Do you want to have a solid understanding of callable bonds and the risks they entail? Look no further! In this article, we will delve into the intricacies of these financial instruments, helping you grasp their nature and potential pitfalls. Callable bonds can be both beneficial and tricky for investors, offering higher yields but also presenting the risk of early redemption. Join us as we explore the ins and outs of understanding callable bonds and their risks, providing you with the knowledge to make informed investment decisions. Let’s embark on this insightful journey together.

Understanding Callable Bonds and Their Risks

Introduction:

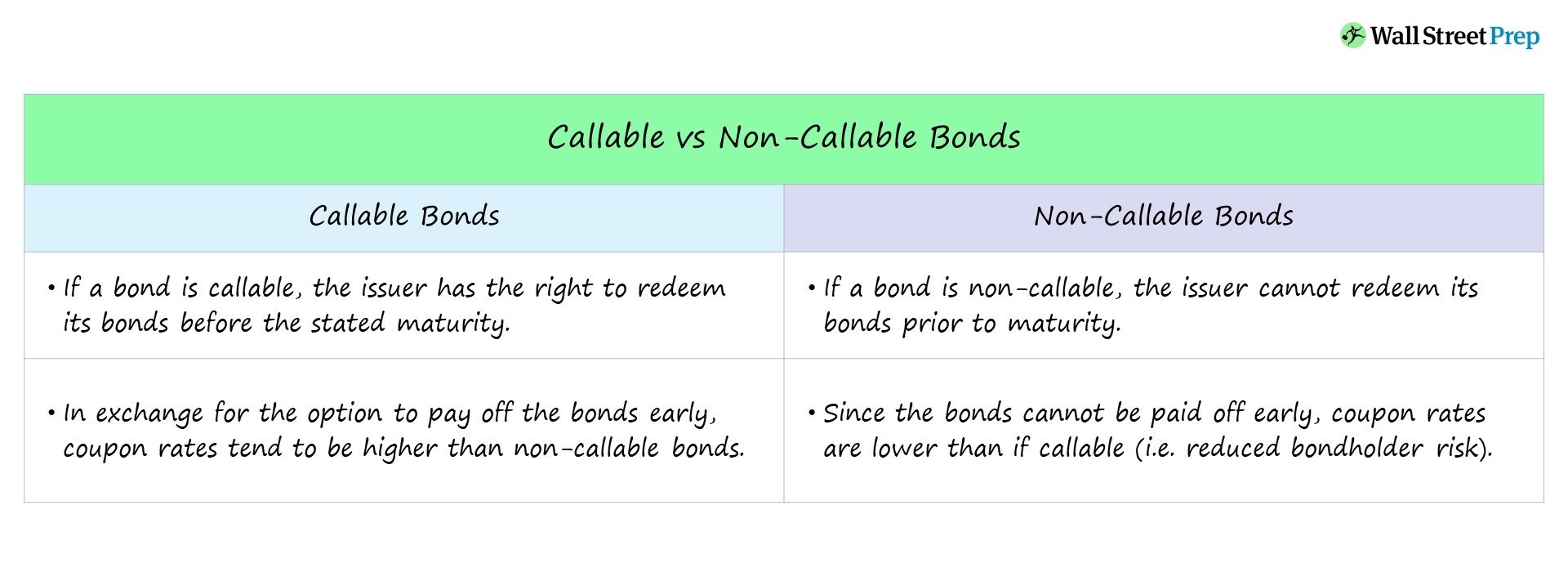

Bonds play a critical role in the world of finance, offering individuals and institutions a means to invest and generate income. One specific type of bond that investors may come across is known as a callable bond. Callable bonds, as the name suggests, provide the issuer with the option to call the bond back before its maturity date. While callable bonds can offer higher yields compared to non-callable bonds, they also present unique risks for investors. In this article, we will delve into the world of callable bonds and explore the various risks associated with them.

I. What are Callable Bonds?

A callable bond, also referred to as a redeemable bond, is a type of bond that allows the issuer to repay the bond’s principal amount before its scheduled maturity date. Callable bonds function similarly to traditional bonds but include a call provision that grants the issuer the right to terminate the bond prematurely.

A. How do Callable Bonds Work?

When an issuer decides to issue a callable bond, they embed a call provision within the bond contract. This provision includes specific terms, such as the call date, call price, and call protection period. The call date indicates the earliest date at which the issuer can exercise their option to call the bond. The call price represents the amount the issuer must repay to bondholders upon calling the bond. Lastly, the call protection period refers to the period during which the issuer is prohibited from calling the bond.

B. Benefits of Callable Bonds for Issuers and Investors

Callable bonds offer benefits to both issuers and investors, albeit with different motivations. Some key advantages include:

1. Issuer Benefits:

– Flexibility: Callable bonds provide issuers with flexibility, allowing them to react to changing market conditions, interest rate fluctuations, or company-specific factors.

– Lower Financing Costs: Issuers can take advantage of falling interest rates by calling and refinancing the bond at a lower coupon rate.

– Manage Debt Load: Issuers can manage their debt load by calling back bonds when they have excess cash on hand.

2. Investor Benefits:

– Higher Yields: Callable bonds typically offer higher yields compared to non-callable bonds to compensate investors for the risk of early bond termination.

– Income Stream: Callable bonds provide investors with a predictable income stream through coupon payments until the bond is called.

– Diversification: Callable bonds can enhance portfolio diversification by adding another asset class with unique risk-return characteristics.

II. Risks Associated with Callable Bonds

While callable bonds may seem attractive to bond issuers and investors, they also introduce certain risks that investors should be aware of before investing. Understanding these risks is crucial for making informed investment decisions.

A. Call Risk

The primary risk associated with callable bonds is call risk. Call risk refers to the possibility that the issuer will exercise their right to call the bond and repay the principal before its scheduled maturity date. When a callable bond is called, investors may face reinvestment risk, which involves finding alternative investments with potentially lower yields than the original bond.

B. Reinvestment Risk

Reinvestment risk arises when an investor must reinvest the principal from a called bond. If the investor cannot find comparable investment opportunities with similar yields, they may have to settle for lower-yielding investments, potentially impacting their overall returns.

C. Interest Rate Risk

Callable bonds are highly sensitive to changes in interest rates. When interest rates decline, issuers are more likely to call their outstanding high-coupon bonds to refinance at a lower rate. This means investors may lose the opportunity to continue earning the higher coupon payments they initially anticipated.

D. Liquidity Risk

Callable bonds may also carry liquidity risk. In some instances, if an investor wants to sell a callable bond before its maturity date, they may struggle to find willing buyers due to the potential for early redemption by the issuer. This lack of liquidity can impact the investor’s ability to exit the investment at their desired price.

E. Limited Upside Potential

Callable bonds usually have limited upside potential. Once interest rates fall, the issuer is likely to call the bond, limiting the potential for capital appreciation and reducing the bond’s overall return.

III. Mitigating Callable Bond Risks

While callable bonds come with inherent risks, investors can take certain steps to mitigate these risks and potentially enhance their investment outcomes.

A. Evaluate Call Provisions and Terms

Investors should carefully examine the call provisions and terms of the bond before investing. Pay attention to the call protection period, call price, and call frequency, as these factors can significantly impact the possibility of early redemption.

B. Consider Yield-to-Call

Yield-to-call (YTC) is a crucial metric for evaluating callable bonds. YTC calculates the total return an investor can expect if the bond is called at the earliest possible date. Comparing YTC with the bond’s current yield can provide insights into the potential risks and rewards associated with the investment.

C. Diversify Your Bond Portfolio

Diversification is a fundamental risk management strategy. By spreading investments across different types of bonds, including callable and non-callable bonds, investors can reduce their exposure to call risk and potentially enhance overall portfolio stability.

D. Stay Informed about Market Conditions

Being aware of current market conditions and interest rate trends is essential when investing in callable bonds. Understanding the macroeconomic factors that could influence an issuer’s decision to call bonds can help investors make more informed decisions.

Conclusion:

Callable bonds offer issuers and investors unique advantages and risks. While callable bonds can provide higher yields, they also carry call risk, reinvestment risk, interest rate risk, liquidity risk, and limited upside potential. By understanding the intricacies of callable bonds and taking appropriate risk-mitigating measures, investors can make more informed decisions when incorporating callable bonds into their investment portfolios. Remember, it’s crucial to carefully evaluate the terms and provisions of callable bonds, consider yield-to-call, diversify the bond portfolio, and stay informed about market conditions to navigate the risks effectively.

Callable Bond Explained – Definition, Benefits & Risks

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are callable bonds?

Callable bonds are debt securities that can be redeemed by the issuer before their maturity date. This means the issuer has the right to pay off the bondholders and retire the debt before the specified maturity.

Why do issuers call bonds?

Issuers call bonds when interest rates decline, enabling them to refinance the debt at a lower cost. By calling bonds, issuers can save money on interest payments and potentially issue new bonds at a lower interest rate.

What risks do callable bonds present for investors?

Callable bonds carry the risk of early redemption, which may result in the bondholder receiving less interest income than anticipated. If the bond is called before its maturity, investors may need to reinvest the proceeds at lower interest rates, reducing overall returns.

How does the call feature affect the price of a bond?

The call feature can have an impact on the price of a bond. When interest rates decline, the likelihood of the bond being called increases, leading to a potential decline in the bond’s price. Investors often demand a higher yield on callable bonds to compensate for this risk.

Are all bonds callable?

No, not all bonds have a call feature. Some bonds are issued as non-callable, meaning the issuer does not have the option to redeem the bonds before maturity. It is important for investors to check the bond’s terms and conditions to determine if it is callable or non-callable.

How can investors protect themselves from callable bond risks?

Investors can protect themselves from callable bond risks by carefully analyzing the bond’s call provisions and potential interest rate movements. Diversifying investments across a range of bonds with different maturity dates and call features can also help mitigate the impact of early redemptions.

What factors should investors consider before investing in callable bonds?

Before investing in callable bonds, investors should consider their risk tolerance, investment goals, and the prevailing interest rate environment. Understanding the financial health of the issuer and evaluating the potential impact of the call feature on the bond’s price are also crucial factors to consider.

Can callable bonds offer any advantages to investors?

Yes, callable bonds can offer advantages to investors. They often provide higher yields compared to non-callable bonds due to the added risk of early redemption. Additionally, if interest rates rise after the bond is purchased, the call feature can protect investors from being locked into lower interest rates for an extended period.

Final Thoughts

Callable bonds offer investors the opportunity to receive higher coupon payments compared to non-callable bonds. However, it is important to understand the risks associated with these types of bonds. One major risk is the possibility of early redemption by the issuer, which can result in the loss of future coupon payments. Additionally, callable bonds may be called when interest rates decline, limiting potential gains for investors. Understanding callable bonds and their risks is crucial for investors to make informed decisions and mitigate potential losses. With proper knowledge and analysis, investors can navigate the callable bond market more effectively and achieve their investment goals.