Are you tired of being burdened by debt and longing for a life free from financial stress? Look no further! In this blog article, we will show you how to plan for a debt-free lifestyle. It’s not just about cutting back on spending or squeezing every penny; it’s about taking control of your finances and making choices that align with your goals. So, let’s dive in and explore practical steps you can take to achieve financial freedom and live a life free from the shackles of debt. Let’s get started on your journey to a debt-free future!

How to Plan for a Debt-Free Lifestyle

Living a debt-free lifestyle is a dream for many people. The burden of debt can weigh heavily on your finances, causing stress and limiting your ability to achieve financial freedom. However, with careful planning and determination, it is possible to become debt-free and take control of your financial future. In this article, we will explore step-by-step strategies to help you plan for a debt-free lifestyle.

1. Assess Your Current Financial Situation

Before you embark on your journey towards a debt-free life, it is essential to have a clear understanding of your current financial situation. This assessment will serve as a foundation for your debt-free plan. Here’s what you can do:

Gather Information

1. Make a list of all your debts, including credit cards, loans, and any other outstanding balances.

2. Note down the interest rates, minimum payments, and outstanding balances for each debt.

3. Collect information about your income, including salary, bonuses, and other sources of income.

4. Calculate your total monthly expenses, including rent/mortgage, utilities, groceries, transportation, and other necessary expenses.

Create a Budget

Once you have gathered all the necessary information, it’s time to create a budget. A budget acts as a roadmap for your financial journey, helping you understand your income, expenses, and potential areas for saving. Here’s how you can create an effective budget:

1. Track your expenses for a month to get an accurate picture of your spending habits.

2. Categorize your expenses into fixed (such as rent, utilities) and variable (like entertainment, dining out).

3. Identify areas where you can cut back on unnecessary expenses and redirect that money towards debt repayment.

4. Allocate a portion of your income towards savings and an emergency fund (to avoid relying on credit in the future).

2. Set Clear Financial Goals

Setting clear financial goals is crucial to stay motivated and focused on your journey to becoming debt-free. Your goals will act as a driving force to keep you on track. Here are a few tips to help you set effective goals:

Identify Short-Term and Long-Term Goals

1. Short-term goals: These are achievable in a relatively short period, typically within a year. Examples include paying off a specific debt or saving a certain amount of money.

2. Long-term goals: These are broader goals that may take several years or more to accomplish. Examples include buying a home, starting a business, or retiring comfortably.

Make Your Goals Specific, Measurable, Attainable, Relevant, and Time-Bound (SMART)

1. Specific: Clearly define what you want to achieve. Instead of saying, “I want to pay off debt,” say, “I want to pay off $10,000 in credit card debt in the next 12 months.”

2. Measurable: Ensure that your goals can be quantified. This will allow you to track your progress and celebrate milestones along the way.

3. Attainable: Set goals that are realistic and within reach. Consider your income, expenses, and other financial obligations when determining what is achievable for you.

4. Relevant: Ensure that your goals align with your overall financial objectives. For example, if your primary focus is becoming debt-free, prioritize debt repayment over other non-essential expenses.

5. Time-Bound: Set specific deadlines for achieving your goals. This will add a sense of urgency and keep you accountable.

3. Develop a Debt Repayment Strategy

To become debt-free, you need a well-defined repayment strategy. Here are some effective methods to consider:

Snowball Method

The snowball method involves paying off your smallest debts first while making minimum payments on all other debts. Once you pay off the smallest debt, you redirect the money towards the next smallest debt. This creates momentum as you see the number of debts decreasing over time, keeping you motivated.

Avalanche Method

The avalanche method focuses on paying off debts with the highest interest rates first. Start by making minimum payments on all debts and allocate any extra funds towards the debt with the highest interest. Once that debt is paid off, move on to the one with the next highest interest rate. This method saves you money on interest payments in the long run.

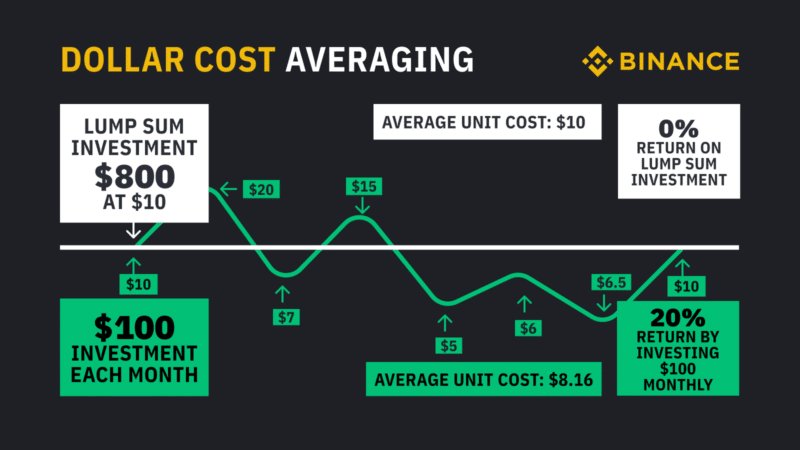

Debt Consolidation

If you have multiple debts with high-interest rates, consider consolidating them into a single loan with a lower interest rate. Debt consolidation can simplify your repayment process and potentially reduce the overall interest you have to pay.

4. Increase Your Income and Reduce Expenses

Accelerating your journey to a debt-free lifestyle can be achieved by finding ways to increase your income and reduce your expenses. Here are some ideas to help you achieve that:

Explore New Income Streams

1. Consider taking on a part-time job or freelancing gig to supplement your income.

2. Monetize your hobbies or skills by offering services or selling products online.

3. Rent out a spare room or a vacation property you own.

Cut Back on Expenses

1. Review your monthly expenses and identify areas where you can make cuts. This might include reducing dining out, canceling unnecessary subscriptions, or negotiating lower rates for services like internet and insurance.

2. Look for ways to save on everyday expenses, such as buying in bulk, using coupons or discounts, and opting for generic brands instead of expensive ones.

5. Seek Professional Help if Needed

If you find yourself overwhelmed or struggling to create a debt-free plan on your own, don’t hesitate to seek professional help. Financial advisors or credit counseling agencies can provide expert guidance tailored to your specific situation. They can help you with budgeting, debt management solutions, and negotiating with creditors.

Achieving a debt-free lifestyle requires careful planning, commitment, and perseverance. By assessing your current financial situation, setting clear goals, developing a debt repayment strategy, increasing your income, and reducing expenses, you can take control of your financial future. Remember, becoming debt-free is a journey, and it may take time, but the rewards are well worth the effort. Take the first step towards financial freedom today!

How to Fully Commit to a Debt Free Lifestyle

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I plan for a debt-free lifestyle?

To plan for a debt-free lifestyle, follow these steps:

- Create a budget and track your expenses.

- Identify unnecessary expenses and cut them down.

- Set financial goals and prioritize them.

- Create an emergency fund to handle unexpected expenses.

- Find ways to increase your income, such as taking on a side job or freelancing.

- Develop a debt repayment plan and stick to it.

- Negotiate with lenders to lower interest rates or develop a repayment plan.

- Seek professional help if needed, like credit counseling.

How important is having a budget in achieving a debt-free lifestyle?

Having a budget is crucial in achieving a debt-free lifestyle. It helps you gain control over your finances and allows you to allocate your money wisely. By tracking your expenses and income, you can identify areas where you can cut costs and save money. A budget also enables you to prioritize debt payments and avoid unnecessary spending, ultimately helping you achieve your goal of living without debt.

What are some effective strategies to cut down on expenses?

To cut down on expenses, you can:

- Avoid unnecessary purchases and impulse buying.

- Comparison shop to find the best deals.

- Reduce dining out and prepare meals at home.

- Cut back on subscriptions or memberships you don’t use often.

- Save on utilities by conserving energy.

- Consider buying used items instead of new.

How can I increase my income to pay off my debts faster?

You can increase your income to pay off debts faster by:

- Taking on a part-time job or freelance work.

- Starting a side business or monetizing a hobby.

- Asking for a raise or promotion at your current job.

- Exploring opportunities for passive income.

- Utilizing your skills to offer services or consultations.

Is it necessary to have an emergency fund when planning for a debt-free lifestyle?

Yes, having an emergency fund is crucial when planning for a debt-free lifestyle. An emergency fund acts as a safety net to cover unexpected expenses, such as medical bills or car repairs. Without an emergency fund, you might resort to taking on more debt to handle these unforeseen costs, derailing your journey towards a debt-free life.

What is the best strategy for repaying debts?

The best strategy for repaying debts is to:

- Start by paying off high-interest debts first.

- Consider consolidating debts to simplify repayment.

- Make consistent and timely payments on all debts.

- Allocate extra money towards debt payments whenever possible.

- Consider negotiating with creditors for lower interest rates or payment plans.

Should I seek professional help if I’m struggling with my debts?

Yes, if you are struggling with your debts, it is advisable to seek professional help. Credit counseling agencies can provide guidance on budgeting, debt management, and negotiating with creditors. They can also offer personalized advice based on your unique financial situation, helping you develop a tailored plan to become debt-free.

How long does it take to achieve a debt-free lifestyle?

The time it takes to achieve a debt-free lifestyle varies based on individual circumstances and the amount of debt. It requires commitment, discipline, and adherence to a well-planned strategy. While it may take months or even years depending on the situation, consistently following a debt repayment plan will eventually lead to a debt-free life.

Final Thoughts

In conclusion, planning for a debt-free lifestyle requires careful consideration and proactive steps. Start by assessing your current financial situation and identifying any outstanding debts. Next, create a realistic budget that allows for saving and debt repayment. Prioritize paying off high-interest debts first while also setting aside an emergency fund. Consider adjusting your spending habits, finding ways to increase your income, and seeking professional financial advice if needed. By taking control of your finances and developing disciplined habits, you can achieve a debt-free lifestyle and financial peace of mind. Remember, it’s never too late to start. Start planning for a debt-free lifestyle today.