Are you wondering how to create a retirement budget? Well, you’re in the right place! Planning for retirement can be a daunting task, but with a well-structured budget, you can gain peace of mind and enjoy your golden years to the fullest. In this article, we will guide you through the process of creating a retirement budget that suits your lifestyle and financial goals. So, let’s get started and take control of your financial future!

How to Create a Retirement Budget

Introduction

Planning for retirement is essential to ensure financial security during your golden years. One crucial aspect of retirement planning is creating a budget that allows you to maintain your desired lifestyle without depleting your savings. In this article, we will provide you with a comprehensive guide on how to create a retirement budget that fits your needs and goals. By following these steps, you can gain peace of mind and enjoy a financially stable retirement.

Assess Your Current Financial Situation

Before diving into the details of creating a retirement budget, it’s important to assess your current financial situation. This step will give you a clear picture of where you stand and help you determine your retirement goals. Consider the following:

- Calculate your net worth by subtracting your liabilities (debts) from your assets (savings, investments, and property).

- Take stock of your income sources, including salary, investments, social security, and any other potential sources.

- Take note of your monthly expenses, including housing, transportation, groceries, healthcare, entertainment, and any outstanding debts.

- Evaluate your current savings and investment accounts, considering the rate of return and growth potential.

Estimate Your Retirement Income

To create an accurate retirement budget, you need to estimate your retirement income. This step requires an understanding of your potential income sources during retirement:

Social Security Benefits

Social Security benefits are an integral part of retirement income for many individuals. To estimate your Social Security benefits, visit the official Social Security Administration website and use their online calculator. This will provide an estimate of the monthly benefit amount you can expect based on your earnings history and retirement age.

Pension Plans

If you have a pension plan through your employer, contact your plan administrator to obtain information about your expected pension benefits. Determine whether you will receive a fixed monthly amount or if there are options for lump-sum distributions.

Other Retirement Accounts

Take stock of your retirement accounts, such as 401(k)s, IRAs, or annuities. Familiarize yourself with the rules and regulations surrounding these accounts and consult with a financial advisor if needed. Evaluate the growth potential of these accounts and estimate the income they will generate during your retirement.

Calculate Your Retirement Expenses

Now that you have an idea of your retirement income, it’s time to calculate your expected expenses. Start by reviewing your current monthly expenses and consider any changes that might occur during retirement. Some key factors to consider include:

Healthcare Expenses

Healthcare costs tend to increase with age, so it’s crucial to budget for medical expenses during retirement. Consider health insurance premiums, prescription medications, regular check-ups, and potential long-term care expenses.

Housing Costs

Evaluate your housing situation and decide whether downsizing or relocating is a viable option. Take into account mortgage or rent payments, property taxes, homeowners’ association fees, and maintenance costs.

Transportation Expenses

Estimate transportation expenses such as vehicle maintenance, insurance, fuel costs, and potential public transportation fees. Consider whether you will need to purchase a new vehicle or rely on existing ones during retirement.

Living Expenses

Factor in everyday living expenses such as groceries, utilities, entertainment, and dining out. Keep in mind that your spending habits may change during retirement, so adjust these figures accordingly.

Create a Retirement Budget

Once you have a clear understanding of your retirement income and expenses, it’s time to create a retirement budget. Here are the steps to help you get started:

1. Set Your Retirement Goals

Define your retirement goals based on your desired lifestyle and financial capabilities. Determine if you want to travel frequently, pursue hobbies, or maintain a modest lifestyle. Your goals will shape your budget and guide your spending decisions.

2. Prioritize Your Expenses

Rank your expenses based on importance and necessity. Ensure that essential expenses such as housing, healthcare, and food are allocated first. Then, allocate funds for discretionary expenses such as travel or entertainment.

3. Consider Inflation

Take inflation into account when creating your retirement budget. Prices tend to rise over time, so it’s wise to factor in an inflation rate when estimating future expenses.

4. Budget for Unforeseen Expenses

Allocate a portion of your budget for unexpected expenses or emergencies. Having a financial safety net will provide peace of mind and protect your retirement savings.

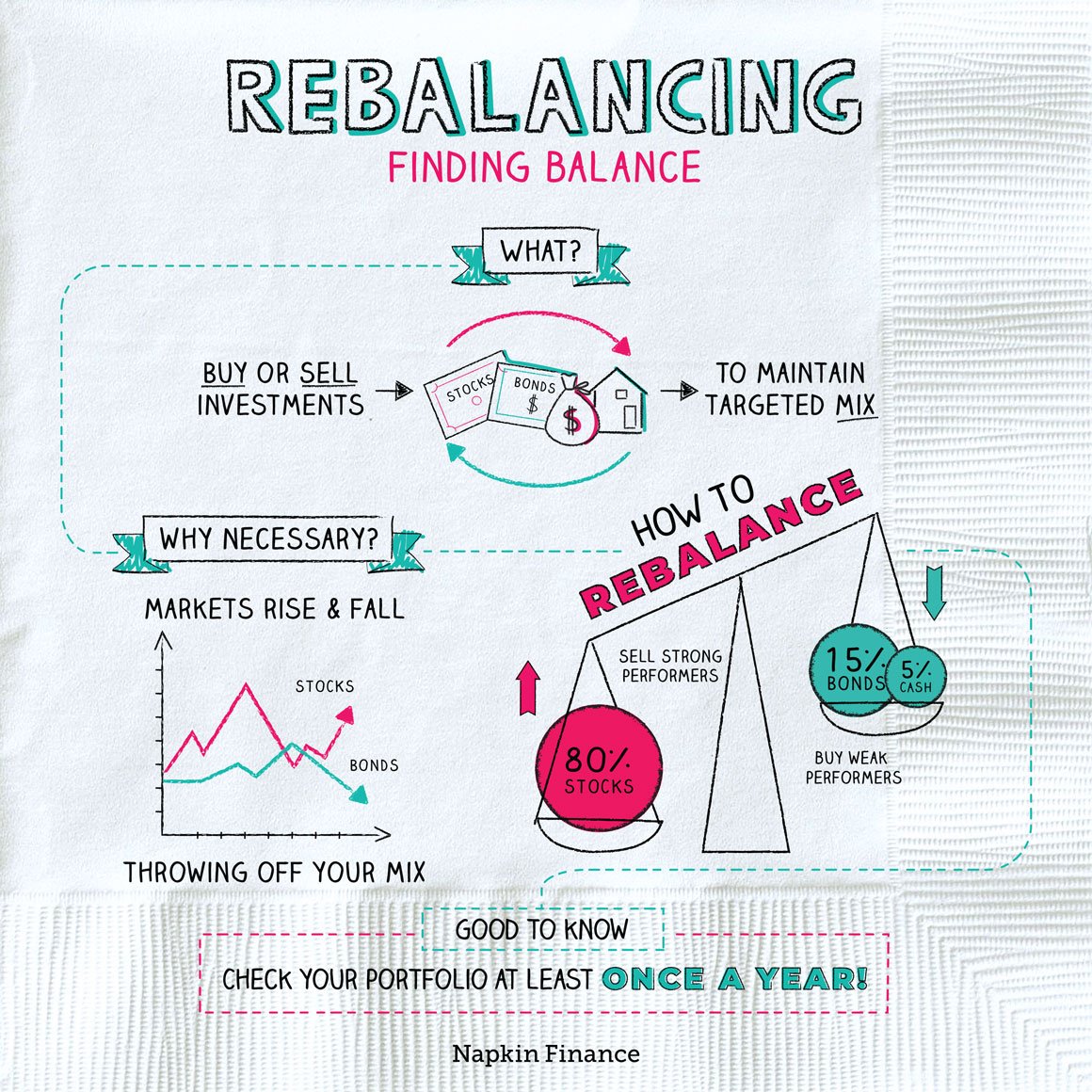

5. Review and Adjust Regularly

Regularly review and adjust your retirement budget based on changes in your financial situation or lifestyle. Monitor your expenses and income to ensure you remain on track towards your retirement goals.

Creating a retirement budget is a pivotal step in securing your financial future. By assessing your current financial situation, estimating your retirement income, calculating your expenses, and carefully crafting a retirement budget, you can take control of your finances and enjoy a comfortable retirement. Remember, seeking guidance from a financial advisor can provide valuable insights and help you make informed decisions. Plan ahead, stick to your budget, and embrace the exciting journey towards a financially secure retirement.

How To Create A Retirement Budget – Jason J. Hamilton, CFP®

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How do I create a retirement budget?

To create a retirement budget, start by calculating your expected post-retirement income, including pension, Social Security benefits, and any other income sources. Then, list all your expenses, including essential costs like housing, healthcare, and transportation, as well as discretionary expenses such as travel or hobbies. Analyze your expenses and adjust them based on your retirement goals and financial abilities.

2. What factors should I consider when creating a retirement budget?

When creating a retirement budget, consider factors such as your anticipated lifespan, healthcare costs, inflation, and potential changes in lifestyle. Also, evaluate any debts you may have and whether they will still be a factor during retirement. Assessing these factors will help ensure your budget adequately supports your post-retirement needs.

3. How can I estimate my post-retirement expenses accurately?

To estimate post-retirement expenses accurately, review your current spending habits. Determine which expenses will likely decrease or disappear after retirement, such as work-related costs. Take into account potential new expenses, like healthcare and leisure activities. Additionally, consider how inflation may affect the purchasing power of your income over time and adjust your budget accordingly.

4. Should I include emergency funds in my retirement budget?

Yes, it’s recommended to include emergency funds in your retirement budget. Unexpected expenses can arise, such as medical emergencies or home repairs, and having a safety net will help alleviate financial stress. Aim to set aside three to six months’ worth of living expenses as an emergency fund.

5. How often should I review my retirement budget?

It’s important to review your retirement budget regularly, especially during the first few years of retirement. Major life events or changes in circumstances, such as healthcare needs or financial fluctuations, may require adjustments to your budget. Aim to review your budget annually or whenever significant changes occur.

6. Is it necessary to consult a financial advisor when creating a retirement budget?

While consulting a financial advisor is not mandatory, it can be beneficial. Financial advisors have expertise in retirement planning and can provide guidance tailored to your specific situation. They can help you make informed decisions, ensure your budget aligns with your retirement goals, and offer insights on investment strategies to support your financial well-being.

7. What are some effective ways to reduce expenses in retirement?

To reduce expenses in retirement, consider downsizing your living arrangements, refinancing your mortgage, or relocating to an area with a lower cost of living. Furthermore, reevaluate discretionary spending and find ways to cut back without sacrificing your well-being. Shopping around for better deals, utilizing discounts and coupons, and prioritizing needs over wants can also contribute to expense reduction.

8. Can a retirement budget be modified after it’s created?

Yes, a retirement budget can and should be modified as needed. Your financial situation and personal circumstances may change over time, requiring adjustments to your budget. Flexibility is key, and regularly assessing and modifying your budget ensures it remains aligned with your evolving needs and goals.

Final Thoughts

Creating a retirement budget is essential for financial stability in your golden years. Start by evaluating your monthly income, including pensions, Social Security, and investments. Next, list your essential expenses, such as housing, healthcare, and basic needs. Consider discretionary expenses like travel and hobbies. Don’t forget to account for unexpected expenses and inflation. Prioritize savings and debt repayment, and adjust your budget as needed. Regularly review and track your expenses to ensure you stay on track. By following these steps, you can confidently create a retirement budget that supports your desired lifestyle while providing financial security.