Looking to understand expense tracking for freelancers? Look no further! As a freelancer, keeping track of your expenses is crucial for maintaining financial stability and success. But if you’re unsure where to start or how to effectively manage your expenses, don’t worry! In this blog article, we’ll delve into the ins and outs of understanding expense tracking for freelancers. From practical tips to user-friendly tools, we’ve got you covered. So, let’s dive in and explore how you can take control of your finances and thrive as a freelancer.

Understanding Expense Tracking for Freelancers

Being a freelancer comes with a great deal of freedom and flexibility, but it also requires a high level of financial responsibility. One essential aspect of managing your freelancer finances is expense tracking. By diligently tracking your expenses, you can gain valuable insights into your spending habits, maximize your tax deductions, and ensure the financial health of your business. In this article, we will dive deep into the world of expense tracking for freelancers, exploring its importance, best practices, tools, and more.

The Importance of Expense Tracking for Freelancers

Expense tracking is the process of recording all your business-related expenses, including purchases, bills, invoices, and receipts. Whether you work as a freelance writer, graphic designer, web developer, or any other profession, keeping track of your expenses is crucial for several reasons:

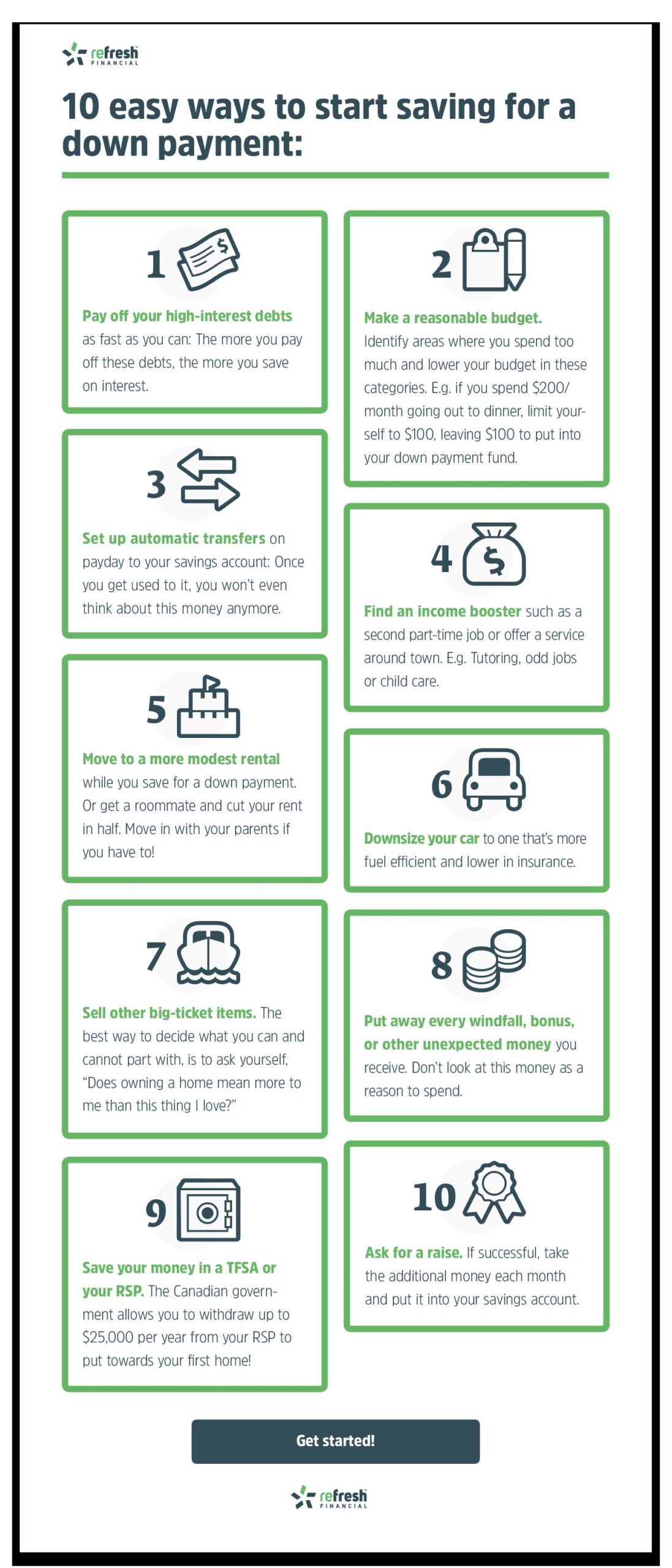

1. Budgeting: Effective expense tracking allows you to create a realistic budget and allocate funds to different business activities. By understanding where your money is going, you can make informed decisions about your spending and plan for future expenses.

2. Tax Deductions: As a freelancer, you are eligible for various tax deductions that can help lower your overall tax liability. By keeping thorough records of your expenses, you can identify deductible items and maximize your potential tax savings.

3. Profitability Analysis: Tracking your expenses enables you to assess the profitability of your freelance business. By comparing your income to your expenses, you can determine if you’re generating enough revenue to cover your costs and make a profit.

4. Client Billing: When working with clients, accurately tracking expenses is crucial for invoicing purposes. It ensures that you can bill clients for any reimbursable expenses incurred during a project, helping you maintain transparency and receive proper compensation.

Best Practices for Expense Tracking

To effectively track your expenses as a freelancer, consider implementing the following best practices:

1. Create a Separate Bank Account: Opening a separate business bank account helps you separate your personal and business finances. This allows for cleaner expense tracking and simplifies the process of reconciling your financial records.

2. Maintain Receipts: Keep all your receipts, whether physical or digital, organized and stored safely. Receipts serve as evidence for your expenses and are necessary for accurate tracking and potential tax deductions.

3. Use Expense Tracking Software: Utilize dedicated expense tracking software or apps to streamline the process. These tools often provide features like receipt scanning, automated categorization, and integration with accounting systems, making expense tracking more efficient.

4. Categorize Your Expenses: Create a logical system for categorizing your expenses. Common categories include office supplies, travel expenses, marketing costs, subscriptions, and professional development. Consistent categorization makes it easier to analyze your spending habits and identify areas for improvement.

5. Record Expenses In Real-Time: Develop a habit of recording your expenses as soon as they occur. Waiting too long can lead to forgetting crucial details and missing out on accurate records. Using expense tracking apps on your smartphone can make this process even more convenient.

6. Track Both Cash and Card Expenses: It’s important to track all types of expenses, whether paid by cash, credit card, or electronic transfer. Maintain a comprehensive record of each transaction to ensure no expenses slip through the cracks.

Expense Tracking Tools for Freelancers

Fortunately, numerous expense tracking tools are available to help freelancers streamline their financial record-keeping. Here are some popular options:

1. QuickBooks Self-Employed: Designed specifically for freelancers and independent contractors, QuickBooks Self-Employed offers features like expense tracking, mileage tracking, and easy tax preparation.

2. Expensify: Expensify simplifies expense tracking by allowing users to scan receipts, automatically extract the relevant information, and categorize expenses. It also integrates with popular accounting software.

3. Wave: Wave provides free accounting and expense tracking software tailored to small businesses and freelancers. It includes features like receipt scanning, expense categorization, and automatic bank transaction imports.

4. Xero: Xero offers comprehensive accounting software that includes expense tracking, invoicing, and bank reconciliation. It allows for easy collaboration with accountants and integrates with various other business tools.

5. Mint: Although primarily a personal finance app, Mint can also be useful for freelancers. It helps track expenses, create budgets, and provides insights into your overall financial health.

6. Google Sheets/Excel: For freelancers on a tight budget, using spreadsheet software like Google Sheets or Excel can be an effective way to track expenses manually. There are also pre-made templates available online to simplify the process.

Expense tracking plays a vital role in the financial well-being of freelancers. It allows you to maintain a clear view of your business expenses, optimize tax deductions, and make informed decisions about your finances. By adopting best practices and utilizing expense tracking tools, you can effectively manage your expenses, streamline your financial processes, and ultimately contribute to the success of your freelance business.

Frequently Asked Questions

Q: What types of expenses should freelancers track?

A: Freelancers should track all their business-related expenses, including purchases, bills, invoices, and receipts. Common categories include office supplies, travel expenses, marketing costs, subscriptions, and professional development.

Q: Can I deduct my home office expenses as a freelancer?

A: Yes, freelancers who use a portion of their home exclusively for their business can deduct home office expenses. This can include expenses like rent, utilities, and internet bills, calculated based on the square footage of the dedicated office space.

Q: Is it necessary to hire an accountant for expense tracking?

A: While hiring an accountant can be beneficial for handling complex financial matters, many freelancers can effectively manage their expense tracking on their own using dedicated software or spreadsheets. However, it’s always a good idea to consult with a tax professional for specific tax advice and to ensure compliance with regulations.

How to Get a Better Overview of your Freelancer Income & Expenses

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is expense tracking for freelancers?

Expense tracking for freelancers is the process of monitoring and recording the expenses incurred in their business operations. It helps freelancers keep track of their spending, categorize expenses, and evaluate their financial health.

Why is expense tracking important for freelancers?

Expense tracking is essential for freelancers as it enables them to manage their finances effectively. By tracking expenses, freelancers can ensure they stay within budget, accurately calculate their tax deductions, and identify areas where they can cut costs or optimize spending.

How can I start tracking my expenses as a freelancer?

To start tracking your expenses as a freelancer, you can begin by setting up a dedicated business bank account. This allows you to separate personal and business expenses. Next, you can use various tools such as spreadsheet software or expense tracking apps to record and categorize your expenses regularly.

What expenses should I track as a freelancer?

As a freelancer, it is important to track both your business and personal expenses. Business expenses include things like equipment purchases, software subscriptions, marketing costs, and travel expenses directly related to your work. Personal expenses include any expenses that are not directly tied to your freelance work.

How often should I track my expenses?

It is recommended to track your expenses on a regular basis. Ideally, you should record and categorize your expenses as soon as possible after the transaction occurs. This ensures accuracy and helps you maintain an up-to-date financial overview.

Are there any tools or software available to assist with expense tracking?

Yes, there are various tools and software available to assist freelancers with expense tracking. Some popular options include QuickBooks, FreshBooks, Excel or Google Sheets, and expense tracking mobile apps like Expensify or Mint. These tools offer features like automatic expense categorization and receipt scanning to simplify the tracking process.

How can expense tracking help with tax deductions?

Expense tracking plays a crucial role in claiming tax deductions as a freelancer. By accurately tracking your business expenses, you can identify deductions that can be claimed on your tax return. This can include deductions for equipment, software licenses, office supplies, professional development, and more.

What are the consequences of not tracking expenses as a freelancer?

Not tracking expenses as a freelancer can lead to financial disorganization and potential problems in the long run. Without proper tracking, it becomes challenging to evaluate profitability, accurately calculate taxes, and manage cash flow effectively. Additionally, it may result in missed deductions and potential errors when filing taxes.

Final Thoughts

Expense tracking is a vital aspect of managing finances for freelancers. By understanding expense tracking, freelancers can effectively monitor their income and expenses, ensuring financial stability and growth. With accurate expense tracking, freelancers can easily calculate their taxable income, claim deductions, and stay compliant with tax regulations. Additionally, it allows them to make informed decisions regarding budgeting, pricing, and improving profitability. By implementing practical expense tracking strategies and utilizing digital tools, freelancers can efficiently track their expenses and optimize their financial management. Understanding expense tracking for freelancers is crucial for their financial success.