Interest rate hikes can often be a cause of concern for many individuals and businesses. So, how can one navigate the potential risks associated with such hikes? Understanding the risk of interest rate hikes is crucial in managing finances effectively and ensuring stability. In this article, we delve into this topic, exploring the implications of interest rate hikes and offering solutions to mitigate the associated risks. Let’s embark on this journey to comprehend the intricacies and consequences of interest rate hikes, enabling us to make informed decisions and safeguard our financial well-being.

Understanding the Risk of Interest Rate Hikes

Interest rates play a crucial role in the economy, affecting everything from borrowing costs to investment decisions. As an investor or consumer, understanding the risks associated with interest rate hikes is essential for making informed financial choices. In this article, we’ll explore the impact of interest rate hikes and discuss strategies to mitigate the potential risks.

The Role of Central Banks in Setting Interest Rates

Before diving into the risks, it’s crucial to understand the role of central banks in setting interest rates. Central banks, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, have the authority to influence interest rates to achieve specific economic objectives.

Central banks use monetary policy tools, primarily adjusting the benchmark interest rate, to regulate the cost of borrowing in the economy. When the central bank raises interest rates, borrowing becomes more expensive, leading to a decrease in spending and investment, and potentially slowing down inflation.

The Impact of Interest Rate Hikes on Borrowers

1. Adjustable-Rate Mortgages and Loans

One of the most direct impacts of interest rate hikes is felt by borrowers with adjustable-rate mortgages (ARMs) or loans. These loans have interest rates that fluctuate based on a benchmark rate, often tied to the central bank’s interest rate.

When interest rates rise, borrowers with adjustable-rate mortgages or loans will experience an increase in their monthly payments. This can put a strain on household budgets, potentially leading to financial difficulties if the borrower is not adequately prepared.

2. Fixed-Rate Mortgages and Loans

While fixed-rate mortgages and loans are not directly affected by interest rate hikes, they can still be influenced indirectly. As the central bank raises interest rates, banks and lenders may adjust their rates for new loans. This means that borrowers seeking new financing may face higher interest rates, making it more expensive to borrow.

3. Credit Card Debt

Credit card debt is another area where interest rate hikes can have a significant impact. Most credit cards have variable interest rates tied to a benchmark rate, such as the prime rate. When interest rates rise, credit card interest rates tend to follow suit.

Higher interest rates on credit card debt mean higher monthly payments for consumers. If the cardholder carries a balance, the increased interest costs can quickly accumulate, leading to a more substantial debt burden.

The Impact of Interest Rate Hikes on Savers and Investors

While borrowers face challenges with higher interest rates, savers and investors can benefit from rising rates. Here’s a closer look at the potential impact on different types of investments:

1. Savings Accounts and Certificates of Deposit (CDs)

Higher interest rates generally lead to increased yields on savings accounts and CDs. Savers who have parked their money in these conservative financial products may see higher returns as a result of interest rate hikes. This can be particularly beneficial for those relying on fixed income or planning for retirement.

2. Bonds and Fixed-Income Investments

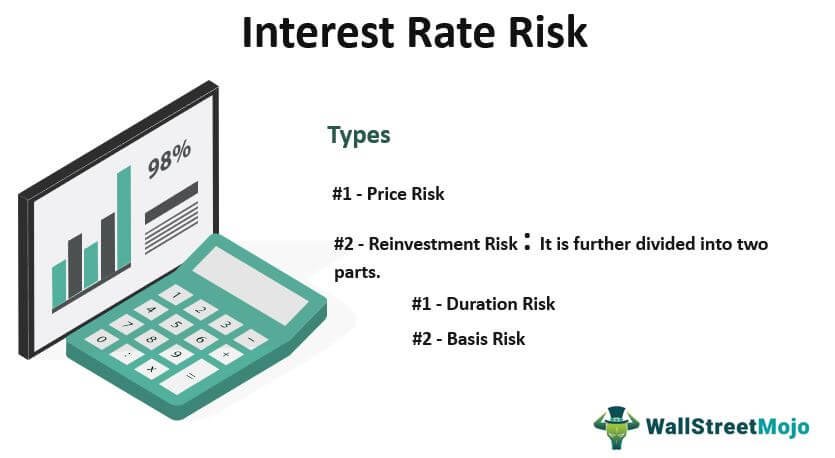

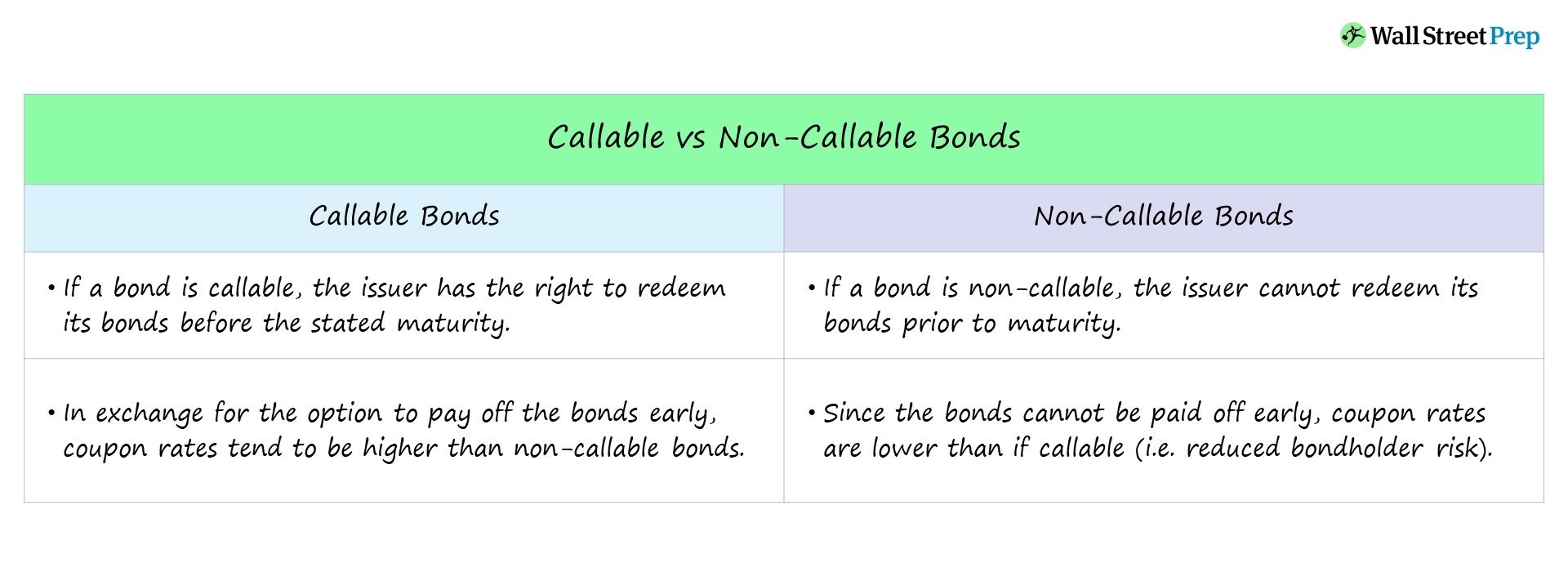

Bonds and other fixed-income investments are also influenced by interest rate changes. When rates rise, the value of existing bonds with lower interest rates tends to decline. This happens because newer bonds with higher interest rates become more attractive to investors.

Investors who hold individual bonds until maturity are not impacted by these price fluctuations, as they will receive the full face value of the bond regardless. However, those who sell their bonds before maturity may experience losses if they sell below the initial purchase price.

3. Stocks and Real Estate

Stocks and real estate are often considered riskier assets compared to conservative investments like bonds. While interest rate hikes can have some indirect impact on these investments, their performance is influenced by various other factors. Stocks, for example, are influenced by corporate earnings, economic growth, and investor sentiment.

Real estate, on the other hand, may experience changes in demand as borrowing costs increase. Higher mortgage rates can make it more challenging for buyers to afford homes, potentially leading to a cooling of the real estate market.

Strategies to Mitigate the Risks of Interest Rate Hikes

While interest rate hikes can pose risks, investors and consumers can take steps to mitigate their impact. Here are some strategies to consider:

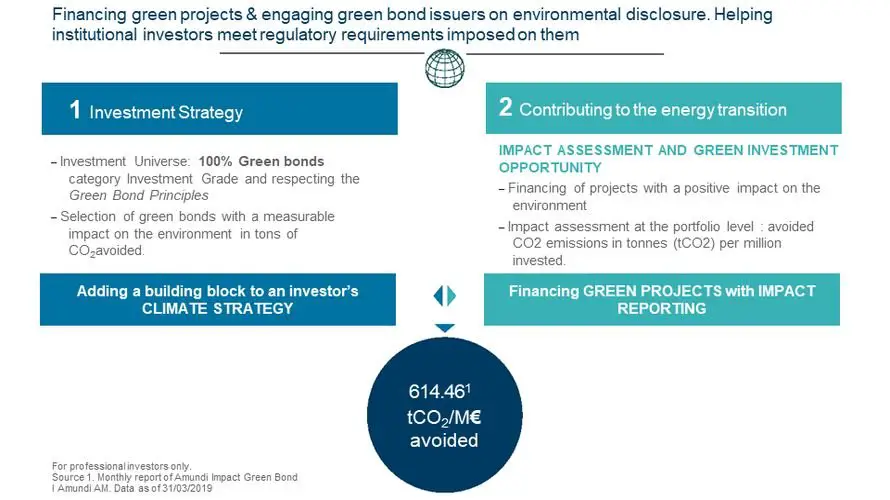

1. Diversify Your Investments

Diversification is often cited as a fundamental principle of investing. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce exposure to any single risk factor, including interest rate hikes.

2. Refinance Adjustable-Rate Loans

If you have adjustable-rate loans or mortgages, consider refinancing to a fixed-rate product when interest rates are low. This can help lock in a stable monthly payment, protecting you from potential future rate increases.

3. Pay Down High-Interest Debt

Paying down high-interest debt, such as credit card balances, can be a sound financial move regardless of interest rate hikes. By reducing your debt burden, you’ll have more financial flexibility and less exposure to rising interest costs.

4. Maintain an Emergency Fund

An emergency fund is a vital financial safety net. It provides a cushion in the event of unexpected expenses or income disruptions. Building and maintaining an emergency fund can help you navigate financial challenges during periods of economic uncertainty and interest rate hikes.

5. Stay Informed and Adjust Your Strategy

Keep an eye on economic indicators, news, and central bank communications to stay informed about potential interest rate changes. This awareness will allow you to make informed decisions and adjust your investment and borrowing strategies accordingly.

By understanding the risks associated with interest rate hikes and implementing appropriate strategies, you can navigate the changing economic landscape and protect your financial well-being.

Remember, financial decisions should be made based on your individual circumstances and goals. Consulting with a financial advisor is always a wise step in making informed choices tailored to your specific needs.

Recession outlook, interest rate hikes, plus risks and signs of a slowdown investors should consider

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the impact of interest rate hikes?

Interest rate hikes can have several impacts on the economy. They can make borrowing more expensive, which can reduce consumer spending and business investment. Additionally, higher interest rates can also attract foreign investors looking for better returns, potentially strengthening the currency.

How do interest rate hikes affect mortgage rates?

When interest rates rise, mortgage rates tend to increase as well. This means that borrowers will have to pay more in interest on their mortgage loans, potentially making homeownership less affordable and reducing demand for real estate.

What are the implications of interest rate hikes for bond investors?

Interest rate hikes can negatively impact the value of existing bonds. When rates rise, the yields on newly issued bonds become more attractive, which can lead to a decrease in demand for older bonds with lower yields. As a result, bond prices may decline.

What strategies can individuals adopt to mitigate the risk of interest rate hikes?

To mitigate the risk of interest rate hikes, individuals can consider refinancing their loans at fixed rates, diversifying their investments, or allocating a portion of their portfolio to assets that have historically performed well during periods of rising interest rates, such as inflation-protected securities or dividend-paying stocks.

How do interest rate hikes affect the stock market?

Interest rate hikes can impact the stock market in various ways. They can increase borrowing costs for businesses, potentially affecting their profitability and leading to lower stock prices. Higher interest rates may also make fixed-income investments, such as bonds, more attractive compared to stocks, leading to a shift in investor preferences and lower demand for equities.

What are the factors that influence the frequency of interest rate hikes?

The frequency of interest rate hikes is influenced by several factors, including the state of the economy, inflation rates, employment levels, and central bank policies. Central banks typically consider these factors when determining whether to raise interest rates and the pace at which they do so.

What are the potential risks associated with interest rate hikes?

Interest rate hikes can introduce various risks. For borrowers, higher interest rates can result in increased debt servicing costs, potentially leading to financial stress and default. Additionally, businesses may experience reduced profit margins due to higher borrowing costs. On the other hand, savers who rely on interest income may benefit from higher rates.

How do interest rate hikes impact exchange rates?

Interest rate hikes can influence exchange rates. When a country’s interest rates rise, its currency may appreciate as foreign investors seek higher returns on their investments. This can make exports more expensive and imports cheaper, potentially impacting a country’s trade balance.

Final Thoughts

Understanding the risk of interest rate hikes is crucial for individuals and businesses alike. With interest rates being a significant factor in various financial decisions, it is essential to comprehend the potential impact that rate hikes can have on borrowing costs, mortgage rates, and investment returns. By staying informed about the current economic climate and monitoring central bank actions, individuals can make well-informed decisions regarding their financial planning. It is also advisable to diversify investments and consider the potential consequences of rising interest rates on different asset classes. Overall, being proactive and knowledgeable about the risk of interest rate hikes can enable individuals to navigate changing economic conditions more effectively.