay premiums and deal with any potential risks associated with the insurance coverage.

Why is financial underwriting necessary in insurance?

Financial underwriting is crucial in insurance to ensure that policyholders can meet their financial obligations towards the insurance contract. It helps insurance companies assess the risk profile of applicants and determine their insurability. By evaluating an individual or organization’s financial capacity, insurers can set appropriate premiums and coverage limits, safeguarding their own financial well-being and ensuring the policyholders’ ability to fulfill contractual obligations.

Can financial underwriting affect insurance premiums?

Yes, financial underwriting can influence insurance premiums. Insurance companies consider an applicant’s financial situation to evaluate risk. If an applicant’s financial records reveal a higher risk profile—for example, substantial debt or unstable income—they may be considered a greater liability, resulting in higher premiums. Conversely, a strong financial position and responsible financial behavior may lead to more favorable premium rates.

How is financial underwriting different from medical underwriting?

Financial underwriting primarily focuses on evaluating an applicant’s financial situation and capacity to meet premium obligations. On the other hand, medical underwriting primarily assesses an applicant’s health condition, medical history, and potential risks associated with pre-existing medical conditions. While both underwriting processes evaluate different aspects, they both play a crucial role in assessing an individual’s overall insurability.

Is financial underwriting applicable to all types of insurance?

Yes, financial underwriting is applicable to many types of insurance, including life insurance, disability insurance, long-term care insurance, and certain business insurance policies. In these cases, evaluating the financial capacity and stability of the applicant is essential for insurance companies to determine the risk involved and set appropriate premiums and coverage limits.

What happens if an applicant fails financial underwriting?

If an applicant fails financial underwriting, it means that their financial situation does not meet the insurance company’s criteria for coverage. This can result in insurance companies either denying the application or offering coverage with higher premiums or certain exclusions to mitigate the perceived risk. In some cases, applicants may have the option to provide additional information or address any concerns raised during the underwriting process to potentially improve their chances of obtaining coverage.

Final Thoughts

Financial underwriting in insurance is a critical process that assesses and evaluates the financial risk of potential policyholders. It involves analyzing various financial factors such as income, credit history, debts, and assets to determine the individual’s ability to pay premiums and meet future obligations. By conducting a thorough financial underwriting, insurance companies can mitigate the risk of insuring individuals who may be financially unstable. This assessment allows insurers to set appropriate premiums and ensure their financial stability. Overall, financial underwriting in insurance is a vital practice that helps safeguard the financial well-being of both policyholders and insurance providers.