Are you wondering what is a capital loss in investments? Simply put, a capital loss occurs when the value of an investment decreases compared to its original purchase price. It’s a common term in the financial world, but understanding the concept can be crucial for any investor. In this article, we will delve into what exactly a capital loss is, how it can affect your investments, and provide some insights on how to handle such situations. So, let’s dive in and demystify the world of capital losses in investments.

What is a Capital Loss in Investments?

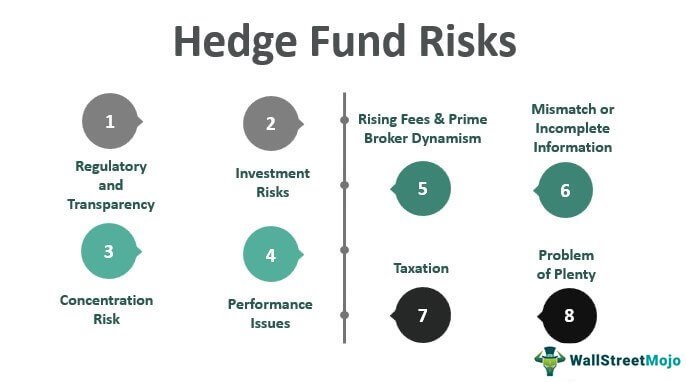

Investing in the financial markets can be a lucrative opportunity for individuals looking to grow their wealth. However, like any investment, there is always a level of risk involved. One of the risks that investors may encounter is the possibility of a capital loss.

A capital loss occurs when the value of an investment decreases compared to its original purchase price. It represents a decrease in the overall worth of an investment, and investors may experience financial losses as a result. Understanding the concept of capital losses is crucial for investors as it helps them make informed decisions about their investment portfolios.

How Capital Losses are Calculated

Calculating capital losses involves comparing the original purchase price of an investment with its current market value. The difference between these two values determines whether there has been a capital gain or loss. To calculate the capital loss, subtract the current market value from the purchase price.

For example, if an investor purchased a stock for $1,000 and its current market value is $800, the capital loss would be $200. This negative value indicates that the investment has decreased in value.

Tax Implications of Capital Losses

Capital losses can have both short-term and long-term tax implications. It is important to understand these implications as they can impact an investor’s overall tax liability.

Short-Term Capital Losses

Short-term capital losses occur when an investment is sold within a one-year period of its purchase date. The tax rules surrounding short-term capital losses differ from those of long-term capital losses.

In the United States, short-term capital losses can be used to offset short-term capital gains. If an individual has more short-term capital losses than gains, they can use the excess losses to offset other types of income, such as ordinary income. However, there are limitations on the amount of capital losses that can be deducted in a given tax year.

Long-Term Capital Losses

Long-term capital losses, on the other hand, apply to investments held for more than one year before being sold. These losses can be used to offset long-term capital gains. If an individual’s long-term capital losses exceed their long-term capital gains, they can use the excess losses to offset short-term capital gains.

The tax treatment of long-term capital losses is generally more favorable than that of short-term capital losses. In the United States, the maximum tax rate for long-term capital gains is typically lower than the tax rate for ordinary income. Therefore, utilizing long-term capital losses can potentially reduce an investor’s overall tax liability.

Strategies for Managing Capital Losses

While capital losses can have a negative impact on an investor’s portfolio, there are strategies one can employ to manage and potentially mitigate these losses. Here are some approaches to consider:

1. Tax Loss Harvesting

Tax loss harvesting is a strategy where investors intentionally sell investments at a loss to offset capital gains and potentially reduce their tax liability. By strategically selling investments that have experienced a decline in value, investors can use the capital losses to offset any capital gains they have realized during the same tax year.

It is important to note that tax loss harvesting should be done carefully, taking into consideration the wash-sale rule. The wash-sale rule prevents investors from claiming a capital loss if they repurchase a substantially identical investment within 30 days before or after the sale.

2. Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and geographic regions. By diversifying their portfolios, investors can reduce the impact of any single investment’s capital loss on their overall portfolio.

When one investment in a diversified portfolio experiences a capital loss, it may be offset by other investments that have performed well. This approach helps investors mitigate the potential impact of capital losses on their overall investment returns.

3. Stop-Loss Orders

A stop-loss order is a risk management tool that investors can utilize to automatically sell an investment if it reaches a predetermined price. This allows investors to protect themselves from further losses if the investment’s value continues to decrease.

Stop-loss orders can be particularly useful for investors who want to limit their potential capital losses while still participating in the market. By setting a stop-loss order at a specific price, investors can ensure that their investments are automatically sold if the price drops, thus minimizing potential losses.

4. Seek Professional Advice

Investing in the financial markets can be complex, and navigating the potential pitfalls of capital losses requires knowledge and expertise. Seeking advice from a financial advisor or investment professional can help investors make informed decisions and create a tailored investment strategy.

Financial advisors can provide insights into investment options, risk management strategies, and tax implications. Their expertise can be particularly valuable when it comes to managing capital losses and optimizing investment portfolios.

In conclusion, a capital loss in investments occurs when the value of an investment decreases compared to its original purchase price. Understanding capital losses and their implications is crucial for investors to make informed decisions about their portfolios. By employing strategies such as tax loss harvesting, diversification, stop-loss orders, and seeking professional advice, investors can manage and potentially mitigate the impact of capital losses on their overall investment returns.

Capital Losses and how they affect your taxes.

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a capital loss in investments?

A capital loss in investments refers to a financial loss incurred when the selling price of an investment is lower than its original purchase price. It occurs when the value of the investment decreases over time, resulting in a negative return.

How is a capital loss calculated?

To calculate a capital loss, subtract the sale price of the investment from its original purchase price. If the resulting amount is negative, it represents a capital loss. However, it is essential to consider any transaction fees or commissions when calculating the total loss.

Why do capital losses occur?

Capital losses can occur due to various factors, such as market fluctuations, economic conditions, company performance, or changes in investor sentiment. These factors can cause the value of an investment to decline, resulting in a capital loss.

Are capital losses permanent?

Capital losses are not necessarily permanent. While they represent a loss in the value of an investment, they can be used to offset capital gains. By offsetting capital gains with capital losses, investors can reduce their overall tax liability.

What is the impact of capital losses on taxes?

Capital losses can be used to offset capital gains when calculating taxable income. By subtracting capital losses from capital gains, investors can reduce their tax liability. If capital losses exceed capital gains, individuals may also be able to deduct the excess losses from their overall income tax.

Can capital losses be carried forward or backward?

Yes, capital losses can be carried forward or backward. If capital losses exceed capital gains in a given tax year, the excess losses can be carried forward to offset future capital gains. In some cases, losses can also be carried backward to offset capital gains from previous years, resulting in potential tax refunds.

Can capital losses be used to reduce taxes on other types of income?

Capital losses can only be used to offset capital gains, not other types of income, such as wages or interest. However, if a capital loss exceeds capital gains in a tax year, individuals may be able to deduct a portion of the excess losses from their overall income tax, subject to specific limitations.

How can investors offset capital losses?

Investors can offset capital losses by strategically balancing their portfolio. By diversifying investments, investors can minimize the impact of potential losses on their overall portfolio value. Additionally, they can use capital losses to offset capital gains and reduce their tax liability.

Final Thoughts

In conclusion, a capital loss in investments refers to the decrease in the value of an asset or investment compared to its original price. It occurs when the selling price is lower than the purchase price, leading to a financial loss for the investor. Capital losses can result from various factors such as market fluctuations, economic downturns, or poor investment decisions. Understanding capital losses is essential for investors to manage their portfolios effectively and make informed decisions. By learning from these losses, investors can refine their strategies and potentially mitigate future losses. With a clear understanding of what is a capital loss in investments, investors can take proactive steps to protect their investments and pursue long-term financial success.