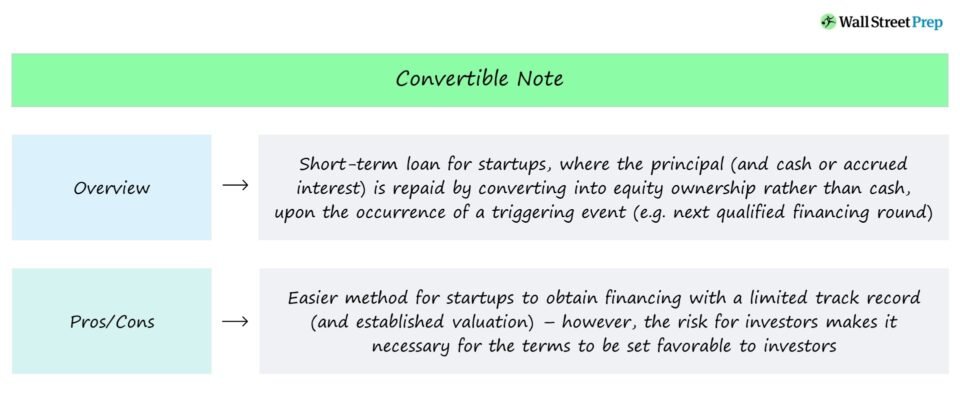

Have you ever wondered what convertible debt is in startup financing? In simple terms, convertible debt is a type of loan that is typically issued by startups to raise capital. But here’s the catch – instead of receiving the loan back with interest, investors have the option to convert their debt into equity in the future. This unique financing method offers a win-win situation for both entrepreneurs and investors. In this article, we will delve into the intricacies of convertible debt in startup financing, discussing how it works and why it has become a popular funding option in the startup ecosystem. So, let’s dive right in!

What is Convertible Debt in Startup Financing?

When it comes to financing startups, there are various options available to entrepreneurs. One popular method is through convertible debt, which offers a unique solution for both the startup and investors. Convertible debt is a form of financing that starts as debt and has the potential to convert into equity at a later stage. It provides a flexible and efficient way to raise funds without determining a valuation for the startup upfront. In this article, we will delve into the details of convertible debt in startup financing, exploring its benefits, drawbacks, and key considerations.

How Does Convertible Debt Work?

Convertible debt operates on the principle of providing a short-term loan to a startup that can later be converted into equity. Let’s break down the process:

1. Seed Investment: A startup seeks funding in the form of a loan, typically from angel investors, venture capitalists, or friends and family. This initial investment is structured as a convertible note.

2. Terms and Conditions: The terms and conditions of the convertible note are outlined in a legal agreement. These terms include the interest rate, maturity date, discount, and valuation cap.

3. Conversion Trigger: Conversion into equity typically occurs when the startup raises a subsequent round of funding, known as a qualified financing round. This round acts as a conversion trigger, at which point the loan converts into shares or preferred stock.

4. Equity Conversion: Upon the conversion trigger, the conversion price is determined based on predefined terms. The conversion price can be at a discount to the subsequent financing round’s share price or subject to a valuation cap.

5. Ownership: Once the conversion takes place, the investor becomes a shareholder or preferred stockholder in the startup, owning a percentage of the company.

Advantages of Convertible Debt for Startups

Startups often choose convertible debt as a financing option due to the following advantages:

- Delay in Valuation: One of the key advantages of convertible debt is that it allows startups to postpone determining their valuation until a later stage. This is particularly beneficial when valuing a startup can be challenging, as it gives entrepreneurs more time to prove their concept and attract more investors.

- Lower Initial Costs: Unlike equity financing, convertible debt does not require immediate valuation or legal fees, reducing upfront costs for startups. This makes it an attractive option for companies seeking quick access to funding without the lengthy valuation process.

- Flexible Terms: Convertible debt can be customized to suit the needs of both the startup and the investor. Terms such as interest rate, maturity date, and conversion price can be negotiated, providing flexibility for both parties.

- Higher Probability of Funding: Convertible debt offers startups a higher likelihood of securing funding compared to equity investment. Investors are often more inclined to invest in convertible debt as it presents a lower risk, making it an attractive option for early-stage startups.

Drawbacks and Considerations of Convertible Debt

While convertible debt has its advantages, it also comes with some drawbacks and considerations:

- Debt Accumulation: The initial investment in convertible debt adds to the startup’s liabilities. If the startup faces financial difficulties or fails to secure a subsequent financing round, the debt may burden the company.

- Uncertain Valuation: As the valuation of the startup is not determined at the time of the investment, the conversion price of the debt into equity can be uncertain. This may result in potential dilution for existing shareholders if the conversion price is set at a significantly lower valuation in the subsequent funding round.

- Investor Protection: Convertible debt agreements often include investor-friendly terms such as conversion discounts and valuation caps. While these terms benefit investors, they may reduce the ownership stake and dilute the startup founders’ equity.

- Potential Conversion Delay: The conversion trigger for convertible debt relies on a subsequent financing round. If the startup faces challenges in raising the required funding round, the conversion of debt into equity may be delayed, impacting investor returns and liquidity.

Key Considerations for Startups and Investors

When opting for convertible debt in startup financing, both startups and investors should consider the following:

- Conversion Terms: The terms of conversion, such as the discount rate and valuation cap, should be carefully evaluated by both parties to ensure a fair and favorable outcome. Startups need to strike a balance between attracting investors and protecting their equity.

- Exit Strategy: Startups should have a clear exit strategy in place to provide potential liquidity for the convertible debt investors. This may include plans for an initial public offering (IPO), acquisition, or another funding round.

- Financial Viability: Investors should thoroughly assess the financial viability and growth potential of the startup before committing to convertible debt. Startups must present a solid business plan, scalability, and a competitive advantage to attract investor interest.

- Legal Advice: Both startups and investors should seek legal advice to ensure the convertible debt agreement protects their interests. Legal professionals experienced in startup financing can guide them through the process and mitigate potential risks.

In conclusion, convertible debt offers an alternative financing option for startups, providing flexibility, lower upfront costs, and delay in valuation. It enables entrepreneurs to raise funds quickly without determining their company’s value at the early stage. However, convertible debt also comes with certain drawbacks and considerations that both startups and investors must carefully evaluate. By understanding the intricacies of convertible debt, entrepreneurs can make informed decisions about financing their startups while attracting potential investors.

Startup Financing 101: How SAFEs and Convertible Notes Work | Equity funding explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is convertible debt in startup financing?

Convertible debt is a type of financing instrument commonly used by startups. It is a form of debt that can be converted into equity at a later stage, typically during a subsequent funding round or an exit event, such as an acquisition or an initial public offering (IPO).

How does convertible debt work?

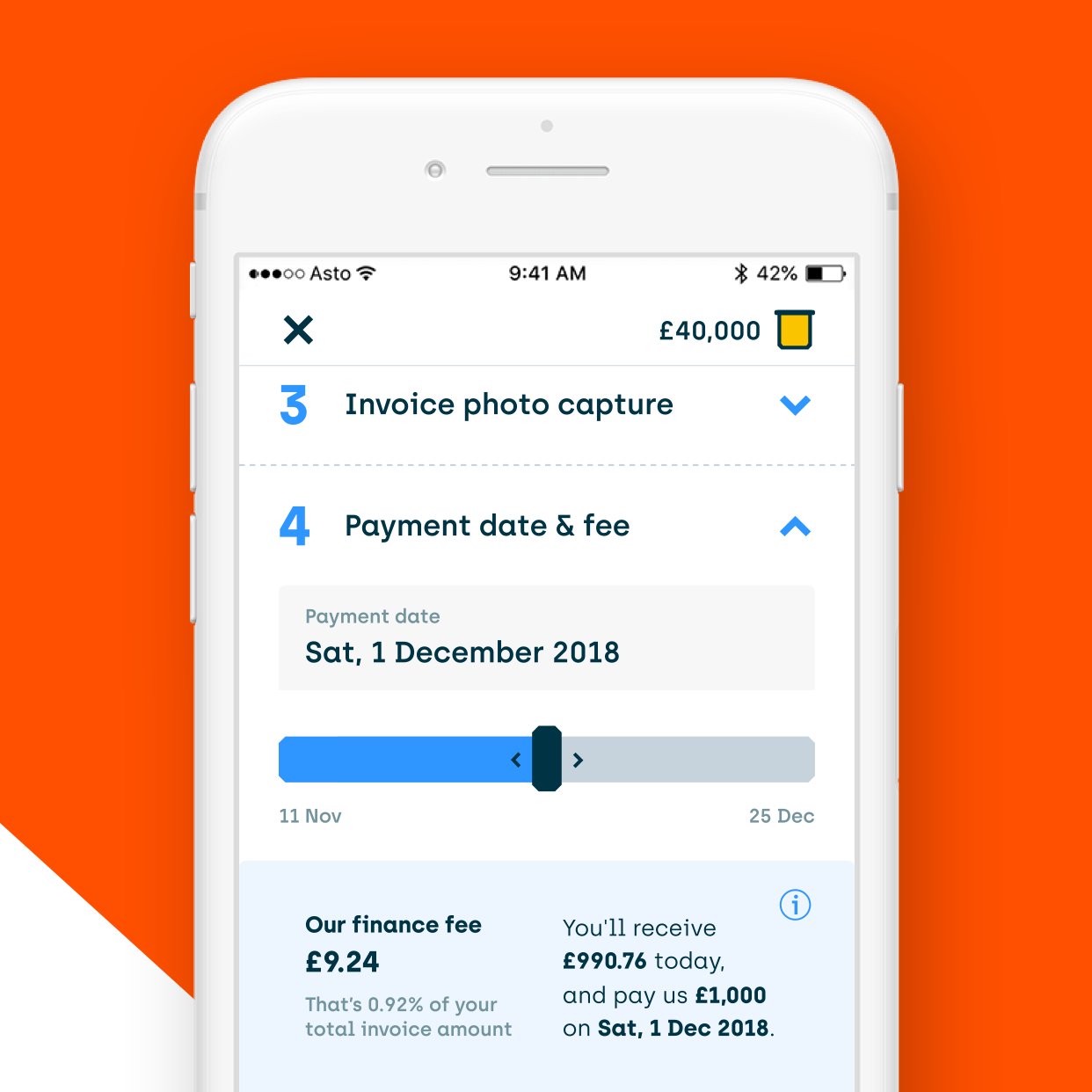

Convertible debt works by providing investors with the option to convert their debt into equity at a predetermined conversion price or upon certain triggering events. Until conversion, the debt typically accrues interest and has a maturity date.

What are the advantages of convertible debt for startups?

Convertible debt offers several advantages for startups. It is often simpler and faster to set up compared to equity financing. It also allows startups to delay valuing their company, which can be beneficial during early stages when the valuation is uncertain.

What is the conversion price?

The conversion price is the price at which the convertible debt can be converted into equity. It is usually determined based on the valuation of the company at the next financing round or the triggering event. The conversion price is typically set to provide investors with a discount or a conversion premium.

What are the typical terms of convertible debt?

The terms of convertible debt can vary, but some common terms include the interest rate, maturity date, conversion price, conversion events, and any additional rights or protections for investors. It is important for startups and investors to negotiate and agree upon these terms before entering into a convertible debt agreement.

Are there any risks associated with convertible debt?

Convertible debt carries some risks for both startups and investors. For startups, if the company fails to raise subsequent funding or achieve a triggering event, the debt may become due and payable. For investors, there is a risk that the conversion price may be higher than the future valuation of the company, resulting in a lower return on investment.

Can convertible debt be used in conjunction with equity financing?

Yes, convertible debt can be used in conjunction with equity financing. Startups may choose to raise funds through a combination of convertible debt and equity financing to meet their capital needs at different stages of growth. This allows startups to balance their immediate financing requirements with the potential for future equity dilution.

What happens if the convertible debt is not converted?

If the convertible debt is not converted, it will typically have a maturity date, upon which it becomes due and payable. At this point, the startup is obligated to repay the debt, usually with interest. If the startup is unable to repay the debt, it may result in default and potential legal consequences.

Final Thoughts

Convertible debt in startup financing is a unique form of debt that can be converted into equity in the future. It offers both benefits and challenges for startups seeking funding. By providing a short-term loan with the option to convert into equity, convertible debt allows startups to secure funding without determining an exact valuation. This flexibility appeals to investors and founders alike. However, the conversion terms and potential dilution of ownership are important considerations. When evaluating funding options, understanding what is convertible debt in startup financing is crucial for making informed decisions. It offers a middle ground between debt and equity, providing startups with valuable funding opportunities while minimizing the risks associated with traditional debt financing.