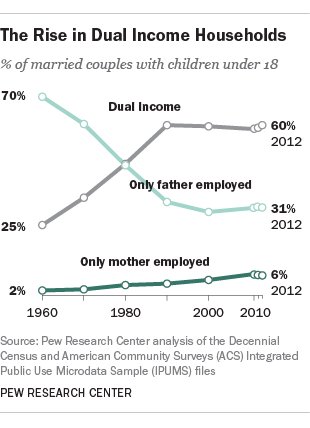

Are you wondering how to transition from a dual to a single income? It may seem like a daunting task, but with the right approach and mindset, you can successfully navigate this change. In this article, we will explore practical strategies and tips to help make this transition smoother and more manageable. From budgeting wisely to exploring additional income sources, we’ll guide you through the essential steps needed to adjust to a single-income lifestyle. So, if you’re ready to embrace this new chapter and achieve financial stability, keep reading for valuable insights on how to transition from a dual to a single income.

How to Transition from a Dual to a Single Income

Transitioning from a dual to a single income can be a challenging process, but with careful planning and a strategic approach, it is possible to navigate this change successfully. Whether you are transitioning due to a job loss, a career change, or a decision to stay at home with children, understanding the steps involved can help ease the transition and ensure financial stability. In this article, we will explore the key strategies and considerations for transitioning from a dual to a single income.

Assess Your Current Financial Situation

Before making the transition, it is essential to assess your current financial situation. This includes understanding your income, expenses, and debt obligations. Take the time to gather all financial documents, such as bank statements, credit card bills, and utility bills, and create a comprehensive overview of your financial landscape.

Consider the following aspects:

- Income: Calculate the total income from both partners, including salary, bonuses, and additional sources of income.

- Expenses: List all monthly expenses, including fixed expenses (rent/mortgage, utilities, insurance) and variable expenses (groceries, transportation, entertainment).

- Debt: Determine the amount of debt you have, including credit card debt, student loans, and car loans. Note the minimum monthly payments and interest rates for each debt.

- Savings: Evaluate your emergency fund and any other savings you have. This will help you gauge your financial cushion during the transition period.

By understanding your current financial situation, you can identify areas where adjustments may be necessary and develop a realistic budget for your new single-income lifestyle.

Create a Budget for Your Single Income

Transitioning to a single income requires careful budgeting to ensure that your expenses align with your new financial reality. To create an effective budget:

- Identify essential expenses: Start by listing your necessary expenses, such as housing, utilities, groceries, transportation, and medical costs. These are the expenses that must be paid each month.

- Eliminate non-essential expenses: Review your current spending habits and identify areas where you can cut back. This may include dining out, subscription services, or entertainment expenses.

- Prioritize debt payments: Allocate a portion of your budget to paying off your debt. Focus on high-interest debt first, as this will save you money in the long run. Consider debt consolidation options if it helps simplify your payments and reduce interest rates.

- Build an emergency fund: Set aside a portion of your income each month to build an emergency fund. This will provide a safety net in case of unexpected expenses or emergencies.

- Allocate for savings and retirement: Even on a single income, it’s important to continue saving for the future. Set aside a portion of your income for short-term goals, such as vacations, and long-term goals, such as retirement.

Creating a budget will not only help you manage your finances effectively but also provide a clear roadmap for your transition to a single income.

Explore Ways to Increase Your Income

Transitioning to a single income doesn’t mean you can’t explore opportunities to increase your overall income. Consider the following strategies:

- Side hustles: Explore part-time or freelance opportunities that can generate additional income. This could include freelance writing, graphic design, tutoring, or pet sitting. Find a side hustle that aligns with your skills and interests.

- Passive income streams: Investigate passive income opportunities, such as rental properties, investments, or online courses. These can provide an additional income stream without requiring too much time and effort.

- Career advancement: If you are transitioning to a single income due to a career change, focus on advancing in your new field. Enhance your skills through courses and certifications to increase your earning potential.

By exploring additional income opportunities, you can supplement your single income and improve your overall financial stability.

Adjust Your Lifestyle

Transitioning from a dual to a single income often requires making adjustments to your lifestyle. This may involve reducing non-essential expenses, prioritizing needs over wants, and finding creative ways to save money. Consider the following:

- Downsizing: If your current housing or vehicle expenses are too burdensome on a single income, consider downsizing. Moving to a smaller home or opting for a more affordable car can significantly reduce your monthly expenses.

- Meal planning and cooking at home: Dining out can take a toll on your budget. Embrace meal planning and cooking at home to save money and improve your overall health.

- Entertainment alternatives: Explore free or low-cost alternatives to expensive entertainment options. This could include visiting parks, organizing game nights with friends, or exploring local community events.

- Couponing and discounts: Take advantage of coupons and discounts to save money on groceries, household items, and other essentials. Look for apps and websites that offer deals and discounts.

By making small lifestyle adjustments, you can stretch your single income and maintain financial stability.

Communicate and Seek Support

Transitioning to a single income is a significant life change that requires open communication and support from your partner, family, and friends. Discuss your financial goals, challenges, and concerns with your loved ones. Seek their understanding and support as you navigate this transition.

Additionally, consider joining support groups or online communities where you can connect with others going through similar experiences. Share tips, seek advice, and find encouragement from those who have successfully transitioned to a single income.

Remember, the transition from a dual to a single income may take time and effort, but with careful planning, budgeting, and lifestyle adjustments, you can achieve financial stability and thrive on a single income.

HOW TO TRANSITION FROM 2 INCOMES TO 1: Tips that will help you thrive on one income!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I transition from a dual to a single income?

Transitioning from a dual to a single income can be a significant change, but with careful planning and adjustment, it can be manageable. Here are some steps to help you through the process:

What financial steps should I take before transitioning to a single income?

Prior to transitioning to a single income, it’s important to take the following financial steps:

How can I create a budget for a single income?

Creating a budget for a single income requires careful planning and consideration. Here’s a step-by-step guide to help you:

What are some ways to reduce expenses during the transition?

Reducing expenses during the transition can help ease the financial strain. Consider the following strategies:

Should I consider downsizing my living arrangements?

Downsizing your living arrangements can be a practical option when transitioning to a single income. Here are some factors to consider:

How can I build an emergency fund during this transition?

Building an emergency fund is essential when transitioning to a single income. Follow these steps to establish one:

What are the best strategies for managing debt during this transition?

Managing debt during the transition from a dual to a single income is crucial. Here are some effective strategies:

What are some ways to increase income during this transition?

Increasing your income can be beneficial during the transition from a dual to a single income. Consider the following options:

How can I adjust my lifestyle expectations during this transition?

Adjusting your lifestyle expectations is necessary when going from a dual to a single income. Here’s how to do it:

Final Thoughts

Transitioning from a dual to a single income can be a challenging but manageable process. Firstly, it is essential to assess your financial situation and create a budget that aligns with your new income. Prioritize your expenses, cut back on non-essential items, and find ways to save money. Secondly, explore additional income streams to supplement your single income. Freelancing, part-time jobs, or starting a side business can provide extra financial support. Lastly, open up honest communication with your partner about financial expectations and goals. By following these steps and staying committed, you can successfully navigate the transition from a dual to a single income.