Are you curious about what exactly a value stock is and what characteristics it possesses? Look no further! In this article, we will delve into the world of value stocks and explore their unique qualities. So, what is a value stock and its characteristics? Essentially, a value stock is a type of investment that is considered to be undervalued by the market. These stocks often have strong fundamentals but are priced lower than their intrinsic value. By identifying and investing in value stocks, you have the potential to capitalize on their eventual increase in worth. Now, let’s delve deeper into the characteristics that define a value stock and uncover the secrets behind their allure.

What is a Value Stock and Its Characteristics

Investing in stocks can be a daunting task, especially for those new to the world of finance. With so many different types of stocks to choose from, it’s important to understand the characteristics and potential benefits of each. One popular type of stock that investors often turn to is value stocks. In this article, we will explore what exactly a value stock is and its key characteristics that make it an attractive option for many investors.

Understanding Value Stocks

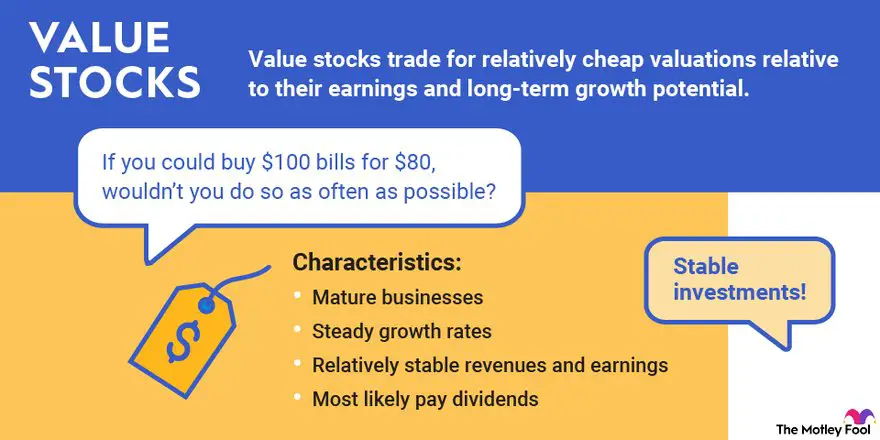

Before diving into the characteristics of value stocks, let’s first define what they are. A value stock is a stock that is considered to be undervalued in the market. In other words, the stock is trading at a price that is lower than its intrinsic value, or what it is truly worth. Value investors believe that the market has overlooked or misunderstood the potential of these undervalued stocks, presenting an opportunity for profit.

Value stocks are typically found in industries or sectors that are out of favor or facing challenges. These companies may have experienced temporary setbacks or are simply not in the spotlight, but they still possess strong fundamentals that suggest they are likely to rebound in the future. This presents an opportunity for investors to buy these stocks at a discount.

Key Characteristics of Value Stocks

Now that we have a general understanding of what value stocks are, let’s take a closer look at their key characteristics:

1. Low Price-to-Earnings (P/E) Ratio

A significant characteristic of value stocks is their low price-to-earnings (P/E) ratio. The P/E ratio is calculated by dividing the current stock price by its earnings per share (EPS). A low P/E ratio indicates that the stock is trading at a lower price relative to its earnings potential. This suggests that the stock may be undervalued and presents an opportunity for investors to purchase it at a bargain.

2. High Dividend Yield

Another common characteristic of value stocks is a high dividend yield. Dividend yield is calculated by dividing the annual dividend payment by the stock price. Value stocks often pay higher dividends compared to growth stocks because they are typically more established and generate consistent cash flow. These dividends can provide investors with a steady income stream, making value stocks an attractive option for income-seeking investors.

3. Strong Fundamentals

Value stocks are known for their strong fundamentals. These companies often have solid balance sheets, consistent cash flow, and a history of profitability. While they may be facing temporary challenges or operating in industries that are currently out of favor, their underlying financial health suggests that they have the potential to rebound in the future. Value investors look for companies with strong fundamentals and believe that the market will eventually recognize their true value.

4. Low Price-to-Book (P/B) Ratio

The price-to-book (P/B) ratio is another important characteristic of value stocks. It compares a company’s stock price to its net assets’ book value per share. A low P/B ratio indicates that the stock is trading at a discount compared to its book value. This implies that the market is undervaluing the company’s assets, providing an opportunity for investors to acquire shares at a favorable price.

5. Contrarian Investment Approach

Investing in value stocks often requires a contrarian approach. Value investors seek out stocks that are unpopular or overlooked by the market. They believe that these stocks have the potential for future growth and are willing to invest in them even when the broader market sentiment is negative. This contrarian mindset allows value investors to take advantage of market inefficiencies and potentially earn higher returns in the long run.

6. Margin of Safety

Value investors also focus on the concept of a margin of safety when investing in value stocks. The margin of safety refers to the difference between the intrinsic value of a stock and its market price. By investing in stocks with a significant margin of safety, value investors aim to minimize the risk of capital loss. This approach provides a cushion in case the stock’s price does not immediately reflect its underlying value.

Value stocks offer investors an opportunity to acquire undervalued stocks with strong potential for future growth. The key characteristics, such as low P/E and P/B ratios, high dividend yield, strong fundamentals, and the contrarian investment approach, make value stocks an attractive option for those looking for potential bargains in the market. By understanding the characteristics of value stocks, investors can make informed decisions and potentially benefit from the eventual market recognition of these undervalued gems.

What is a Value Stock?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a value stock and its characteristics?

A value stock refers to a stock that is considered undervalued by investors based on various fundamental factors. These stocks are typically priced lower than their intrinsic value, making them attractive investment opportunities. Some common characteristics of value stocks include:

1. What are the main factors that define a value stock?

Value stocks are defined by factors such as low price-to-earnings (P/E) ratio, low price-to-book (P/B) ratio, and high dividend yield. These metrics help identify stocks that are trading below their perceived intrinsic value.

2. How can I determine if a stock is undervalued?

To determine if a stock is undervalued, you can analyze various financial ratios and metrics such as P/E ratio, P/B ratio, dividend yield, and comparing them to industry averages or historical data. Additionally, thorough fundamental analysis of the company’s financial statements can provide insights into its true value.

3. Is there a specific industry where value stocks are more common?

Value stocks can be found across various industries. However, some sectors, such as utilities, energy, and consumer goods, often have a higher presence of value stocks due to their stable nature and steady cash flows.

4. Are value stocks riskier than other types of stocks?

Investing in value stocks does come with its own set of risks. There is a possibility that the stock’s value may not increase as expected, despite being undervalued. Additionally, value stocks may have temporarily depreciated due to underlying issues within the company or industry. It is crucial to conduct thorough research and analysis before investing in any stock.

5. Can value stocks provide consistent returns?

While value stocks have the potential for providing consistent returns over the long term, it is important to note that the market dynamics can impact their performance. Value stocks may require patience, as it may take some time for the market to recognize their true value and for prices to adjust accordingly.

6. How do value stocks differ from growth stocks?

Value stocks and growth stocks differ in terms of investment strategy. Value stocks are typically characterized by stable, established companies that may be temporarily undervalued, while growth stocks are associated with companies that are expected to experience rapid growth in the future. The investment focus and potential risks associated with each type of stock can vary significantly.

7. Can value stocks pay dividends?

Yes, value stocks can often pay dividends. In fact, many value stocks are known for their consistent dividend payments. Companies that generate stable cash flows and have a history of returning profits to shareholders through dividends are often sought after by investors looking for value investments.

8. How can I identify potential value stocks?

Identifying potential value stocks involves conducting thorough research and analysis. This can include evaluating financial statements, analyzing key ratios and metrics, comparing valuations to industry peers, and keeping an eye on market trends. Additionally, seeking professional advice or using investment tools can provide further assistance in identifying potential value stocks.

Final Thoughts

In conclusion, a value stock refers to a stock that is considered undervalued by the market. These stocks typically have characteristics such as low price-to-earnings ratio, high dividend yield, and strong fundamentals. Investors seek value stocks as they believe that their true worth will eventually be recognized, leading to potential gains. By focusing on the fundamentals and looking for companies with strong financials but lower market prices, value investors aim to capitalize on the market’s occasional mispricing. Investing in value stocks requires thorough research and analysis, but it can potentially yield substantial returns in the long run.