Looking to invest your money wisely? Wondering what robo-advisors are and how they can benefit you? Look no further! Robo-advisors are automated investment platforms that use algorithms and technology to manage your investments. They offer a convenient and low-cost way to invest, making them increasingly popular among both beginners and experienced investors. In this article, we will delve into what robo-advisors are and explore their advantages. So, if you’re curious about how robo-advisors can help you achieve your financial goals, keep reading to find out!

What is Robo-Advisors and Its Advantages

Robo-advisors have revolutionized the way individuals invest their money. These digital platforms offer automated investment solutions that use algorithms to provide financial advice and manage portfolios. This article will delve into the world of robo-advisors, exploring their advantages and how they have transformed the investment landscape.

Understanding Robo-Advisors

Robo-advisors are online platforms that use advanced algorithms to provide investment advice and manage portfolios. These platforms eliminate the need for traditional human financial advisors, making investment management accessible to a broader audience. By leveraging technology, robo-advisors offer cost-effective and efficient investment solutions.

How do Robo-Advisors Work?

Robo-advisors utilize sophisticated algorithms and financial models to analyze various factors, such as risk tolerance, investment goals, and time horizons. Investors typically begin by answering a series of questions related to their financial situation and investment preferences. The robo-advisor then uses this information to generate a personalized investment plan.

Once the initial setup is complete, the robo-advisor takes care of portfolio management and rebalancing. It automatically adjusts the investment allocations based on market conditions and the investor’s goals. This automated process ensures that the portfolio remains aligned with the investor’s risk tolerance and objectives.

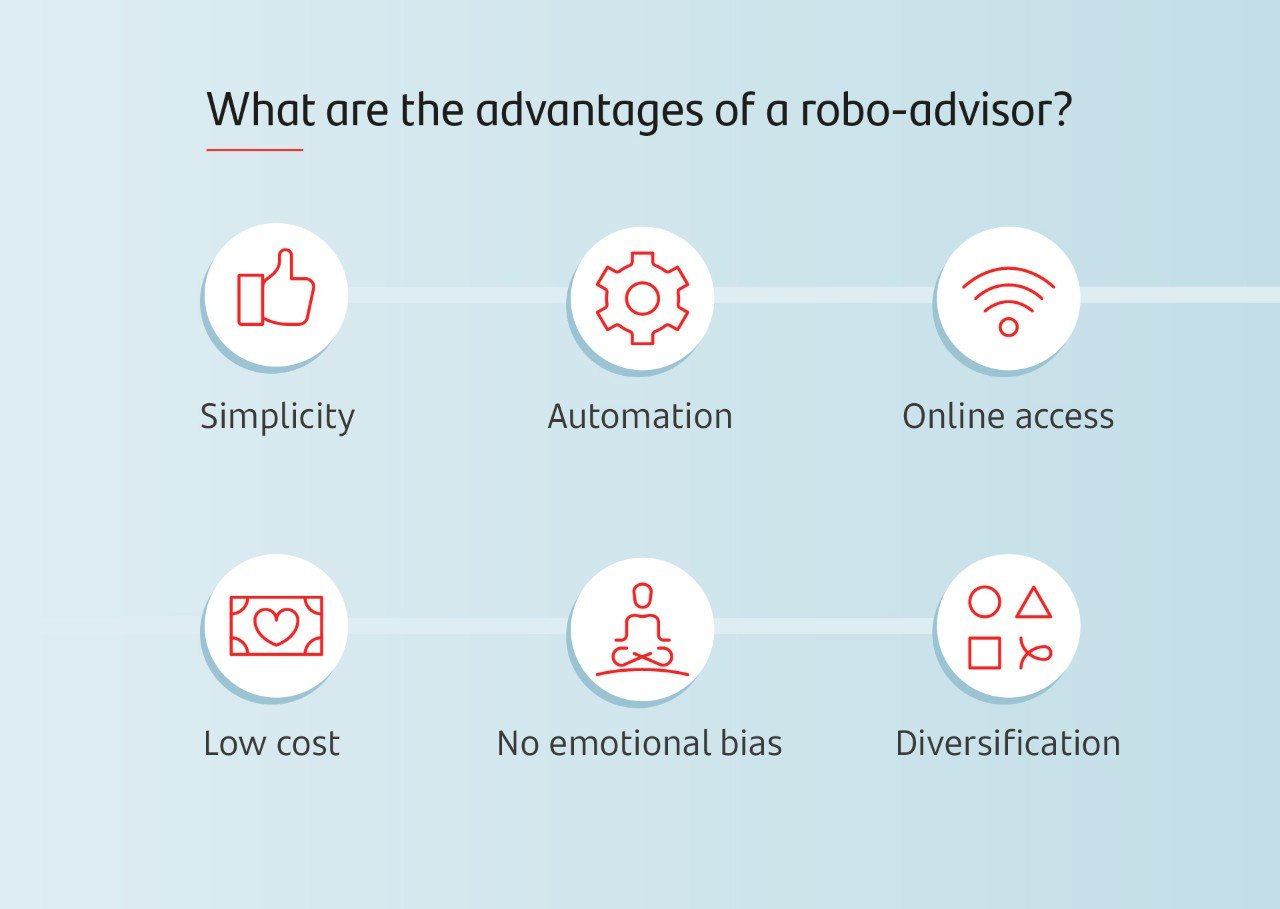

Advantages of Robo-Advisors

Robo-advisors offer numerous advantages that have made them increasingly popular among both beginner and experienced investors. Let’s explore some of the key benefits of using robo-advisors:

1. Cost-Effective

Traditional financial advisors often charge high fees for their services, making them inaccessible to many investors. Robo-advisors, on the other hand, typically offer low-cost investment management solutions. By leveraging technology and automation, robo-advisors minimize overhead costs, allowing them to pass on the savings to their clients. This cost-effectiveness makes robo-advisors an attractive option for investors looking to minimize fees and maximize returns.

2. Accessibility

Robo-advisors have made investment management accessible to a broader audience. With low minimum investment requirements, individuals with limited funds can start investing and benefit from professional portfolio management. This level of accessibility breaks down traditional barriers and empowers individuals to take control of their financial future.

3. Diversification

Diversification is a critical component of successful investing, as it helps mitigate risks and optimize returns. Robo-advisors excel in diversification by allocating investments across multiple asset classes, such as stocks, bonds, and exchange-traded funds (ETFs). These platforms leverage their algorithms to ensure that portfolios are well-diversified based on the investor’s risk profile. By spreading investments across different asset classes, robo-advisors help protect against market volatility and potentially increase returns over the long term.

4. Emotional Discipline

One common challenge faced by investors is emotional decision-making. Emotional biases often lead to poor investment choices, such as panic selling during market downturns or chasing hot investment trends. Robo-advisors eliminate emotions from the decision-making process. Their algorithms rely on data and objective analysis, ensuring that investment decisions are based on sound strategies rather than impulsive reactions. This emotional discipline helps investors stay on track with their long-term goals and avoid costly mistakes.

5. Time Efficiency

Managing investments can be time-consuming, especially for individuals with busy lifestyles. Traditional investment strategies require extensive research, monitoring, and regular rebalancing. Robo-advisors streamline this process by handling all the investment-related tasks automatically. Investors can save valuable time and energy by delegating portfolio management to robo-advisors, allowing them to focus on other aspects of their lives.

6. Transparency

Transparency is crucial when it comes to financial matters. Robo-advisors strive to provide investors with transparent and clear information about their investment portfolios. These platforms offer easy access to portfolio performance, investment holdings, and associated fees. Investors can monitor the progress of their investments in real-time and make informed decisions based on comprehensive and accurate data.

7. Robust Security Measures

Due to the sensitive nature of financial information, security is a top concern for investors. Robo-advisors prioritize data security and employ robust measures to protect personal and financial information. These platforms utilize encryption protocols, multi-factor authentication, and other advanced security features to ensure that the investor’s sensitive data remains confidential and safe.

Robo-advisors have revolutionized the investment industry by democratizing access to professional portfolio management. With their cost-effectiveness, accessibility, diversification, emotional discipline, time efficiency, transparency, and robust security measures, robo-advisors have gained widespread popularity. They provide investors with an efficient and convenient way to invest, helping them achieve their financial goals. Whether you’re a novice investor or an experienced one, robo-advisors can be a valuable tool in your financial journey.

What Are The Main Advantages Of Robo Advisors?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a robo-advisor?

A robo-advisor is an automated digital platform that uses algorithms to provide financial advice and manage investment portfolios. It eliminates the need for human financial advisors by utilizing advanced technology to create and execute investment strategies.

What are the advantages of using a robo-advisor?

Robo-advisors offer several advantages, including:

– Convenience: Users can access their investment accounts anytime and anywhere through online platforms or mobile apps.

– Cost-effectiveness: Robo-advisors typically have lower fees compared to traditional financial advisors, making them more affordable for many investors.

– Diversification: Robo-advisors use algorithms to create well-diversified portfolios based on the individual investor’s risk tolerance and financial goals.

– Automation: The automated nature of robo-advisors allows for automatic rebalancing of investment portfolios, ensuring they stay aligned with the desired asset allocation.

– Transparency: Robo-advisors provide transparent reporting and performance updates, allowing investors to monitor the progress of their investments easily.

Can I trust a robo-advisor to manage my investments?

Yes, you can trust a robo-advisor to manage your investments. Robo-advisors are regulated financial entities that must meet stringent standards to ensure the security and protection of investors’ assets. Additionally, reputable robo-advisory platforms utilize advanced security measures, such as encryption and secure data storage, to safeguard users’ personal and financial information.

How do robo-advisors determine the best investment strategy for me?

Robo-advisors determine the best investment strategy for you by evaluating your risk tolerance, investment goals, and time horizon. They use sophisticated algorithms and data analysis to create customized portfolios tailored to your specific needs. These algorithms consider various factors such as market conditions, historical performance data, and your personal preferences to generate an optimal investment strategy.

Can a robo-advisor provide personalized financial advice?

While robo-advisors lack the human touch of traditional advisors, they can provide personalized financial advice by leveraging the information provided during the account setup process. This includes assessing your risk tolerance, investment objectives, and financial goals. The algorithms then utilize this data to create a personalized investment plan.

Are robo-advisors suitable for all types of investors?

Robo-advisors are suitable for a wide range of investors, from beginners to experienced investors. They offer accessibility, affordability, and convenience, making them especially popular among millennials and individuals with smaller investment portfolios. However, it’s important to consider your unique needs and preferences before choosing a robo-advisor.

What is the minimum investment required to use a robo-advisor?

The minimum investment requirements vary among robo-advisory platforms. While some have no minimum investment, others may require a minimum initial deposit, which can range from as low as $500 to a few thousand dollars. It is advisable to research different platforms to find one that aligns with your investment budget.

Can I switch to a different robo-advisor?

Yes, you can switch to a different robo-advisor if you are unhappy with your current provider or find another platform that better suits your needs. However, it’s important to consider any associated fees or restrictions when transferring your investments. Prior research and comparing different robo-advisory platforms will help you make an informed decision.

Final Thoughts

Robo-advisors are automated investment platforms that provide financial advice and investment management services. They utilize algorithms and computer algorithms to analyze investor data and create personalized investment portfolios. One of the main advantages of robo-advisors is their accessibility and affordability, making investment advice and management more accessible to individuals with lower investment amounts. Additionally, robo-advisors offer diversified portfolios, taking into account the investor’s risk tolerance and investment goals. This automated approach eliminates human biases and emotions and ensures consistent and objective investment decisions. With robo-advisors, investors can benefit from lower fees, transparency, and convenience, making it an appealing option for many individuals seeking financial guidance.