If you’re wondering what a money market account is and what benefits it offers, you’ve come to the right place. A money market account is a type of savings account that allows you to earn higher interest rates compared to traditional savings accounts. Unlike a checking account, it also provides the flexibility to write checks and make withdrawals. In this article, we’ll delve into the details of what a money market account is and explore its various benefits. Whether you’re looking to grow your savings or have easy access to your funds, a money market account could be the ideal solution for you. Let’s dive in!

What is a Money Market Account and Its Benefits

Introduction

In today’s financial landscape, it’s important to make your money work for you. One way to do that is by exploring various investment options that offer higher interest rates than traditional savings accounts. One such option is a money market account (MMA). In this comprehensive guide, we will delve into the depths of money market accounts, explaining what they are, how they work, and the benefits they offer to investors.

What is a Money Market Account?

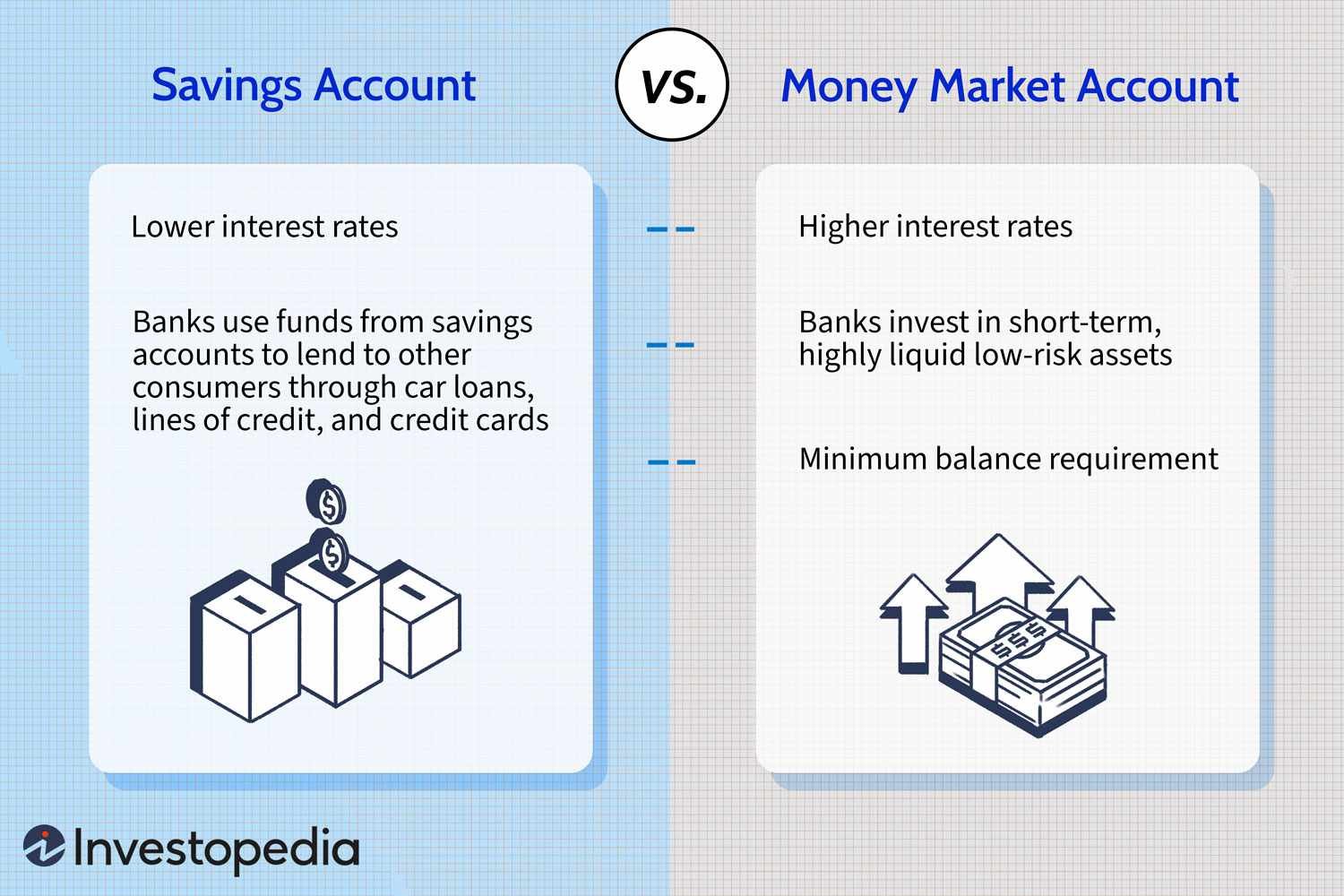

A money market account is a type of savings account offered by financial institutions such as banks or credit unions. It combines the features of a savings account and a checking account, providing a higher interest rate than a regular savings account while allowing limited check-writing abilities. MMAs are typically considered a low-risk investment option.

How Does a Money Market Account Work?

When you open a money market account, you deposit a certain amount of money into the account, similar to how you would with a regular savings account. This initial deposit acts as your investment, and the financial institution uses it to invest in low-risk securities such as Treasury bills, certificates of deposit, or short-term government bonds.

The interest accrued from these investments is then passed on to you as the account holder. The interest rate on an MMA is typically higher than that of a regular savings account due to the low-risk nature of the investments made by the financial institution.

Benefits of a Money Market Account

1. Higher Interest Rates

One of the primary benefits of a money market account is the higher interest rates it offers compared to traditional savings accounts. This means that your money can grow at a faster pace, allowing you to maximize your savings potential.

2. Liquidity

Unlike certain long-term investment options, money market accounts provide a high level of liquidity. This means that you can access your funds easily and quickly whenever the need arises. Most MMAs offer check-writing capabilities, making them a convenient option for managing your day-to-day expenses while still earning interest on your savings.

3. Safety and Security

Money market accounts are considered to be relatively safe investments. The low-risk securities in which the financial institution invests your money provide stability and minimize the chances of losing your principal. Additionally, most MMAs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), providing an extra layer of protection for your funds.

4. Diversification

By investing in a money market account, you gain exposure to a diverse range of low-risk securities that may not be easily accessible to individual investors. This diversification helps spread the risk and can provide stability to your investment portfolio.

5. Flexibility

Money market accounts offer flexibility in terms of minimum deposit requirements and balance maintenance. While some MMAs have higher minimum deposit requirements, others may have lower barriers to entry. Additionally, some financial institutions offer tiered interest rates based on the account balance, allowing you to earn a higher rate as your savings grow.

6. FDIC or NCUA Insurance

As mentioned earlier, most money market accounts are insured by the FDIC or NCUA. This insurance coverage protects your funds up to a certain limit (currently $250,000 per depositor per institution for FDIC-insured accounts). This gives you peace of mind and reassurance that even if the financial institution were to face financial troubles, your investment would still be safeguarded.

Is a Money Market Account Right for You?

While money market accounts offer several benefits, they may not be the perfect fit for everyone. Consider the following factors when deciding if an MMA is right for you:

- Your savings goals: MMAs are ideal for individuals looking for a relatively low-risk investment option with higher interest rates than regular savings accounts.

- Liquidity needs: If you require frequent access to your funds or need check-writing capabilities, MMAs provide a convenient solution.

- Tolerance for risk: If you are uncomfortable with the fluctuation of returns in more aggressive investment options such as stocks, money market accounts provide stability.

- Minimum balance requirements: Some MMAs have minimum balance requirements, so ensure that you can meet them before opening an account.

In conclusion, a money market account is a versatile and low-risk investment option that offers higher interest rates than traditional savings accounts. With the potential for increased savings, liquidity, safety, and diversification, MMAs can be an attractive choice for investors seeking stability. However, it’s essential to assess your savings goals, liquidity needs, risk tolerance, and minimum balance requirements before opening an MMA. By understanding the benefits and considering your individual circumstances, you can make an informed decision about whether a money market account is the right fit for you.

What Is A Money Market Account?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a money market account and how does it work?

A money market account is a type of savings account offered by banks and credit unions. It typically earns a higher interest rate than a regular savings account. It works by allowing you to deposit funds into the account, which the financial institution uses to invest in low-risk, short-term securities such as Treasury bills and certificates of deposit.

What are the benefits of a money market account?

A money market account offers several benefits, including:

– Competitive interest rates that are typically higher than regular savings accounts.

– Easy access to your funds, usually through checks, debit cards, and online transfers.

– Federal deposit insurance coverage of up to $250,000 per depositor, ensuring the safety of your money.

– Capital preservation and security due to the low-risk nature of the investments made by the financial institution.

Are money market accounts safe?

Yes, money market accounts are generally considered safe. They are backed by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), providing insurance coverage for up to $250,000 per depositor. However, it’s important to note that money market accounts are not risk-free and can still be subject to market fluctuations.

What is the minimum balance requirement for a money market account?

The minimum balance requirement for a money market account varies depending on the financial institution. Some may require a minimum initial deposit to open the account, while others may have ongoing minimum balance requirements to avoid monthly fees. It’s essential to check with your specific bank or credit union for their specific requirements.

Can I withdraw money from a money market account?

Yes, you can withdraw money from a money market account. However, there may be limitations on the number of withdrawals or transfers you can make each month. These limitations are usually imposed by federal regulations and are in place to maintain the account’s status as a savings vehicle rather than a transactional account.

Can I write checks from a money market account?

Yes, most money market accounts offer check-writing capabilities. This allows you to conveniently access your funds and make payments directly from the account. However, keep in mind that there may be limitations on the number of checks you can write per month.

Does a money market account earn interest?

Yes, a money market account earns interest. The interest rate is typically higher than that of a regular savings account but may vary depending on market conditions and the specific financial institution offering the account. The interest is usually compounded and credited to the account on a monthly basis.

Are there fees associated with a money market account?

Some money market accounts may have fees associated with them. These fees can include monthly maintenance fees, excessive withdrawal fees, or fees for not maintaining the minimum balance requirements. It’s important to review the terms and conditions of the account before opening to understand any potential fees that may apply.

Final Thoughts

A money market account is a type of savings account that offers higher interest rates compared to regular savings accounts. It combines the benefits of a savings account with the liquidity of a checking account. With a money market account, you can earn a competitive interest rate while still having easy access to your funds. These accounts are ideal for individuals who want to earn more from their savings without sacrificing liquidity. With no minimum deposit requirements and the ability to write checks, money market accounts provide a flexible and convenient way to grow your savings. So, if you are looking for a secure and accessible savings option, a money market account is worth considering.