Managing money as a full-time freelancer can be challenging, but don’t worry, we’ve got you covered. In this article, we’ll walk you through some practical tips on how to effectively manage your finances as a freelancer. From budgeting and tracking expenses to setting aside funds for taxes and emergencies, we’ll help you navigate the financial aspects of freelancing smoothly. So, if you’re wondering how to manage money as a full-time freelancer, keep reading for some valuable insights and actionable strategies that will empower you to take control of your financial well-being.

How to Manage Money as a Full-Time Freelancer

Being a full-time freelancer offers great flexibility and the ability to be your own boss. However, it also comes with the responsibility of managing your finances effectively. Unlike a traditional job, freelancers have irregular income and must handle their own taxes and expenses. To ensure financial stability and success in your freelancing career, it is crucial to develop good money management habits. In this article, we will explore various aspects of managing money as a full-time freelancer, including budgeting, pricing your services, tracking income and expenses, saving for taxes, and setting financial goals.

1. Create a Detailed Budget

One of the first steps to effectively managing your money as a full-time freelancer is creating a detailed budget. Having a clear understanding of your income and expenses will help you make informed decisions and allocate your funds wisely. Here’s how you can create a comprehensive budget:

- Track your expenses: Begin by recording all your monthly expenses, including rent or mortgage payments, utilities, transportation, groceries, health insurance, and any other recurring bills. Don’t forget to account for occasional or one-time expenses, such as professional development courses or equipment upgrades.

- Calculate your income: Estimate your monthly income based on your current clients and projects. Take into consideration the potential fluctuations in your earnings due to seasonal changes or project delays.

- Set financial goals: Determine your short-term and long-term financial goals, such as saving for emergencies, paying off debt, or investing for the future. Assign a specific amount to allocate towards each goal.

- Allocate your income: With your expenses and goals in mind, allocate your income accordingly. Make sure to set aside funds for taxes, retirement savings, and a contingency fund for unexpected expenses.

Having a detailed budget will provide you with a clear picture of your financial health and help you make informed decisions about your spending and savings.

2. Price Your Services Strategically

Setting the right prices for your freelance services is essential for maintaining a sustainable income and profitability. Here are some key factors to consider when pricing your services:

- Research the market: Get to know the industry standards and rates for similar services in your area. Consider factors like your experience, expertise, and the value you bring to clients.

- Consider your expenses: Take into account your business expenses, including software subscriptions, marketing costs, self-employment taxes, and overhead expenses. Ensure that your pricing covers these expenses and leaves room for profit.

- Factor in your desired income: Determine the income you want to achieve and calculate how much you need to earn per project or hour to reach that goal. Remember to account for potential downtime or unbillable hours.

- Value-based pricing: Consider using a value-based pricing strategy where you charge based on the unique value you provide to your clients. Focus on the outcomes and results you can deliver rather than simply charging based on your time or effort.

- Offer different pricing options: Provide clients with different packages or pricing tiers that align with their needs and budgets. This can help attract a wider range of clients and increase your overall revenue.

Finding the right balance between competitive pricing and fair compensation for your expertise is key to maintaining a healthy financial foundation as a freelancer.

3. Track Income and Expenses Regularly

As a freelancer, it is crucial to maintain accurate records of your income and expenses. Regularly tracking your financial transactions will make tax season less daunting and provide valuable insights into the financial health of your business. Here are some tips to help you stay organized:

- Use accounting software: Consider using accounting software or online tools specifically designed for freelancers to streamline your financial tracking. These tools can automate tasks like invoicing, expense categorization, and generating financial reports.

- Separate business and personal finances: Open a separate bank account and credit card dedicated solely to your freelance business. This separation will make it easier to track your business expenses and maintain clean financial records.

- Keep digital copies of invoices and receipts: Digitize your invoices and receipts to avoid losing important documentation. Store them securely in the cloud or a dedicated folder on your computer for easy access and reference.

- Regularly reconcile your accounts: Reconcile your bank statements and credit card statements with your accounting records to ensure accuracy. This process will help identify any discrepancies and enable you to correct them promptly.

- Review your financial reports: Take the time to review your profit and loss statements, balance sheets, and cash flow reports. These reports will give you a comprehensive overview of your business’s financial performance and help you make informed decisions.

By consistently tracking your income and expenses, you will have a clear understanding of your cash flow, be better prepared for tax obligations, and make smarter financial decisions.

4. Save for Taxes

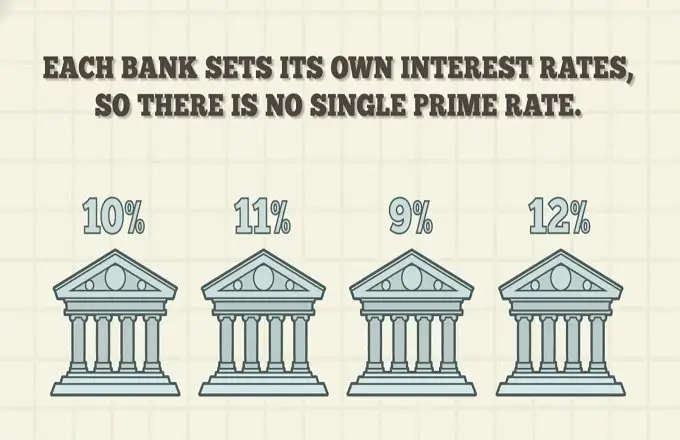

Unlike traditional employees, freelancers are responsible for paying their own taxes. It’s important to set aside a portion of your income throughout the year to cover your tax obligations. Here are some tips for effectively saving for taxes:

- Estimate your tax liability: Consult with a tax professional or use online tax calculators to estimate your tax liability based on your projected income. This will help you determine the percentage or amount you should set aside.

- Create a separate tax savings account: Open a separate savings account dedicated to saving for taxes. Transfer a portion of your income into this account regularly, preferably after each payment you receive.

- Automate your tax savings: Set up automatic transfers from your main business account to your tax savings account. This ensures that you consistently save for taxes and reduces the temptation to spend those funds.

- Adjust savings based on tax brackets: As your income increases, be mindful of potential changes in tax brackets. Adjust your tax savings accordingly to ensure you are setting aside an appropriate amount.

- Stay informed about tax deductions: Familiarize yourself with tax deductions and credits available to freelancers. Properly documenting and deducting eligible business expenses can help lower your overall tax burden.

By saving for taxes throughout the year, you will avoid unnecessary stress and ensure that you have enough funds to meet your tax obligations when the time comes.

5. Set Financial Goals and Milestones

Having clear financial goals and milestones is essential for staying motivated and focused. They provide direction and help measure your progress. Here’s how you can set financial goals as a full-time freelancer:

- Long-term goals: Identify long-term financial aspirations, such as saving for retirement, buying a house, or achieving a specific level of income. Break these goals down into smaller, actionable steps.

- Short-term goals: Set short-term goals that are achievable within a few months or a year. Examples could include paying off a credit card balance, increasing your emergency fund, or investing in professional development.

- SMART goals: Use the SMART goal framework, which stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework ensures that your goals are well-defined and actionable.

- Track your progress: Regularly review and track your progress towards your financial goals. This will help you stay accountable and make any necessary adjustments along the way.

- Celebrate milestones: When you achieve a financial milestone or reach a goal, take the time to celebrate your accomplishments. Rewarding yourself will motivate you to continue striving for success.

Setting financial goals and having a roadmap to achieve them will give you a sense of purpose and direction in your freelancing career. It will also help ensure that you are making progress towards your desired financial outcomes.

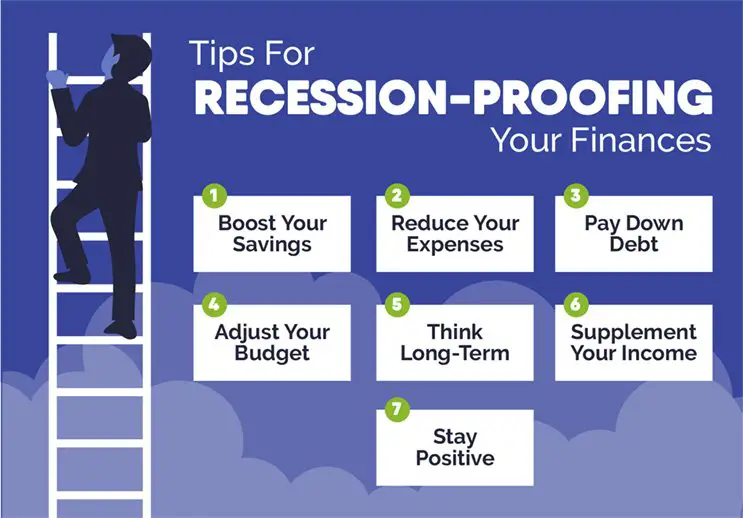

Managing money as a full-time freelancer requires discipline, organization, and a proactive approach. By creating a detailed budget, pricing your services strategically, tracking income and expenses regularly, saving for taxes, and setting financial goals, you can establish a solid foundation for financial success. Remember that managing your money effectively is an ongoing process that requires continuous monitoring and adjustment. With the right mindset and financial practices, you can achieve financial stability and thrive in your freelancing career.

How I manage my time with full time job, freelance & side hustles ☕️

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I manage money effectively as a full-time freelancer?

To manage money effectively as a full-time freelancer, follow these tips:

- Create a budget: Track your income and expenses to understand where your money is going.

- Set financial goals: Establish short-term and long-term goals such as saving for emergencies or retirement.

- Separate business and personal finances: Open a separate bank account for your freelance income and expenses.

- Save for taxes: Set aside a portion of your earnings to cover taxes and avoid surprises at tax time.

- Invoice promptly: Send out invoices as soon as you complete a project to ensure timely payment.

- Manage cash flow: Plan for irregular income by building an emergency fund and setting up a consistent invoicing and payment system.

- Monitor expenses: Keep track of your business-related expenses and take advantage of deductions when filing taxes.

- Invest in your financial education: Learn about personal finance, budgeting, and investing to make informed decisions about your money.

How should I handle irregular income as a full-time freelancer?

Dealing with irregular income as a full-time freelancer requires careful planning and budgeting. Here’s how:

- Create a budget based on your average monthly income.

- Build an emergency fund to cover expenses during low-income months.

- Monitor your cash flow closely and adjust your spending accordingly.

- Diversify your client base to reduce reliance on a single source of income.

- Consider taking on part-time work to supplement your freelance income during slower periods.

What are some effective strategies for saving money as a full-time freelancer?

Here are some strategies to save money as a full-time freelancer:

- Automate your savings by setting up recurring transfers to a separate savings account.

- Take advantage of business expense deductions when filing taxes.

- Shop around for the best deals on essential business services and supplies.

- Minimize non-essential expenses and prioritize your spending.

- Consider joining a freelancer’s association or professional networking group to access discounts and resources.

How can I effectively handle taxes as a full-time freelancer?

To handle taxes effectively as a full-time freelancer, follow these guidelines:

- Keep track of your income and expenses throughout the year.

- Set aside a portion of your earnings for tax payments.

- Consult with a tax professional or use tax software to ensure you file correctly.

- Know which business expenses are deductible and keep proper documentation.

- Understand self-employment tax obligations and deadlines.

Should I consider hiring an accountant or bookkeeper as a full-time freelancer?

While hiring an accountant or bookkeeper is not mandatory, it can be beneficial for full-time freelancers. Here’s why:

- Professional expertise: Qualified accountants or bookkeepers can help you navigate complex tax laws, manage your finances efficiently, and provide valuable advice.

- Time-saving: Outsourcing bookkeeping or tax-related tasks frees up your time to focus on your core freelancing activities.

- Reduced errors: A professional can help minimize errors in bookkeeping, which can save you from costly mistakes.

What are the best practices for invoicing and getting paid as a full-time freelancer?

Follow these best practices to ensure smooth invoicing and timely payments:

- Use professional invoicing software or templates to create clear and detailed invoices.

- Include all necessary information, such as your contact details, payment terms, and a breakdown of services rendered.

- Send invoices promptly after completing a project or on agreed-upon dates.

- Follow up on outstanding payments politely but firmly, adhering to the agreed-upon payment terms.

- Consider offering multiple payment options, such as bank transfers or online payment platforms, to accommodate client preferences.

How can I plan for retirement as a full-time freelancer?

Planning for retirement as a full-time freelancer is crucial. Here’s what you can do:

- Set specific retirement goals and determine how much you need to save.

- Explore retirement account options such as Individual Retirement Accounts (IRAs) or Simplified Employee Pension (SEP) IRAs.

- Contribute regularly to your retirement accounts.

- Consider working with a financial advisor who specializes in retirement planning for freelancers.

- Stay informed about retirement saving strategies and keep track of changes in tax laws that may affect freelancers.

Final Thoughts

As a full-time freelancer, managing money effectively is key to achieving financial stability and success. Start by creating a budget that accounts for both your business and personal expenses. Track your income and expenses diligently to gain insights into your cash flow. Establish an emergency fund to prepare for unexpected expenses or dry spells. Consider setting up separate bank accounts for your business and personal finances to keep them organized. Prioritize saving for taxes by setting aside a portion of your earnings regularly. Finally, continuously evaluate and adjust your financial strategies as your freelance business grows and evolves. By implementing these practices, you’ll be well on your way to mastering how to manage money as a full-time freelancer.