Struggling with student loans after graduation? Wondering how to manage them effectively? You’re not alone. Many recent graduates find themselves overwhelmed by the burden of student loan debt, unsure of where to start or how to navigate the repayment process. But fear not, because in this article, I will guide you through the essential steps on how to manage student loans after graduation. From creating a repayment plan to exploring potential consolidation options, we will explore practical strategies to help you take control of your financial future. So, let’s dive in and uncover the secrets to successfully managing your student loans!

How to Manage Student Loans After Graduation

Introduction

After years of hard work and dedication, you have finally graduated from college. Congratulations! However, along with the joy of this milestone comes the reality of managing your student loans. It’s essential to have a clear plan on how to handle your student loans after graduation to avoid financial stress in the future. This comprehensive guide will provide you with valuable insights, tips, and strategies to effectively manage your student loans, set yourself up for success, and achieve financial stability.

Understanding Your Student Loans

Before diving into how to manage your student loans, it’s crucial to understand the different types of student loans and the terms associated with them. Here are the key points to consider:

1. Federal Student Loans

- Direct Subsidized Loans: These loans are based on financial need, and the interest is paid by the government while you are in school.

- Direct Unsubsidized Loans: These loans do not require financial need, and you are responsible for the interest that accrues during all periods.

- PLUS Loans: These loans are available to graduate or professional students and parents of dependent undergraduate students. They require a credit check.

2. Private Student Loans

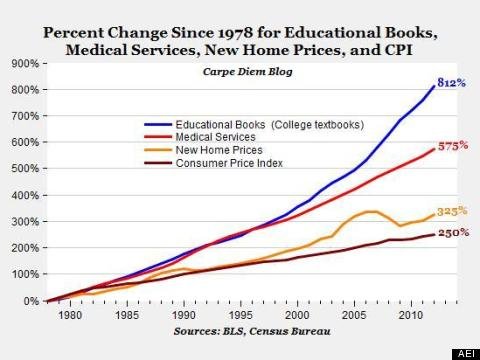

- Private student loans are offered by banks, credit unions, or online lenders. Interest rates and terms vary based on your credit history and other factors.

- Private loans often have higher interest rates compared to federal loans and may require a co-signer.

3. Loan Terms and Conditions

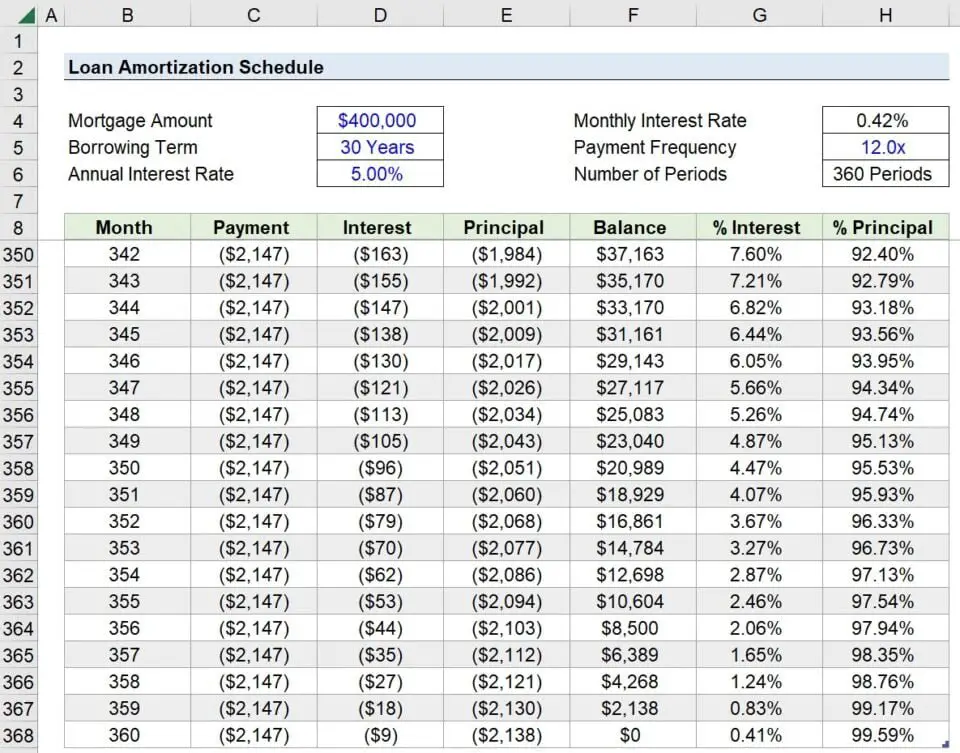

- Loan Principal: The original amount of money borrowed.

- Interest Rate: The percentage of the loan amount charged as interest.

- Loan Repayment Period: The timeframe in which you need to repay the loan.

- Grace Period: A period of time after graduation during which you are not required to make loan payments.

- Loan Servicer: The company responsible for collecting loan payments and managing the loan account.

- Repayment Plans: Various options for structuring your loan payments, such as standard, extended, income-driven, or graduated plans.

Create a Repayment Strategy

Now that you have a solid understanding of your student loans, it’s time to create a repayment strategy. Here are some steps to help you get started:

1. Determine Your Loan Repayment Goals

Before deciding on a repayment strategy, assess your financial situation and consider what you want to achieve in the long run. Ask yourself the following questions:

- Do you want to pay off your loans as quickly as possible?

- Are you looking for ways to minimize monthly payments?

- Do you qualify for loan forgiveness programs?

Understanding your goals will guide you in choosing the most suitable repayment strategy.

2. Review Your Repayment Options

Federal student loans offer several repayment options to accommodate different financial circumstances. Familiarize yourself with the following plans:

- Standard Repayment Plan: Fixed monthly payments over a 10-year period.

- Extended Repayment Plan: Fixed or graduated monthly payments over a 25-year period.

- Income-Driven Repayment Plans: Monthly payments based on your income and family size.

- Graduated Repayment Plan: Payments start low and increase every two years over a 10-year period.

3. Calculate Your Loan Payments

Use an online loan calculator or consult your loan servicer to determine your monthly payment amount under each repayment plan. Compare the options to see which one aligns with your financial goals and abilities.

4. Consider Loan Forgiveness Programs

If you work in public service or certain other eligible professions, you may qualify for loan forgiveness programs. These programs can significantly reduce or eliminate your remaining loan balance after a specified period of time.

Managing Student Loan Payments

Once you have chosen a repayment plan, you need to develop strategies to effectively manage your student loan payments. Here are some practical tips to help you stay on track:

1. Set Up Automatic Payments

Consider setting up automatic payments with your loan servicer. By doing so, you ensure that you never miss a payment, avoid late fees, and may even qualify for interest rate reductions.

2. Create a Budget

Developing a budget is essential for managing your finances and ensuring you have enough money to cover your loan payments. Track your income and expenses, and prioritize your loan payments within your budget.

3. Reduce Other Expenses

Identify areas where you can cut back on expenses to free up more money for your loan payments. This could involve minimizing discretionary spending, finding cheaper alternatives for certain purchases, or negotiating lower bills.

4. Increase Your Income

Consider ways to boost your income to put more towards your loan payments. This could involve taking on a part-time job, freelancing, or leveraging your skills to earn additional income.

5. Avoid Defaulting on Your Loans

Defaulting on your student loans can have severe consequences, including damage to your credit score and the possibility of wage garnishment. It’s crucial to prioritize your loan payments and explore options if you’re facing financial hardship.

Repayment Assistance and Loan Consolidation

If you find yourself struggling to meet your monthly loan payments, there are options available to alleviate the financial burden. Here are a few potential solutions:

1. Loan Deferment or Forbearance

If you’re experiencing temporary financial hardship, you may qualify for loan deferment or forbearance. These options allow you to temporarily pause or reduce your loan payments without going into default.

2. Loan Consolidation

Consolidating your loans can simplify your repayment process by combining multiple loans into a single loan with one monthly payment. However, it’s crucial to weigh the pros and cons, as consolidation may affect your interest rate and repayment terms.

3. Explore Loan Forgiveness Programs

Look into loan forgiveness programs specific to your field or occupation. Public Service Loan Forgiveness (PSLF) is a well-known program that forgives the remaining loan balance after making 120 qualifying payments while working full-time for a qualifying employer.

Successfully managing your student loans after graduation requires careful planning, understanding your options, and implementing sound financial strategies. By taking the time to evaluate your loan terms, create a repayment strategy, and optimize your budget, you can navigate the post-graduation phase with confidence and work towards achieving long-term financial stability. Remember, staying informed, proactive, and disciplined will help you conquer your student loan debt and pave the way for a bright financial future.

What Everyone's Getting Wrong About Student Loans

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I manage my student loans after graduation?

After graduating, managing your student loans is important to ensure a smooth repayment journey. Here are some steps you can take:

What are the first steps in managing my student loans after graduation?

The first steps to manage your student loans after graduation include:

Can I consolidate my student loans after graduation?

Yes, you can consolidate your student loans after graduation. Consolidation involves combining multiple loans into one, making it easier to manage repayments.

What are some options for reducing my monthly student loan payments?

To reduce your monthly student loan payments, you can consider the following options:

Are there any forgiveness programs available for student loan borrowers after graduation?

Yes, there are forgiveness programs available for student loan borrowers after graduation. These programs can help alleviate the burden of student loan debt under certain conditions.

How can I pay off my student loans faster after graduation?

If you want to pay off your student loans faster after graduation, consider the following strategies:

What happens if I am unable to make my student loan payments after graduation?

If you can’t make your student loan payments after graduation, it’s crucial to take action immediately. Here are some steps you can take:

Should I prioritize paying off my student loans or saving for other financial goals?

The prioritization of paying off student loans versus saving for other financial goals depends on your specific situation. Consider the following factors:

Final Thoughts

Managing student loans after graduation can be a daunting task, but with proper planning and organization, it is achievable. Firstly, create a budget to track expenses and prioritize loan payments. Explore repayment options such as income-driven plans or loan forgiveness programs that might be applicable to your situation. It is essential to stay updated on loan details and never miss a payment. Consider refinancing options to potentially lower interest rates. Lastly, always seek guidance from financial advisors or resources to ensure you are making informed decisions and effectively managing your student loans after graduation.