Are you looking to embark on a second career but unsure how to navigate the financial aspect of the transition? Planning for a second career financially can be a daunting task, but fear not! In this article, we will delve into practical strategies and actionable steps that will empower you to take charge of your financial future. So, if you’ve been wondering how to plan for a second career financially, you’ve come to the right place. Let’s dive in and explore the key principles that will set you on a path to success.

How to Plan for a Second Career Financially

Introduction

Embarking on a second career can be an exciting and rewarding endeavor. Whether you’re considering a career change out of passion, necessity, or a desire for personal growth, it’s crucial to have a solid financial plan in place. Planning for a second career financially not only ensures a smooth transition but also allows you to pave the way for a financially secure future. In this article, we will explore key steps and strategies to help you plan for a second career financially.

Evaluate Your Current Financial Situation

Before diving into your second career journey, it’s essential to assess your current financial situation. Take the following steps to gain a clear understanding of where you stand financially:

- Calculate your net worth: Determine your net worth by subtracting your liabilities from your assets. This exercise will give you an overview of your financial health and help you identify areas that need attention.

- Analyze your spending habits: Review your current expenses and identify areas where you can cut costs. This evaluation will free up funds for investing in your second career transition.

- Assess your current income streams: Evaluate your current sources of income and estimate how they might change during your second career. Consider factors such as salary fluctuations, benefits, and potential periods of unemployment.

Set Clear Financial Goals

Setting clear financial goals is crucial for planning your second career. Here’s how you can define your objectives:

- Short-term goals: Identify specific financial milestones you want to achieve within the next one to three years. These goals could include building an emergency fund, paying off debt, or saving a specific amount for your career transition.

- Medium-term goals: Outline your financial aspirations for the next three to ten years. This timeframe could encompass saving for further education or certifications related to your second career or purchasing necessary equipment or tools.

- Long-term goals: Consider your retirement plans and how your second career fits into your overall financial strategy. Determine how much you need to save for retirement and how your second career might contribute to that goal.

Create a Budget

To ensure your financial stability during your second career transition, creating a budget is essential. Here’s how you can effectively manage your finances:

- Track your income and expenses: Analyze your income and list all your expenses, including fixed costs (rent, utilities, insurance) and discretionary spending (entertainment, dining out). This exercise will give you a clear picture of your financial inflows and outflows.

- Identify areas for adjustment: Look for opportunities to reduce unnecessary expenses and allocate funds towards your second career goals. This might involve cutting back on non-essential spending or finding ways to save on your monthly bills.

- Allocate funds strategically: Prioritize your spending based on your goals. Allocate funds towards your second career transition, savings, debt repayment, and other essential expenses.

- Monitor and adjust: Regularly review and update your budget as your financial situation and second career plans evolve. Be flexible and make necessary adjustments to ensure you stay on track.

Invest Wisely

Investing wisely can significantly impact your financial security in the long run. Consider the following strategies for successful investing:

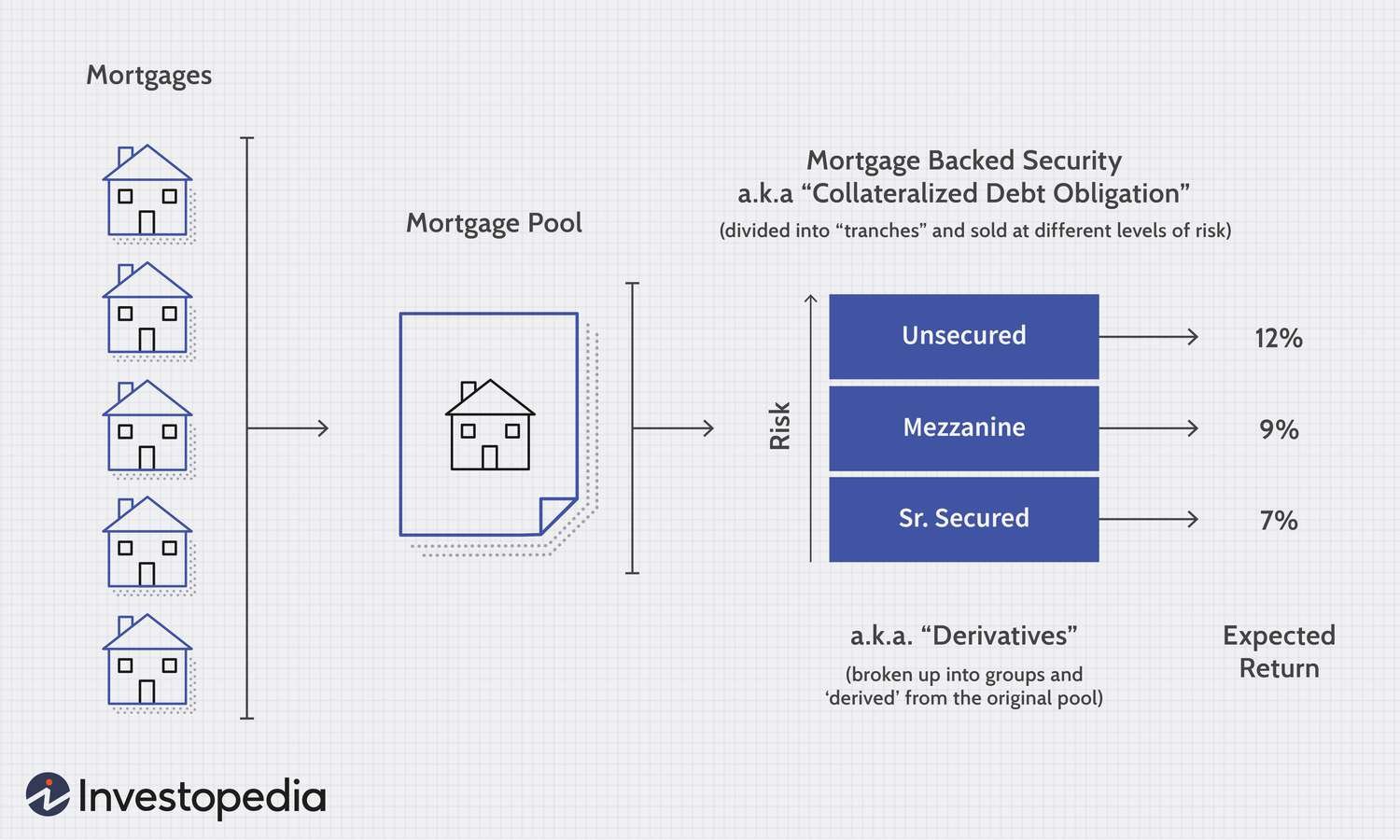

- Education and research: Take the time to educate yourself on various investment options. Understand the risks, potential returns, and long-term implications. Research different investment vehicles that align with your risk tolerance and financial goals.

- Diversify your portfolio: Spread your investments across different asset classes to minimize risk. Consider a mix of stocks, bonds, real estate, and other investment vehicles that suit your risk profile.

- Consult a financial advisor: If you’re unsure about making investment decisions, seek guidance from a qualified financial advisor. They can help you develop an investment strategy tailored to your second career plans and financial objectives.

- Regularly review and rebalance: Keep a close eye on your investment portfolio and make adjustments as needed. Rebalancing your investments ensures you maintain an appropriate asset allocation and align with your long-term goals.

Explore Second Career Financing Options

Transitioning into a second career might require additional financial resources. Consider the following options to fund your career change:

- Personal savings: Leverage your existing savings to cover expenses during your second career transition. Build an emergency fund to provide a financial safety net.

- Part-time or freelance work: Explore opportunities for part-time or freelance work in your desired industry before fully transitioning. This can provide supplemental income and help you build relevant experience.

- Grants and scholarships: Research grants and scholarships that align with your second career goals. Many organizations offer financial assistance for individuals looking to pursue specific fields or further education.

- Career development loans: Investigate career development loans or similar programs designed to support individuals seeking to switch careers. These loans often come with favorable terms and can be tailored to your specific needs.

- Community and government resources: Check local community organizations and government programs that offer financial assistance or subsidized training for individuals pursuing second careers.

Continuously Review and Adjust Your Plan

Planning for a second career financially is an ongoing process. As you progress in your transition, continuously review and adjust your plan to ensure financial success. Regularly evaluate your goals, budget, investments, and progress towards your objectives. Stay informed about changes in the job market, industry trends, and financial opportunities that can benefit your second career plans.

Remember, embarking on a second career is an exciting opportunity, but it requires careful financial planning. By assessing your current finances, setting clear goals, creating a budget, investing wisely, exploring financing options, and continuously reviewing your plan, you can confidently navigate your second career journey and secure a bright financial future.

Become a CFP as a Second Career?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially plan for a second career?

Financially planning for a second career involves several key steps:

- Evaluate your current financial situation and determine your financial goals for the second career.

- Create a budget that takes into account any changes in income and expenses.

- Research the potential income and expenses of the second career to estimate its financial viability.

- Consider the need for additional education or training and plan for the associated costs.

- Assess your existing savings and investments and determine if adjustments are needed to support the transition.

- Consult with a financial advisor to develop a comprehensive plan and explore strategies such as retirement account rollovers or investment options.

2. How can I ensure a smooth financial transition to a second career?

To ensure a smooth financial transition to a second career:

- Start saving and investing early to build a financial cushion.

- Pay off high-interest debts and minimize financial obligations before making the switch.

- Explore income-generating opportunities or part-time work during the transition period.

- Consider setting up an emergency fund to handle unexpected expenses.

- Review and update your insurance coverage to protect against potential risks.

- Continuously monitor and reassess your financial plan as your second career progresses.

3. Should I seek professional financial advice when planning for a second career?

Seeking professional financial advice when planning for a second career can provide valuable insights and guidance. Financial advisors can help assess your current situation, understand your goals, and develop a personalized plan to navigate the financial aspects of your transition. They can also provide expertise on areas such as tax implications, investment strategies, and retirement planning.

4. What should I consider when estimating the income of a potential second career?

When estimating the income of a potential second career, consider the following:

- Research the average salaries or hourly rates in the chosen field.

- Assess the demand for professionals in that field and potential growth opportunities.

- Consider any additional costs or investments required to establish yourself in the new career.

- Take into account any potential fluctuations in income, especially during the initial stages of the second career.

5. How can I fund additional education or training for a second career?

Funding additional education or training for a second career can be achieved through various means:

- Research and apply for scholarships or grants specific to the desired field.

- Explore tuition reimbursement programs offered by employers.

- Consider taking out student loans and evaluate the terms, interest rates, and repayment options available.

- Save and budget for the education or training expenses over time.

6. Should I consider adjusting my investment strategy for a second career?

When transitioning to a second career, it is advisable to assess and potentially adjust your investment strategy based on the following:

- Review your risk tolerance and investment goals, considering the new career’s income potential and stability.

- Diversify your investment portfolio to manage risk and achieve long-term financial growth.

- Monitor and adjust your investment allocations as your financial situation and career progress.

- Consult with a financial advisor to determine the most suitable investment strategy for your specific circumstances.

7. Can I access my retirement savings to support a second career?

Yes, you may be able to access your retirement savings to support a second career. Some options include:

- Rolling over your retirement account into an individual retirement account (IRA) or a new employer’s retirement plan.

- Withdrawing funds from your retirement account, but be aware of potential tax implications and early withdrawal penalties.

- Exploring the option of a loan or hardship withdrawal if your retirement account allows it.

- Evaluating the impact of accessing retirement savings on your long-term financial goals.

8. How can I protect myself financially during the transition to a second career?

To protect yourself financially during the transition to a second career:

- Review and update your insurance coverage, including health insurance, disability insurance, and liability insurance.

- Consider having an emergency fund to handle unexpected expenses or income gaps.

- Evaluate your current debt and work towards reducing or eliminating high-interest debt.

- Prepare for potential fluctuations in income by establishing a realistic budget and managing expenses.

Final Thoughts

Planning for a second career financially requires careful consideration. Start by assessing your financial situation and setting specific goals. Determine the income you will need to support your desired lifestyle and research potential second career options. Create a budget to manage your expenses and save for the transition period. Consider the costs of retraining or acquiring new skills to make yourself more marketable. Develop a backup plan and build an emergency fund to handle any unexpected challenges. Seek professional advice to optimize your investments and retirement savings. By taking these steps, you can plan for a second career financially and ensure a smooth transition.