Compound interest is a powerful concept that has the potential to greatly impact your financial future. Its magic lies in its ability to make your money grow exponentially over time. So, what exactly is compound interest and how can it work its magic? Well, put simply, compound interest is the interest you earn on both the initial amount of money you deposit (the principal) and any interest that accrues over time. In other words, it’s interest on top of interest, and it has the power to turn small, regular investments into a substantial nest egg. Let’s delve deeper into the realm of compound interest and explore its immense potential.

What is Compound Interest and Its Power

Compound interest is a powerful concept that can greatly impact our financial lives. It is a financial principle that allows for exponential growth of money over time. In simple terms, compound interest refers to the interest earned on both the initial amount of money deposited (principal) and the interest that accumulates over time. Unlike simple interest, which only accrues on the principal amount, compound interest allows for the growth of both the principal and the interest earned.

Understanding how compound interest works and harnessing its power can be vital in achieving financial goals, building wealth, and securing our future. In this article, we will dive deep into the concept of compound interest, explore its mechanics, and discover how it can work wonders for our financial well-being.

The Mechanics of Compound Interest

Compound interest is calculated based on three factors: the principal amount, the interest rate, and the compounding period. Let’s take a closer look at each of these components:

Principal Amount

The principal amount refers to the initial sum of money that is invested or deposited into an account. Whether it’s a savings account, a fixed deposit, or an investment portfolio, the principal amount serves as the foundation on which compound interest is calculated.

Interest Rate

The interest rate determines the percentage of the principal that will be added as interest over a specific period. This rate can vary depending on the type of account or investment. It is important to note that a higher interest rate leads to faster growth of the investment.

Compounding Period

The compounding period is the frequency at which the interest is compounded. It can be daily, monthly, quarterly, annually, or any other predefined time interval. The more frequent the compounding, the more interest is added to the principal, resulting in a higher overall growth.

The Power of Compound Interest

Now that we have a basic understanding of how compound interest works, let’s explore its power and why it is often referred to as the “eighth wonder of the world.”

Exponential Growth

Compound interest has the remarkable ability to generate exponential growth over time. As the interest earned gets added back to the principal, the subsequent interest calculations are based on a larger amount. This compounding effect leads to a snowball effect, where the growth of the investment accelerates over time.

Long-Term Investing

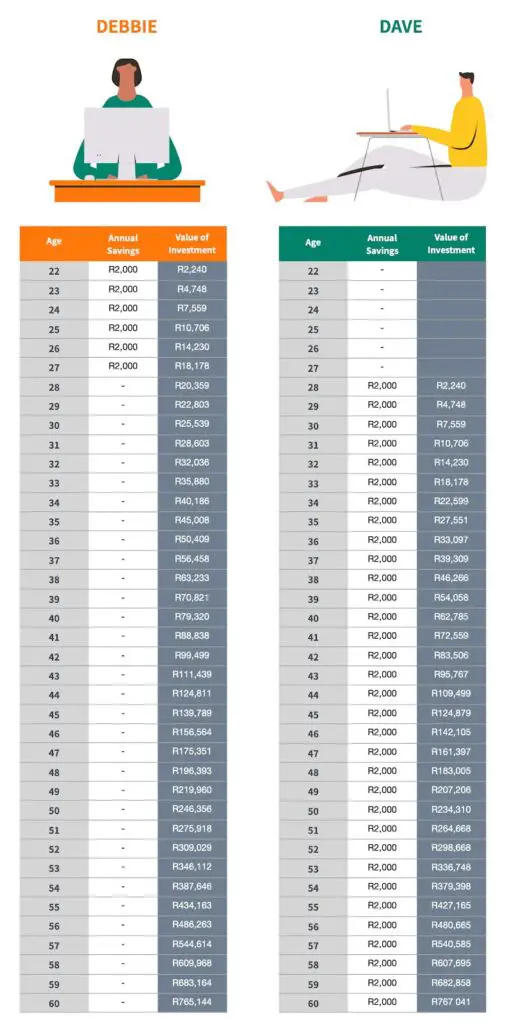

One of the key advantages of compound interest is its effectiveness when it comes to long-term investing. By starting early and allowing the investment to compound over a long period, even small amounts can grow into substantial sums. This is often referred to as the “time value of money,” where the longer the money is invested, the greater the impact of compound interest.

Building Wealth

Compound interest is a powerful tool for building wealth. By consistently saving or investing and allowing the interest to compound, individuals can witness their wealth grow exponentially. It provides a pathway to financial independence and opens doors to opportunities that otherwise would not be possible.

Retirement Planning

Compound interest plays a crucial role in retirement planning. By saving and investing early in life, individuals can take advantage of the compounding effect to build a substantial retirement fund. The power of compound interest ensures that their investments continue to grow, even during retirement, allowing for a comfortable and secure future.

Debt Repayment

Compound interest is not just beneficial for investments but can also be a detriment when it comes to debt. Credit card debt, mortgages, and loans often involve compound interest working against us. For example, if we only make minimum payments on our credit card balance, the interest will continue to compound, resulting in a cycle of increasing debt. It is crucial to be aware of this and develop strategies to minimize or eliminate high-interest debt as soon as possible.

Maximizing Compound Interest

To fully harness the power of compound interest, it is essential to adopt strategies that maximize its benefits. Here are some key tips to consider:

Start Early

The earlier you start saving or investing, the greater the advantage of compound interest. Even small amounts can make a significant difference when given time to compound.

Consistency is Key

Consistent contributions to savings or investment accounts allow for regular compounding. Set up automatic transfers or direct deposits to ensure a disciplined approach to saving.

Choose High-Interest Investments

Selecting investment options with higher interest rates can amplify the growth potential of compound interest. Research and choose wisely to ensure you are maximizing your returns.

Reinvest Dividends and Interest

If you receive dividends or interest payments from your investments, consider reinvesting them back into the investment. By doing so, you can take advantage of compounding on these additional earnings.

Stay Committed for the Long Term

Compound interest works best when given time to work its magic. Avoid unnecessary withdrawals or disruptions to the investment or savings plan to fully realize the power of compound interest.

In conclusion, compound interest is a remarkable financial tool that can transform our financial lives. Understanding its mechanics and harnessing its power can help us achieve our financial goals, build wealth, and secure our future. By starting early, being consistent, and making informed investment decisions, we can unlock the full potential of compound interest. So, take advantage of this incredible concept and let compound interest work for you in the journey towards financial prosperity.

Investopedia Video: Compound Interest Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is compound interest and how does it work?

Compound interest is the interest calculated on the initial principal amount as well as the accumulated interest from previous periods. It allows your investments or savings to grow exponentially over time. The interest is added to the principal, and subsequent interest calculations are based on the new total.

How is compound interest different from simple interest?

Compound interest takes into account both the initial principal and the accumulated interest, whereas simple interest is calculated only on the principal amount. As a result, compound interest grows faster over time compared to simple interest.

Why is compound interest considered powerful for long-term investments?

Compound interest has the power to significantly increase your investment returns over a long period. The interest earned in each period is added to the principal, and as the investment grows, the interest earned also increases. This compounding effect can lead to substantial growth and larger returns.

How can compound interest benefit my savings account?

By taking advantage of compound interest, your savings account can grow at an accelerated rate. As the interest is continuously added to your savings, it generates additional interest in subsequent periods, allowing your savings to increase progressively over time.

What factors influence the growth of compound interest?

Several factors influence the growth of compound interest, including the interest rate, the length of the investment or saving period, and the frequency at which the interest is compounded. Higher interest rates, longer time periods, and more frequent compounding can all contribute to faster growth.

Is compound interest only applicable to financial investments?

No, compound interest can be applied to various areas beyond financial investments. It is also commonly used in areas such as loans, mortgages, and credit cards, where interest is added to the outstanding balance. In such cases, compound interest can work against you, as the debt grows over time.

Can compound interest have a negative impact?

Yes, compound interest can have a negative impact if you have outstanding debts that accrue interest. As the interest is continuously added to the principal, the debt can grow rapidly over time if not managed effectively. It is important to understand and carefully manage the impact of compound interest on your financial obligations.

How can I maximize the power of compound interest?

To maximize the power of compound interest, you can start saving or investing as early as possible. The longer your money remains invested, the more time it has to grow through the compounding effect. Additionally, seeking higher interest rates or increasing the frequency of compounding can further enhance the benefits of compound interest.

Final Thoughts

Compound interest is a powerful financial concept that can have a significant impact on your wealth over time. By reinvesting the interest earned on your initial investment, your money has the potential to grow exponentially. This compounding effect can lead to substantial returns, especially when investing for the long term. Understanding how compound interest works is crucial for building wealth and achieving financial goals. By harnessing the power of compound interest, you can take advantage of the time value of money and maximize your investment growth. So, what is compound interest and its power? It is the ability to grow your wealth exponentially by reinvesting the interest earned on your investments over time.