Setting realistic financial goals is vital for securing a stable financial future. Whether you are aiming to save for a dream vacation, pay off debts, or build a comfortable retirement fund, having a clear plan is essential. But how do you set realistic financial goals that you can actually achieve? In this article, we will explore practical steps and strategies to help you confidently navigate the process. From understanding your current financial situation to creating a realistic timeline and developing an actionable plan, we will guide you through the process of setting and achieving your financial goals. So, let’s dive in and learn how to set realistic financial goals that will empower you to take control of your financial well-being.

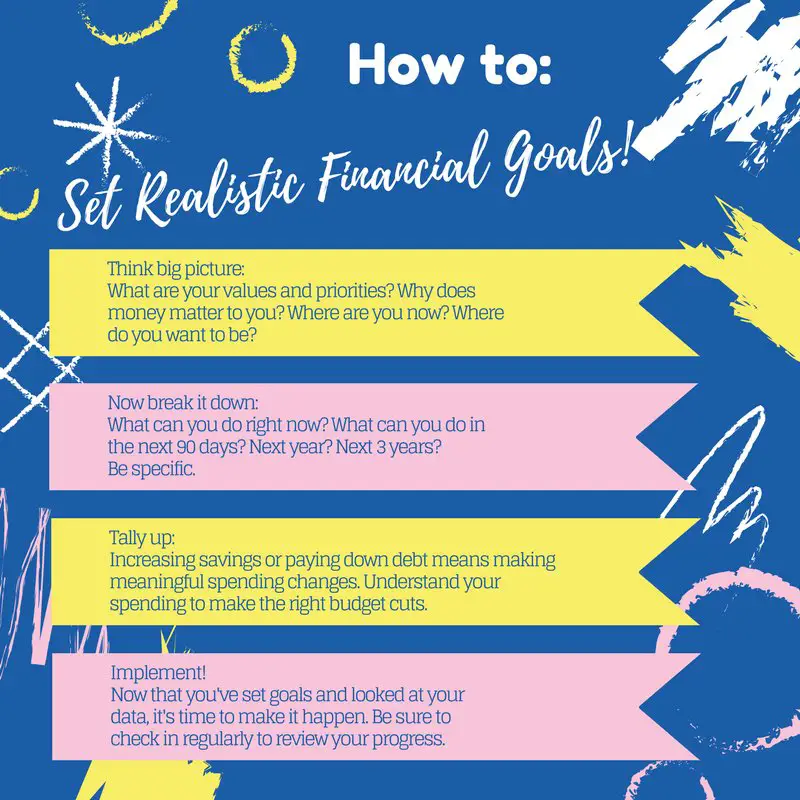

How to Set Realistic Financial Goals

Setting realistic financial goals is an essential step towards achieving financial stability and success. Whether you’re aiming to pay off debt, save for a dream vacation, or build long-term wealth, having clear and attainable financial goals can provide you with a sense of direction and motivation. In this article, we will explore the key steps and strategies to help you set realistic financial goals and increase your chances of achieving them.

1. Assess Your Current Financial Situation

Before you start setting financial goals, it’s crucial to have a clear understanding of your current financial situation. Take some time to evaluate your income, expenses, assets, and debts. This assessment will serve as a foundation for setting realistic goals and determining the actions required to achieve them.

- Review your income sources: Identify all the streams of income you have, including your salary, investments, or side hustles.

- Analyze your expenses: Track your expenses for a few months to determine where your money is going. Categorize your spending to understand your fixed expenses (e.g., rent, utilities) and discretionary expenses (e.g., dining out, entertainment).

- Calculate your net worth: Subtract your total debts from your total assets to calculate your net worth. This will give you an indication of your overall financial health.

2. Define Your Financial Goals

Once you have a comprehensive understanding of your financial situation, it’s time to define your goals. It’s important to set specific, measurable, achievable, relevant, and time-bound (SMART) goals. Here’s how you can define your financial goals effectively:

- Be specific: Clearly articulate what you want to achieve. Rather than saying, “I want to save money,” specify the amount you aim to save and the timeline.

- Make them measurable: Set goals that you can track and measure. For example, if you want to pay off debt, set a goal to pay off a specific amount within a particular time frame.

- Keep them achievable: Set goals that are within your reach. While it’s good to aim high, setting unrealistic goals can lead to frustration and demotivation.

- Ensure relevance: Align your goals with your values and priorities. Consider what truly matters to you and how achieving these goals will enhance your life.

- Make them time-bound: Set deadlines for your goals to create a sense of urgency and accountability. This will help you stay focused and motivated.

3. Prioritize Your Goals

Once you have a list of financial goals, it’s essential to prioritize them based on their importance and urgency. Consider the short-term, medium-term, and long-term goals you have set and rank them accordingly. By prioritizing your goals, you can focus your time, energy, and resources on the most critical objectives.

4. Break Goals into Actionable Steps

To make your financial goals more manageable, break them down into smaller, actionable steps. This approach allows you to create a clear roadmap towards achieving your goals. Here’s how you can break down your goals into actionable steps:

- Identify specific actions: Determine the specific actions you need to take to move closer to your goals. For example, if your goal is to save $10,000 for a down payment on a house, your actions might include reducing discretionary spending, increasing your income with a side hustle, and automating regular savings.

- Set deadlines: Assign deadlines to each action step to ensure progress and maintain focus.

- Create a timeline: Map out a timeline for each action step and the overall goal. This will help you track your progress and stay motivated.

- Celebrate milestones: Celebrate your achievements along the way to maintain motivation and reinforce positive financial habits.

5. Monitor and Adjust Your Goals

Setting financial goals is not a one-time activity; it requires ongoing monitoring and adjustment. Regularly review your progress, reassess your goals, and make any necessary adjustments. Here are some tips for monitoring and adjusting your financial goals:

- Track your progress: Regularly review your finances to see how you’re progressing towards your goals. Use tools like budgeting apps or spreadsheets to monitor your income, expenses, and savings.

- Make course corrections: If you’re not making adequate progress towards a goal, evaluate what’s not working and make the necessary adjustments. This could involve revisiting your budget, seeking additional income sources, or cutting back on expenses.

- Set new goals as you progress: As you achieve your financial goals, set new ones to continue challenging yourself and progressing further.

6. Seek Professional Guidance

Sometimes, seeking professional guidance can greatly help you in setting realistic financial goals. Financial advisors or planners are experts in the field who can provide valuable advice and tailor a plan specifically to your needs. They can also assist in aligning your goals with appropriate investment strategies, retirement planning, and risk management.

7. Stay Motivated and Stay on Track

Setting and achieving financial goals requires discipline, motivation, and perseverance. Here are some strategies to help you stay motivated and stay on track:

- Visualize your goals: Create a visual representation of your goals and display it somewhere visible. This can serve as a constant reminder of what you’re working towards.

- Celebrate milestones: Celebrate the milestones you achieve along the way. Treat yourself to small rewards when you reach specific targets.

- Find an accountability partner: Share your goals with a trusted friend or family member who can hold you accountable and provide support throughout your journey.

- Review your progress regularly: Set aside time to review your progress regularly. Reflect on the positive changes and improvements you’ve made to stay motivated.

Setting realistic financial goals is a powerful tool for improving your financial well-being. By assessing your current situation, defining specific goals, prioritizing them, breaking them down into actionable steps, monitoring your progress, seeking guidance when needed, and staying motivated, you can set yourself on the path to financial success. Remember, setting realistic goals is just the beginning; taking consistent action is what will ultimately lead you to achieve your financial dreams.

How to Set Realistic Financial Goals in 2023 (5 easy ways!)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I set realistic financial goals?

Setting realistic financial goals requires careful planning and analysis. Start by assessing your current financial situation, including your income, expenses, and debt. Then, identify your short-term and long-term financial objectives. Consider your priorities and what you hope to achieve financially. Next, break down your goals into specific, measurable, achievable, relevant, and time-bound (SMART) targets. Create a budget, track your expenses, and adjust your spending habits accordingly. Regularly review and update your goals as needed to stay on track.

What are the benefits of setting realistic financial goals?

Setting realistic financial goals provides several benefits. Firstly, it helps you gain control over your finances by providing a clear roadmap for your financial decisions. It also motivates you to save and invest wisely, increasing your chances of achieving long-term financial security. Setting goals also allows you to prioritize your spending, ensuring that your money is directed towards what matters most to you. Additionally, clear financial goals can reduce stress and provide peace of mind, knowing that you are actively working towards your desired financial outcomes.

How do I determine what is a realistic financial goal for me?

Determining realistic financial goals involves considering your unique circumstances, such as your income, expenses, debts, and financial obligations. Start by evaluating your current financial situation and analyzing your cash flow. Consider your short-term and long-term priorities, such as paying off debt, saving for emergencies, buying a home, or planning for retirement. Set goals that are attainable within your resources and timeframe, taking into account any constraints or limitations you may have. It’s important to strike a balance between ambition and practicality to ensure successful goal achievement.

Should I involve my partner or spouse in setting financial goals?

Yes, involving your partner or spouse in setting financial goals is highly beneficial. Open communication and shared financial goals can strengthen your relationship and create a sense of unity when it comes to managing finances. Start by having an open and honest conversation about your individual financial goals and aspirations. Identify common goals and discuss how you can work together to achieve them. Consider the strengths and weaknesses of each person, and allocate responsibilities accordingly. Regularly review your progress together and make adjustments as necessary to stay aligned.

What are some common mistakes to avoid when setting financial goals?

When setting financial goals, it’s important to avoid certain mistakes that can derail your progress. One common mistake is setting unrealistic goals that are beyond your current financial capabilities. It’s crucial to be honest with yourself about what is attainable within your resources. Another mistake is not having a clear plan, including specific actions and timelines, to achieve your goals. Without a roadmap, it’s easy to lose focus or get discouraged along the way. Lastly, failing to regularly track and review your progress can prevent you from identifying any necessary adjustments or missed opportunities.

How can I stay motivated to achieve my financial goals?

Staying motivated to achieve your financial goals is crucial for long-term success. Start by breaking down your goals into smaller, manageable milestones. Celebrate each milestone you reach to maintain a sense of accomplishment and motivation. Additionally, visualize the benefits and rewards that come with achieving your goals. Regularly remind yourself of the financial freedom, security, or dreams you are working towards. Furthermore, find an accountability partner, such as a friend or family member, who can support and encourage you throughout your financial journey.

What role does budgeting play in setting realistic financial goals?

Budgeting plays a crucial role in setting and achieving realistic financial goals. A budget helps you understand your income, expenses, and spending habits. It allows you to identify areas where you can cut back or save in order to allocate funds towards your goals. By tracking your expenses and sticking to a budget, you can ensure that you are making progress towards your financial objectives. Regularly review your budget and make adjustments as necessary to align with your changing goals and priorities.

What resources or tools can assist me in setting realistic financial goals?

Numerous resources and tools are available to assist you in setting realistic financial goals. Online budgeting apps and tools can help you track your income and expenses, create budgets, and set savings targets. Personal finance books and websites offer valuable insights and strategies for goal setting and financial planning. Additionally, seeking guidance from a financial advisor or attending financial literacy workshops can provide expert advice tailored to your specific needs. Take advantage of these resources to enhance your financial knowledge and improve your goal-setting abilities.

Final Thoughts

Setting realistic financial goals is crucial for achieving long-term financial success. By identifying your financial aspirations, you can create a roadmap that aligns with your income, expenses, and savings. Start by assessing your current financial situation and determining what matters most to you. Then, prioritize your goals based on their feasibility and timeline. Break down each goal into smaller, actionable steps, and track your progress regularly. Remember to be flexible and make adjustments as necessary. By following these steps, you can set realistic financial goals that are attainable and sustainable.