A financial analyst plays a crucial role in the world of finance. They are experts who assess, analyze, and interpret financial data to provide valuable insights and recommendations to businesses and individuals. So, what exactly is a financial analyst and what do they do? In simple terms, a financial analyst is a professional who helps organizations and individuals make informed financial decisions. Their roles involve conducting extensive research, evaluating investment opportunities, preparing financial reports, and offering strategic guidance to achieve financial goals. In this article, we’ll delve deeper into the world of financial analysts, exploring their responsibilities and the skills required to excel in this field. Let’s get started!

What is a Financial Analyst and Their Roles

Financial analysts play a crucial role in the world of finance. They are skilled professionals who help individuals, businesses, and institutions make informed decisions regarding investments, financial planning, and risk management. In this article, we will explore what a financial analyst does, the skills required to excel in this field, and the various roles they play in different sectors.

The Role of a Financial Analyst

Financial analysts primarily analyze financial data and provide insights and recommendations to guide decision-making. Their work involves conducting thorough research, interpreting financial statements, and assessing market trends. They use their expertise to offer valuable advice on investment opportunities, financial strategies, and risk management practices. Here are some key responsibilities of a financial analyst:

1. Financial Planning and Analysis

Financial analysts help individuals and businesses plan their financial future by creating comprehensive financial plans. They analyze income and expenses, evaluate assets and liabilities, and develop strategies to optimize cash flow. This includes forecasting financial performance, identifying areas for improvement, and providing recommendations to achieve financial goals.

2. Investment Analysis and Portfolio Management

Financial analysts evaluate investment options and assess the potential risks and returns associated with different securities, such as stocks, bonds, and mutual funds. They conduct thorough research on companies, industries, and market trends to identify investment opportunities. They also monitor and manage investment portfolios, making adjustments as needed to maximize returns and minimize risks.

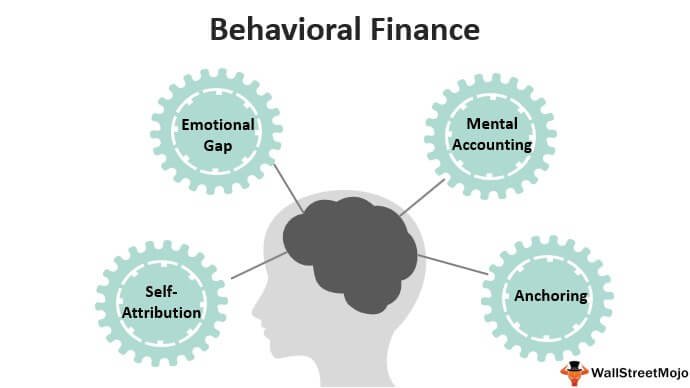

3. Risk Assessment and Management

Financial analysts assess and manage risks that individuals, businesses, and institutions may face. They analyze financial data, market conditions, and industry trends to identify potential risks and develop strategies to mitigate them. This involves evaluating factors such as credit risk, market risk, liquidity risk, and operational risk to ensure financial stability and security.

4. Financial Modeling and Forecasting

Financial analysts use financial models and statistical techniques to make accurate financial forecasts. They analyze historical data, market trends, and economic indicators to predict future financial performance. These forecasts are crucial in making informed decisions regarding budgeting, strategic planning, and investment opportunities.

5. Mergers and Acquisitions

Financial analysts play a vital role in the mergers and acquisitions (M&A) process. They assess the financial viability of potential mergers or acquisitions by conducting due diligence, analyzing financial statements, and evaluating the synergy between the involved entities. Their analysis helps determine the value of the deal and identifies potential risks or opportunities.

Skills Required to Excel as a Financial Analyst

Being a financial analyst requires a specific skill set that combines analytical expertise, financial knowledge, and strong communication abilities. Here are some essential skills needed to excel in this field:

1. Financial Analysis

Financial analysts must possess strong analytical skills to interpret complex financial data, identify trends, and make accurate projections. They need to have a deep understanding of financial concepts, ratios, and valuation methods to assess investment opportunities and recommend strategies.

2. Critical Thinking

Critical thinking is crucial for financial analysts as they need to analyze information from multiple sources, consider different perspectives, and make sound judgments. They must be able to identify potential risks, evaluate various solutions, and make informed decisions that align with their clients’ or organizations’ objectives.

3. Problem-Solving

Financial analysts often encounter complex financial problems that require innovative solutions. They must be skilled problem solvers who can think creatively, develop alternative strategies, and adapt to evolving market conditions. Effective problem-solving skills enable them to navigate challenges and guide their clients toward financial success.

4. Communication and Presentation

Strong communication skills are essential for financial analysts to effectively convey complex financial information to clients, colleagues, and stakeholders. They must be able to explain their analysis, recommendations, and forecasts in a clear and concise manner. Additionally, they need to be proficient in presenting their findings through reports, presentations, and visual aids.

5. Technology and Data Analysis

Financial analysts must be proficient in using financial software, data analysis tools, and spreadsheets to analyze large sets of data efficiently. They need to stay updated with the latest technological advancements and leverage automation and artificial intelligence tools to streamline their analytical processes.

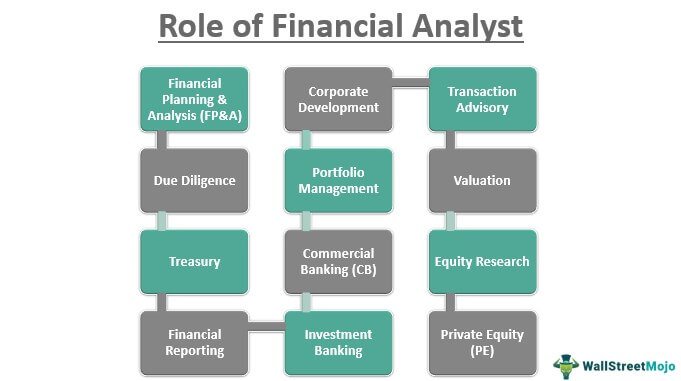

The Different Roles of Financial Analysts

Financial analysts work in various sectors and industries, each requiring specific skills and expertise. Here are some common roles of financial analysts:

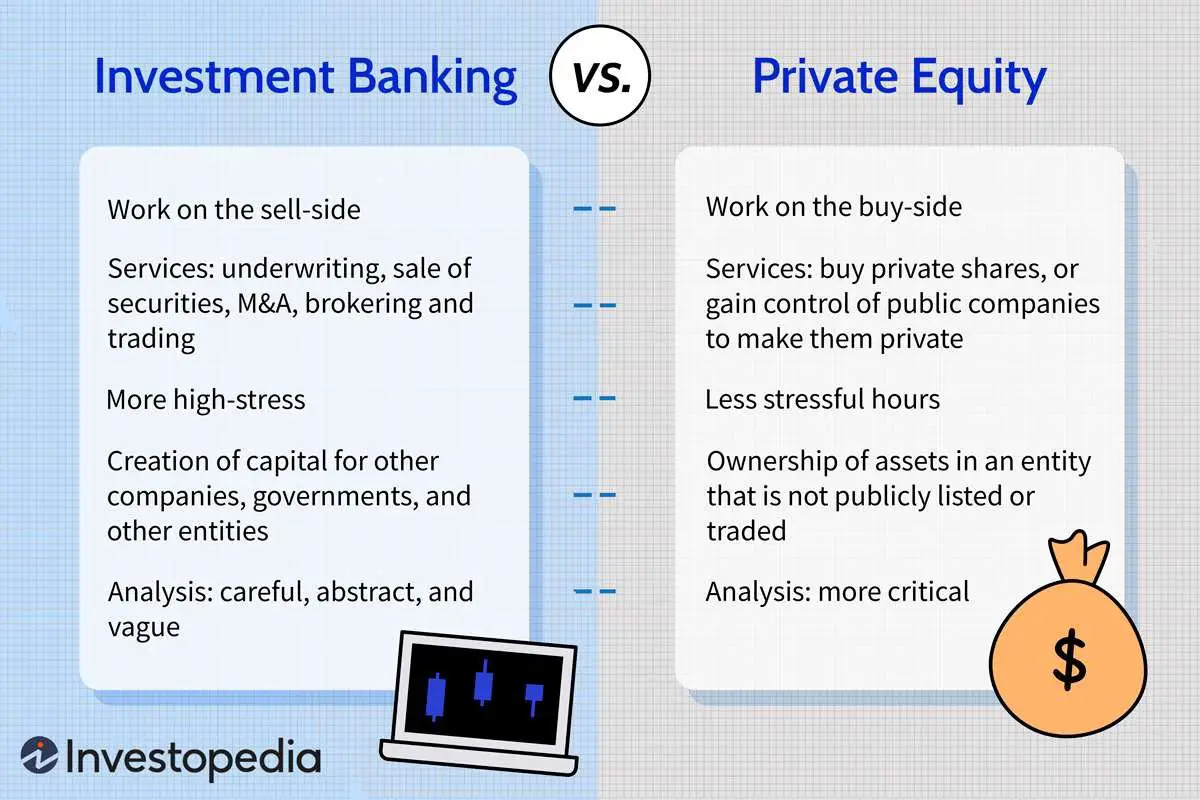

1. Investment Banking

Financial analysts in investment banking assist clients in raising capital, structuring financial deals, and providing merger and acquisition advisory services. They analyze financial data, prepare valuation models, and develop investment recommendations. They work closely with investment bankers, traders, and other financial professionals to execute financial transactions.

2. Corporate Finance

Financial analysts in corporate finance work within companies to manage financial planning, budgeting, and forecasting. They analyze financial statements, perform cost-benefit analyses, and make strategic recommendations to optimize financial performance. They play a crucial role in capital budgeting decisions, evaluating investment proposals, and managing the company’s financial resources.

3. Wealth Management

Financial analysts in wealth management assist individuals and families in managing their investments and financial assets. They develop personalized investment strategies, analyze market trends, and provide recommendations to help clients achieve their financial goals. They monitor investment portfolios, assess risk tolerance, and provide ongoing financial guidance.

4. Research and Analysis

Financial analysts in research and analysis roles work for financial institutions, research firms, or investment companies. They conduct in-depth research on companies, industries, and market trends to provide insights and recommendations to clients or internal stakeholders. Their analysis helps clients make informed investment decisions or guides internal investment strategies.

5. Risk Management

Financial analysts in risk management assess and manage potential risks faced by financial institutions, insurance companies, or corporate entities. They identify and analyze risks, develop risk mitigation strategies, and ensure compliance with regulatory frameworks. Their work helps organizations safeguard their financial stability and protect against potential losses.

In conclusion, financial analysts are indispensable professionals who provide valuable insights and recommendations to individuals, businesses, and institutions. They play diverse roles in financial planning, investment analysis, risk management, and strategic decision-making. With their analytical skills, financial knowledge, and critical thinking abilities, financial analysts contribute to the success and stability of the financial world.

What Does a Financial Analyst Do

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a financial analyst?

A financial analyst is a professional who assesses the financial health and performance of companies and individuals. They analyze financial data, prepare reports, and provide recommendations to guide investment decisions.

What are the roles of a financial analyst?

The roles of a financial analyst include:

– Conducting financial research and analysis to support business decisions.

– Evaluating the performance of investments and making recommendations.

– Creating financial models and forecasts.

– Assessing the financial risks and opportunities of an organization.

– Presenting findings and insights to stakeholders.

– Monitoring financial trends and market conditions.

– Collaborating with other teams to develop financial strategies.

– Providing guidance on budgeting and cost control.

What skills are required to be a financial analyst?

To be a successful financial analyst, you need the following skills:

– Strong analytical and critical thinking abilities.

– Proficiency in financial modeling and data analysis.

– Solid understanding of financial markets and investment strategies.

– Excellent communication and presentation skills.

– Knowledge of accounting principles and financial regulations.

– Attention to detail and accuracy in financial analysis.

– Ability to work with complex datasets and use financial software.

– Good problem-solving and decision-making skills.

What educational qualifications are necessary to become a financial analyst?

Typically, a bachelor’s degree in finance, economics, or a related field is required to become a financial analyst. Some positions may also require a master’s degree in finance or business administration. Additionally, obtaining professional certifications like the Chartered Financial Analyst (CFA) designation can enhance career prospects.

What industries employ financial analysts?

Financial analysts are employed in various industries, including:

– Banking and financial services

– Investment firms and asset management companies

– Insurance companies

– Consulting firms

– Corporate finance departments

– Government agencies

– Non-profit organizations

What is the career outlook for financial analysts?

The career outlook for financial analysts is positive, with a projected growth rate of 5% from 2019 to 2029, according to the U.S. Bureau of Labor Statistics. The demand for financial analysts is driven by the need for expertise in investment and risk management.

Are financial analysts the same as financial advisors?

No, financial analysts and financial advisors have distinct roles. While financial analysts primarily focus on analyzing financial data and providing insights and recommendations, financial advisors work directly with clients to provide personalized financial planning and investment advice.

Can a financial analyst become a portfolio manager?

Yes, the role of a financial analyst can serve as a stepping stone toward a career as a portfolio manager. Financial analysts who gain experience and expertise in investment analysis and portfolio management can progress to portfolio manager positions, where they are responsible for managing investment portfolios for clients or organizations.

Final Thoughts

A financial analyst plays a crucial role in the financial industry by evaluating financial data, providing insights, and making recommendations to support decision-making. They analyze financial statements, market trends, and economic conditions to assess the performance and potential risks of companies, industries, and investment opportunities. Additionally, they create financial models, forecast future outcomes, and communicate their findings and recommendations to key stakeholders. Financial analysts also play a role in mergers and acquisitions, investment management, and risk assessment. In summary, a financial analyst is responsible for analyzing financial data and providing insights to guide strategic and investment decisions in various sectors.