Are you in need of quick financial assistance to bridge the gap between buying a new home and selling your current one? Look no further! A bridge loan could be the solution you’ve been searching for. So, what is a bridge loan and its benefits? Simply put, a bridge loan is a short-term loan that helps bridge the financial gap when buying a new property before selling your current one. This type of loan offers benefits such as flexibility, convenience, and accessibility, making it a popular choice for many homebuyers. Let’s delve deeper into the world of bridge loans and discover how they can be advantageous for you.

What is a Bridge Loan and Its Benefits

A bridge loan is a short-term loan that provides immediate financing to bridge the gap between the purchase of a new property and the sale of an existing one. It is a useful tool for individuals or businesses who find themselves in need of temporary funds to facilitate a smooth transition in real estate transactions. In this article, we will delve into the various aspects of bridge loans, their benefits, and how they can be advantageous in different situations.

How Does a Bridge Loan Work?

Bridge loans are designed to offer temporary financial support when there is a timing gap between the purchase of a new property and the sale of an existing one. These loans provide the necessary funds to bridge the gap, allowing the borrower to proceed with the purchase while waiting for the sale to close.

Bridge loans are typically short-term loans with a repayment period ranging from a few weeks to a few months. They are usually secured by the borrower’s existing property or the new property being purchased. The amount of the loan is determined based on the value of the collateral and the borrower’s ability to repay.

The Benefits of Bridge Loans

Bridge loans offer several benefits that make them an attractive option for individuals or businesses in need of temporary financing:

- Quick Access to Funds: Bridge loans provide immediate access to funds, allowing borrowers to seize opportunities without waiting for the sale of their existing property.

- Smooth Transition: By providing temporary financing, bridge loans ensure a smooth transition between properties, preventing delays and allowing borrowers to move forward with their plans.

- Flexibility: Bridge loans are flexible in terms of repayment options. Borrowers can often choose to make interest-only payments during the loan term, alleviating some financial burden while waiting for the sale of their property.

- No Prepayment Penalties: Unlike some other types of loans, bridge loans often do not carry prepayment penalties. This allows borrowers to pay off the loan early without incurring additional costs.

- Increased Purchasing Power: With a bridge loan, borrowers have the flexibility to make competitive offers on new properties, as they have the funds readily available.

When to Consider a Bridge Loan

Bridge loans can be beneficial in various situations where timing and financing are crucial. Here are a few scenarios where a bridge loan might be considered:

Real Estate Transactions

When buying a new home or property, a bridge loan can help facilitate the purchase before the sale of an existing property is finalized. This ensures that the borrower does not miss out on a desired property while waiting for the proceeds from the sale.

Property Renovations or Flips

Investors or individuals looking to renovate or flip properties can also benefit from bridge loans. These loans provide the necessary funds to purchase and renovate the property, with the intention of selling it for a profit within a short period of time.

Business Expansion

Bridge loans can be used by businesses to bridge the financing gap during expansions or when additional capital is needed. They can provide immediate funds to support growth initiatives or cover operational expenses until long-term financing is secured.

The Bridge Loan Process

Applying for a bridge loan involves a specific process that includes the following steps:

1. Research and Find Lenders

Start by researching and identifying reputable lenders or financial institutions that offer bridge loans. Consider factors such as interest rates, loan terms, and customer reviews to make an informed decision.

2. Gather Documentation

Before approaching a lender, gather the necessary documentation to support your loan application. This may include proof of income, financial statements, property appraisals, and any other relevant documents required by the lender.

3. Submit Loan Application

Once you have selected a lender, submit a loan application along with the required documentation. The lender will review the application and assess your eligibility based on factors such as creditworthiness and the value of the collateral.

4. Loan Approval and Terms

If your application is approved, the lender will provide details regarding the loan amount, interest rate, repayment terms, and any other conditions. Take time to carefully review and understand the terms before proceeding.

5. Closing and Disbursement

Once the loan details are finalized, the closing process begins. This involves signing the necessary legal documents and finalizing the loan agreement. Once the loan is closed, the funds will be disbursed to you, allowing you to proceed with your plans.

Bridge Loan vs. Traditional Loans

While traditional loans and bridge loans serve different purposes, it’s worth noting the key differences between them:

1. Purpose

Traditional loans are typically used for long-term financing, such as purchasing a home or funding a business. On the other hand, bridge loans are short-term loans used to bridge the financing gap between property transactions.

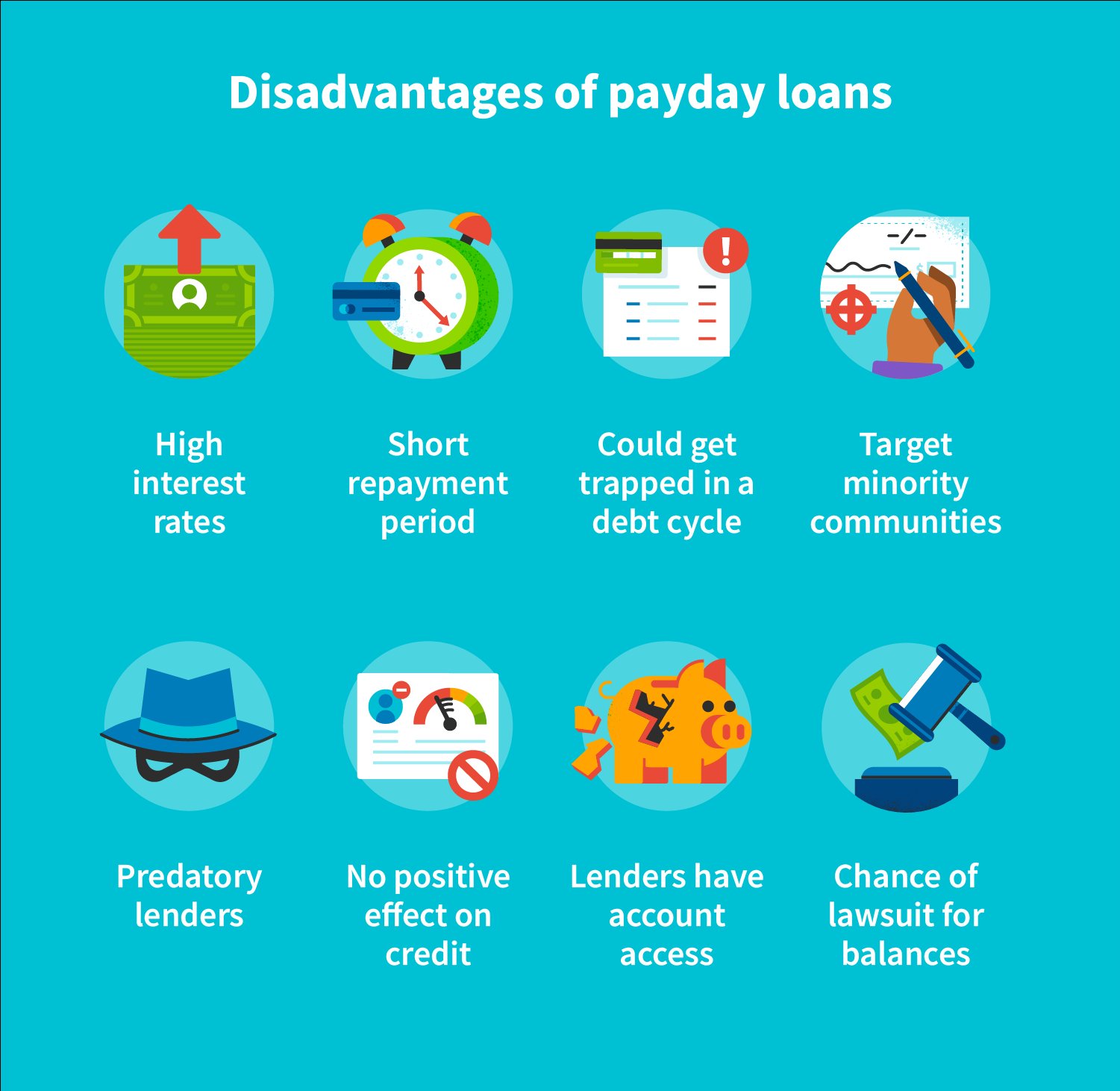

2. Repayment Period

Traditional loans often have longer repayment periods, spanning several years or even decades, depending on the loan type. In contrast, bridge loans have much shorter repayment periods ranging from a few weeks to a few months.

3. Collateral

Both traditional loans and bridge loans can be secured by collateral. However, bridge loans are commonly secured by the borrower’s existing property or the new property being purchased.

4. Interest Rates

Interest rates for traditional loans are typically lower compared to bridge loans. Since bridge loans carry higher risk due to their short-term nature, lenders may charge higher interest rates to compensate for the increased risk.

5. Approval Process

The approval process for traditional loans can be more extensive and time-consuming compared to bridge loans. Traditional loans often require thorough credit checks, income verification, and other detailed assessments.

Bridge loans provide a temporary financing solution for individuals or businesses in need of immediate funds to bridge the gap between property transactions. They offer quick access to funds, flexibility in repayment options, and can be advantageous in various situations. Whether you’re a homeowner looking to purchase a new property, an investor flipping houses, or a business owner seeking temporary capital, bridge loans can help you navigate the financial challenges and ensure a smooth transition.

What is a Bridging Loan? How Does Bridging Finance Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a bridge loan?

A bridge loan is a short-term loan that is used to bridge the gap in financing when buying a new property before selling an existing one. It provides temporary funds to cover the down payment and other expenses until the old property is sold.

How does a bridge loan work?

A bridge loan works by providing immediate cash flow to the borrower, allowing them to purchase a new property while waiting for the sale of their current property. The loan is typically repaid when the old property is sold, or through alternative means such as refinancing.

What are the benefits of a bridge loan?

1. Flexibility: Bridge loans offer flexibility in terms of repayment options and can be customized to fit the borrower’s specific needs.

2. Quick access to funds: Bridge loans provide fast access to cash, allowing borrowers to take advantage of opportunities without delay.

3. Smooth transition: Bridge loans help ensure a smoother transition between properties by eliminating the need to wait for the sale of the old property.

4. Competitive terms: Bridge loans often offer competitive interest rates and terms compared to alternative financing options.

Can bridge loans be used for both residential and commercial properties?

Yes, bridge loans can be used for both residential and commercial properties. They are commonly used by individuals and businesses to facilitate property purchases and investments.

Are bridge loans only available for borrowers with excellent credit?

No, bridge loans are available to borrowers with a range of credit scores. While a good credit score may help secure more favorable terms, lenders also consider other factors such as the property value and the borrower’s ability to repay the loan.

What is the typical duration of a bridge loan?

The typical duration of a bridge loan is usually between six months to two years. However, the duration can vary depending on the lender, borrower’s needs, and the specific circumstances.

Can bridge loans be extended if needed?

Yes, bridge loans can often be extended if needed. However, extending the loan may be subject to certain conditions and additional fees. It is important to discuss extension options with the lender beforehand.

What happens if the old property doesn’t sell before the bridge loan term ends?

If the old property doesn’t sell before the bridge loan term ends, alternative arrangements may need to be made. These can include refinancing the bridge loan, negotiating an extension, or exploring other financing options. It is essential to communicate with the lender to find the most suitable solution.

Final Thoughts

A bridge loan is a short-term financing option that can provide immediate funds to individuals or businesses in need. It is typically used to bridge the gap between the purchase of a new property and the sale of an existing one. One of the key benefits of a bridge loan is its quick approval process, allowing borrowers to access funds quickly. Additionally, bridge loans offer flexibility in terms of repayment, enabling borrowers to repay the loan in a lump sum or in installments. Overall, a bridge loan can be a valuable financial tool for those looking to secure immediate funds while navigating real estate transactions or other financial needs.