Looking for a financial institution that offers a unique and rewarding banking experience? Wondering what a credit union is and how it can benefit you? Look no further! A credit union is a not-for-profit financial cooperative owned and operated by its members. Unlike traditional banks, credit unions exist to serve their members rather than maximize profits. In this blog post, we will explore what exactly a credit union is and delve into the multitude of benefits it can provide. So, let’s dive in and uncover the world of credit unions and their amazing advantages.

What is a Credit Union and Its Benefits

Introduction

When it comes to managing our finances, we often turn to traditional banks as our go-to choice. However, credit unions offer an alternative that is worth considering. Credit unions are member-owned financial cooperatives that provide a wide range of banking services. In this article, we will delve into the world of credit unions, exploring what they are and highlighting their numerous benefits. Whether you’re looking for better savings rates, lower loan interest rates, or personalized customer service, credit unions have a lot to offer.

What is a Credit Union?

A credit union is a not-for-profit financial institution that is owned and operated by its members. Unlike banks, which are profit-driven and owned by shareholders, credit unions operate under the principle of “people helping people.” This cooperative structure allows credit unions to prioritize the needs of their members rather than maximizing profits.

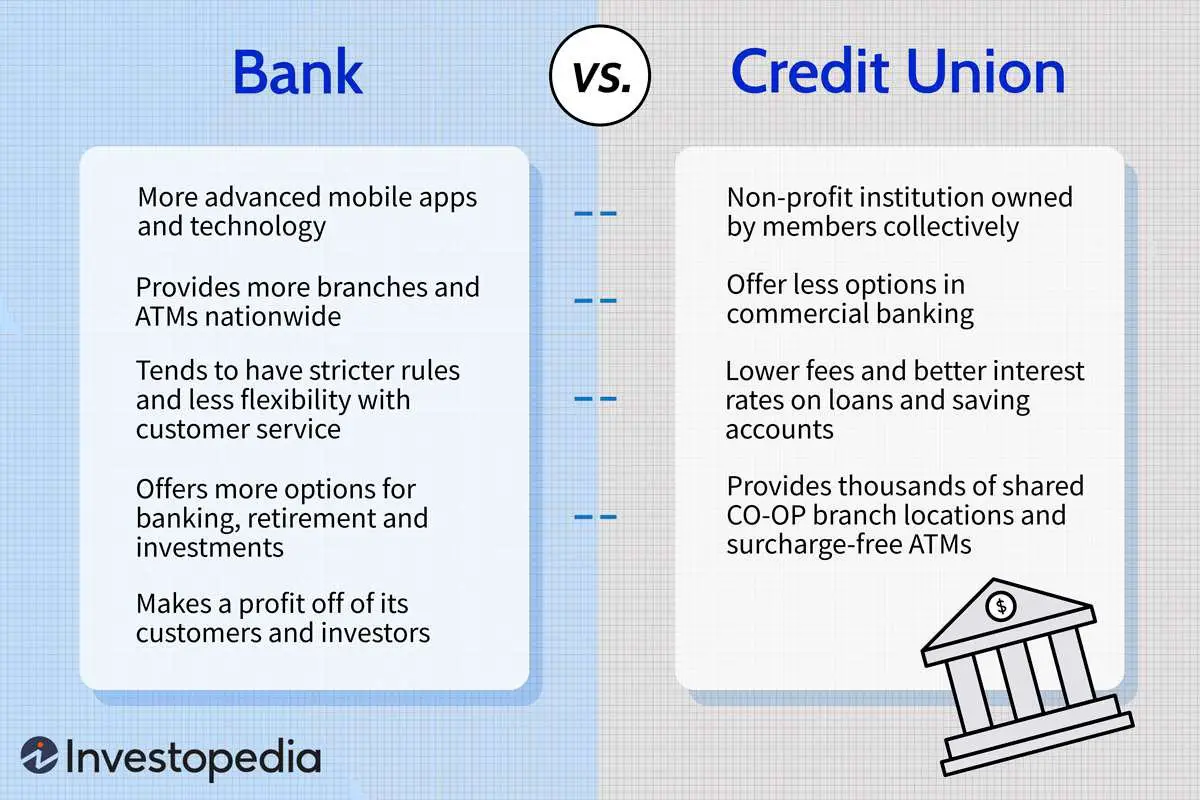

Credit unions offer the same services as traditional banks, such as checking and savings accounts, loans, mortgages, and credit cards. However, there are some key differences that set credit unions apart from banks:

1. Membership: To become a member of a credit union, you must meet certain eligibility criteria. These criteria can vary, but they often include factors such as employment in a particular industry or affiliation with a specific organization. Once you become a member, you gain a share in the credit union and the right to vote on important decisions.

2. Not-for-profit Status: Credit unions are not-for-profit organizations. This means that any profits made by the credit union are reinvested back into the institution to benefit the members. Instead of paying dividends to shareholders, credit unions offer their members better rates, lower fees, and improved services.

3. Customer Service: Credit unions are known for their personalized and friendly customer service. Since credit unions have a smaller membership base compared to banks, they can focus on building strong relationships with their members. This often results in more tailored financial advice and assistance.

4. Member Ownership: As a member of a credit union, you have a say in how the credit union operates. You have the opportunity to elect the board of directors and participate in the decision-making process. This member-oriented approach ensures that the credit union’s policies and practices align with the needs and interests of its members.

Benefits of Joining a Credit Union

Now that we have a better understanding of what a credit union is, let’s explore the various benefits that come with being a member:

1. Competitive Rates and Lower Fees

One of the biggest advantages of credit unions is their ability to offer competitive interest rates on savings and loans. Since credit unions are not-for-profit organizations, they can pass on their earnings to their members in the form of higher savings rates and lower loan interest rates. Additionally, credit unions often have lower fees compared to traditional banks, saving you money in the long run.

2. Personalized Approach

Credit unions pride themselves on providing personalized service to their members. Unlike banks that may treat you as just another account number, credit union staff takes the time to get to know their members and understand their financial goals. This personalized approach enables credit unions to offer tailored financial solutions and advice.

3. Community Focus

Credit unions have deep roots in the communities they serve. They often support local initiatives, charities, and community events. By joining a credit union, you contribute to the growth and development of your community. Additionally, credit unions frequently collaborate with other local businesses, fostering a sense of economic interconnectedness.

4. Accessible Banking Services

Credit unions understand the importance of accessible banking services for all members, regardless of their financial situation. They strive to provide services that are inclusive and convenient. Many credit unions offer online and mobile banking options, making it easy to manage your finances on the go. Additionally, credit unions are often part of a shared network of ATMs, providing widespread access to cash withdrawal without incurring additional fees.

5. Transparent and Democratic Structure

As a member of a credit union, you have a voice in the decision-making process. Credit unions operate on a democratic structure, allowing members to elect the board of directors and participate in shaping the institution’s policies. This transparency ensures that the credit union serves the best interests of its members.

6. Financial Education and Support

Credit unions prioritize financial literacy and often offer educational resources and workshops to help members improve their financial well-being. They understand that informed members are more likely to make sound financial decisions. Whether you need assistance with budgeting, debt management, or investments, credit unions are there to support you every step of the way.

In summary, credit unions provide an alternative to traditional banks, offering numerous benefits to their members. From competitive rates and lower fees to personalized service and a community focus, credit unions prioritize the needs of their members above all else. By joining a credit union, you become part of a democratic and member-driven organization that is dedicated to your financial well-being. If you value exceptional customer service, want access to competitive financial products, and believe in the power of community, a credit union may be the perfect fit for you.

Credit unions: Everything you need to know

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a credit union?

A credit union is a financial cooperative that is owned and controlled by its members. It provides financial services, such as savings accounts, loans, and other products, to its members.

What are the benefits of using a credit union?

Using a credit union has several benefits, including:

– Lower fees: Credit unions often have lower fees compared to traditional banks.

– Higher interest rates: Credit unions tend to offer higher interest rates on savings accounts and lower interest rates on loans.

– Personalized service: Credit unions provide a more personalized and community-oriented approach to banking.

– Member ownership: As a member of a credit union, you have a say in decision-making and can benefit from any profits made by the credit union.

How is a credit union different from a bank?

Credit unions are different from banks in the following ways:

– Ownership: Credit unions are owned by their members, while banks are owned by shareholders.

– Profit distribution: Credit unions distribute profits to their members in the form of lower fees, higher interest rates, and improved services, while banks distribute profits to shareholders.

– Focus: Credit unions focus on serving their members and the local community, while banks aim to maximize profits for shareholders.

Can anyone join a credit union?

Membership eligibility criteria vary from one credit union to another. Some credit unions have specific membership requirements based on factors like geographic location, occupation, or affiliation with certain organizations. However, many credit unions have broad eligibility criteria, allowing almost anyone to join.

How do I join a credit union?

To join a credit union, you typically need to meet the membership eligibility criteria and complete a membership application. This may involve providing identification, proof of address, and paying a nominal membership fee. Once your application is approved, you become a member of the credit union and can start taking advantage of its services.

Are credit unions insured?

Most credit unions are insured by the National Credit Union Administration (NCUA), which provides insurance coverage similar to the Federal Deposit Insurance Corporation (FDIC) for banks. NCUA insurance protects members’ deposits up to a certain limit, providing peace of mind and financial security.

Do credit unions offer online banking services?

Yes, many credit unions offer online banking services to their members. These services typically include features like checking account management, bill payment, fund transfers, and access to online statements. Some credit unions also have mobile banking apps for added convenience.

Can credit unions help me with my financial goals?

Absolutely! Credit unions are dedicated to helping their members achieve their financial goals. They offer various financial products and services, such as savings accounts, loans, investment options, and financial counseling. Credit unions also often provide educational resources and workshops to help members make informed financial decisions.

Final Thoughts

Credit unions are financial institutions that offer a wide range of services to their members. They provide a convenient and affordable alternative to traditional banks. One of the main benefits of credit unions is that they are owned and operated by the members themselves, which means that profits are reinvested back into the institution, resulting in better rates and lower fees for members. In addition, credit unions often have a strong focus on community involvement and provide personalized customer service. If you are looking for a financial institution that prioritizes your needs and offers competitive rates, look no further than a credit union.