Looking to make the most of your employer’s 401(k) match? You’re in the right place! Maximizing your employer 401(k) match is essential for boosting your retirement savings and taking advantage of the benefits your company offers. In this article, we’ll share practical tips on how to make the most of your employer 401(k) match, so you can secure a strong financial future. Whether you’re just starting out or have been contributing for years, these strategies will help you optimize your retirement savings without sacrificing your current financial stability. So, let’s dive in and discover how to maximize employer 401(k) match.

How to Maximize Your Employer 401(k) Match

Saving for retirement is crucial, and if you have access to a 401(k) plan through your employer, you have a great opportunity to build a retirement nest egg. One of the key benefits of a 401(k) plan is the employer match. This matching contribution can significantly boost your retirement savings, but only if you take full advantage of it. In this article, we will explore various strategies and tips to help you maximize your employer 401(k) match and make the most of this valuable benefit.

1. Understand Your Employer’s Matching Policy

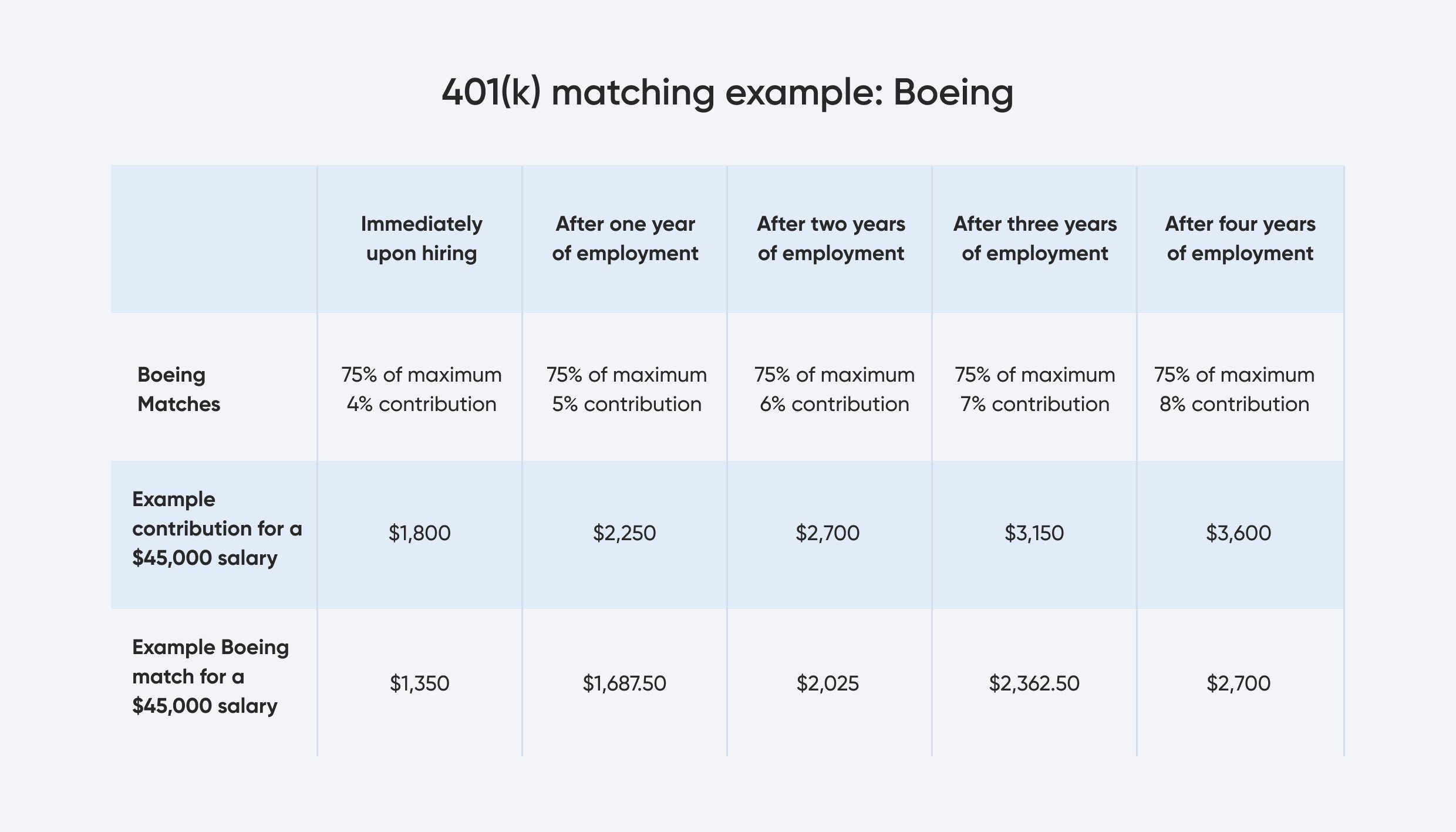

Before you can maximize your employer’s 401(k) match, it’s important to thoroughly understand the matching policy. Every employer has its own set of rules and guidelines regarding how much they contribute to your plan.

Review your plan’s official documents, such as the Summary Plan Description (SPD), to learn about the specific details of your employer’s match. Pay attention to factors such as:

- The percentage of your salary that your employer will match

- The maximum amount or cap on the employer match

- The vesting schedule (the time it takes for you to fully own the employer match)

- Any additional requirements, such as a minimum contribution percentage

By understanding these details, you can tailor your 401(k) strategy to maximize the match and take full advantage of your employer’s contributions.

2. Contribute Enough to Receive the Full Match

The first and most important step in maximizing your employer’s 401(k) match is to contribute enough to receive the full match. Employer matches are typically structured as a percentage of your salary, such as 3% or 6%. To maximize the match, contribute at least enough to reach the maximum matching percentage.

For example, if your employer offers a 3% match, contribute at least 3% of your salary to your 401(k) plan. If you can afford to contribute more, even better, as it will accelerate your retirement savings. However, make sure you are at least contributing enough to receive the full match.

3. Increase Your Contribution Rate Over Time

While contributing enough to receive the full match is a great starting point, it’s important to continue increasing your contribution rate over time. Aim to gradually increase your contributions each year until you reach the maximum allowed by the IRS, which is $19,500 (in 2021) for most individuals under the age of 50.

By increasing your contribution rate, you not only boost your retirement savings but also increase the employer match. For example, if your employer matches 3% of your salary, a higher contribution rate means a higher dollar amount matched by your employer.

Strategies to gradually increase your contribution rate include:

- Bump up your contribution by 1% each year during annual performance reviews or salary increases

- Allocate a portion of any bonuses or windfalls directly to your 401(k) contribution

- Automate your contributions to increase by a certain percentage annually

By consistently increasing your contribution rate, you’ll maximize your employer’s match and accelerate your retirement savings.

4. Take Advantage of Catch-Up Contributions

If you’re age 50 or older, you’re eligible for catch-up contributions, which allow you to contribute additional funds to your 401(k) on top of the regular contribution limits. For 2021, the catch-up contribution limit is $6,500.

By taking advantage of catch-up contributions, you can further maximize your employer match and accelerate your retirement savings as you approach retirement age.

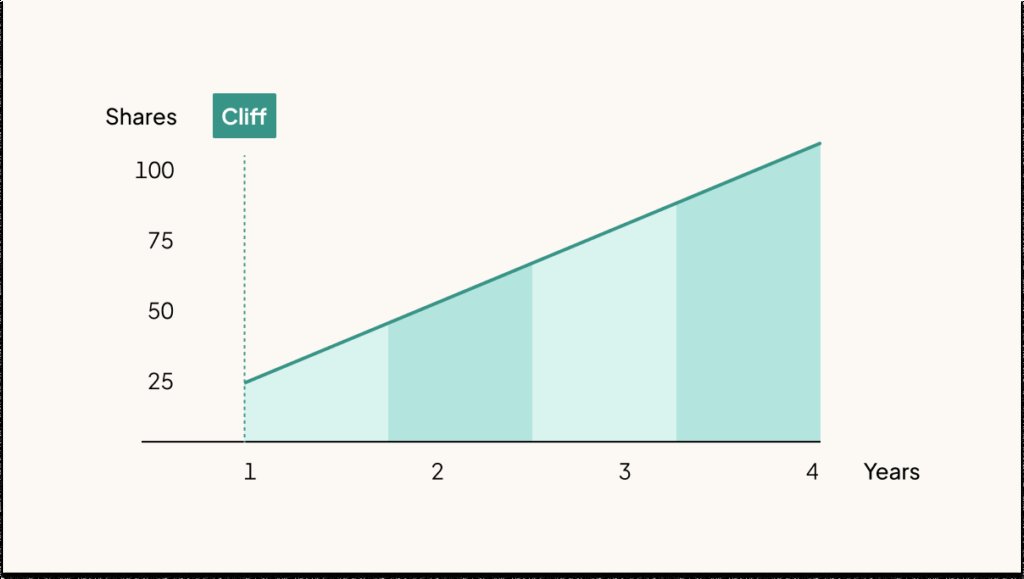

5. Consider the Vesting Schedule

As mentioned earlier, the vesting schedule determines how long it takes for you to fully own the employer match. Vesting schedules can vary, but they typically range from immediate vesting to a graded vesting schedule over several years.

Understanding your vesting schedule is crucial because if you leave your job before you are fully vested, you may forfeit a portion or all of the employer match. Take this into account when evaluating job opportunities and consider the long-term implications of the vesting schedule.

6. Leverage Other Tax-Advantaged Accounts

While your employer’s 401(k) match is an excellent way to save for retirement, it’s important to diversify your retirement savings strategy. Consider leveraging other tax-advantaged accounts, such as an Individual Retirement Account (IRA) or a Health Savings Account (HSA).

Contributing to an IRA, for example, allows you to save additional funds for retirement and potentially qualify for tax deductions. By maximizing contributions to both your employer’s 401(k) plan and other tax-advantaged accounts, you can further optimize your overall retirement savings strategy.

7. Revisit Your Investment Strategy Regularly

While capturing the employer match is crucial, it’s equally important to regularly review and adjust your investment strategy. Market conditions change, and your investment goals may evolve over time.

Schedule periodic reviews of your 401(k) investment allocations and consider seeking professional advice to ensure your strategy aligns with your retirement objectives. By staying proactive, you can optimize your investment performance and maximize the growth potential of your retirement savings.

8. Stay Informed About Plan Updates

Employer 401(k) plans may undergo modifications and plan updates from time to time. It’s essential to stay informed about any changes to your plan to fully maximize your employer’s contributions.

Keep an eye out for communications from your employer’s human resources department or plan administrator. Attend any educational seminars or webinars offered by your employer to ensure you understand how to make the most of your 401(k) plan and employer match.

By staying informed, you’ll be well-positioned to take advantage of any enhancements or new features offered by your employer’s retirement plan.

Remember, maximizing your employer 401(k) match is a valuable opportunity that can significantly boost your retirement savings. By understanding your employer’s matching policy, contributing enough to receive the full match, increasing your contributions over time, and leveraging other tax-advantaged accounts, you can optimize your retirement savings strategy.

4 Ways to Potentially Maximize Your 401(k) Company Match

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I maximize my employer 401(k) match?

To maximize your employer 401(k) match, follow these steps:

What is an employer 401(k) match?

An employer 401(k) match is a contribution made by your employer to your 401(k) retirement savings plan, usually based on a percentage of your own contributions.

How does an employer 401(k) match work?

When you contribute to your 401(k) plan, your employer matches a certain portion of your contributions, typically up to a specified maximum percentage or dollar amount.

What strategies can help me maximize my employer 401(k) match?

Here are some strategies to maximize your employer 401(k) match:

Should I contribute enough to my 401(k) to receive the full employer match?

Yes, it is generally recommended to contribute enough to your 401(k) to receive the full employer match. This allows you to take full advantage of the benefits provided by your employer.

Can I contribute more than the minimum required to receive the employer match?

Yes, you can contribute more than the minimum required to receive the employer match. However, keep in mind that there may be contribution limits set by the IRS, so it’s important to be aware of those limits.

What happens if I don’t contribute enough to receive the full employer match?

If you don’t contribute enough to receive the full employer match, you are essentially leaving free money on the table. It is highly recommended to contribute at least enough to receive the full match.

Are employer 401(k) matches taxable?

No, employer 401(k) matches are not taxable when they are made. However, the contributions and earnings in your 401(k) account are generally taxed when you withdraw them during retirement.

Can I make changes to my 401(k) contributions at any time?

The ability to make changes to your 401(k) contributions depends on the rules and policies set by your employer. In many cases, you can make changes during designated enrollment periods or under certain circumstances, such as a change in employment status.

Please note that these FAQs provide general information and it is always advisable to consult with a financial advisor or HR representative for personalized guidance regarding your specific 401(k) plan.

Final Thoughts

To maximize your employer 401(k) match, start by understanding your company’s matching policy. Take advantage of the full match offered by contributing at least the minimum required amount. Consider increasing your contributions gradually to get the maximum match. Take advantage of automatic enrollment if available, and don’t forget to adjust your contributions whenever there’s a pay raise. Keep an eye on your vesting schedule to ensure you’re eligible for the full match. Lastly, regularly review your investment options and seek professional advice if needed. By following these steps, you can effectively maximize your employer 401(k) match.