Looking to effectively refinance your student loans? Look no further! In this article, we will share valuable tips for refinancing student loans effectively, so you can take control of your finances and save money in the process. Whether you’re struggling with high interest rates or want to simplify your loan payments, refinancing can be a game-changer. By understanding the key strategies and techniques, you’ll be able to navigate the refinancing process with confidence and achieve your financial goals. So let’s dive in and discover how to make the most of refinancing your student loans!

Tips for Refinancing Student Loans Effectively

Refinancing student loans can be a smart financial move if done correctly. It can help you save money on interest, reduce your monthly payments, or pay off the debt faster. However, it’s important to approach the process with careful consideration and understanding. In this article, we will delve into some tips for refinancing student loans effectively to help you make informed decisions and achieve the best outcome for your financial situation.

1. Understand Your Current Loans and Objectives

Before diving into the refinancing process, it’s crucial to have a clear understanding of your current loans and what you aim to achieve through refinancing. Take the time to gather all the necessary information about your existing loans, including the interest rates, repayment terms, and outstanding balances. Additionally, define your goals for refinancing, whether it’s to lower your monthly payments, save on interest over the long term, or consolidate multiple loans into a single payment.

2. Check Your Credit Score

Your credit score plays a significant role in the refinancing process, as it affects the interest rates and terms you may qualify for. Before applying for refinancing, obtain a copy of your credit report and check your credit score. If your score is lower than desired, take steps to improve it, such as paying down debt, making timely payments, and correcting any errors on your report. A higher credit score can help you secure better refinancing options.

3. Research and Compare Lenders

To find the best refinancing options, it’s important to research and compare lenders. Look for reputable lenders that specialize in student loan refinancing. Explore their websites to understand their eligibility criteria, interest rates, repayment terms, and any fees involved. Consider reading reviews or seeking recommendations from reliable sources. By comparing multiple lenders, you can identify those that offer the most favorable terms and choose the one that aligns with your goals.

4. Evaluate Interest Rates and Terms

Interest rates are one of the most crucial factors to consider when refinancing student loans. Lower interest rates can significantly reduce the overall cost of your loan. Compare the interest rates offered by different lenders and pay attention to whether they are fixed or variable rates. Fixed rates remain the same throughout the loan term, providing stability and predictability, while variable rates may fluctuate over time. Evaluate the pros and cons of each option based on your financial goals and risk tolerance.

5. Calculate the Potential Savings

Before refinancing, take the time to calculate the potential savings. Use online calculators or speak with lenders to estimate how much you can save on interest and monthly payments by refinancing. Factor in the fees associated with refinancing and determine whether the savings outweigh the costs. This analysis will give you a clearer picture of the financial benefits refinancing can bring and help you make an informed decision.

6. Consider Loan Repayment Terms

When refinancing student loans, carefully consider the repayment terms offered by different lenders. Longer repayment terms may result in lower monthly payments but can increase the overall cost of the loan due to accruing interest over a more extended period. Conversely, shorter repayment terms may yield higher monthly payments but help you save on interest over time. Evaluate your financial situation and long-term goals to determine the ideal repayment term that strikes a balance between affordability and savings.

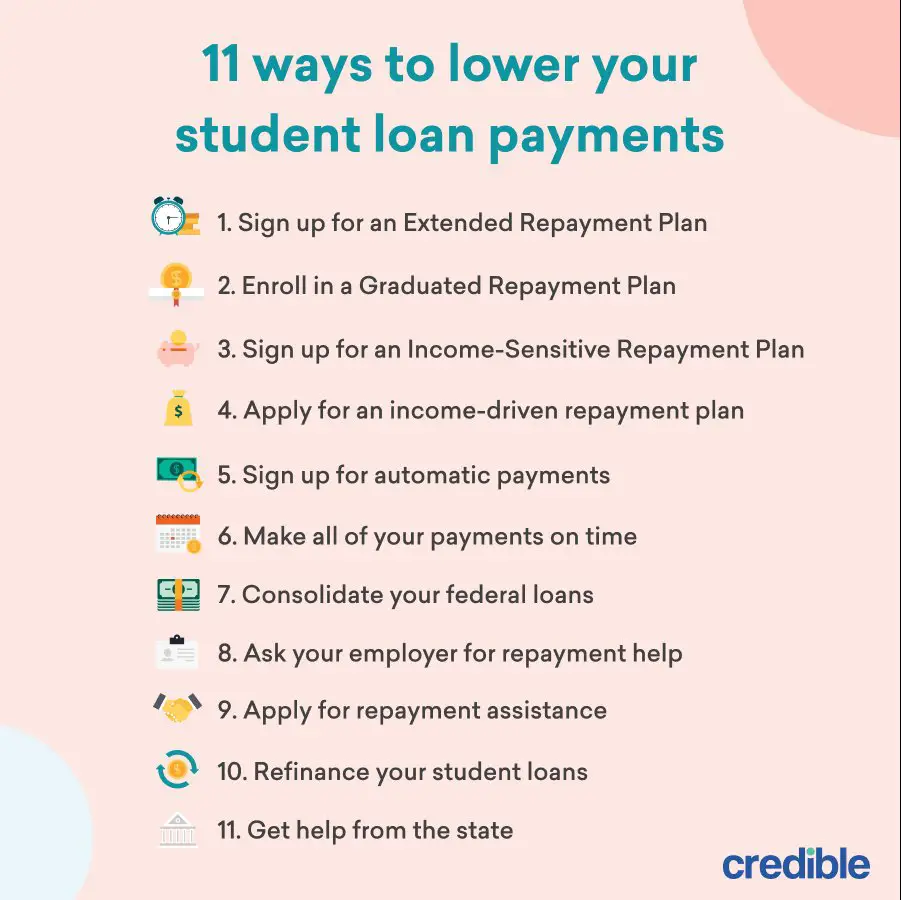

7. Be Aware of Potential Risks

While refinancing student loans can be advantageous, it’s essential to be aware of potential risks. For instance, refinancing federal student loans with a private lender means forfeiting federal loan benefits like income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options. Evaluate the importance of these benefits to your financial circumstances before refinancing. It’s advisable to consult a financial advisor or student loan expert to understand the implications fully.

8. Gather Required Documentation

Once you’ve identified a lender and decided to proceed with refinancing, gather all the required documentation. This may include proof of income, tax returns, bank statements, and information about your current loans. Having these documents readily available will streamline the application process and help you complete it accurately and efficiently.

9. Apply with Multiple Lenders

To increase your chances of securing the best refinancing terms, consider applying with multiple lenders. Simultaneously applying with different lenders within a short timeframe allows you to compare offers and choose the most favorable option. Be mindful that multiple credit inquiries within a specific period usually count as a single inquiry, minimizing the potential impact on your credit score.

10. Read and Understand the Fine Print

Before signing any loan agreement, thoroughly read and understand the fine print. Pay close attention to the terms and conditions, including any fees, repayment schedules, interest rate adjustment provisions, and potential penalties for early repayment. If you have any doubts or questions, seek clarification from the lender. It’s crucial to be fully informed and confident about the terms you are agreeing to.

By following these tips for refinancing student loans effectively, you can make informed decisions and improve your financial situation. Remember, each individual’s circumstances are unique, so take the time to assess your needs and find a refinancing option that aligns with your goals. Refinancing can be a powerful tool for managing student debt, and with careful planning, it can lead to significant savings and greater financial stability.

Student Loan Debt Refinancing Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is refinancing student loans?

Refinancing student loans refers to the process of taking out a new loan to pay off existing student loans. This new loan typically comes with a lower interest rate and better terms, allowing borrowers to save money and potentially reduce their monthly payments.

Is refinancing student loans a good idea?

Refinancing student loans can be a smart financial move for borrowers who are looking to lower their interest rates, reduce their monthly payments, or consolidate multiple loans into one. However, it may not be the best option for everyone, so it’s essential to evaluate your individual circumstances before deciding.

How can I determine if refinancing student loans is right for me?

To determine if refinancing student loans is the right choice for you, consider factors such as your current interest rate, credit score, income, and financial goals. It’s also wise to compare offers from different lenders and carefully review the terms and conditions before making a decision.

What are the potential benefits of refinancing student loans?

Some potential benefits of refinancing student loans include saving money on interest, lowering monthly payments, simplifying repayment by combining multiple loans into one, and potentially improving your credit score. It can also provide flexibility in choosing a new repayment term that aligns with your financial situation.

Will refinancing student loans affect my credit score?

Refinancing student loans may impact your credit score temporarily. When you apply for a new loan, the lender will perform a hard credit inquiry, which can cause a slight drop in your credit score. However, if you consistently make on-time payments on your new loan, it can have a positive long-term effect on your credit.

Can I refinance both federal and private student loans?

Yes, it is possible to refinance both federal and private student loans. However, keep in mind that refinancing federal loans means forfeiting certain borrower benefits and repayment options, such as income-driven repayment plans and loan forgiveness programs. Consider this carefully before refinancing federal loans.

What are the eligibility criteria for refinancing student loans?

Eligibility criteria for refinancing student loans vary among lenders. Typically, lenders consider factors such as credit score, income, employment history, and debt-to-income ratio. Meeting these requirements demonstrates your ability to repay the loan and increases your chances of being approved for refinancing.

Can I refinance student loans if I have bad credit?

While having bad credit may make it more challenging to refinance student loans, it is not impossible. Some lenders specialize in providing refinancing options for borrowers with less-than-perfect credit. However, keep in mind that you may face higher interest rates or require a cosigner to secure the loan.

Final Thoughts

In conclusion, effectively refinancing student loans involves a few key tips to keep in mind. First, assess your current loan terms and compare them to potential refinancing options to ensure you’ll get better terms. Secondly, carefully consider interest rates, loan terms, and repayment options offered by various lenders. Next, aim to improve your credit score before refinancing, as it can help you secure lower interest rates. Additionally, it’s important to thoroughly research and compare lenders to find the best fit for your needs. Lastly, don’t forget to consider any potential fees or penalties associated with refinancing. By following these tips for refinancing student loans effectively, you can potentially save money and better manage your loan repayment.