Running a small business can be both challenging and rewarding. One common concern that all entrepreneurs face is maintaining a healthy cash flow. After all, cash flow is the lifeblood of any business. But worry not! In this article, we will provide you with practical tips for improving your small business cash flow. From effective invoicing strategies to smart expense management, we have got you covered. So, let’s dive right in and explore the key techniques that can help you secure a steady and sustainable flow of funds for your business.

Tips for Improving Your Small Business Cash Flow

Running a small business comes with numerous challenges, and managing cash flow is often at the top of the list. Cash flow refers to the movement of money in and out of your business, and it is crucial for sustaining day-to-day operations, profitability, and growth. A healthy cash flow ensures you can pay your bills, invest in your business, and weather any unexpected financial storms. In this article, we will explore practical and effective tips to help you improve your small business cash flow.

1. Monitor and Forecast Cash Flow Regularly

To effectively manage your cash flow, you must have a clear understanding of your current financial position and anticipate potential cash shortages. Regularly monitor and forecast your cash flow by analyzing your historical financial data, including sales revenue, expenses, and payment cycles. This will enable you to identify patterns, discover trends, and make informed decisions about your business.

Consider using cash flow management tools or software that can automate the process for you. These tools can provide real-time insights into your cash flow, generate forecasts, and help you identify potential cash flow gaps before they become critical.

2. Improve Invoicing and Payment Processes

Late payments from customers can significantly disrupt your cash flow. Implementing efficient invoicing and payment processes can minimize payment delays and improve your cash flow. Here are some best practices to consider:

- Standardize your invoicing process: Use a consistent format and include all necessary details, such as due dates, payment terms, and accepted payment methods.

- Send invoices promptly: Issue invoices as soon as the products or services are delivered. Delaying invoicing can lead to late payments.

- Offer multiple payment options: Provide your customers with various payment methods, including online payment gateways, credit cards, and bank transfers.

- Follow up on overdue payments: Implement a systematic approach to remind customers of their outstanding invoices. Send reminders via email or make friendly phone calls to ensure timely payments.

3. Negotiate Favorable Payment Terms

Negotiating favorable payment terms with your suppliers can have a positive impact on your cash flow. Longer payment terms can provide you with more time to generate revenue before paying your bills. Consider the following strategies:

- Request extended payment terms: Approach your suppliers and negotiate longer payment terms without incurring additional costs or penalties.

- Negotiate early payment discounts: Conversely, negotiate discounts with suppliers for early or prompt payments. This can incentivize faster payments and potentially improve your cash flow.

- Consider installment payments: If negotiating extended payment terms is not possible, explore the option of installment payments to spread out the cash outflows over a specific period.

4. Control Expenses Proactively

Controlling expenses is essential for maintaining a healthy cash flow. Explore ways to reduce costs without compromising the quality of your products or services. Here are some strategies to consider:

- Review recurring expenses: Analyze your recurring expenses regularly to identify potential savings. Consider renegotiating contracts, switching to cheaper alternatives, or eliminating unnecessary services.

- Negotiate with suppliers: Negotiate better pricing or discounts with your suppliers to reduce the cost of raw materials or other inputs.

- Monitor inventory levels: Optimize your inventory management to avoid overstocking or running out of crucial items. Excess inventory ties up your cash, while stockouts can result in missed sales opportunities.

- Implement cost-saving initiatives: Encourage your employees to suggest cost-saving ideas and reward them for successful initiatives.

5. Regularly Review Pricing and Profit Margins

Pricing your products or services appropriately plays a significant role in cash flow management. Regularly review your pricing strategy and profit margins to ensure they align with your business objectives and market conditions. Consider the following approaches:

- Conduct market research: Stay updated on market trends, competitor pricing, and customer preferences to determine if your prices are competitive.

- Reevaluate your profit margins: Analyze your profit margins to ensure they cover your expenses and provide the desired level of profitability.

- Consider tiered pricing or upselling: Introduce tiered pricing or upsell additional services or features to increase the average transaction value and boost your revenue.

- Offer seasonal promotions: Implement seasonal promotions or discounts strategically to stimulate sales and generate cash flow during slower periods.

6. Consider Financing Options

In some instances, accessing additional funding or financing can help improve your cash flow. Consider the following options:

- Small business loans: Explore loan options from banks or alternative lenders to bridge temporary cash flow gaps or fund business expansion.

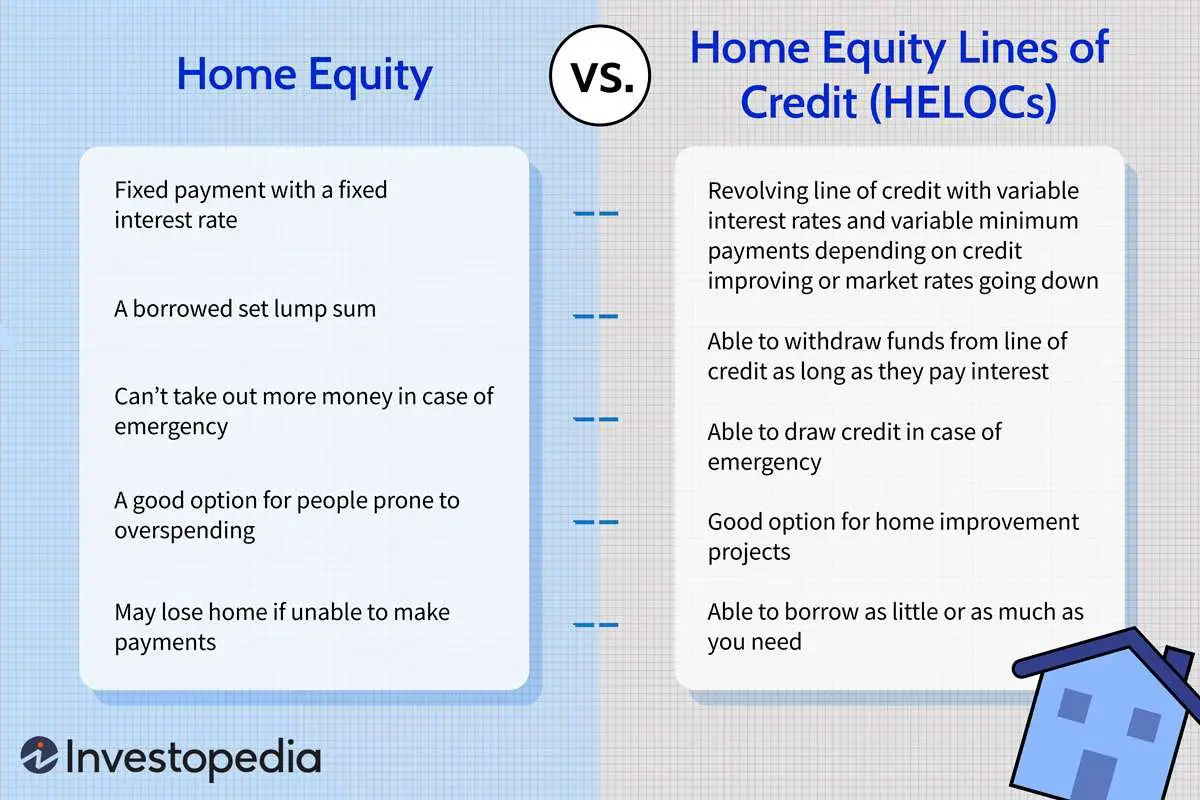

- Business lines of credit: Establish a business line of credit that provides access to funds whenever needed. This can help you manage unexpected expenses or temporary declines in cash flow.

- Invoice financing or factoring: Utilize invoice financing or factoring services to receive immediate payment for your outstanding invoices, eliminating the waiting period for customer payments.

- Asset-based lending: Leverage your business assets, such as inventory or equipment, to secure a loan or line of credit.

7. Build Strong Relationships with Customers and Suppliers

Nurturing strong relationships with your customers and suppliers can have a positive impact on your cash flow. Here’s how:

- Offer excellent customer service: Providing exceptional customer service can foster loyalty and encourage timely payments.

- Establish mutually beneficial partnerships: Cultivate partnerships with reliable suppliers who offer favorable payment terms, discounts, or other advantages that improve your cash flow.

- Encourage early payments: Consider offering incentives, such as discounts or rewards, for customers who make early or prompt payments.

- Communicate openly: Maintain open lines of communication with your customers and suppliers. Address any issues or concerns promptly to avoid payment delays or disruptions in the supply chain.

8. Seek Professional Advice

Managing cash flow effectively can be complex, especially as your small business grows. Consider seeking professional advice from accountants, financial advisors, or business consultants. They can provide valuable insights, recommend personalized strategies, and help you navigate through challenging financial situations.

Implementing these tips to improve your small business cash flow requires ongoing discipline, monitoring, and adaptability. By taking proactive steps to manage your cash flow effectively, you can create a more stable and financially secure future for your business.

The Secret to Improving Your Small Business' Cash Flow

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I improve cash flow for my small business?

To improve cash flow for your small business, you can implement a few strategies such as negotiating better payment terms with suppliers, incentivizing early payments from customers, reducing unnecessary expenses, and closely monitoring your cash flow statements.

2. Is it important to have a cash flow forecast for my small business?

Yes, having a cash flow forecast is crucial for managing your small business’s finances effectively. It allows you to anticipate and plan for any upcoming cash shortages or surpluses, enabling you to make informed decisions to keep your business running smoothly.

3. What are some effective ways to speed up customer payments?

To speed up customer payments, consider offering discounts for early payments or implementing late payment fees. Additionally, sending out timely and accurate invoices, following up with customers, and providing multiple payment options can also encourage faster payments.

4. How can I reduce expenses to improve cash flow?

To reduce expenses and improve cash flow, you can analyze your current spending patterns, negotiate better deals with suppliers, explore cost-saving alternatives, and streamline your business processes to eliminate inefficiencies. Regularly reviewing and adjusting your budget can also help you identify areas where you can cut back on expenses.

5. Should I consider applying for a business line of credit?

Applying for a business line of credit can be a wise decision to manage cash flow gaps during lean periods or when unexpected expenses arise. It provides you with a flexible source of financing that you can tap into when needed, helping you maintain a steady cash flow for your small business.

6. How can I better manage my accounts receivable?

To effectively manage your accounts receivable, you can establish clear payment terms and policies, send regular reminders for overdue payments, offer incentives for early payments, and consider implementing an automated billing and invoicing system to streamline the process.

7. What role does inventory management play in improving cash flow?

Proper inventory management plays a significant role in improving cash flow as it helps prevent excess inventory and stockouts. By optimizing your inventory levels, implementing just-in-time ordering, and monitoring inventory turnover, you can reduce holding costs and improve your cash flow.

8. How often should I review my cash flow statements?

It is advisable to review your cash flow statements regularly, preferably on a monthly basis. By monitoring your cash flow statements, you can identify any recurring patterns, spot potential cash flow issues in advance, and make necessary adjustments to ensure your small business’s financial stability.

Final Thoughts

In order to improve your small business cash flow, it is crucial to implement effective strategies. Firstly, closely monitor your expenses and focus on reducing unnecessary costs. Secondly, incentivize timely payments by offering discounts or implementing late fees. Additionally, consider negotiating better terms with your suppliers. Furthermore, regularly review and adjust your pricing to ensure profitability. Lastly, invest in marketing efforts to attract new customers and retain existing ones. By following these tips for improving your small business cash flow, you can enhance your financial stability and success.