Crowdfunding has taken the financial world by storm, revolutionizing the way ideas and projects are funded. But what exactly is crowdfunding and what risks does it entail? Defined as the practice of funding a project or venture by raising small amounts of money from a large number of people, crowdfunding offers a unique opportunity for entrepreneurs and creatives to bring their visions to life. However, like any investment opportunity, there are risks involved. In this article, we will explore what crowdfunding is and delve into the potential risks that both backers and project creators should be aware of. Let’s jump right in!

What is Crowdfunding and Its Risks

An Introduction to Crowdfunding

Crowdfunding has become an increasingly popular method for individuals, startups, and organizations to raise funds for their projects or ventures. It offers an alternative to traditional methods of financing, such as bank loans or venture capital, by harnessing the power of the crowd. In this section, we will explore what crowdfunding is and how it works.

Crowdfunding is a process of raising funds from a large number of individuals, typically through an online platform. It brings together people who are interested in supporting a particular project or idea and allows them to contribute small amounts of money. These contributions, when combined, can provide the necessary funding to bring the project to life.

The Different Types of Crowdfunding

There are several types of crowdfunding, each with its own characteristics and purposes. Understanding the different types can help potential project creators choose the most suitable platform for their fundraising needs.

1. Rewards-based Crowdfunding: This is the most common type of crowdfunding, where backers contribute money in exchange for rewards or perks. These rewards can range from early access to the product, exclusive merchandise, or experiences related to the project.

2. Donation-based Crowdfunding: In donation-based crowdfunding, individuals contribute money without expecting any material gain in return. This type of crowdfunding is often used for charitable causes or to support personal emergencies or creative endeavors.

3. Equity-based Crowdfunding: Equity-based crowdfunding allows individuals to invest in a project or business in exchange for ownership or shares. Backers become shareholders and can potentially earn a return on their investment if the project succeeds.

4. Debt-based Crowdfunding: Debt-based crowdfunding, also known as peer-to-peer lending, involves individuals lending money to others with the expectation of being paid back with interest. This type of crowdfunding is similar to traditional lending, but it bypasses financial institutions.

The Benefits of Crowdfunding

Crowdfunding offers a range of benefits for project creators, investors, and the wider community. Let’s explore these benefits in detail:

1. Access to Capital: One of the primary advantages of crowdfunding is that it provides access to capital for individuals and businesses who may struggle to secure funding through traditional methods. It allows creators to tap into a larger pool of potential investors.

2. Market Validation: Crowdfunding serves as a validation mechanism for ideas and products. A successful crowdfunding campaign demonstrates market demand and generates interest, which can attract additional funding from investors or traditional financial institutions.

3. Community Engagement: Crowdfunding creates an opportunity for creators to engage with their target audience, build a community around their project, and gain valuable feedback. This direct interaction can help shape the final product, improve marketing strategies, and foster a sense of ownership among backers.

4. Promotion and Marketing: Crowdfunding campaigns often attract media attention and generate buzz, providing valuable promotional opportunities for the project. This exposure can increase brand visibility and attract potential customers or partners.

5. Flexibility and Control: Crowdfunding allows creators to maintain control over their project and make decisions independently. It provides the flexibility to set funding goals, choose the duration of the campaign, and determine the terms of engagement with backers.

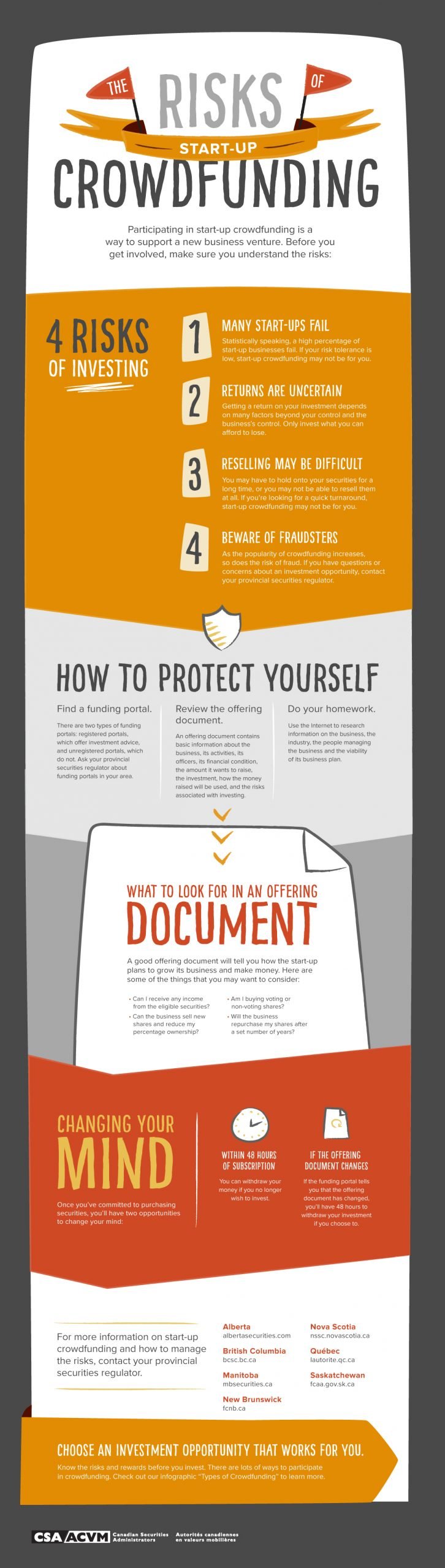

The Risks of Crowdfunding

While crowdfunding can be a powerful tool for raising funds, it is not without risks. Understanding and mitigating these risks is crucial for both project creators and backers. Let’s explore some of the common risks associated with crowdfunding:

1. Project Failure: Not all projects or ventures succeed, and crowdfunding is no exception. There is a risk that despite the initial excitement and support, the project may encounter unforeseen challenges or fail to deliver on its promises. Backers need to be aware of this possibility and evaluate the project’s feasibility and the creator’s track record before contributing.

2. Lack of Regulation: Crowdfunding platforms operate in a relatively new and evolving industry, which means there may be a lack of regulatory oversight. This absence of stringent regulations increases the risk of fraud, mismanagement, or unethical practices. Backers should exercise caution and thoroughly research the project and the platform before making a financial commitment.

3. Delays and Uncertainty: Crowdfunding projects often face delays in execution, manufacturing, or delivery. Creators may encounter unexpected obstacles that cause setbacks or affect the timeline of the project. Backers should be prepared for potential delays and factor them into their decision-making process.

4. Intellectual Property Risks: Crowdfunding platforms attract a wide range of ideas and projects, some of which may involve intellectual property (IP). There is a risk that creators may infringe on existing patents, copyrights, or trademarks without proper due diligence or legal protection. Investors should assess the potential IP risks associated with the project before making a financial commitment.

5. Lack of Control and Influence: Backers have limited control and influence over the project once they have contributed their funds. While some platforms provide updates and communication channels, backers do not have direct decision-making power. It is essential to understand this limitation and assess the level of involvement desired before contributing to a project.

Overall, crowdfunding offers exciting opportunities for both creators and backers. However, it is essential to be aware of the risks involved and take necessary precautions. Conducting thorough research, evaluating the project’s viability, and understanding the terms and conditions set by the platform are vital steps to minimize these risks. By navigating the crowdfunding landscape with caution, individuals can make informed decisions and contribute to projects that align with their interests and goals.

What you need to know about the benefits, risks of crowdfunding

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is crowdfunding?

Crowdfunding is a method of raising funds through the collective contributions of a large number of people, typically via the internet. It allows individuals, businesses, or organizations to obtain financial support for their projects or ventures from a wide range of individuals.

What are the benefits of crowdfunding?

Crowdfunding offers several benefits, including access to a larger pool of potential investors, increased exposure and marketing opportunities, validation of ideas or products, and the ability to gauge market interest before fully launching a project. It can also foster community engagement and provide a sense of ownership to backers.

What are the risks associated with crowdfunding?

While crowdfunding presents opportunities, it also comes with certain risks. Some common risks include:

– Potential for project failure or delays: Despite thorough planning, projects may not meet their intended goals or timelines.

– Lack of control: By involving numerous investors, decision-making authority may be shared, potentially leading to conflicts or disagreements.

– Potential fraud or scams: Crowdfunding platforms can attract fraudulent campaigns or individuals seeking to take advantage of contributors’ goodwill.

– Intellectual property concerns: Sharing project details publicly may expose ideas to intellectual property theft or infringement.

– Regulatory challenges: Crowdfunding may be subject to specific legal and regulatory requirements, varying across jurisdictions, which can present hurdles for project creators.

– Reputation management: Negative experiences, such as poorly managed projects, can harm the reputation of both creators and crowdfunding platforms.

How does crowdfunding work?

Crowdfunding typically involves three main parties: the project creator, the backers or contributors, and the crowdfunding platform. The project creator sets a funding goal and creates a campaign, which includes a detailed description of their project, the funding target, and any rewards offered to backers. Contributors browse through various campaigns and choose the projects they wish to support by making monetary contributions.

What are the different types of crowdfunding?

There are several types of crowdfunding, including donation-based crowdfunding (where contributors donate without expecting financial return), reward-based crowdfunding (where backers receive non-financial rewards or products), equity crowdfunding (where investors receive shares or equity in the project or company), and debt crowdfunding (where contributors lend money to the project creator).

Are there any fees associated with crowdfunding?

Crowdfunding platforms typically charge fees for hosting campaigns and facilitating transactions. These fees can vary depending on the platform and the type of crowdfunding being used. It’s important to review the platform’s fee structure before launching a campaign to understand the costs involved.

How can I mitigate the risks of crowdfunding?

To mitigate the risks associated with crowdfunding, consider the following measures:

– Thoroughly research the crowdfunding platform you plan to use, ensuring it has a good reputation and a history of successfully funded projects.

– Assess the credibility of project creators by reviewing their track record, experience, and qualifications.

– Scrutinize project details, financial projections, and updates to gain confidence in the feasibility and progress of the project.

– Be cautious of campaigns that promise high returns or seem too good to be true.

– Diversify your investments by supporting multiple projects or campaigns rather than concentrating all your contributions on a single endeavor.

Can I get my money back if a crowdfunding project fails?

If a crowdfunding project fails, the likelihood of getting your money back depends on the type of crowdfunding and the platform’s specific terms and conditions. In some cases, you may be eligible for a refund or be protected by the platform’s policies or legal regulations. However, there is no guarantee of a full refund, and it’s important to carefully review the terms and conditions before making any contributions.

Final Thoughts

Crowdfunding is a popular method of raising funds for projects or ventures through a collective effort of individuals. However, it comes with its own set of risks. One major concern is the potential for scams and fraudulent activities since crowdfunding platforms are not regulated like traditional financial institutions. Moreover, there is a possibility of projects failing to meet their objectives or deliver promised outcomes. Transparency can also be an issue, as project creators may lack accountability or fail to provide regular updates on progress. Therefore, individuals should exercise caution and conduct thorough research before participating in crowdfunding campaigns to mitigate these risks. Overall, understanding what crowdfunding is and being aware of its risks is crucial for individuals considering this form of fundraising.