Are you searching for a way to build a financial safety net? Look no further! In this article, we will uncover effective strategies on how to establish a secure financial foundation that will provide you with the peace of mind you deserve. Whether you’re just starting your journey towards financial stability or looking to strengthen your existing safety net, we’ve got you covered. By following these practical steps and incorporating them into your everyday life, you’ll be well on your way to building a solid financial future. Let’s dive in and explore how to build a financial safety net that will protect you through life’s uncertainties.

How to Build a Financial Safety Net

Introduction

In today’s uncertain world, building a financial safety net is crucial for your peace of mind and future stability. A financial safety net refers to having enough savings and resources to weather unexpected emergencies, job loss, or other financial setbacks. By taking proactive steps to establish a solid foundation, you can protect yourself and your family from the uncertainties of life. This guide will provide you with practical tips and strategies to help you build a robust financial safety net.

Assess Your Current Financial Situation

Before you start building a financial safety net, it’s essential to assess your current financial situation. This evaluation will help you understand where you stand financially and identify areas that need improvement. Here’s what you should consider:

- Evaluate your income: Calculate your monthly income from all sources, including salary, investments, and any side gigs.

- Analyze your expenses: Track your spending for a few months to determine where your money goes. Categorize your expenses, such as housing, groceries, transportation, and entertainment.

- Calculate your net worth: Subtract your liabilities (such as debts and loans) from your assets (savings, investments, and valuable possessions) to determine your net worth.

- Review your insurance coverage: Ensure that you have adequate health, home, and auto insurance to protect yourself and your assets.

Establish an Emergency Fund

One of the first steps to building a financial safety net is creating an emergency fund. An emergency fund is a dedicated savings account that you can tap into during unexpected situations. Here’s how to establish and grow your emergency fund:

- Set a savings goal: Aim to save at least three to six months’ worth of living expenses in your emergency fund. Consider factors such as your job security, family situation, and any potential risks.

- Automate your savings: Set up automatic transfers from your primary bank account to your emergency fund. This way, you won’t forget to save and will gradually build your savings over time.

- Keep it separate: Open a separate savings account specifically for your emergency fund. This will help you avoid dipping into these funds for non-emergency expenses.

- Save windfalls: Whenever you receive unexpected income, such as tax refunds, bonuses, or monetary gifts, allocate a portion of it to your emergency fund.

- Replenish after use: If you ever need to use your emergency fund, make it a priority to replenish it as soon as possible to maintain its effectiveness.

Reduce Debt

Debt can prevent you from building a solid financial safety net. High-interest debt, such as credit card debt or loans, can drain your resources and make it challenging to save for emergencies. Here are some strategies to reduce your debt:

- Create a repayment plan: Prioritize your debts based on interest rates and outstanding balances. Consider the avalanche or the snowball method to tackle your debts strategically.

- Pay more than the minimum: Whenever possible, pay more than the minimum payment on your debts. This will help you pay off the principal faster and save on interest charges.

- Consolidate and refinance: Explore options to consolidate your debts or refinance high-interest loans to lower interest rates. This can make your repayment more manageable.

- Avoid new debt: While you’re paying off your existing debts, try to avoid taking on new debt. Cut unnecessary expenses and focus on living within your means.

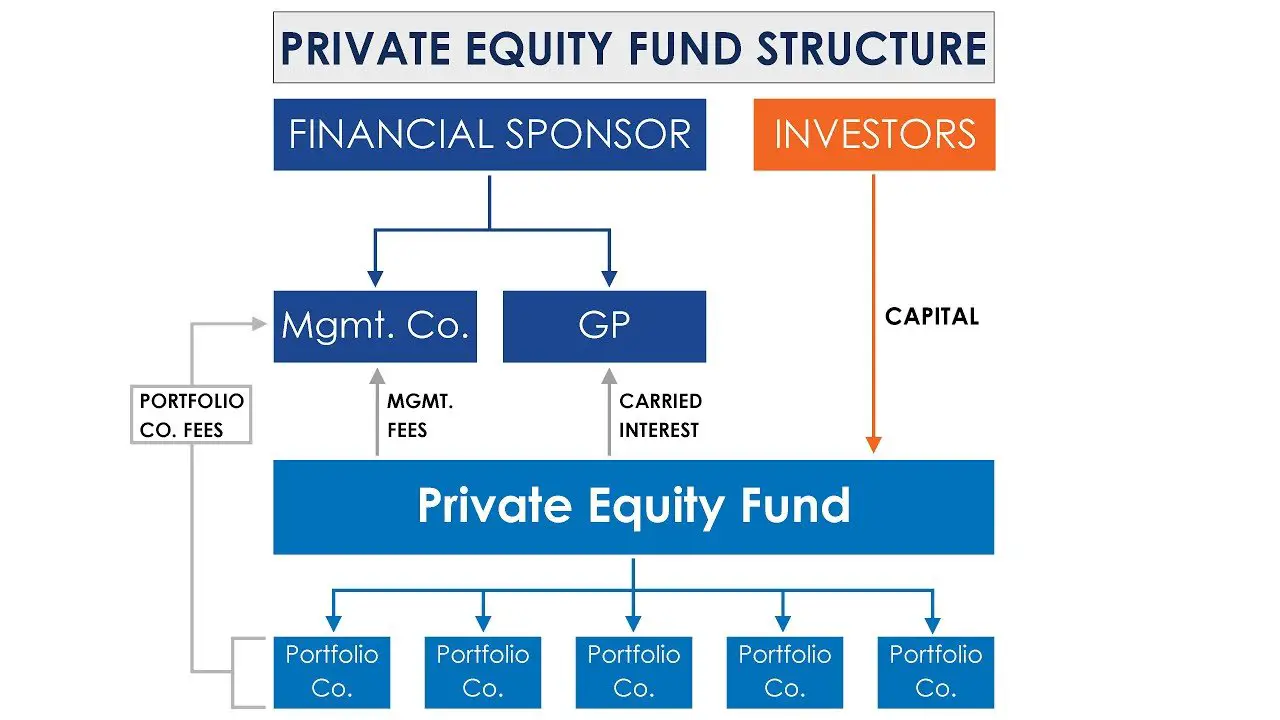

Create Multiple Streams of Income

Relying solely on one source of income can leave you vulnerable to financial hardships. Building multiple streams of income can provide stability and supplement any unexpected income loss. Here are some income diversification strategies:

- Explore passive income opportunities: Invest in rental properties, dividend-paying stocks, or peer-to-peer lending platforms that generate passive income streams.

- Start a side business or freelance: Utilize your skills or hobbies to start a small business or offer freelance services. This can provide an additional income stream.

- Invest in stocks and bonds: Consider investing in the stock market or bonds to earn dividends and interest income.

- Participate in the gig economy: Join platforms that offer gig opportunities such as ride-sharing, food delivery, or freelance work.

Invest in Insurance Protection

Insurance is a vital component of a comprehensive financial safety net. It protects you from significant financial losses due to accidents, illnesses, or unexpected events. Here are some essential insurance policies you should consider:

- Health insurance: Ensure that you have comprehensive health insurance coverage to protect yourself from high medical expenses.

- Life insurance: If you have dependents, consider purchasing life insurance to provide financial security for them in the event of your passing.

- Disability insurance: Protect your income by having disability insurance that will provide financial support if you become unable to work due to illness or injury.

- Home insurance: Safeguard your home and belongings from natural disasters, theft, or accidents with a comprehensive home insurance policy.

- Auto insurance: Protect yourself and others from car accidents by having appropriate auto insurance coverage.

Continually Review and Update Your Plan

Building a financial safety net is not a one-time task. As your life circumstances change, it’s crucial to review and update your plan regularly. Here’s what you should keep in mind:

- Monitor your savings and investments: Track your progress regularly and adjust your savings and investment strategies as needed.

- Reassess your insurance coverage: Review your insurance policies annually to ensure they adequately meet your needs.

- Stay informed: Keep yourself updated on personal finance topics and the best practices for building a financial safety net. Attend workshops, read books, or follow reputable financial blogs.

- Adjust your plan with life changes: Major life events such as marriage, divorce, having children, or changing jobs may require adjustments to your financial safety net plan.

Building a financial safety net is an ongoing process that requires careful planning and discipline. By following the steps outlined in this guide, you can establish a strong foundation and protect yourself from unexpected financial hardships. Remember, creating an emergency fund, reducing debt, diversifying your income, and investing in insurance are all essential elements of a comprehensive financial safety net. Stay proactive, adapt to changes, and prioritize your financial well-being. Start building your financial safety net today for a more secure tomorrow.

How to Have a Financial Safety Net

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start building a financial safety net?

To start building a financial safety net, you can follow these steps:

- Create a budget to track your income and expenses

- Set aside a portion of your income for savings

- Build an emergency fund to cover unexpected expenses

- Consider insurance options to protect yourself and your assets

- Invest in retirement accounts for long-term financial security

2. How much should I save for an emergency fund?

The general rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund. This can provide a financial cushion in case of job loss, medical emergencies, or unexpected expenses. However, the exact amount may vary based on your individual circumstances and comfort level.

3. Should I pay off debt before building a financial safety net?

It’s generally recommended to prioritize building a small emergency fund while simultaneously managing your debt. This way, you can have some financial backup while working towards paying off your debt. Once you have a basic safety net, you can allocate more funds towards debt repayment.

4. What are some effective strategies for saving money?

Here are a few strategies to help you save money:

- Automate your savings by setting up automatic transfers to a separate savings account

- Cut back on non-essential expenses such as eating out or subscription services

- Shop smart by comparing prices, using coupons, and looking for discounts

- Create a grocery list and stick to it to avoid unnecessary purchases

- Consider energy-efficient options to reduce utility bills

5. How can I protect myself from unexpected financial setbacks?

While it’s impossible to completely eliminate the risk of financial setbacks, there are steps you can take to protect yourself:

- Have adequate insurance coverage for health, home, auto, and other relevant areas

- Regularly review and update your insurance policies as needed

- Build a solid emergency fund to cover unexpected expenses

- Invest in your skills and education to enhance your employability

- Diversify your sources of income to reduce reliance on a single source

6. How can I make saving a habit?

Here are a few suggestions to make saving a habit:

- Set specific savings goals and track your progress

- Pay yourself first by automating regular contributions to your savings account

- Visualize the benefits and financial security that saving can provide

- Reward yourself for reaching savings milestones

- Find an accountability partner or join a savings challenge to stay motivated

7. Is it necessary to consult a financial advisor?

While not mandatory, consulting a financial advisor can provide valuable insights and guidance tailored to your specific financial situation. An advisor can help you create a personalized plan, offer investment advice, and help you navigate complex financial matters.

8. How often should I review and adjust my financial safety net?

It’s recommended to review your financial safety net periodically and make adjustments as needed. Life circumstances, goals, and financial situations can change over time, so it’s important to ensure that your savings, insurance, and investment strategies align with your current needs.

Final Thoughts

Building a financial safety net is crucial for achieving long-term financial stability. Start by creating an emergency fund, setting aside a percentage of your income each month. Make sure to reduce debt and avoid unnecessary expenses by budgeting wisely. Investing in insurance policies to protect yourself and your assets is essential. Diversify your income sources to increase financial security. Regularly review and adjust your financial plan as circumstances change. By taking these proactive steps, you can build a strong financial safety net and achieve peace of mind for the future.