Looking to build an emergency fund from scratch? You’re in the right place! In this article, we’ll dive into practical steps and smart strategies on how to build an emergency fund from scratch. From understanding the importance of an emergency fund to finding ways to save and grow your money, we’ve got you covered. So, whether unexpected expenses come knocking or you simply want peace of mind, read on to discover how to build an emergency fund from scratch and secure your financial future.

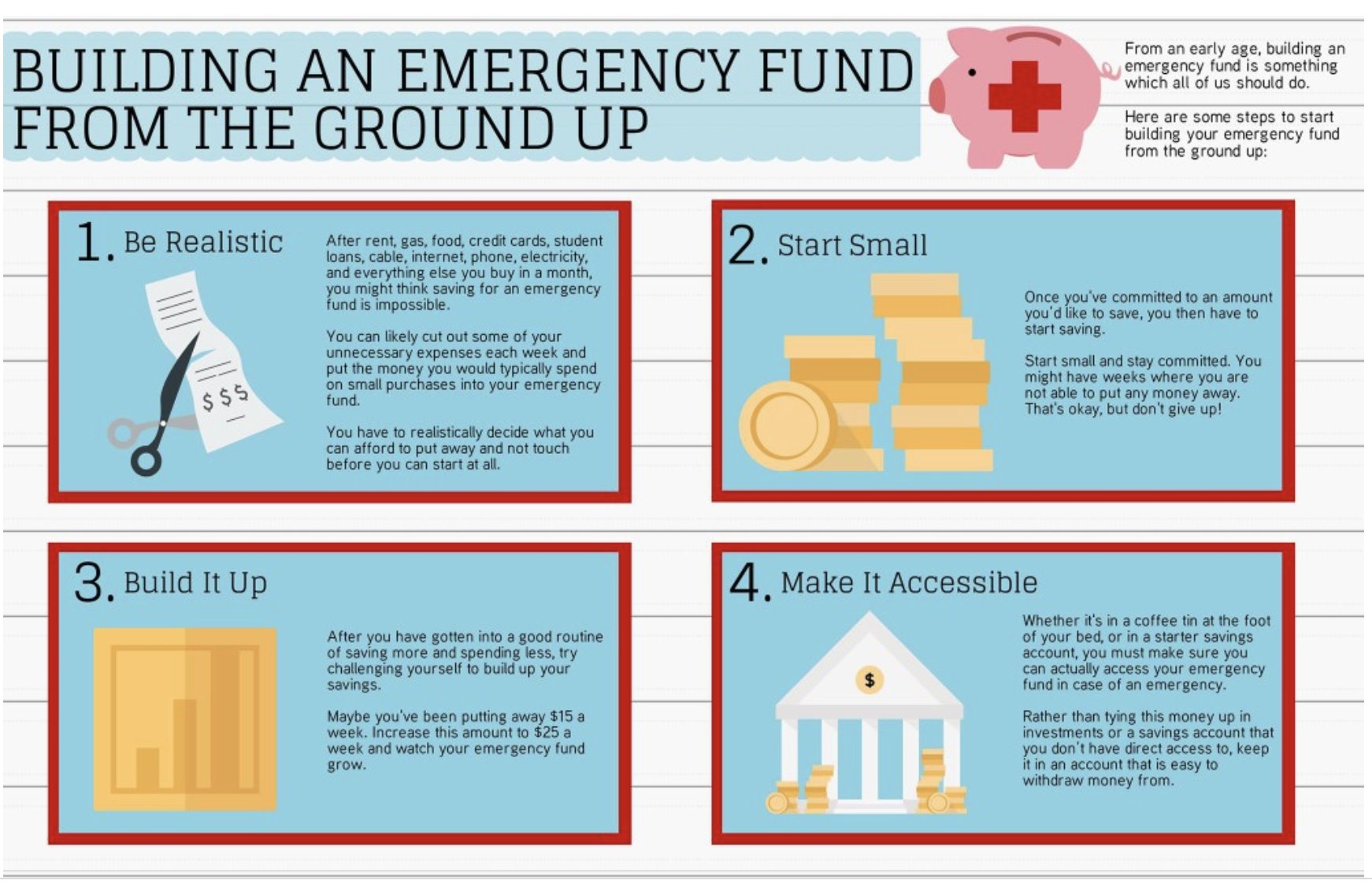

How to Build an Emergency Fund From Scratch

The Importance of an Emergency Fund

An emergency fund is a crucial financial safety net that can provide you with peace of mind and protect you during unexpected situations. Whether it’s a sudden medical expense, car repairs, or a job loss, having a solid emergency fund can help you weather the storm without resorting to accumulating debt or stressing about your financial stability.

Setting Financial Goals

Before you start building your emergency fund, it’s important to establish clear financial goals. Determine how much you want to save and within what time frame. It’s recommended to have at least three to six months’ worth of living expenses saved in your emergency fund. Assess your current financial situation and calculate your monthly expenses to figure out the ideal target amount.

Creating a Budget

To build an emergency fund, you need to have a clear understanding of your income and expenses. Creating a budget allows you to track your spending, identify areas where you can cut back, and allocate a portion of your income to your emergency fund. Here’s how you can create an effective budget:

- List all your sources of income: Start by listing all the money you receive each month, including your salary, side hustle income, and any other sources of income.

- Track your expenses: Record all your monthly expenses, including bills, groceries, transportation, entertainment, and miscellaneous expenses.

- Analyze your spending: Categorize your expenses and identify areas where you can reduce or eliminate unnecessary costs. This might include reducing dining out, cutting back on entertainment subscriptions, or finding ways to save on utility bills.

- Allocate funds to your emergency fund: Set a specific amount or percentage of your income that will go directly into your emergency fund each month. Treat it as a non-negotiable expense.

Start Small and Be Consistent

Building an emergency fund from scratch can be intimidating, especially if you’re on a tight budget. However, it’s essential to start small and be consistent. Remember, every little contribution adds up over time. Start by saving a set amount each week or month, and gradually increase your savings as your financial situation improves. It’s better to save a smaller amount consistently than to wait until you can save a larger sum.

Automate Your Savings

One of the most effective ways to ensure consistent savings is by automating the process. Set up an automatic transfer from your checking account to your emergency fund each time you receive your paycheck. By automating your savings, you eliminate the temptation to spend the money elsewhere and make saving a regular habit.

Maximize Your Income

In addition to cutting expenses, boosting your income can significantly accelerate your emergency fund growth. Consider exploring opportunities to increase your earnings, such as taking on a part-time job, freelancing, or monetizing a hobby or skill. Redirect the extra income towards your emergency fund to reach your savings goal faster.

Reduce High-Interest Debt

When building an emergency fund, it’s important to strike a balance between debt repayment and saving. High-interest debt, such as credit card debt or payday loans, can quickly accumulate and hinder your progress. Prioritize paying off these debts while still contributing to your emergency fund. Allocate a portion of your budget towards debt repayment until you’re able to eliminate these debts completely.

Make Savings a Priority

Building an emergency fund requires discipline and a commitment to making savings a priority. Avoid the temptation to dip into your emergency fund for non-essential expenses. Instead, focus on ensuring your fund remains untouched, except for genuine emergencies. Create a mental barrier between your emergency fund and your regular savings or checking account to avoid any temptation to use the money for non-emergency purposes.

Consider High-Interest Savings Accounts

While it’s important to have quick access to your emergency funds, consider opening a high-interest savings account. These accounts typically offer higher interest rates than standard savings accounts, allowing your money to grow over time. Research different financial institutions or online banks to find the best options available.

Reassess and Adjust Your Goals

Life is full of surprises, and your financial goals may change along the way. Regularly reassess your emergency fund goals and adjust them if necessary. Take into account any major life events, such as marriage, starting a family, or buying a home, that may impact your financial needs. Revisit your budget regularly to ensure it aligns with your evolving goals.

Stay Motivated and Celebrate Milestones

Building an emergency fund requires discipline and perseverance. Stay motivated by celebrating milestones along the way. Set mini-goals and reward yourself when you reach them. For example, treat yourself to a small indulgence or take a day off to relax and recharge. Celebrating your progress will help you stay motivated and committed to your financial goals.

Building an emergency fund from scratch may seem challenging, but with commitment and careful planning, it is entirely achievable. By creating a budget, automating your savings, and staying consistent, you can gradually grow your emergency fund and gain financial security. Remember to reassess your goals regularly and celebrate your milestones along the way. Start today, and take the first step towards building a strong financial foundation.

How to Build an Emergency Fund | Quick & Easy Guide to Starting An Emergency Fund

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I start building an emergency fund from scratch?

To build an emergency fund from scratch, you can begin by following these steps:

1. Assess your income and expenses to determine how much you can save each month.

2. Create a budget to track your spending and identify areas where you can cut back.

3. Set a specific savings goal for your emergency fund, such as three to six months’ worth of expenses.

4. Open a separate savings account dedicated solely to your emergency fund.

5. Automate your savings by setting up automatic transfers from your checking account to your emergency fund.

6. Avoid using your emergency fund for non-emergency expenses.

7. Continuously contribute to your fund, even if it’s a small amount at first.

8. Regularly review and adjust your budget and savings goals as needed.

How much should I save in my emergency fund?

The amount you should save in your emergency fund depends on your individual circumstances. As a general rule, aim to save three to six months’ worth of living expenses. Consider factors such as your job stability, monthly obligations, and any potential financial risks. If you have dependents or irregular income, you may want to save closer to six months’ worth.

What expenses should be included when calculating my emergency fund?

When calculating your emergency fund, include essential expenses like rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, and any outstanding debts. Consider any other necessary expenses you would need to cover if you were to face a financial emergency.

Should I build an emergency fund even if I have debt?

Yes, it is recommended to build an emergency fund even if you have debt. While it’s important to address your debt, having an emergency fund will provide a financial safety net. Aim to balance your debt repayment efforts with saving for emergencies. Start by saving a small amount while focusing on high-interest debt, and gradually increase your emergency fund contributions as you make progress in paying off your debt.

What if I am struggling to save for an emergency fund?

If you are having difficulty saving for an emergency fund, consider the following steps:

1. Look for areas in your budget where you can cut back on expenses.

2. Find ways to increase your income, such as taking on a part-time job or freelancing.

3. Start small by saving a small percentage of your income and gradually increase it over time.

4. Seek advice from a financial advisor who can provide personalized guidance based on your situation.

How long does it take to build an emergency fund from scratch?

The time it takes to build an emergency fund from scratch varies based on individual circumstances. It depends on factors such as your monthly savings contributions, income level, expenses, and any unexpected setbacks along the way. With consistent effort and discipline, it is possible to build an emergency fund within a few months to a year.

Can I use my emergency fund for non-emergency expenses?

It is not advisable to use your emergency fund for non-emergency expenses. The purpose of an emergency fund is to provide financial security in case of unexpected events, such as medical emergencies, job loss, or major car repairs. Using the fund for non-emergencies may leave you vulnerable in the event of a real crisis.

What should I do if I have to use my emergency fund?

If you have to use your emergency fund, it’s important to replenish it as soon as possible. Review your budget and make adjustments to allocate more funds towards rebuilding your emergency savings. Prioritize saving over non-essential expenses until your emergency fund is fully restored.

Final Thoughts

In conclusion, building an emergency fund from scratch is an essential step towards financial security. By diligently saving a portion of your income, even if it’s small at first, you can gradually establish a fund that will provide a safety net during unexpected expenses or emergencies. It is crucial to prioritize this fund and consistently contribute to it, ensuring that it grows steadily over time. By following a budget, minimizing unnecessary expenses, and focusing on saving, you can successfully build an emergency fund from scratch and achieve peace of mind in uncertain times.