Are you eagerly anticipating the arrival of a little bundle of joy but feeling slightly overwhelmed by the financial aspect of taking parental leave? Well, fret not! In this article, we’ll guide you through the steps on how to financially prepare for a parental leave while keeping your stress levels in check. From creating a budget, exploring various benefits and resources, to considering alternative sources of income, we’ve got you covered. So, if you’re wondering how to financially prepare for a parental leave, sit back, relax, and let us help you navigate this exciting yet challenging chapter of your life.

How to Financially Prepare for Parental Leave

Bringing a child into the world is a joyous occasion, but it also comes with a range of responsibilities, including the need for financial preparation. Planning ahead will help ensure a smooth transition during your parental leave and allow you to focus on your new bundle of joy. In this guide, we will explore various strategies to help you financially prepare for parental leave, from budgeting to accessing government benefits. Let’s dive in!

Assess Your Current Financial Situation

Before embarking on your parental leave journey, it’s essential to evaluate your current financial standing. Take note of your income, savings, investments, and debt. This assessment will provide a clear picture of your financial resources and obligations, enabling you to make informed decisions moving forward.

- Calculate your monthly income: Determine how much money you earn each month by considering your salary, bonuses, and any other sources of income.

- Identify your expenses: Track your expenses to understand where your money goes. Categorize them into essentials (e.g., rent/mortgage, utilities, groceries), discretionary spending (e.g., dining out, entertainment), and debts (e.g., loans, credit cards).

- Assess your debt: Determine the amount of outstanding debt you have, such as student loans, car loans, or credit card balances, as this will impact your ability to save during parental leave.

- Evaluate your savings and investments: Take stock of your current savings and investment accounts, such as emergency funds, retirement funds, or stocks. This will give you an idea of your financial safety net.

Create a Budget for Parental Leave

Establishing a budget is a crucial step in financially preparing for parental leave. It will help you manage your expenses, allocate resources more efficiently, and potentially identify areas where you can save money. Here’s how to create a budget:

- List your expected income during parental leave: Consider any paid parental leave benefits from your employer, insurance policies, or government programs. Be aware of the duration and percentage of income replacement offered.

- Estimate your expenses: Review your current expenses and anticipate any additional costs associated with your new baby, such as diapers, formula, medical expenses, and child care.

- Make adjustments: If your expected income during parental leave is lower than your current income, identify areas where you can reduce expenses. Cut back on discretionary spending, renegotiate bills, or find ways to save on essential expenses.

- Set savings goals: Aim to allocate a portion of your income towards savings during parental leave. Building an emergency fund or increasing your existing savings will provide a financial safety net and give you peace of mind.

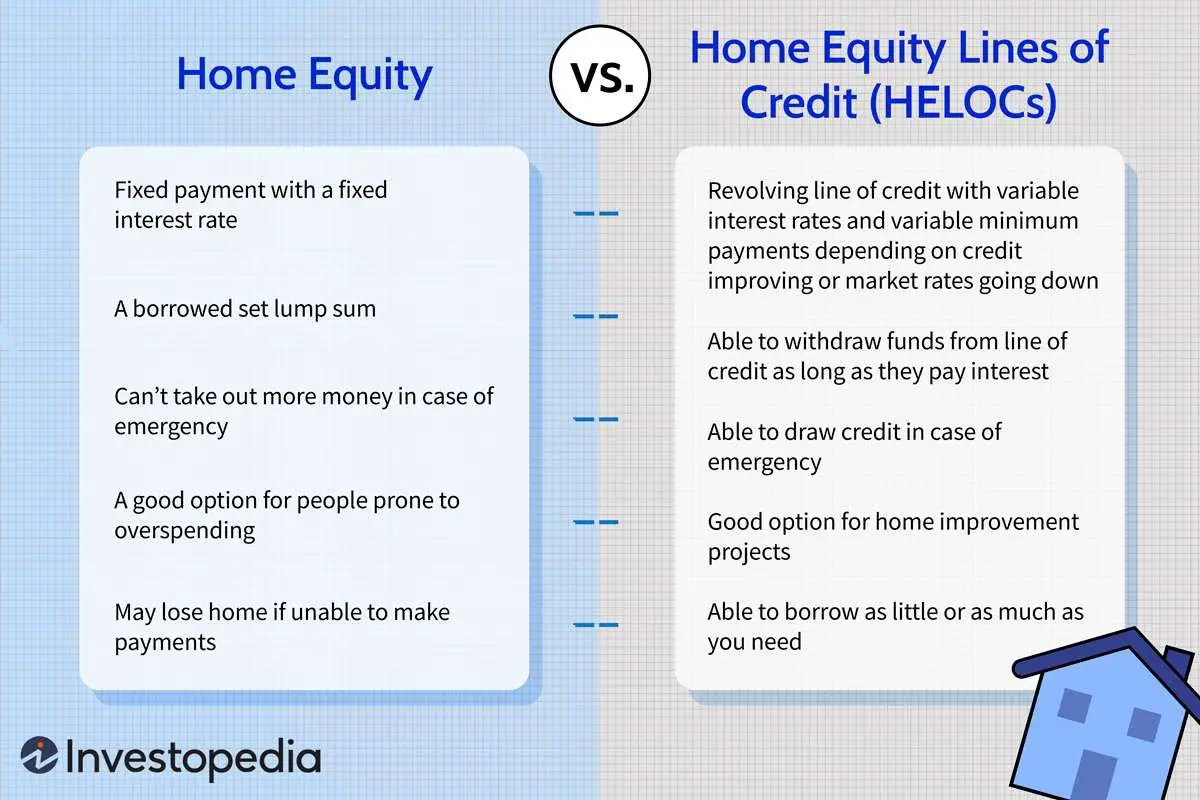

Review and Enhance Your Insurance Coverage

Insurance plays a vital role in shielding you and your family from unexpected financial hardships. Reviewing and enhancing your insurance coverage before your parental leave is crucial for protecting your growing family. Consider the following types of insurance:

Health Insurance

Check your health insurance policy to ensure it covers prenatal care, delivery, and postnatal care for both you and your baby. Understand the deductibles, co-pays, and any out-of-pocket expenses you may be responsible for during this time.

Life Insurance

Evaluate your life insurance policy to ensure it provides adequate coverage for your family’s needs. Life insurance can help replace your income and provide financial protection for your loved ones in the event of your untimely passing.

Disability Insurance

Review your disability insurance policy, especially if it covers maternity or parental leave. Some policies provide partial income replacement during periods of temporary disability, which may apply to parental leave.

Auto and Home Insurance

Take the opportunity to review your auto and home insurance policies. Ensure they provide sufficient coverage and consider adjusting your coverage limits if necessary.

Explore Employer Benefits

Many employers offer benefits and programs that can help alleviate the financial burden of parental leave. Familiarize yourself with your employer’s policies and take advantage of the following resources:

Paid Parental Leave

Check if your employer offers paid parental leave benefits. Understand the duration and amount of income replacement provided and any requirements or documentation needed to access these benefits.

Flexible Spending Accounts (FSAs)

Explore the availability of FSAs, which allow you to set aside pre-tax dollars for eligible medical expenses or dependent care. Utilizing an FSA can help reduce your taxable income and save you money on qualified expenses.

Employee Assistance Programs (EAPs)

Find out if your employer offers EAPs that provide free or low-cost counseling, legal advice, or financial planning services. These programs can offer invaluable support during the transition to parenthood.

Other Benefits and Discounts

Investigate any additional benefits or discounts your employer may provide, such as discounts on baby supplies, child care assistance, or reimbursement programs for childbirth or breastfeeding classes.

Understand Government Benefits

In addition to employer benefits, various government programs can provide financial assistance during parental leave. Familiarize yourself with these options and determine if you qualify for the following benefits:

Paid Family Leave

Research your country’s or state’s laws regarding paid family leave. Determine the eligibility criteria, duration, and percentage of income replacement offered. Ensure you understand the application process and any required documentation.

Maternity and Parental Leave Benefits

Investigate government programs that provide maternity or parental leave benefits. Determine the eligibility requirements and the amount of income replacement offered. Familiarize yourself with the application process and necessary documentation.

Child Tax Credits and Benefits

Look into child tax credits and benefits provided by your government. These programs aim to provide financial support to families with young children. Understand the eligibility requirements and the process for claiming these benefits.

Child Care Subsidies

Research if your government offers child care subsidies or assistance programs. These programs can help reduce the cost of child care, making it more affordable during parental leave and beyond.

Explore Supplemental Sources of Income

To further bolster your finances during parental leave, consider exploring supplemental sources of income:

Side Hustles

Explore opportunities for side hustles that allow you to work from home or have flexible hours. Freelancing, online tutoring, or selling handmade products can provide an additional income stream during your parental leave.

Passive Income Investments

Consider passive income investments such as rental properties, dividend-paying stocks, or peer-to-peer lending. These investments can generate income even while you’re on parental leave.

Rent Out Unused Space

If you have unused space in your home, consider renting it out temporarily. Short-term renting platforms can help you find suitable tenants for a defined period, providing an additional source of income.

Seek Financial Advice

If you find yourself overwhelmed or unsure about the financial aspects of parental leave, don’t hesitate to seek professional advice. Consult with a financial advisor who specializes in family finances or reach out to organizations that provide free financial counseling services. A professional can help you create a personalized plan tailored to your specific circumstances.

Remember, planning for parental leave is an ongoing process. Continuously reassess your financial goals, monitor your budget, and adjust your strategies as needed. With proper financial preparation, you can confidently embark on your parental leave journey, knowing that you have taken steps to secure your family’s financial well-being.

8 tips to financially prepare for maternity leave (California)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially prepare for a parental leave?

Financially preparing for a parental leave requires careful planning and budgeting to ensure a smooth transition. Here are some steps you can take:

What are the benefits of saving for a parental leave in advance?

Saving for a parental leave in advance can provide you with financial security during your time off. Benefits include:

Should I consider creating an emergency fund before going on parental leave?

Yes, it is advisable to create an emergency fund before going on parental leave. An emergency fund can help you cover unexpected expenses during this period without affecting your regular savings or budget.

How can I create a realistic budget for my parental leave?

Creating a realistic budget for your parental leave involves assessing your current expenses and making necessary adjustments. Here’s how you can do it:

What options do I have if I need additional financial support during my parental leave?

If you need additional financial support during your parental leave, there are various options you can explore:

Is it recommended to speak with a financial advisor before going on parental leave?

Yes, it is recommended to speak with a financial advisor before going on parental leave. A financial advisor can provide personalized guidance based on your specific circumstances and help you make informed decisions.

Are there any government programs or benefits available to parents on leave?

Yes, there are government programs and benefits available to parents on leave. Some common options include:

Should I consider obtaining insurance coverage before going on parental leave?

Obtaining insurance coverage before going on parental leave can provide an added layer of financial protection. Consider the following options:

Final Thoughts

Financially preparing for a parental leave requires careful planning and consideration. Start by creating a budget and assessing your expenses to ensure you have a clear understanding of your financial obligations. Explore available resources such as government benefits, employer-provided leave policies, and supplemental insurance options to help cover any income gaps. Consider saving money in advance by setting aside a portion of your income specifically for parental leave expenses. Additionally, it’s important to communicate with your employer about your plans and explore any flexible work arrangements that may be available. By taking these steps, you can better navigate the financial challenges of parental leave and ensure a smoother transition for you and your family.