Are you looking to understand the benefits of index funds? Look no further! Index funds have become increasingly popular among investors for their simplicity and potential for solid returns. In this article, we will delve into the ins and outs of index funds, demystifying their advantages and how they can enhance your investment portfolio. From providing diversification to low costs and consistent performance, understanding the benefits of index funds can help you make informed and strategic investment decisions. So, let’s jump right in and unlock the potential of index funds!

Understanding the Benefits of Index Funds

When it comes to investing your hard-earned money, it’s essential to make informed decisions that align with your financial goals. One investment option that has gained significant popularity in recent years is index funds. In this article, we will delve into the world of index funds and explore their numerous benefits. Whether you are new to investing or a seasoned investor, understanding the advantages of index funds can help you make sound investment choices that can potentially lead to long-term financial success.

What are Index Funds?

Before we delve into the benefits, let’s clarify what index funds are. An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500 or the NASDAQ-100. These funds are designed to provide investors with broad market exposure, allowing them to own a diverse portfolio of stocks that represent the overall market.

Instead of relying on active fund managers to select individual stocks, index funds passively track the performance of an index by holding the same stocks in the same proportion as the index they aim to replicate. This passive approach eliminates the need for frequent buying and selling of stocks, making index funds a cost-effective and efficient investment option.

The Benefits of Index Funds

Now that we have a basic understanding of what index funds are, let’s explore their many benefits:

1. Diversification

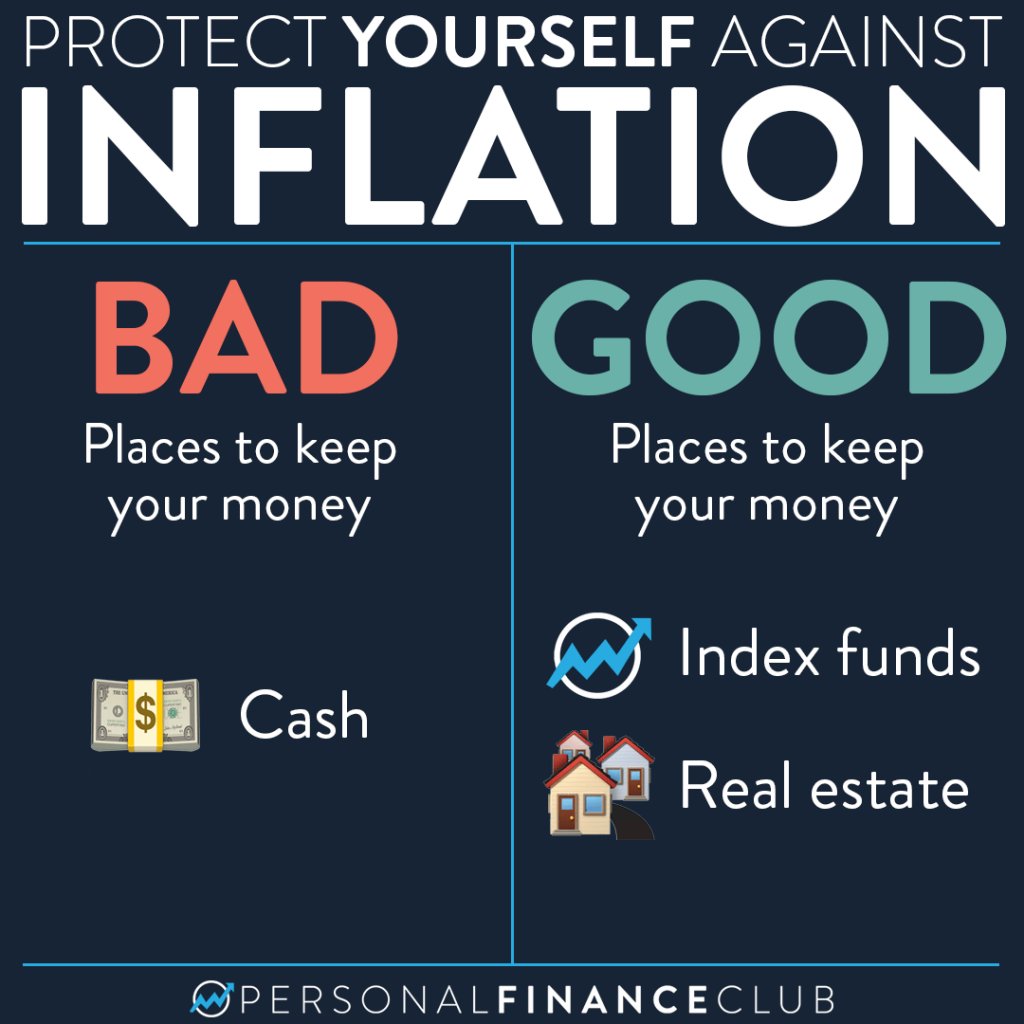

Diversification is a crucial aspect of investment. By spreading your investments across different asset classes and sectors, you can reduce the impact of any single investment’s performance on your overall portfolio. Index funds inherently provide diversification by holding a large number of stocks within a specific market index. This diversification helps mitigate risk, as the performance of one individual stock will have a limited impact on the overall fund.

- Index funds offer exposure to a wide range of companies, reducing reliance on the success or failure of a few individual stocks.

- Investing in index funds can help lower the risk associated with investing in individual stocks.

- Diversification through index funds can help investors achieve a more stable and consistent long-term investment performance.

2. Lower Costs

Costs play a crucial role in investment returns. Traditional actively managed funds often have higher expense ratios due to the fees associated with fund managers’ active trading strategies. In contrast, index funds follow a passive investment approach, which typically results in lower fees and expenses.

Here’s why index funds are more cost-effective:

- Index funds require minimal research and analysis, reducing overall management expenses.

- With no need for constant buying and selling of stocks, index funds have lower transaction costs.

- Lower expenses mean more of your investment returns stay in your pocket, potentially compounding over time.

3. Consistent Returns

While index funds aim to replicate the performance of a specific index, it’s important to understand that it may not always match it exactly. However, over the long term, index funds have demonstrated the ability to deliver consistent returns.

- By investing in a broad market index, index funds allow you to capture the overall performance of the market.

- While individual stocks can experience significant fluctuations, the collective performance of the index tends to be more stable over time.

- Consistent returns can help investors achieve their financial goals, whether it be saving for retirement or funding a child’s education.

4. Transparency

Transparency is a key advantage of index funds. As the composition of the underlying index is readily available, investors have full visibility into the stocks and sectors they are investing in. This transparency allows investors to make informed decisions based on their risk tolerance and investment objectives.

- Index funds disclose their holdings regularly, providing complete transparency to investors.

- Investors can assess the risk involved in an index fund by reviewing the stocks it holds and the diversification it offers.

- Transparency helps investors gain confidence in their investment choices, as they know exactly what they are investing in.

5. Tax Efficiency

Index funds are known for their tax efficiency, which can be an important consideration for investors. The passive management style of index funds leads to fewer taxable events compared to actively managed funds.

- Index funds have lower portfolio turnover, resulting in fewer capital gains distributions.

- This can lead to potential tax savings for investors, especially when held in taxable accounts.

- Lower tax implications can enhance overall investment returns and allow investors to keep a larger portion of their profits.

6. Accessibility

Another significant benefit of index funds is their accessibility. Investors of all experience levels and financial means can easily invest in index funds due to their low investment minimums and wide availability.

- Many index funds have low initial investment requirements, making them accessible to a broad range of investors.

- Investors can purchase index funds through brokerage accounts, retirement accounts, or even directly from fund providers.

- Accessibility ensures that more individuals can take advantage of the benefits of index funds and participate in the growth of the overall market.

Index funds offer numerous benefits that make them an attractive investment option for both novice and seasoned investors. Their diversification, lower costs, consistent returns, transparency, tax efficiency, and accessibility set them apart from other investment options. By understanding and harnessing the benefits of index funds, investors can build a well-rounded portfolio and work towards their financial goals with greater confidence and peace of mind.

Index Funds For Beginners: Your Guide For Passive Investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aim to mirror the performance of a specific market index, such as the S&P 500. These funds invest in a diversified portfolio of securities that represent the underlying index, providing investors with a broad exposure to the entire market or a specific segment.

How do index funds work?

Index funds work by passively tracking the performance of a specific market index. Instead of relying on active management decisions to select individual stocks, index funds hold a representative sample of stocks or other securities that make up the index. The fund’s value changes in proportion to the changes in the underlying index, giving investors a similar return.

What are the benefits of investing in index funds?

– Broad Market Exposure: Index funds provide investors with exposure to a wide range of stocks or securities, allowing them to diversify their investments and reduce the risk associated with individual stock picking.

– Lower Costs: Index funds typically have lower expense ratios compared to actively managed funds since they require less management and research. This can lead to higher net returns for investors.

– Consistent Performance: Index funds aim to replicate the performance of the underlying index, offering investors a predictable and stable investment option over the long term.

– Transparency: The holdings of index funds are usually publicly disclosed, allowing investors to see the securities they own and understand the composition of their portfolio.

Are index funds suitable for all investors?

While index funds can be a suitable investment option for many investors, they may not be appropriate for everyone. Investors with a higher risk tolerance and a longer investment horizon are often more inclined to invest in index funds. It is crucial for individuals to assess their own financial goals, risk appetite, and investment preferences before deciding to invest in any specific fund.

Can index funds outperform actively managed funds?

In general, index funds aim to match the performance of the underlying index rather than outperform it. While there may be periods where some actively managed funds outperform their respective indexes, numerous studies have shown that the majority of actively managed funds fail to consistently beat the market over the long term. Index funds offer a more passive and cost-effective approach to investing.

Do index funds pay dividends?

Yes, index funds can pay dividends. When the companies within the index pay dividends to their shareholders, index funds that hold those stocks pass on the dividends to their own investors in proportion to their holdings. Investors can choose to receive the dividends as cash or reinvest them back into the fund.

What is the minimum investment required for index funds?

The minimum investment required for index funds can vary depending on the fund provider. Some index funds have low minimum investment requirements, allowing investors to start with relatively small amounts. However, certain index funds may have higher minimums, particularly if they are institutional funds or have specific eligibility criteria.

How can I invest in index funds?

Investing in index funds is relatively straightforward. Investors can typically access index funds through brokerage accounts, mutual fund companies, or online platforms. The process usually involves opening an account, selecting the desired index fund(s), and investing the desired amount. It is advisable to conduct thorough research and consider factors such as expense ratios, historical performance, and fund provider reputation before making investment decisions.

Final Thoughts

Understanding the benefits of index funds is crucial for investors seeking a reliable and low-cost investment strategy. By passively tracking a specific market index, index funds offer diversification and broad market exposure. This approach minimizes the risk associated with individual stock picking and enables long-term growth potential. Additionally, index funds have historically outperformed actively managed funds due to their lower fees and consistent returns. Whether you’re a novice investor or experienced, index funds provide a simple and effective way to achieve your financial goals. So, consider investing in index funds to maximize your portfolio’s potential and secure your financial future.