Looking to boost employee morale and increase company productivity? Consider implementing a profit-sharing plan in your organization. So, what exactly is a profit-sharing plan in companies? It’s a compensation program where employees receive a percentage of the company’s profits, in addition to their regular salaries. This innovative approach creates a sense of ownership and incentivizes employees to work harder towards the company’s success. In this blog article, we will explore the many benefits of profit-sharing plans and how they can positively impact your business. Let’s dive in!

What is a Profit-Sharing Plan in Companies?

A profit-sharing plan in companies is a type of incentive program designed to distribute a portion of the company’s profits among its employees. These plans are intended to motivate employees, promote loyalty, and align their interests with that of the company’s financial success. Profit-sharing plans can vary in structure, eligibility criteria, and the amount of profit distributed.

How Does a Profit-Sharing Plan Work?

Profit-sharing plans typically involve the following key elements:

1. Establishing Eligibility: Companies determine the eligibility criteria for participating employees. Often, employees must meet certain tenure or performance requirements to qualify for the profit-sharing plan.

2. Profit Allocation: Once the company’s profits are calculated and financial obligations are met, a portion of the remaining profit is allocated for distribution among eligible employees. The allocation can be based on various factors, such as individual performance, salary level, or a combination of both.

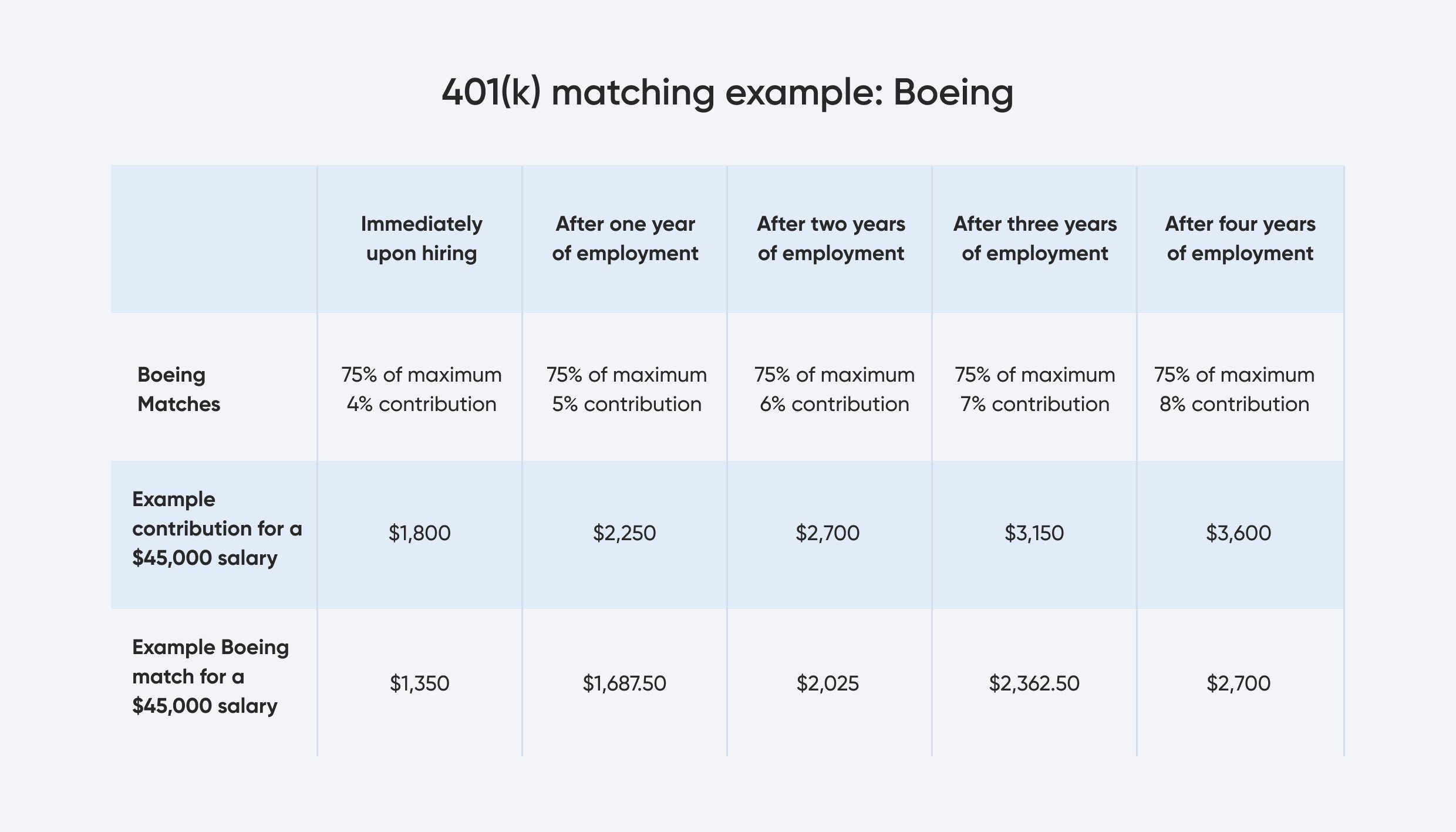

3. Distribution Methods: Companies have flexibility in choosing how to distribute the profits. Some common methods include cash payments, additional contributions to retirement accounts, or company stock. The chosen distribution method depends on the company’s objectives and the preferences of its employees.

The Benefits of Profit-Sharing Plans

Profit-sharing plans offer several benefits for both companies and employees:

1. Employee Motivation and Engagement: By sharing the profits with employees, profit-sharing plans create a sense of ownership and motivation. Employees have a direct stake in the company’s financial success and are encouraged to contribute their best efforts to achieve shared goals.

2. Retention and Loyalty: Offering a profit-sharing plan can foster employee loyalty and increase retention rates. Employees are less likely to seek opportunities elsewhere when they feel valued and rewarded for their contributions to the company’s success.

3. Alignment of Interests: Profit-sharing plans align the interests of employees with the company’s financial performance. When employees benefit from the company’s profits, they are more likely to make decisions and take actions that positively impact the company’s bottom line.

4. Attracting Top Talent: A well-structured profit-sharing plan can be an attractive benefit when recruiting new employees. Potential candidates may prioritize companies that offer profit-sharing opportunities as it demonstrates a commitment to fairness and recognition of employee contributions.

5. Tax Advantages: Profit-sharing plans can provide tax advantages for both companies and employees. Contributions made by the employer are tax-deductible, while employees may receive favorable tax treatment on their share of the profits, depending on the distribution method chosen.

Types of Profit-Sharing Plans

Companies can adopt various types of profit-sharing plans, tailored to their specific objectives and employee demographics. Here are a few common types:

1. Straight Profit-Sharing Plan: In this type of plan, the allocation of profits is based solely on the company’s financial performance. It does not take into account individual employee performance or other factors. The distribution is typically made in cash and is usually proportional to an employee’s salary or length of service.

2. Performance-Based Profit-Sharing Plan: This type of plan combines the company’s financial performance with individual employee performance evaluations. Employees who meet or exceed performance targets receive a higher share of the profit pool. It provides an additional incentive for employees to strive for excellence.

3. Shared Savings Plan: Unlike traditional profit-sharing plans, shared savings plans focus on cost savings rather than profits. Employees are encouraged to identify and implement cost-saving measures, and a portion of the savings achieved is shared with the employees as a reward.

4. Employee Stock Ownership Plan (ESOP): ESOPs are profit-sharing plans that provide eligible employees with company stock. As the company’s value increases, so does the value of the employees’ stock. ESOPs can be a powerful tool for creating a sense of ownership and aligning employee interests with long-term company success.

Considerations for Implementing a Profit-Sharing Plan

Before implementing a profit-sharing plan, companies should carefully consider the following factors:

1. Financial Viability: It is important to assess the financial feasibility of implementing a profit-sharing plan. Companies should ensure they have consistent profitability and cash flow to support regular distributions.

2. Communication and Transparency: Transparent communication about the profit-sharing plan’s structure, eligibility criteria, and distribution methodology is essential. Employees need to understand how the plan works, their role in achieving its objectives, and the potential rewards.

3. Legal and Regulatory Compliance: Companies must comply with applicable laws and regulations while designing and implementing a profit-sharing plan. Consulting with legal and financial experts can help ensure compliance and avoid potential legal pitfalls.

4. Regular Evaluation: Companies should regularly review and evaluate the effectiveness of their profit-sharing plan. This includes assessing the plan’s impact on employee motivation, retention, and overall company performance. Adjustments may be necessary to optimize the plan’s outcomes.

In conclusion, profit-sharing plans in companies provide a powerful tool to motivate employees, align their interests with company success, and attract and retain top talent. By distributing a portion of the company’s profits, these plans create a sense of ownership and drive employee engagement. However, careful consideration of eligibility criteria, distribution methods, and legal compliance is essential. Implementing a well-designed profit-sharing plan can yield substantial benefits for both companies and employees, fostering a culture of shared success and financial rewards.

What Profit Sharing Means For Your Money | What is a Profit Sharing Plan vs 401k Contributions

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a profit-sharing plan in companies?

A profit-sharing plan is a type of incentive program offered by companies that allows employees to receive a share of the company’s profits. It is designed to motivate and reward employees for their contributions to the company’s success.

How does a profit-sharing plan work?

In a profit-sharing plan, a predetermined portion of the company’s profits is set aside to be distributed among eligible employees. The distribution can be made in cash, additional benefits, or through contributions to a retirement or investment account. The amount each employee receives is often based on factors such as their salary and length of service.

What are the benefits of implementing a profit-sharing plan?

Implementing a profit-sharing plan can have several benefits for both the company and its employees. It can help attract and retain talented employees, increase employee motivation and morale, foster a sense of ownership and loyalty, and align the interests of employees with the success of the company.

Are there different types of profit-sharing plans?

Yes, there are different types of profit-sharing plans. Some common types include cash-based plans, where employees receive a cash bonus based on the company’s profits, and deferred plans, where the money is placed into retirement or investment accounts for the employees.

Are profit-sharing contributions taxable?

Yes, profit-sharing contributions are generally taxable. When employees receive distributions from a profit-sharing plan, the amount is typically subject to income tax. However, there may be certain tax advantages depending on the specific plan and local tax laws.

Can all employees participate in a profit-sharing plan?

The eligibility criteria for participating in a profit-sharing plan can vary from company to company. Some companies may choose to include all employees, while others may have specific requirements such as a minimum length of service or a certain level of job classification.

Is a profit-sharing plan the same as an employee stock ownership plan (ESOP)?

No, a profit-sharing plan is not the same as an employee stock ownership plan (ESOP). While both plans aim to provide employees with a share in the company’s success, an ESOP specifically involves granting employees ownership of company stock. Profit-sharing plans, on the other hand, distribute profits without granting ownership.

Can a profit-sharing plan be combined with other employee benefits?

Yes, a profit-sharing plan can often be combined with other employee benefits. Many companies choose to offer profit-sharing in conjunction with retirement plans, health benefits, or other forms of compensation to create a comprehensive employee benefits package.

Final Thoughts

A profit-sharing plan in companies is a scheme that allows employees to receive a portion of the company’s profits as additional compensation. It serves as a motivator for employees to work together towards the success of the organization, as they directly benefit from its financial performance. The plan promotes a sense of shared ownership and encourages employees to actively contribute to the company’s growth and profitability. Through profit-sharing, companies can foster a positive and collaborative work environment, enhance employee loyalty and engagement, and ultimately drive overall business success. Implementing a profit-sharing plan can be a valuable strategy for companies to attract, retain, and motivate talented employees, while also aligning their interests with the company’s success. In conclusion, a profit-sharing plan in companies is a powerful tool that helps foster a culture of shared success and mutual benefit between employees and the organization.