Looking to improve your day trading skills and maximize your profits? Look no further! In this blog article, we will show you how to avoid common pitfalls in day trading. By following these simple yet effective strategies, you can navigate the volatile world of day trading with confidence and make informed decisions. With our helpful tips and expert guidance, you’ll be well on your way to becoming a successful day trader. So, let’s dive right in and discover how to avoid common pitfalls in day trading!

How to Avoid Common Pitfalls in Day Trading

Day trading can be an exciting and potentially profitable venture for those who have a knack for reading the markets and making quick decisions. However, it’s important to approach day trading with caution, as there are several common pitfalls that can trip up even the most experienced traders. In this article, we’ll explore some of these pitfalls and provide practical tips on how to avoid them.

1. Lack of Proper Education and Preparation

One of the biggest mistakes that many day traders make is diving into the market without a solid understanding of how it works. Trading stocks, currencies, or commodities requires a deep knowledge of the market dynamics, technical analysis, and risk management strategies. To avoid this pitfall, consider the following:

- Educate yourself: Take the time to study and learn the basics of day trading. There are numerous books, online courses, and webinars available that can help you gain a solid foundation of knowledge.

- Practice with a demo account: Most reputable trading platforms offer a demo account that allows you to test your strategies without risking real money. Use this opportunity to practice and refine your skills before trading with real capital.

- Develop a trading plan: A well-defined trading plan outlines your goals, risk tolerance, entry and exit strategies, and money management rules. Stick to your plan and avoid impulsive trades based on emotions or rumors.

2. Overtrading and Impulsive Decisions

Day traders are often tempted to make frequent trades in search of quick profits. However, overtrading can lead to poor decision-making and increased transaction costs. Here’s how you can avoid this pitfall:

- Set realistic goals: Avoid the mindset of getting rich overnight. Instead, focus on consistent profits over time. Set daily, weekly, or monthly targets that align with your risk tolerance and overall trading strategy.

- Stick to your strategy: Define a clear set of rules that govern your trading decisions. This includes specific entry and exit points, stop-loss orders, and profit targets. Avoid deviating from your strategy based on short-term market fluctuations or rumors.

- Control your emotions: Emotional trading can cloud your judgment and lead to impulsive decisions. Learn to control your emotions, such as fear and greed, by sticking to your predetermined plan and avoiding knee-jerk reactions.

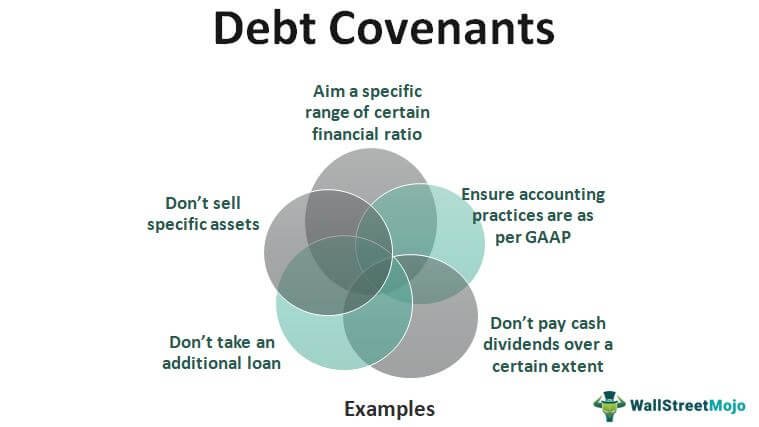

3. Lack of Risk Management

Risk management is crucial in day trading. Without effective risk management strategies, you run the risk of wiping out your entire trading capital. Consider the following tips to mitigate risk:

- Set stop-loss orders: A stop-loss order automatically sells your position when the price reaches a predetermined level. This helps limit potential losses and protects your capital.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your trading portfolio by investing in different markets, sectors, or asset classes. This can help reduce the impact of individual trade losses.

- Use proper position sizing: Determine the appropriate position size for each trade based on your risk tolerance and the size of your trading account. Avoid risking too much of your capital on a single trade.

- Monitor and adjust risk: Regularly review and adjust your risk management strategies as needed. As your trading capital grows or market conditions change, it’s important to reassess and adapt your risk tolerance and position sizing accordingly.

4. Poor Record-Keeping and Analysis

Keeping detailed records of your trades and analyzing the data is essential for improving your trading skills and identifying patterns and trends. Here’s what you should do:

- Maintain a trading journal: Record all your trades, including entry and exit points, profit or loss, and the reasons behind your decisions. This will help you identify recurring mistakes or successful strategies.

- Analyze your trades: Regularly review your trading journal and look for patterns or trends. Identify what worked and what didn’t, and adjust your strategies accordingly.

- Use technical analysis tools: Utilize technical analysis indicators, charts, and patterns to uncover potential opportunities and make more informed trading decisions.

- Learn from your mistakes: Don’t be discouraged by losses or mistakes. Instead, view them as learning opportunities. Analyze your unsuccessful trades to identify the reasons behind them and develop strategies to avoid similar mistakes in the future.

5. Ignoring Market Trends and News

Day traders need to stay informed about market trends, news, and events that can influence the markets. Ignoring these factors can lead to missed opportunities or unexpected losses. Follow these guidelines:

- Stay updated: Regularly read financial news and market reports to stay informed about the latest trends, economic indicators, and company news that could impact the markets.

- Follow key technical indicators: Pay attention to key technical analysis indicators, such as moving averages, support and resistance levels, and volume patterns, to identify potential entry or exit points.

- Use a real-time news feed: Consider subscribing to a real-time news feed or using a trading platform that provides timely news updates. This will allow you to react quickly to market-moving events.

- Be cautious of rumors: Verify any market rumors or tips before acting on them. Rely on credible sources and perform your own due diligence before making trading decisions.

By being aware of these common pitfalls and implementing the suggested strategies, you can significantly increase your chances of success in day trading. Remember, patience, discipline, and continuous learning are key to avoiding these pitfalls and becoming a consistently profitable day trader.

The 6 Biggest Trading Mistakes You're Probably Making

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I avoid common pitfalls in day trading?

To avoid common pitfalls in day trading, it is important to educate yourself about the market, develop a solid trading strategy, set realistic goals, manage risk effectively, and continuously adapt and learn from your experiences. It is also crucial to avoid emotional decision-making, overtrading, and relying solely on tips or rumors.

2. What are some common pitfalls I should be aware of in day trading?

Some common pitfalls in day trading include chasing hot stocks, not having a clear exit strategy, failing to use stop-loss orders, trading without a plan, and not properly managing your emotions. It is important to be aware of these pitfalls to avoid unnecessary losses.

3. How can I educate myself about day trading to avoid pitfalls?

To educate yourself about day trading, you can start by reading books, attending seminars or webinars, taking online courses, and following reputable trading blogs or forums. It is essential to gain knowledge about technical and fundamental analysis, risk management, and trading psychology.

4. Is it necessary to have a trading strategy to avoid pitfalls in day trading?

Yes, having a well-defined trading strategy is crucial to avoid pitfalls in day trading. Your strategy should include entry and exit rules, risk management guidelines, and criteria for selecting trades. Following a strategy helps you stay disciplined, avoid impulsive decisions, and increase your chances of success.

5. How can I set realistic goals to avoid pitfalls in day trading?

Setting realistic goals in day trading involves considering factors such as your capital, experience, and time commitment. It is important to set achievable profit targets and not get carried away by unrealistic expectations. By setting realistic goals, you can maintain a focused and disciplined approach in your trading activities.

6. What role does risk management play in avoiding pitfalls in day trading?

Risk management is vital in day trading to avoid significant losses. It involves determining the amount of capital you are willing to risk per trade, setting stop-loss orders to limit losses, and diversifying your portfolio. Implementing effective risk management strategies helps protect your trading capital and minimizes the impact of potential pitfalls.

7. How should I handle my emotions to avoid pitfalls in day trading?

Handling emotions is crucial in day trading to avoid impulsive and irrational decision-making. It is essential to stay disciplined, follow your trading plan, and not let fear or greed dictate your actions. Developing emotional awareness, practicing mindfulness, and taking regular breaks can also help in managing emotions effectively.

8. Can relying on tips or rumors lead to pitfalls in day trading?

Yes, relying solely on tips or rumors can be a common pitfall in day trading. It is important to verify information independently and conduct thorough research before making any trading decisions. Relying on your own analysis and having a solid understanding of market dynamics is key to avoiding pitfalls caused by unfounded tips or rumors.

Final Thoughts

In day trading, avoiding common pitfalls is crucial for success. Firstly, setting realistic expectations is key. Understanding that day trading carries risks and requires dedication is essential. Secondly, developing a well-defined strategy and sticking to it helps to avoid impulsive decisions. A disciplined approach includes thorough research, managing risk, and setting stop-loss orders. Thirdly, maintaining emotional control is vital. Emotions can cloud judgment and lead to costly mistakes. Finally, continuously learning and adapting to market trends ensures staying ahead. By embracing these practices, day traders can navigate the unpredictable nature of the market and avoid common pitfalls in day trading.