Are you a freelancer looking for a reliable and efficient way to manage your finances? Look no further! Invoice financing for freelancers might just be the solution you’ve been searching for. But what exactly is invoice financing for freelancers? In simple terms, it’s a financing option that allows you to receive early payments for your outstanding invoices. Instead of waiting for your clients to pay, invoice financing lets you access a portion of the invoice amount upfront. With this flexible and convenient financing method, you can focus on your work without worrying about cash flow. Let’s delve deeper into the benefits and workings of invoice financing for freelancers.

What is Invoice Financing for Freelancers?

As a freelancer, you’re probably familiar with the joys and challenges of working for yourself. While being your own boss comes with numerous benefits, such as flexible working hours and the ability to choose your clients, it also means that you’re responsible for managing your finances. One aspect of financial management that can be particularly challenging for freelancers is cash flow.

Cash flow refers to the movement of money into and out of your business. It’s crucial for freelancers to maintain a steady cash flow to cover their expenses and ensure they can get paid on time. However, clients often have payment terms that can stretch for weeks or even months, leaving freelancers waiting for payment long after they’ve completed a project. This delay in receiving payments can have a significant impact on a freelancer’s ability to meet their financial obligations and grow their business.

This is where invoice financing, also known as invoice factoring or accounts receivable financing, comes in. Invoice financing is a financial solution that allows freelancers to access the funds tied up in their unpaid invoices before the clients actually pay. It provides a way for freelancers to improve their cash flow and address short-term financial needs.

How Does Invoice Financing Work for Freelancers?

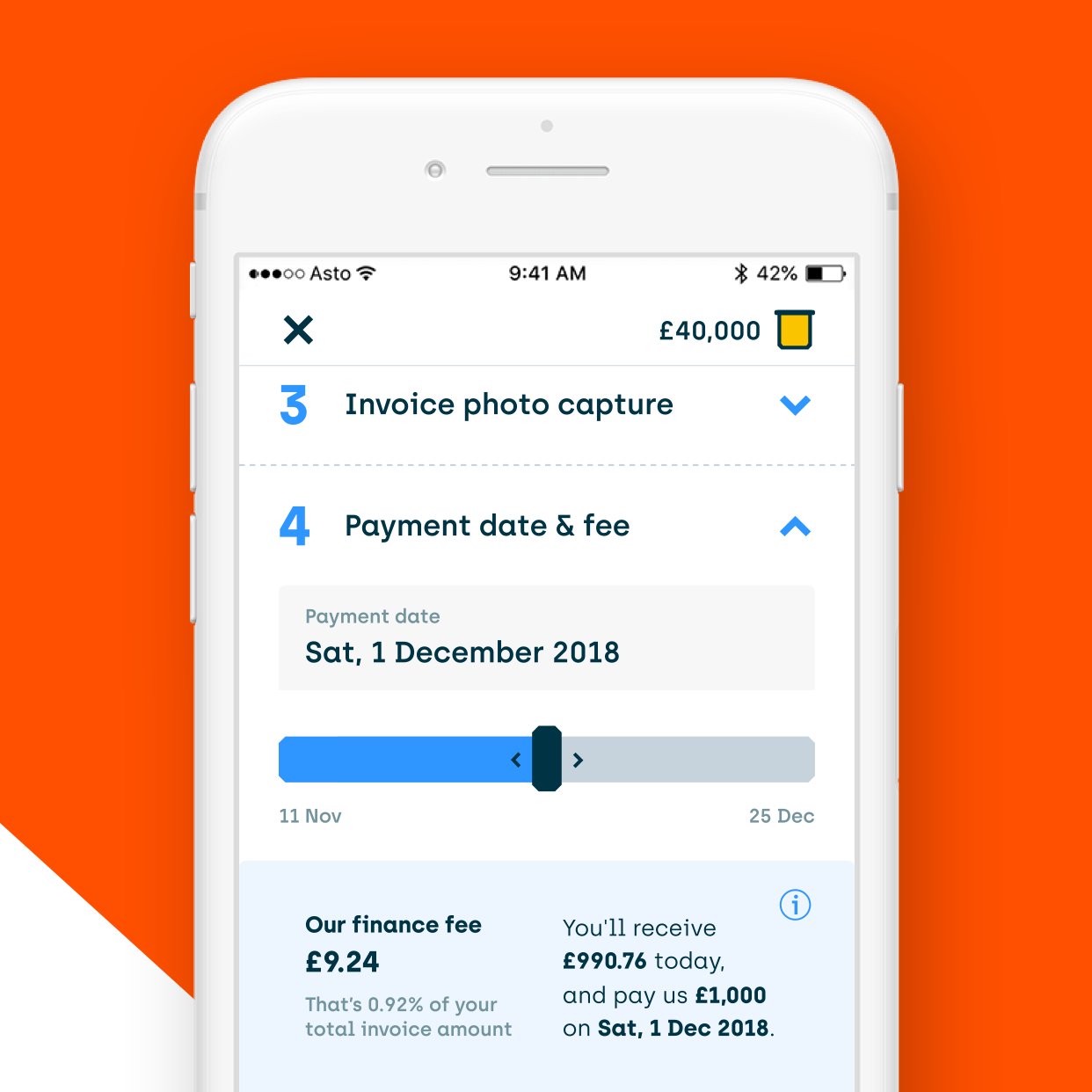

Invoice financing works by selling your unpaid invoices to a third-party company, often referred to as a factoring company or a factor. The factor advances you a percentage of the invoice’s value upfront, typically around 80-90%. The remaining balance, minus a fee or discount, is paid to you once the client settles the invoice with the factor.

Let’s break down the invoice financing process step by step:

1. Invoice Generation: As a freelancer, you provide your services to clients and generate invoices detailing the work you’ve completed and the amount owed by the client.

2. Invoice Submission to the Factor: You submit the invoices to the factoring company for evaluation. Factors typically prefer to work with invoices that have already been approved by the client, as it reduces the risk of disputes.

3. Verification and Approval: The factor reviews the submitted invoices and evaluates the creditworthiness of your clients to ensure they are likely to pay. They may also verify the legitimacy of the invoices and the accuracy of the information provided.

4. Funding: Once the invoices are approved, the factor advances you a percentage of the invoice value, usually within 24-48 hours. This immediate cash injection allows you to cover your business expenses or invest in growth opportunities.

5. Client Payment: Your client pays the invoice amount directly to the factor instead of paying you. The factor then deducts their fee or discount from the payment.

6. Final Payment: After deducting their fee, the factor pays you the remaining balance. The amount paid to you is typically around 10-20% less than the total value of the invoice, depending on the factor’s fee structure.

The Benefits of Invoice Financing for Freelancers

Invoice financing offers several benefits to freelancers, including:

1. Improved Cash Flow: By accessing funds tied up in unpaid invoices, freelancers can bridge the gap between completing a project and receiving payment. This ensures a more consistent cash flow and helps cover immediate expenses.

2. Faster Payments: Instead of waiting for clients to pay according to their payment terms, freelancers can receive a significant portion of their invoice amount within a few days. This can be especially beneficial for freelancers who rely on timely payment to meet their financial obligations.

3. Flexibility: Invoice financing is not a loan, but rather a way to access funds you’ve already earned. This means there are no strict repayment terms or interest charges. As a freelancer, you have the flexibility to use the funds as you see fit without the added burden of debt.

Factors to Consider When Choosing an Invoice Financing Company

When selecting an invoice financing company, it’s essential to consider the following factors:

1. Fee Structure: Different factors have varying fee structures, including discount rates or service fees. It’s crucial to understand these costs and evaluate them against your projected cash flow to determine the affordability of the financing solution.

2. Client Approval Criteria: Factors assess the creditworthiness of your clients before approving invoices for financing. Understanding the factors’ criteria for client approval can help you determine if they are a good fit for your business and its clients.

3. Contract Terms: Carefully review the terms and conditions of the invoice financing agreement. Pay attention to factors such as contract length, termination clauses, and any hidden fees or penalties.

4. Customer Support: Consider the level of customer support provided by the factoring company. Having a responsive and knowledgeable team to address your concerns or answer your questions can greatly enhance your experience with invoice financing.

Invoice financing offers freelancers a valuable financial tool to manage cash flow challenges and meet their immediate business needs. By unlocking the funds tied up in unpaid invoices, freelancers can access the working capital required to grow their business and take on new opportunities. With increased cash flow, faster payments, and flexibility, invoice financing can be a game-changer for freelancers looking to take control of their finances.

Remember, every freelancer’s financial situation is unique, and it’s essential to evaluate the costs and benefits of invoice financing before making a decision. By understanding the process, benefits, and factors to consider, you can determine if invoice financing is the right solution for your freelance business.

Invoice Financing Turn Your Unpaid Invoices into Cash Flow

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is invoice financing for freelancers?

Invoice financing for freelancers is a financial solution that allows freelancers to access funds tied up in unpaid invoices. It enables them to receive immediate payment for their work instead of waiting for clients to settle their invoices.

How does invoice financing work for freelancers?

When freelancers opt for invoice financing, they submit their unpaid invoices to a financing company. The company advances a portion of the invoice’s value, usually around 80-90%. Once the client pays the invoice, the financing company pays the freelancer the remaining amount, deducting a small fee for their services.

Is invoice financing suitable for all types of freelancers?

Yes, invoice financing is suitable for freelancers from various industries, including graphic designers, writers, consultants, photographers, and more. As long as you have unpaid invoices and need immediate access to funds, invoice financing can be beneficial.

What are the benefits of using invoice financing for freelancers?

Invoice financing offers several benefits to freelancers, including improved cash flow, immediate access to funds, reduced financial stress, and the ability to focus on their work without worrying about delayed payments.

Can freelancers with bad credit avail invoice financing?

Yes, freelancers with bad credit can still avail invoice financing. Unlike traditional loans, invoice financing companies primarily consider the creditworthiness of the client rather than the freelancer. As long as freelancers have reputable clients, they have a higher chance of approval.

Are there any drawbacks to invoice financing for freelancers?

While invoice financing can be advantageous, it’s essential to consider a few drawbacks. These may include fees charged by the financing company, potential strain on client relationships due to involving a third party, and the possibility of not receiving the full invoice amount.

Can freelancers choose which invoices to finance?

Yes, freelancers can select which invoices they want to finance. Whether they need immediate funds for a specific project or want to finance multiple invoices at once, the flexibility lies with the freelancer.

How long does it take to receive funds through invoice financing?

The time it takes to receive funds through invoice financing varies depending on the financing company. While some companies offer quick turnaround times of a few business days, others may take slightly longer. It’s advisable to inquire about the timeline with the chosen financing provider.

Can freelancers use invoice financing multiple times?

Yes, freelancers can use invoice financing multiple times. As long as they have unpaid invoices, they can continue to opt for invoice financing whenever they face cash flow challenges.

Final Thoughts

To summarize, invoice financing for freelancers is a reliable solution to manage cash flow challenges. By selling unpaid invoices to a third-party lender, freelancers can access immediate funds to meet their financial obligations. This form of financing eliminates the need to wait for clients to pay, providing freelancers with the capital they need to run their businesses smoothly. With invoice financing, freelancers can focus on their work and avoid the stress of late payments. It is a convenient and practical tool for managing finances and ensuring a steady income for freelancers.