Cash advances on a credit card can be a lifesaver in times of financial emergencies. If you find yourself in need of quick cash, a cash advance on your credit card allows you to withdraw money from an ATM or receive cash directly from a bank or financial institution. It’s a convenient solution when you’re in a pinch, but it’s essential to understand the implications and costs associated with this type of transaction. So, what is cash advance on a credit card exactly, and how does it work? Let’s dive into the details without any delay.

What is Cash Advance on a Credit Card?

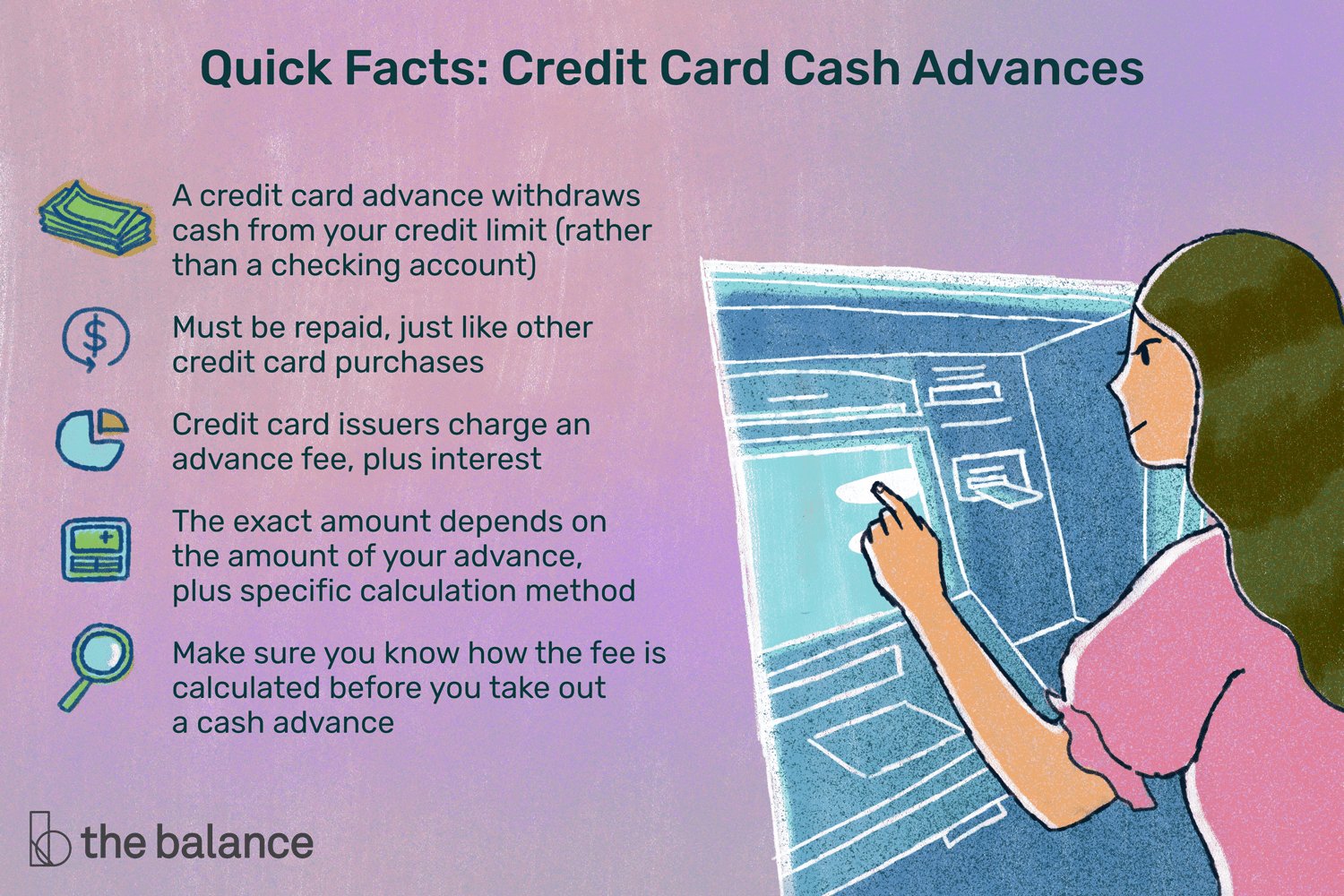

Cash advance on a credit card refers to a financial transaction in which the cardholder withdraws cash from their credit card balance. It allows individuals to obtain cash quickly and conveniently, especially in situations where cash is needed and other payment methods may not be accepted. While credit cards are primarily designed for purchases, cash advances provide an additional feature that can be beneficial in emergencies or when cash is not readily available.

How Does Cash Advance Work?

To understand how cash advance works, it is essential to know the mechanics involved. Here is a step-by-step breakdown:

1. Credit Card Usage: Credit cards are typically used for making purchases either online or in physical establishments. When using a credit card, the cardholder is essentially borrowing money from the credit card issuer to complete the transaction.

2. Cash Advance Request: In scenarios where cash is needed, the cardholder can request a cash advance on their credit card. This can be done through various methods, including ATM withdrawals, bank teller transactions, or online transfers, depending on the credit card issuer’s policies.

3. Cash Advance Limit: Each credit card has a specific cash advance limit, which is usually a percentage of the overall credit limit. The cardholder cannot exceed this limit when obtaining a cash advance.

4. Fees and Interest: Cash advances typically come with fees and higher interest rates compared to regular credit card purchases. These fees are often charged as a percentage of the amount withdrawn or as a flat fee. It is crucial to review the terms and conditions of the credit card agreement to understand the associated costs.

5. Repayment: Cash advances on credit cards need to be repaid, just like any other credit card debt. However, the repayment terms for cash advances may differ from regular credit card balances. It is important to consult the credit card issuer to understand the specific repayment requirements.

When Should You Use a Cash Advance?

While cash advances on credit cards can provide immediate access to cash, it is important to carefully consider when it is appropriate to use this feature. Here are some instances where using a cash advance may be necessary or advantageous:

1. Emergencies: In unexpected situations where cash is urgently needed, such as medical emergencies or car repairs, a cash advance can help cover immediate expenses when other options are not available.

2. Limited Acceptance of Credit Cards: Some establishments, particularly smaller businesses or certain service providers, may not accept credit card payments. In such cases, a cash advance allows individuals to access cash for transactions where credit cards are not viable.

3. Traveling: When traveling to locations where credit card acceptance may be limited or unreliable, having a cash advance option can provide a sense of security. It ensures access to cash for essential expenses like transportation, food, and accommodations.

4. Cash-only Transactions: In situations where cash-only transactions are required, such as paying for parking fees, tipping service providers, or using vending machines, a cash advance can be a convenient solution.

5. Immediate Financial Needs: If an individual is facing a critical financial situation and requires cash urgently, a cash advance on a credit card may be a viable short-term solution until alternative arrangements can be made.

Advantages and Disadvantages of Cash Advances on Credit Cards

Like any financial tool, cash advances on credit cards have both advantages and disadvantages. It is crucial to consider these factors before deciding to use this feature:

Advantages:

- Convenience: Cash advances allow cardholders to access cash quickly and conveniently, especially in emergency situations.

- Immediate Availability: Unlike other forms of borrowing, cash advances are usually available instantly, without requiring an application or approval process.

- Widely Accepted: Cash advances can be used at ATMs, banks, and various establishments that accept credit cards.

Disadvantages:

- Higher Fees and Interest Rates: Cash advances often incur higher fees and interest rates compared to regular credit card purchases, making them more expensive.

- No Grace Period: Unlike regular credit card purchases, cash advances usually start accruing interest immediately, with no grace period.

- Impact on Credit Utilization: Cash advances can increase a cardholder’s credit utilization, potentially affecting credit scores and future borrowing opportunities.

- Repayment Challenges: Repayment terms for cash advances may differ from regular credit card balances, requiring careful planning to avoid excessive debt.

Tips for Responsible Use of Cash Advances

To avoid potential pitfalls and manage cash advances responsibly, consider the following tips:

1. Limit Cash Advance Usage: Cash advances should be reserved for genuine emergencies or situations where no other viable payment options are available. It is essential to evaluate the urgency and necessity before proceeding with a cash advance.

2. Minimize Withdrawal Amounts: Only withdraw the amount of cash needed, as the associated fees and interest can accumulate quickly. Larger withdrawals can lead to higher costs and potential debt challenges.

3. Repay the Balance Promptly: Aim to repay the cash advance balance as soon as possible. Making only the minimum payment can result in increased interest charges and prolong the repayment period.

4. Understand the Terms and Costs: Familiarize yourself with the credit card terms and conditions regarding cash advances. Be aware of the associated fees, interest rates, and any other applicable charges.

5. Explore Alternatives: Before opting for a cash advance, consider other options like personal loans, borrowing from friends or family, or using a line of credit with lower interest rates.

In Conclusion

Cash advances on credit cards can be a useful tool when immediate access to cash is required. While they offer convenience and flexibility, it is crucial to use them responsibly and understand the associated costs. By carefully considering the circumstances and exploring alternative options, individuals can make informed decisions about when to utilize this feature. Remember, responsible financial management is the key to maintaining a healthy credit profile and overall financial well-being.

How a Credit Card Cash Advance Works (and why you shouldn't do one)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a cash advance on a credit card?

A cash advance on a credit card is a service provided by credit card issuers that allows cardholders to withdraw cash using their credit limit. It works like a short-term loan, where you can access funds in the form of cash from an ATM or by visiting a bank or financial institution.

How does a cash advance on a credit card work?

When you request a cash advance on your credit card, the issuer will typically charge you a fee, which is either a flat rate or a percentage of the amount withdrawn. The cash advance also starts accruing interest immediately, typically at a higher rate than regular purchases. It is important to note that cash advances usually have a separate credit limit from your regular purchases.

Can I get a cash advance on any credit card?

Not all credit cards offer cash advance services, so it is important to check with your credit card issuer to see if this service is available. Additionally, some credit cards may have restrictions or limitations on cash advances, such as a maximum limit or a higher interest rate.

What are the fees associated with cash advances on credit cards?

The fees for cash advances on credit cards typically include a transaction fee, which can be either a flat rate or a percentage of the amount advanced. Additionally, interest charges on cash advances are generally higher than those on regular purchases and start accruing immediately with no grace period.

What are the advantages of using a cash advance on a credit card?

Using a cash advance on your credit card can provide immediate access to funds in emergency situations when cash is needed. It eliminates the need to apply for a separate loan or borrow from other sources. Cash advances can also be useful when traveling in areas where credit cards may not be widely accepted, but cash is needed.

What are the disadvantages of using a cash advance on a credit card?

Cash advances on credit cards come with certain drawbacks. The fees and interest rates associated with cash advances are often higher than those for regular purchases. Additionally, there is usually no grace period, meaning interest starts accruing immediately. It is important to understand the terms and fees associated with cash advances before considering this option.

How does a cash advance affect my credit card balance?

A cash advance increases the outstanding balance on your credit card. It is treated as a separate type of transaction, and the cash advance amount is usually subject to its own interest rate and repayment terms. It is important to consider the impact on your overall credit card balance and to make timely payments to avoid accumulating interest charges.

Can I repay a cash advance separately from my regular credit card balance?

Yes, you can typically repay a cash advance separately from your regular credit card balance. However, it is important to check with your credit card issuer to understand their specific repayment policies. Paying off your cash advance as soon as possible can help minimize interest charges.

Final Thoughts

In summary, a cash advance on a credit card is a convenient but costly option for obtaining cash. It allows cardholders to withdraw money from an ATM or obtain cash from a bank using their credit card. However, cash advances often come with high interest rates, transaction fees, and no grace period for interest charges. It is important to carefully consider the financial implications before using this feature. Overall, while cash advances provide immediate access to cash, they should be used sparingly, and other alternatives should be explored first.