Looking to apply for a mortgage loan online? You’ve come to the right place! In this article, we will guide you through the process of securing a mortgage loan from the comfort of your own home. No more long waits or endless paperwork – we will show you how to apply for a mortgage loan online quickly and efficiently. Whether you’re a first-time homebuyer or looking to refinance, we’ve got you covered. So, let’s dive in and explore the world of online mortgage applications.

How to Apply for a Mortgage Loan Online

Applying for a mortgage loan online has become increasingly popular in recent years. With the convenience and efficiency it offers, more and more people are opting to go through the mortgage application process from the comfort of their own homes. In this comprehensive guide, we will walk you through the steps of applying for a mortgage loan online, covering everything you need to know to make the process smooth and successful.

Gather All the Necessary Documents

Before you embark on the online mortgage application journey, it’s important to gather all the necessary documents. This will help streamline the process and prevent any delays in your application. Here are the key documents you’ll typically need:

- Proof of income: This can include pay stubs, W-2 forms, or income tax returns.

- Proof of employment: Lenders often require verification of your employment status, which can be done through employment letters or recent bank statements.

- Identification documents: Prepare your driver’s license, passport, or any other government-issued ID.

- Bank statements: Lenders will want to review your bank statements to assess your financial stability.

- Proof of assets: If you have any other valuable assets, such as stocks or real estate, provide relevant documentation.

- Proof of debts: Prepare any documentation related to outstanding debts, such as credit card statements or loan agreements.

Once you have gathered all these documents, you will be well-prepared to begin the online application process.

Research Lenders and Loan Options

With numerous lenders and loan options available in the online mortgage market, it’s crucial to conduct thorough research before making any decisions. Different lenders may offer varying interest rates, loan terms, and eligibility criteria. Take the time to compare lenders and explore the loan options they provide to ensure you find the best fit for your needs.

Consider the following factors during your research:

- Interest rates: Look for lenders offering competitive interest rates that align with your financial situation.

- Loan terms: Assess the different loan terms available, such as fixed-rate or adjustable-rate mortgages, and determine which would be most suitable for your circumstances.

- Customer reviews: Read reviews and testimonials about the lenders you are considering to get a sense of their reputation and customer satisfaction.

- Additional fees: Inquire about any additional fees associated with the loan, such as closing costs or origination fees.

- Loan programs: Explore any specialized loan programs the lender offers, such as first-time homebuyer programs or VA loans.

By conducting thorough research, you can make an informed decision about the lender and loan that best aligns with your goals.

Use Online Mortgage Calculators

Before diving into the application process, take advantage of online mortgage calculators to gain a better understanding of your financial position and potential loan options. These calculators can help you estimate monthly mortgage payments, determine affordability, and evaluate different scenarios based on interest rates and loan terms.

Here are some key calculations you can make using online mortgage calculators:

- Monthly payments: Enter the loan amount, interest rate, and loan term to calculate your estimated monthly payments.

- Affordability: Input your income, down payment amount, and monthly debt obligations to determine the price range of homes you can afford.

- Refinancing options: If you are considering refinancing an existing mortgage, use the calculator to assess how different interest rates and terms could impact your monthly payments.

- Amortization schedule: Generate an amortization schedule to visualize how your mortgage payments will be divided between principal and interest over the life of the loan.

By utilizing online mortgage calculators, you can gain valuable insights that will help guide your decision-making process.

Complete the Online Application

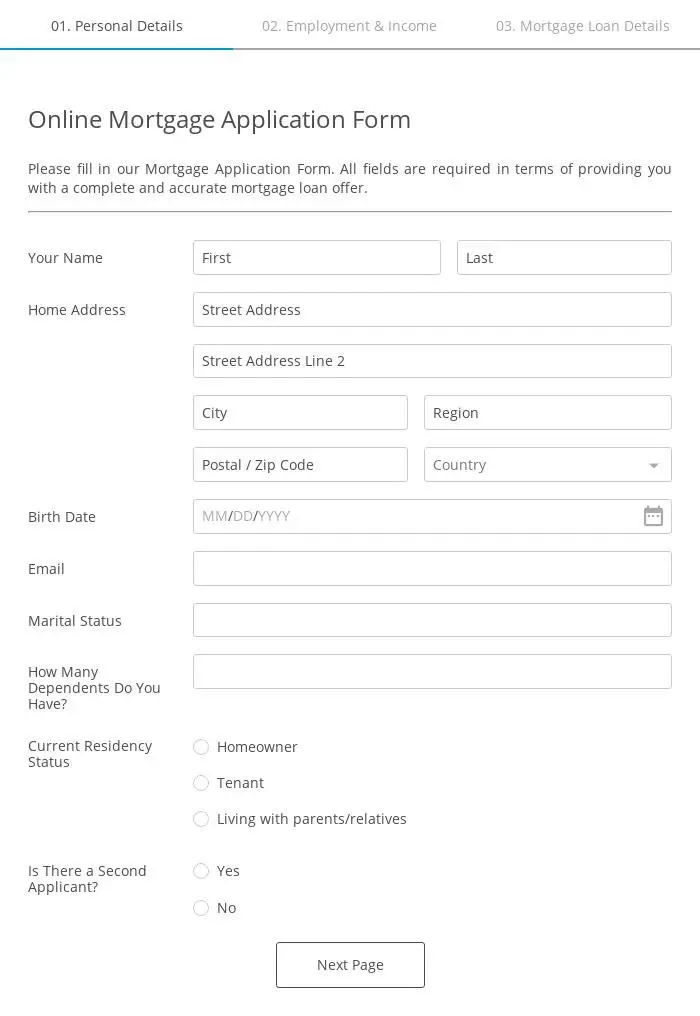

Once you have gathered your documents, researched lenders, and used mortgage calculators to assess your financial position, it’s time to complete the online application. This step-by-step process may differ slightly depending on the lender, but here are the general stages you can expect:

1. Create an Account

Most online lenders will require you to create an account before initiating the application process. This involves providing basic personal information such as your name, contact details, and social security number. Create a strong password to protect your account information.

2. Provide Personal and Financial Information

After creating an account, you will need to provide detailed personal and financial information. This typically includes:

- Personal details: Fill in your date of birth, current address, and any previous addresses you have had within the past few years.

- Employment information: Input your current employment details, including the name of your employer, job title, and duration of employment.

- Financial information: Provide accurate information about your income, assets, and debts. This helps lenders assess your financial stability and determine the loan amount you qualify for.

Make sure to double-check all the details you enter to avoid any errors that could potentially delay your application.

3. Submit Supporting Documents

Once you have provided your personal and financial information, you will be prompted to upload all the supporting documents you gathered earlier. Follow the instructions carefully to ensure proper submission.

4. Agree to Terms and Conditions

Before finalizing your application, carefully review and agree to the lender’s terms and conditions. These will outline the loan agreement, interest rates, repayment terms, and any additional fees associated with the mortgage.

5. Submit the Application

Finally, submit your completed application. After submission, you will receive confirmation and an application reference number. Keep this number handy for future reference and communication with the lender.

Stay Organized and Responsive

Once you have submitted your application, it’s important to stay organized and responsive throughout the process. Here are some tips to keep in mind:

- Monitor your email: Check your email regularly for updates and requests for additional information from the lender. Promptly respond to any inquiries to avoid delays.

- Track your application status: Most online lenders provide a tracking system, allowing you to monitor the progress of your application. Take advantage of this feature to stay informed.

- Communicate with your lender: If you have any questions or concerns, don’t hesitate to reach out to your lender for clarification. Clear communication can help ensure a smooth and efficient application process.

- Be proactive: If you come across any issues or discrepancies during the application process, address them immediately. Proactive action can prevent potential roadblocks and expedite the approval process.

By staying organized, responsive, and proactive, you can navigate the online mortgage application process with confidence.

Applying for a mortgage loan online offers convenience and flexibility, allowing you to complete the application process at your own pace. By gathering the necessary documents, conducting thorough research, utilizing online mortgage calculators, and completing the online application accurately, you can increase your chances of securing a mortgage loan that aligns with your goals. Stay organized, responsive, and proactive throughout the process for a smooth and efficient experience. Now you are equipped with the knowledge and tools to confidently apply for a mortgage loan online. Happy house hunting!

Applying For A Mortgage 2023

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I apply for a mortgage loan online?

To apply for a mortgage loan online, you can follow these steps:

What documents do I need to apply for a mortgage loan online?

When applying for a mortgage loan online, you will typically need the following documents:

Is it safe to apply for a mortgage loan online?

Yes, applying for a mortgage loan online can be safe if you take certain precautions:

How long does the online mortgage loan application process take?

The duration of the online mortgage loan application process can vary depending on several factors:

What information do I need to provide in the online mortgage loan application?

When filling out an online mortgage loan application, you will be required to provide various information:

Can I apply for a mortgage loan online if I have bad credit?

Yes, it is possible to apply for a mortgage loan online even if you have bad credit:

Can I apply for a mortgage loan online if I am self-employed?

Yes, you can apply for a mortgage loan online if you are self-employed:

What happens after I submit my online mortgage loan application?

After submitting your online mortgage loan application, the lender will typically take the following steps:

Final Thoughts

In today’s digital age, applying for a mortgage loan online has never been easier. By following a few simple steps, you can streamline the application process and save time and effort. Start by researching and comparing different lenders to find the best rates and terms. Next, gather all of the necessary documents, such as income verification and bank statements. Once you have everything in order, fill out the online application accurately and submit it. Finally, be prepared to provide any additional information or answer any questions that may arise during the review process. By mastering the art of applying for a mortgage loan online, you can take advantage of the convenience and efficiency it offers. So, if you’re looking to secure your dream home, look no further! Apply for a mortgage loan online today.