Understanding the importance of financial literacy is crucial for navigating the complexities of the modern world. Whether you’re an individual trying to manage personal finances or a business owner aiming for long-term financial success, having a solid understanding of financial literacy is essential. So, why is financial literacy so important? In simple terms, it empowers you to make informed decisions about money, investments, and financial planning, ultimately leading to a more secure and stable future. With the right knowledge and skills, you can take control of your finances and achieve your financial goals.

Understanding the Importance of Financial Literacy

Financial literacy is an essential skill that everyone should acquire in order to navigate the complex world of personal finance. It involves having the knowledge, skills, and confidence to make informed financial decisions that can positively impact one’s financial well-being. In today’s society, where financial products and services are constantly evolving, understanding the importance of financial literacy is more crucial than ever before. This article will explore various aspects of financial literacy, including why it matters, its benefits, and how to improve it.

I. What is Financial Literacy?

Financial literacy refers to the ability to understand and use various financial skills, including personal financial management, budgeting, saving, investing, and understanding financial concepts such as interest rates, inflation, and risk management. It encompasses knowing how to make informed decisions about financial products, services, and investments, as well as understanding the consequences of financial choices.

II. Why Does Financial Literacy Matter?

1. Making Informed Financial Decisions:

Financial literacy empowers individuals to make informed decisions regarding their finances. It enables them to understand the implications of their choices and make sound financial decisions that align with their goals and priorities.

2. Building Financial Security:

Having a strong foundation in financial literacy can help individuals build financial security for themselves and their families. By understanding concepts such as budgeting, saving, and investing, individuals can establish good financial habits that contribute to their long-term financial well-being.

3. Avoiding Financial Pitfalls:

A lack of financial literacy can lead to costly mistakes and financial hardships. People who are financially literate are better equipped to avoid common financial pitfalls such as excessive debt, predatory lending, and falling victim to scams or fraudulent activities.

4. Planning for the Future:

Financial literacy encourages individuals to plan for their future and set financial goals. By understanding concepts like retirement planning, insurance, and estate planning, individuals can secure their financial future and ensure a comfortable retirement.

5. Economic Stability:

Financially literate individuals contribute to the overall economic stability of society. They are more likely to make sound financial decisions, which reduces the risk of financial crises and promotes economic growth.

III. The Benefits of Financial Literacy

1. Increased Financial Confidence:

Financial literacy enhances individuals’ confidence in managing their money. When individuals understand their finances and have the necessary skills to make informed decisions, they can approach financial matters with confidence, leading to better financial outcomes.

2. Better Money Management:

Financial literacy equips individuals with the knowledge and tools needed to manage their money effectively. People who are financially literate are more likely to create budgets, track their expenses, and save money for emergencies and future goals.

3. Improved Financial Well-being:

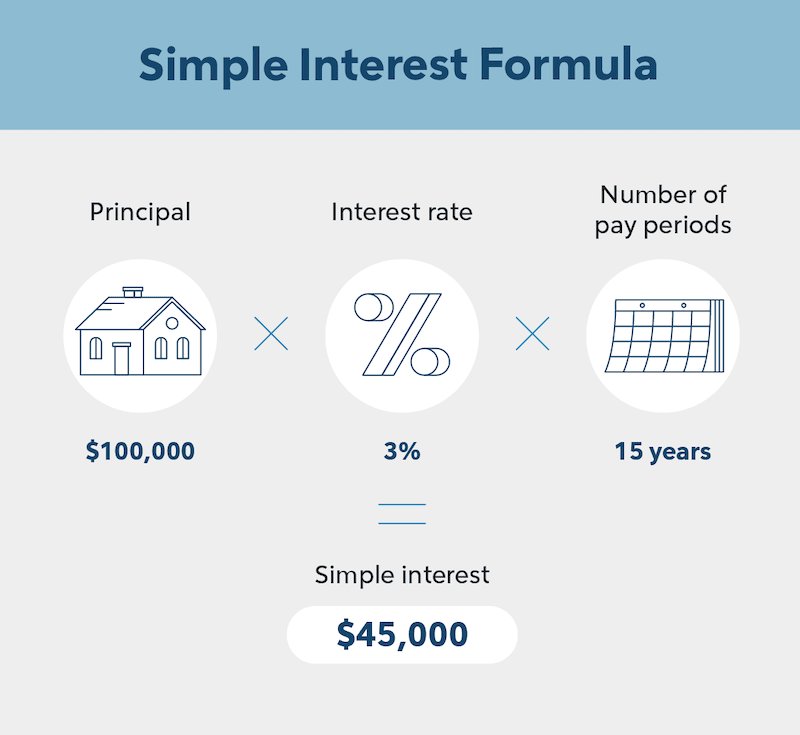

By understanding financial concepts like compound interest, inflation, and risk management, individuals can optimize their financial decisions. This can lead to increased wealth accumulation, improved credit scores, and a higher overall level of financial well-being.

4. Greater Investment Opportunities:

Financial literacy enables individuals to understand investment options and make informed decisions about growing their wealth. By understanding the risks and potential returns associated with different investments, individuals can make choices that align with their risk tolerance and financial goals.

5. Enhanced Entrepreneurial Skills:

Financial literacy is especially important for aspiring entrepreneurs. It equips individuals with the knowledge of managing business finances, understanding cash flow, and making financial projections. This enhances their ability to start and successfully run their own businesses.

IV. How to Improve Financial Literacy

1. Education and Training:

Formal education plays a vital role in improving financial literacy. Schools, colleges, and universities should include personal finance courses as part of their curriculum, ensuring that students have a solid foundation in financial literacy.

2. Online Resources and Courses:

The internet provides a wealth of resources and online courses that can help individuals enhance their financial literacy. There are numerous websites, blogs, and videos offering free educational content on various financial topics.

3. Workshops and Seminars:

Attending workshops and seminars conducted by financial professionals is an excellent way to deepen one’s understanding of personal finance. These events often cover topics such as budgeting, investing, retirement planning, and debt management.

4. Seeking Professional Advice:

Financial advisors can provide personalized guidance and advice tailored to an individual’s specific financial situation. They can help individuals develop a financial plan, set goals, and make informed decisions related to saving, investing, and insurance.

5. Self-Study and Personal Finance Books:

Engaging in self-study and reading personal finance books is a valuable way to improve financial literacy. Books written by experts in the field offer valuable insights and practical tips for managing money effectively.

V. Conclusion

Financial literacy is a vital skill that empowers individuals to make informed financial decisions, avoid costly mistakes, and build a secure financial future. By understanding the importance of financial literacy and taking steps to improve it, individuals can experience increased financial well-being, confidence, and overall success in managing their finances. It is an ongoing process that requires continuous learning and application of financial knowledge. By embracing financial literacy, individuals can take control of their financial lives and achieve their long-term goals.

The importance of teen financial literacy | Igor Curic | TEDxAmsterdamSalon

Frequently Asked Questions

Understanding the Importance of Financial Literacy

Why is financial literacy important?

Financial literacy is important because it equips individuals with the knowledge and skills to make informed financial decisions. It helps them understand concepts like budgeting, saving, investing, and managing debt, leading to better financial stability and long-term success.

What are the benefits of being financially literate?

Being financially literate brings several benefits. It allows individuals to set and achieve financial goals, make informed investment choices, avoid debt traps, manage financial risks, and plan for retirement. It also helps to improve credit scores and overall financial well-being.

How can financial literacy impact my daily life?

Financial literacy has a direct impact on daily life. It helps in managing personal finances efficiently, making wise purchasing decisions, avoiding financial scams, and understanding the implications of financial contracts like mortgages or loans. It empowers individuals to take control of their financial future.

Where can I learn about financial literacy?

There are various resources available to learn about financial literacy. You can start by exploring educational websites, attending workshops or seminars, reading books or articles on personal finance, or taking online courses. Many banks and financial institutions also offer financial literacy programs.

Is financial literacy important for all age groups?

Yes, financial literacy is important for all age groups. It is never too early or too late to enhance your financial knowledge. Starting young helps build a strong foundation, while improving financial literacy later in life can help overcome financial difficulties and plan for retirement.

Can financial literacy improve my career prospects?

Yes, financial literacy can improve your career prospects. Many job roles require a basic understanding of financial concepts and skills. Knowing how to manage personal finances effectively can demonstrate responsibility and financial acumen, which are valuable attributes to employers.

How can financial literacy help me avoid financial pitfalls?

Financial literacy provides the knowledge necessary to avoid common financial pitfalls. By understanding concepts like budgeting, saving, and investing, you can steer clear of excessive debt, predatory lending, and other financial traps. It helps you make informed decisions and protect your financial well-being.

What steps can I take to improve my financial literacy?

To improve your financial literacy, you can start by setting financial goals, creating a budget, tracking your expenses, and learning about different investment options. Stay updated with financial news and trends, seek guidance from financial advisors, and continuously educate yourself about personal finance concepts.

Final Thoughts

Understanding the importance of financial literacy is crucial in today’s complex world. It empowers individuals to make informed decisions about their money, leading to financial stability and security. By acquiring financial knowledge, individuals can manage their expenses, save effectively, and invest wisely. Moreover, financial literacy enables individuals to protect themselves from scams and frauds, ensuring their financial well-being. It is imperative for educational institutions, governments, and society as a whole to prioritize and promote financial literacy. Only through a comprehensive understanding of financial concepts can individuals take control of their financial futures and achieve long-term success. So, let’s prioritize understanding the importance of financial literacy to secure our financial well-being.